Transfer Pricing Documentation and Intercompany Agreements

Imagine you were going to buy a 12-month-old car. Would you pay more if you were going to buy from an authorized car dealer, or if you were buying from a private individual who had advertised in the small ads? Of course, you would pay more to the dealer, even though the physical goods concerned – the car – may be identical in specification and condition.

The difference is partly the status of your counterparty (financial status and reputation), and partly the legal terms of the contract (such as warranties and after-sales support).

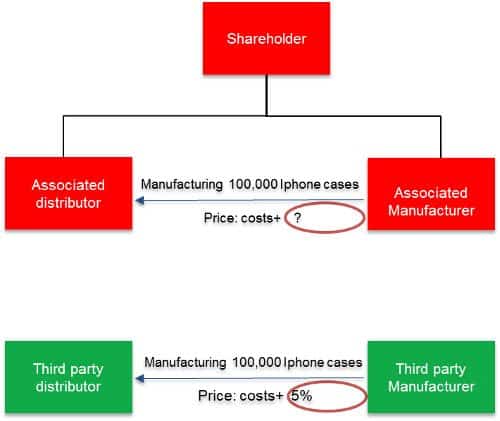

The same considerations apply to intercompany sales. Documenting the legal arrangements is not just important to support the transfer pricing position. It is also essential to enable the directors of each of the companies to demonstrate that they have complied with their legal duties as directors – irrespective of the fact that they may also act as directors of other companies in the group.

Here’s a sample checklist of issues that may be taken into consideration when putting in place written intercompany agreements for the supply or distribution of goods, and which should also underpin the transfer pricing analysis.

Factors relating to the parties

– Financial standing

– Availability of security (e.g. parent company guarantees)

– Legal form and location

Market issues

– Responsibility for local marketing costs

– Responsibility for compliance with local regulations (product and packaging)

– Responsibility for defending IP rights / pursuing infringements

– Responsibility for providing after-sales assistance

Security of tenure/ability to benefit from investment in the market

– Exclusivity/Territory

– Prohibition on direct sales

– Duration/notice periods for termination without cause

– Ownership of customer lists/requirement to hand over lists on termination

– Obligation to pay compensation/indemnity on termination

Supply issues

– Seller obliged to accept/perform orders

– Seller committed to supplying minimum volumes

– Distributor restricted from selling/procuring competing products

– Distributor able to procure substitutable products elsewhere

Inventory issues

– Minimum purchase volumes

– Seller maintains local stock of products for distributor (consignment stock)

– Distributor required to physically adapt the product for the local market

– Seller bears the risk of loss/damage to products in transit

– Seller obliged to repurchase unsold/obsolete stock

Price/payment risks

– Prices guaranteed /fixed for a specified period (irrespective of raw material costs)

– Responsibility for currency risks

– Responsibility for credit risks regarding customers

Product liability risks

– Responsibility for design defects

– Responsibility for manufacturing defects

– Obligation to replace defective products

– Responsibility for third-party IP infringement claims

– Liability for loss of profits and third-party claims

– Limitations on recourse (e.g. caps on claims, limitation periods)

Approaches for documenting intercompany agreements appear to vary widely – not only between different groups but also within groups themselves.

In my experience, the most efficient approach is for a group to prepare standard conditions for each type of arrangement (e.g. R&D services, supply of goods, supply of HQ services). These standard conditions are then incorporated into a short-form contract schedule which is signed up for each agreement. This has the advantage of reducing the administrative burden involved, and it also fits well with the master file / local file approach for wider transfer pricing documentation.