Understanding Options And Futures Trading

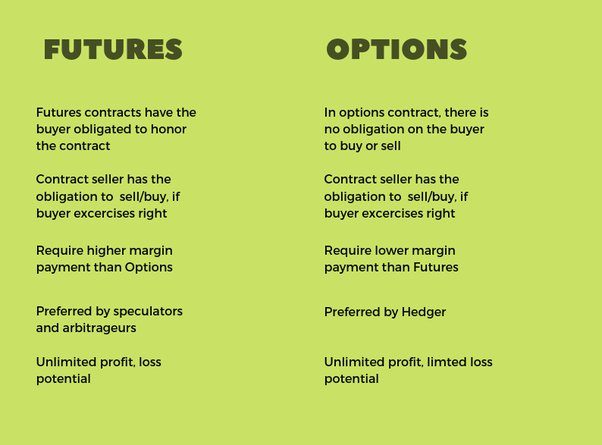

Options and futures trading are contracts between two traders. Some people consider these investment options quite risky; however, with proper understanding and planning, it is possible to make a profit. At the same time, investors need to understand all the risks involved in these investment choices. In options trading, the future price of a financial instrument such as a bond, stock, or commodity is fixed. One trader agrees to sell while another trader agrees to buy the particular item at the fixed price on the predetermined date.

In the options contract, if the share is trading at a higher price on the predetermined date then the investor buys the share at the agreed price and makes a profit. However, if the share is selling at a lower price on the predetermined date then the investor can decide not to buy the share. In both cases, the investor has to pay an option price. There are two types of option contracts – calls and puts. The first is generally bought in the hope that there will be an increase in the price. The put options are generally purchased when the investor expects the price to decrease in the future.

Trading in futures is considered somewhat more risky than options trading. In futures trading, the buying trader is obliged to buy the contract. The terms are generally standard and fixed. In this type of trading, the buying trader can decide to take physical delivery of the assets, go for the cash settlement, or choose the opposite of the agreement.

In futures trading, one party faces higher risk because both the buyer and the seller must sell or purchase the assets at a fixed price on the settlement date. Unlike options trading, where a premium has to be paid; futures trading does not require any advance expenditure from the buyer. Generally, the asset size in it is quite huge.

This type of trading is considered more volatile. Still, many investors prefer dealing in it because both parties know the assets that would be sold and bought in the future. In the case of a commodity, usually it involves a cash settlement and not an actual exchange of goods. There are some important considerations regarding both investment options, and it is important to know about them.

It is better to trade after understanding the trends. The investment should be made only if there is a chance of making a profit. One needs to avoid any emotional attachment and work according to the trading plan. Such a plan should have proper objectives as well as exit and entry points. This type of investment is a riskier proposition compared to other investment options available in the financial market.

This makes it necessary to use only the spare money, losing which will not cause any financial problems. All the reward and risk options must be evaluated properly. There are some important tools and techniques that can be used to avoid losses. When it comes to options and futures trading, investors are advised not to over-trade.

Source by Edmund Peh