Should Brands Play Politics? | BoF Professional, This Week in Fashion

In a way, the November 3rd US presidential election offered few surprises: America revealed itself to be divided almost exactly down the middle along deeply partisan lines. Former Vice President Joe Biden appears to have succeeded in securing the 270 electoral votes needed to prevail, but President Donald Trump, and the “America First” movement he stands for, will remain a major force in the country’s politics and culture no matter the outcome.

Most fashion brands have had the good sense not to wade into this divide, at least for now, staying silent as the last few votes are counted. Not so, Gap. The chain tweeted a video of a hoodie, one side red, one side blue, and the slogan “The one thing we know, is that together, we can move forward.” The video depicted the hoodie being zipped up.

Perhaps a company once seen as the quintessential American apparel brand believed it still had the cultural clout to unite the country. And in a way, it did: “I find it beautiful that we can all take a break from this anxious hellscape to come together and hate the Gap sweatshirt,” fashion editor Lauren Alexis Fisher wrote in a typical tweet. Gap quickly removed the video, telling The New York Times: “From the start, we have been a brand that bridges the gap between individuals, cultures and generations. The intention of our social media post, that featured a red and blue hoodie, was to show the power of unity. It was just too soon for this message.”

The incident read like a parody of the sort of brand-led activism that has become common over the last four years. Companies increasingly feel compelled to take stands on the issues that matter most to their customers. That’s perhaps never been more true than during a tense US presidential election, which has dominated the country’s cultural conversation this year, along with the pandemic and a new civil rights movement.

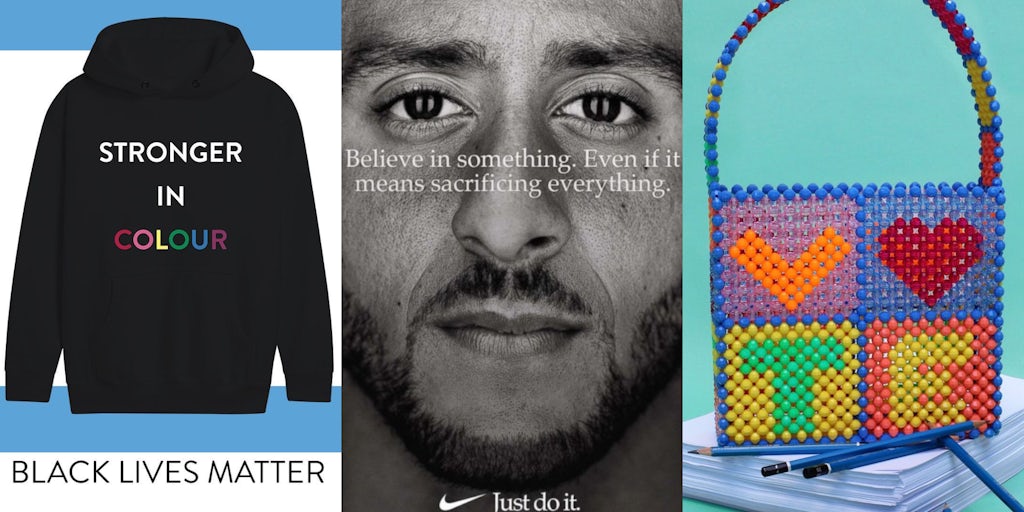

Brand activism in the US has flourished during the Trump years, as consumers — at least, the left-leaning ones — increasingly turned to corporations for leadership against political institutions they no longer trusted to do the right thing. The ban on visitors from predominately Muslim countries in 2017 was something of a watershed moment, with fashion leaders like Nike Chief Executive Mark Parker and Kering Chief Executive Francois Henri-Pinault, and brands like Levi Strauss & Co and Warby Parker, speaking out as protestors stormed airports and the policy was challenged in court. But most players, particularly large, publicly traded companies, stayed silent. The climate had changed by 2018 when Nike released an ad featuring Colin Kaepernick, the NFL quarterback who had been blackballed from the league after kneeling during the national anthem to protest police brutality. The brand ultimately reaped enormous rewards in terms of publicity, goodwill and sales.

Today, brands are sometimes seen as outliers if they haven’t staked a claim to one or all of the hottest issues of the moment. Most companies at least nod to sustainability and fighting climate change, an easy win when the Trump administration’s denialism is at odds with the views of a majority of consumers. But it’s no longer surprising when fashion speaks out about more-polarising issues, as seen this summer when brands flooded social media with support for Black Lives Matter.

The industry’s political evolution is partly a defensive response, as a subset of consumers equates silence with acquiescence. Brands also see politics as a marketing device, a way to reach the growing number of consumers for whom certain causes are part of the toolset they use to compose and signal their identities, right alongside movies, music, fashion and art.

Still, politics is never an easy fit. Some companies, such as Patagonia, have activism baked into their brand DNA or are owned by founders who see themselves on a higher mission. The overwhelming majority exist primarily to sell clothes and make money. Consumers are getting better at detecting when brands are failing to live up to their idealistic advertising — quite a few found themselves targeted this summer for supporting Black Lives Matter while discriminating against Black employees. Some felt companies’ messages, including the ubiquitous “Blackout Tuesday” squares on Instagram, were crowding out more-authentic voices.

On balance though, corporate activism seems to be proving itself to be a force for good. A company speaking up for Black Lives Matter won’t singlehandedly end racism, but the sheer volume of statements, donations and other shows of support from fashion brands lends visibility to causes and helps maintain their momentum after the protestors go home. It’s harder to argue that opposition to police brutality is concentrated solely among hardcore leftists when American Eagle and Walmart show support for the cause.

That said, brands need to devote themselves first to cleaning up their own house before claiming to speak for the nation or the world. That means ending discriminatory practices inside the industry, promoting more diverse leadership, eradicating labour abuses in supply chains, treating low-level employees better and ensuring marketing isn’t spreading the same toxic messages on race, gender and beauty standards that purport to fight against. Often it’s a company’s own employees, rather than customers, pressuring their bosses to take a stand.

Sometimes, brand activism can also be useful in promoting progressive values overseas. At the same time, American brands that are still working out how to approach controversial issues at home need to be extra careful about entering into political debates abroad, where they are often under-informed and opinions and sensitivities vary widely. The global nature of business also makes it increasingly difficult for brands to be consistent across national borders. For instance, the fashion industry has yet to reconcile its more vocal support of human rights at home with its increasing reliance on sales from China, where there are concerns in that very realm.

Which brings us back to the 2020 election. Gap stumbled because, as so many users said on Twitter, the retailer failed to read the room. Americans aren’t united, and those on opposite ends of issues such as racial injustice, gun violence, LGBTQIA+ rights and abortion view meeting in the middle as tantamount to defeat. That may change someday, and Gap’s sweatshirt may be looked on more charitably in a less-polarised future. In the meantime, brands must continue the work of finding their voice, and becoming better corporate citizens.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

A Farfetch 2020 campaign | Source: Courtesy

Farfetch announces partnership with Alibaba and Richemont. As part of the deal, the Chinese tech giant and Swiss luxury group have invested $300 million each in Farfetch, plus $250 million each for a combined 25 percent stake in a new joint venture, Farfetch China. Richemont is banking on the Farfetch deal to further boost strong China sales. The Cartier owner posted an 82 percent drop in net profits in the first half of its fiscal year ending September 30, despite a 78 percent jump in Chinese sales.

Denmark to cull mink population amid coronavirus fears. The move comes after 12 people were infected by a mutated strain of coronavirus found in minks. However, sceptics have demanded more evidence to back up the decision to kill up to 17 million animals, which could cost more than $800 million. The industry association for Danish mink breeders said the government’s decision amounted to a death knell for the country’s pelt industry.

CBL files for Chapter 11 bankruptcy protection. The process will give the mall operator a chance to continue functioning while reorganising its finances and business. Troubled retailer J.C. Penney is one of CBL’s biggest renters and the pandemic is still hurting income across the American retail sector.

Capri Holdings beats quarterly revenue estimates. The Michael Kors owner’s total revenue fell to $1.1 billion in the second quarter from $1.4 billion a year earlier. The Italian fashion company nonetheless beat analyst expectations, helped by strong demand for its clothes in China.

EssilorLuxottica sales recover as second virus wave looms. Sales at the Oakley and Ray-Ban owner dipped 1 percent compared to a year earlier to €4.09 billion ($4.77 billion) in the quarter ended September 30, a significant improvement from the second quarter when sales nearly halved. But a second coronavirus wave threatens another heavy blow in the coming months.

Hugo Boss returns to profit even as sales slow. The German suit maker reported a better-than-expected third-quarter operating profit of €15 million ($17.5 million). Hugo Boss was bolstered by online demand: digital sales jumped 66 percent in the third quarter after the retailer launched e-commerce in 24 new markets.

Swarovski shareholders approve 6,000 job cuts. Chief Executive Robert Buchbauer plans to shrink the company’s lower-margin mass-market business and focus on more expensive jewellery. However, many founding family members still oppose the plan, warning that they will legally challenge the vote and push for nullification of the result.

Primark earnings slump as company prepares for second lockdown. The low-cost fashion retailer saw its full year profit plunge to £362 million from £969 million. The company’s owner, Associated British Foods, said it expects to lose around £375 million in sales as a result of a second UK lockdown that came into effect this week.

Superdry’s revenue falls as virus curbs hit footfall. The retailer’s quarterly revenue dropped 23 percent, while e-commerce sales jumped 50 percent. The revenue drop came as Superdry shut its shops for a second national lockdown in England. The company said its focus is on maximising online sales in time for Black Friday.

John Lewis to cut 1,500 head office jobs. The British retailer said the move was part of its strategy to return to sustainable profit by 2025. The job cuts are estimated to save John Lewis £50 million ($65 million) a year, and comes shortly after the department store group reported a first-half loss of £635 million ($824 million) in September.

UK retailers face Christmas nightmare with fresh lockdown. The new restrictions could prove fatal for some businesses, particularly if they’re extended beyond the initial four weeks. November and December typically generate 80 percent of profits for non-food retailers, according to Mark Price, former deputy chairman of John Lewis Partnership Plc. France, Germany and other European countries have also imposed new restrictions in a bid to curb new waves of Covid-19.

Italy locks down Milan and much of industrial north. Unlike Italy’s national lockdown in the spring, all factories will remain open. Lombardy — Italy’s wealthiest region surrounding Milan — has been declared a critical “red” zone, meaning all bars, restaurants and non-essential shops will be forced to close.

Hong Kong’s retail woes persisted in September. With inbound tourism unlikely to see a swift rebound, the city’s retail sector continues to suffer as a result of Covid-19 and socio-political unrest. Hong Kong’s retail sales dropped 12.9 percent compared to this time last year to HKD $26.1 billion ($3.4 billion), slightly worse than forecasts of 12.3 percent.

THE BUSINESS OF BEAUTY

Estée Lauder store interior | Source: Shutterstock

Estée Lauder tops estimates thanks to China demand and online boost. The M.A.C. brand owner has seen growth in demand for its skincare products, while sales in the Asia Pacific market increased 9 percent to $1.2 billion. Even so, overall sales dropped 9 percent to $3.6 billion but beat forecasts of $3.5 billion.

L’Oréal turns to Google as coronavirus spurs virtual makeup shift. The new deal will allow customers who come across L’Oréal ads on Google to try on products digitally. The partnership relies on technology designed by ModiFace, a Canadian augmented reality specialist acquired by L’Oréal in 2018, and will also extend to the US group’s YouTube video sharing platform.

Coty posts surprise profit as beauty product sales recover. The cosmetics maker’s net revenue decreased by about 13 percent to $1.7 billion, beating analysts’ forecasts. Beauty sales have improved in the past few months as a surge in online orders and higher demand for skincare products offset the blow from weak traffic at brick-and-mortar stores.

PEOPLE

Celeste Burgoyne | Source: Getty Images

Lululemon adds to executive team. Lululemon has promoted Celeste Burgoyne to president of the Americas and global guest innovation teams. Additionally, the company has hired André Maestrini from Adidas. He will join the company as executive vice president, international, overseeing the company’s global growth. Stacia Jones is also joining Lululemon at vice president level, with the title global head of inclusion, diversity, equity and action.

Lauren Guthrie appointed VP, global inclusion and diversity of VF Corp. Guthrie replaces Reggie Miller overseeing diversity and inclusion initiatives within the company. Guthrie previously served as vice president of VF’s council to advance racial equity and inclusion and diversity in the Americas region, where she focused on external-facing racial equity efforts.

Thibault Villet named Tory Burch’s new APAC president. Villet’s appointment is effective December 28. In his new role, Villet will be responsible for operations and growth in the region. Villet, who was most recently president for Asia at One in Beauty, will report directly to CEO Pierre-Yves Roussel.

MEDIA AND TECHNOLOGY

French investor Eurazeo sells Farfetch stake. Eurazeo, which has been an investor in the luxury retailer since 2016, raised €90 million ($105 million) through the sale.

Alibaba beats quarterly sales estimates. The group’s core e-commerce business continues to grow post-pandemic. The results came just as Chinese authorities suspended Alibaba affiliate Ant Group’s record $37 billion Shanghai listing.

Zalando reports an increase in third-quarter sales. The online fashion retailer said its quarterly operating profit came in at €118 million ($138 million) with sales up 22 percent to €1.8 billion. Zalando said it is looking to put more stores online as lockdowns are re-imposed across Europe and will waive commissions until the end of March to help new brick-and-mortar additions.

Zozo says new body-measuring suit overcomes flaws of original. The original bodysuit received massive interest from the fashion industry, but failed to drive sales. The suit, which can be scanned by a smartphone in order for users to upload their measurements and order custom-made clothes, has now increased the number of measuring markers to 20,000, up from 400 in the previous version.

Compiled by Daphne Milner.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.