UK energy support measures for firms a ‘massive disappointment’ – business live | Business

Introduction: FSB says energy support package is ‘massive disappointment’

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK government’s new energy support packages for businesses does not go far enough to protect companies from the shock of gas and electricity prices, industry groups are warning.

Under the plan, announced last night, non-domestic users will receive reduced support for their energy bills from the end of March. Rather than a fixed cap on energy costs, there will be a reduction to wholesale prices, for a year.

Martin McTague, National Chair of the Federation of Small Businesses, fears that small firms are being “left at the mercy” of the economic war being waged by Vladimir Putin, who drove up gas prices last year.

He told Radio 4’s Today Programme that the new scheme is a “massive disappointment”, and will hardly scratch the surface for many businesses.

The new plan means non-domestic energy customers – including businesses, schools and charities – will automatically receive a discount of £6.97 a megawatt hour for gas and £19.61 a MWh for electricity. James Cartlidge, the exchequer secretary to the Treasury, said this was the equivalent to a £2,300 saving for a pub, or £400 for a typical small retail store.

But businesses with energy costs below £107 a MWh for gas and £302 a MWh for electricity will not receive support.

McTague points out that around one in four small businesses have said they’d be in trouble if there was a big increase in wholesale energy prices in March.

They’ve already spent £18bn getting this far. It seems absolutely crazy to abandon so many firms when they’ve spent so much money getting them through the winter.

The government has said the existing package, which expires at the end of March, was unsustainable – Cartlidge pointed out last night that “it is not for the government to habitually pay the bills of businesses.”

McTague, though, points to the shock suffered by businesses last year, saying it it is “completely unrealistic” to think that small businesses can adapt to the new energy landscape in six months, over the winter.

They have to have a realistic timetable in which they can adapt to the new, much higher prices.

Otherwise, what you’re essentially doing is leaving them at the mercy of Putin.

Last night, McTague warned that 2023 “looks like the beginning of the end for tens of thousands of small businesses”.

The steel industry has welcomed the launch of the Energy Bill Discount Scheme [EBDS], but warned that it falls short when compared to the support available in European countries, such as Germany.

UK Steel say the extended support will provide a critical shield against high energy prices. But… Gareth Stace, director general of UK Steel, fears that domestic steelmakers will continue to suffer a ‘competitive disadvantage’:

The Government is betting on a calm and stable 2023 energy market, in a climate of unstable global markets, with the scheme no longer protecting against extremely volatile prices. The German Government guarantees an electricity price of €130/MWh for the whole of 2023, ensuring German industry can continue to operate competitively within Europe and beyond.

In contrast, the reformed EBDS provides a discount for electricity prices above £185/MWh, leaving UK steel producers paying an estimated 63% more for power than German steel producers this year. This situation will maintain a long-standing competitive disadvantage for UK producers, resulting in higher production costs and a reduced ability to compete this year.

“Today I can confirm a new Energy Bill Discount Scheme for businesses, charities & the public sector.”

Exchequer Secretary to the Treasury @jcartlidgemp sets out the new 12 month energy scheme, providing support in the face of high energy prices. pic.twitter.com/4llQoORVEg

— HM Treasury (@hmtreasury) January 9, 2023

The agenda

- 7.45am GMT: French industrial production for November

- 9.45am GMT: Treasury Committee hearing with Andrew Griffith, Economic Secretary to the Treasury, on crypto-assets and the Government’s ‘Edinburgh reforms’ to financial services

- 11am GMT: NFIB index of small US business optimism

Key events

Filters BETA

Recruitment market hit by global slowdown

Recruiter Robert Walters has warned that its full-year profit is expected to be slightly below market expectations, as the global economic slowdown hits demand for new staff.

In a trading update this morning, CEO Robert Walters cited difficult market conditions as he warned that full year profits for 202 are expected to be slightly below current market expectations, although still a record.

He said:

“The global macro-economic backdrop became increasingly uncertain as the quarter progressed resulting in a softening of recruitment activity levels across many of the Group’s markets.”

Robert Walters also reported an 11% increase in net fees, year-on-year, in the last quarter of 2022.

But its headcount peaked in November and declined in December “reflecting the more challenging market conditions”.

Net fee income in Mainland China fell by 24% in the quarter, “market conditions still heavily impacted by Covid disruption and restrictions”.

Shares in Robert Walters are down 8%, with other recruiters also lower (Pagegroup are off 7.2%)

a miss for Robert Walters (RWA LN, international recruitment, mkt cap £371mn), with net fee income well below previous quarter and market estimates. read across to other stocks in the space such as Pagegroup, Adecco. a reminder that recruitment is an early cycle business: pic.twitter.com/lfvwgOkpxD

— BionicBanker (@BrokenBanker) January 10, 2023

Victoria Scholar, head of investment at interactive investor, explains:

Shares in Robert Walters are extending losses today with the stock nursing an annual loss of nearly 40% over a one-year period. On the one hand, the recruitment firm has benefited from labour shortages which have prompted businesses to seek help sourcing potential hires and filling key roles. On the other hand, the recruitment firm which has a specialism in technology has suffered amid the slew of job cuts in the sector.

Plus, the broader global slowdown when combined with China’s covid lockdowns has muted hiring activity as businesses batten down the hatches, putting recruitment plans on hold amid cost inflation pressures and a softening consumer.”

Some small and medium-sized businesses will be pushed to the brink of collapse this spring, fears Jonathan Andrew, CEO of Bibby Financial Services.

He warns that “sky high costs and interest rates” are squeezing cash-strapped businesses, meaning some are struggling to pay back loans – while lenders are also pulling back from the market.

Andrew says:

“The Government’s rationale for dialling down energy bill support is understandable. But the past few years have served blow after blow for the UK’s small and medium sized enterprises as they bounce from one crisis to another.

Low on cash, and short of resilience, too many will find themselves on the precipice of collapse come April unless other specific support is put in place.

Andrew adds that “urgent action” is required from the Government to provide clear direction to ensure SMEs can access finance, and to ensure the right level of support to keep them growing.

Retail news. UK sales volumes dropped over the Christmas period, but inflation meant consumers had to spend more in the shops, to get less.

Total sales rose by 6.9% in December compared with a year earlier, up from November’s annual growth rate of 4.2%, the British Retail Consortium reports this morning.

However, the BRC said much of the rise was a result of high inflation pushing up the value of goods being sold, masking weaker sales volumes, although there was a spending boost from Christmas shopping and the World Cup too. Consumer price inflation was around double-digit levels at the end of last year, with CPI at 10.7% in the 12 months to November.

Victoria Scholar, head of investment at interactive investor, says:

“The British Retail Consortium’s measure of like-for-like retail sales grew by 6.5% in December versus last year, ahead of expectations and rising month-on-month, partly thanks to a seasonal boost to spending around the festive period.

However volumes fell for a ninth consecutive month with rising prices responsible for the increase. Double-digit UK inflation is still sharply outpacing the level of retail spending, highlighting the rising cost burden businesses are having to pass on to consumers.

With a looming recession, a softening consumer and ongoing inflation pressures, the start of 2023 looks set to be challenging for the retail sector after the Christmas cheer fades and the crisis of the cost-of-living reality sets in.”

UKHospitality chief executive Kate Nicholls fears that hospitality businesses face an unsustainable jump in energy bills this year.

Nicholls said it was “crucial” for hospitality businesses to receive an extension to energy support, which she says was a “vital lifeline” for many this winter.

“While I’m relieved the Chancellor has listened to UKHospitality’s concerns and extended the scheme as a whole, the absence of a sector-specific package that helps vulnerable sectors like hospitality will still result in higher bills.

Our analysis shows the new, lower level of support will see a total £4.5bn hike in bills for the sector compared to the previous scheme.

“This will simply be unsustainable for many.

Grant Shapps has also defended the government’s new anti-strike legislation, saying it will bring the UK “into line” with other European countries.

A bill will be introduce to parliament today for “minimum safety levels” during industrial action.

Shapps told the Today Programme that the measure “made a huge amount of sense”, and hopes that agreements could be reached without the need to enfoce minimum safety levels.

It can’t be right that the British people are exposed to that variance in service depending on where they happen to live, when it comes to calling an ambulance.

Shapps also told Sky News:

“The problem we had in the recent strikes was that the Royal College of Nursing – that’s the nurses – did make that agreement at the national level so there was a guarantee.

“Unfortunately, the ambulance unions didn’t do that last time round, so there was a sort of regional postcode lottery. That’s the thing we want to avoid.

“That’s why today I’ll introduce minimum safety levels and service levels for key public services to make sure that we don’t end up in a situation where people’s lives are at risk, while still respecting the right to withdraw labour and strike.”

Shapps: Falling wholesale energy prices should be passed on

Business secretary Grant Shapps says energy suppliers need to pass on falling wholesale energy prices to customers, such as businesses.

Speaking on the Today programme, Shapps insisted that the government doesn’t want to see small businesses go under due to high energy prices, as the Federation of Small Businesses warns could happen.

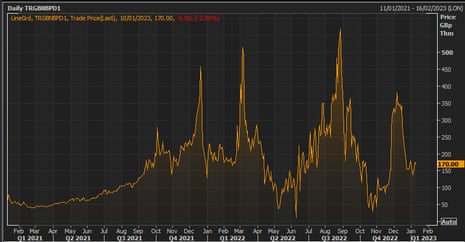

Nor should that be the case, Shapps argues, pointing out that wholesale gas prices are lower than they were before Putin invaded Ukraine, but still historially high.

The problem, though is that this isn’t being felt by businesses in their energy bills, Shapps points out

Shapps says ministers are very concerned that customers benefit from falling wholesale prices, saying:

One of the things the Chancellor and I are very concerned about is those wholesale prices, which as I say, have now come down again, making sure that’s passed on to the end users and those businesses.

So we’ve written to Ofgem to ask them to review the market and how that’s operating to make sure that it’s wholesale prices lead to lower prices for those businesses as well.

The Night Time Industries Association, which represents firms which typically operate between 6pm and 6am, fears that the scaling back of non-domestic energy bill support will cost jobs.

Michael Kill, CEO of NTIA, said last night’s announcement showed how “out of touch” the Government are with businesses.

Kill added:

“Even under the current relief scheme, greedy, profiteering energy companies are subjecting businesses to over 400% increase on previous energy bills.”

“All of this in light of the fact that gas/oil wholesale prices in recent months have dropped below the levels prior to Russia’s invasion of Ukraine.”

“The scaling back of the energy relief scheme by Government at the end of April, will without doubt mean thousands of businesses and jobs will be lost in the coming months.”

IoD: Some vulnerable SMEs may cease trading

The Institute of Directors are disappointed that there isn’t targeted support for the hospitality sector in the government’s new energy support package.

Alex Hall-Chen, principal policy advisor for Sustainability, Skills and Employment at the IoD, says businesses will be reassured that some support will continue for a further twelve months beyond the end of March.

But, she warns, shifting to a discount on energy bills rather than the current fixed cap will create more uncertainty for firms, making it harder to budget.

It could force some struggling small firms under, Hall-Chen says:

“However, whilst many manufacturers will also receive additional support, it is a shame that the government has not found a way to target other firms most exposed to volatile international energy markets, such as those in the hospitality sector.

“The design of the new scheme will also provide less certainty for businesses in budgeting. Given that future energy costs will no longer be able to be projected with any degree of confidence, the willingness of directors and auditors to sign off their entities as going concerns will be impaired. In the case of the most vulnerable SMEs, this may affect insolvency assessments and lead some companies to cease trading altogether.”

Introduction: FSB says energy support package is ‘massive disappointment’

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK government’s new energy support packages for businesses does not go far enough to protect companies from the shock of gas and electricity prices, industry groups are warning.

Under the plan, announced last night, non-domestic users will receive reduced support for their energy bills from the end of March. Rather than a fixed cap on energy costs, there will be a reduction to wholesale prices, for a year.

Martin McTague, National Chair of the Federation of Small Businesses, fears that small firms are being “left at the mercy” of the economic war being waged by Vladimir Putin, who drove up gas prices last year.

He told Radio 4’s Today Programme that the new scheme is a “massive disappointment”, and will hardly scratch the surface for many businesses.

The new plan means non-domestic energy customers – including businesses, schools and charities – will automatically receive a discount of £6.97 a megawatt hour for gas and £19.61 a MWh for electricity. James Cartlidge, the exchequer secretary to the Treasury, said this was the equivalent to a £2,300 saving for a pub, or £400 for a typical small retail store.

But businesses with energy costs below £107 a MWh for gas and £302 a MWh for electricity will not receive support.

McTague points out that around one in four small businesses have said they’d be in trouble if there was a big increase in wholesale energy prices in March.

They’ve already spent £18bn getting this far. It seems absolutely crazy to abandon so many firms when they’ve spent so much money getting them through the winter.

The government has said the existing package, which expires at the end of March, was unsustainable – Cartlidge pointed out last night that “it is not for the government to habitually pay the bills of businesses.”

McTague, though, points to the shock suffered by businesses last year, saying it it is “completely unrealistic” to think that small businesses can adapt to the new energy landscape in six months, over the winter.

They have to have a realistic timetable in which they can adapt to the new, much higher prices.

Otherwise, what you’re essentially doing is leaving them at the mercy of Putin.

Last night, McTague warned that 2023 “looks like the beginning of the end for tens of thousands of small businesses”.

The steel industry has welcomed the launch of the Energy Bill Discount Scheme [EBDS], but warned that it falls short when compared to the support available in European countries, such as Germany.

UK Steel say the extended support will provide a critical shield against high energy prices. But… Gareth Stace, director general of UK Steel, fears that domestic steelmakers will continue to suffer a ‘competitive disadvantage’:

The Government is betting on a calm and stable 2023 energy market, in a climate of unstable global markets, with the scheme no longer protecting against extremely volatile prices. The German Government guarantees an electricity price of €130/MWh for the whole of 2023, ensuring German industry can continue to operate competitively within Europe and beyond.

In contrast, the reformed EBDS provides a discount for electricity prices above £185/MWh, leaving UK steel producers paying an estimated 63% more for power than German steel producers this year. This situation will maintain a long-standing competitive disadvantage for UK producers, resulting in higher production costs and a reduced ability to compete this year.

“Today I can confirm a new Energy Bill Discount Scheme for businesses, charities & the public sector.”

Exchequer Secretary to the Treasury @jcartlidgemp sets out the new 12 month energy scheme, providing support in the face of high energy prices. pic.twitter.com/4llQoORVEg

— HM Treasury (@hmtreasury) January 9, 2023

The agenda

- 7.45am GMT: French industrial production for November

- 9.45am GMT: Treasury Committee hearing with Andrew Griffith, Economic Secretary to the Treasury, on crypto-assets and the Government’s ‘Edinburgh reforms’ to financial services

- 11am GMT: NFIB index of small US business optimism