Rent the Runway’s Uphill Battle | This Week in Fashion, BoF Professional

Ahead of its IPO this week, Rent the Runway was a subject of discussion among plenty of working women in New York City. The online rental service has currency with price-conscious fashion fans: there’s undoubtedly value in being able to wear items from brands like Nanushka, Sandy Liang and Jil Sander for a fraction of what it would cost to buy them.

Rent the Runway’s biggest strength is its loyal customer base, nearly 90 percent of whom join the service through word of mouth rather than paid marketing. Within three months of subscribing, users generate on average $286 in revenue, and that figure goes up to about $1,000 when subscriptions reach the two-year mark, according to its S-1 filing.

Brands say the platform is a reliable wholesale partner that orders few pieces from each collection but in deep volumes; the company said in its prospectus that it has retained nearly 100 percent of its brand partners over the course of its 12 years in operation.

But in the cold light of Wall Street, those happy customers and happy suppliers are not enough — or at least, there aren’t enough of them. While Rent the Runway shares initially rose when they began trading, reaching a high of $23 early Wednesday, they have since fallen, closing Thursday at $18.85.

Investors are wary of Rent the Runway’s relatively small user base — 112,000 subscribers, many clustered in a few major US cities — and its uncertain path to profitability. On revenue of $257 million in 2019, Rent the Runway posted $157 million in losses. Its biggest expense is fulfilment, which totalled $118 million in the year ending Jan. 31, 2020, followed by technology and marketing.

Rent the Runway said it expects losses to narrow through scale, and has demonstrated improved margins in the past 18 months. Its gross margin increased from 21 percent in 2019 to 33 percent in the six months ending on July 31, 2021.

To achieve that scale, Rent the Runway knows it must diversify its user base beyond college-educated, professional women. The company also plans to venture into new rental categories and perhaps even foray into men’s apparel.

“I think there’s a world in the future where men aren’t even off the table anymore,” founder Jennifer Hyman told The New York Times earlier this week.

There are 130 million women 18 years and older in the US, the company noted in its S-1, implying that this is the sheer size of its addressable market.

The company faces an uphill climb to reach the mass market. A decade into the second-hand clothing boom, renting fashion is still seen as a novelty by many shoppers. Many women know of Rent the Runway but have yet to take the plunge. This group, far larger than the company’s active subscriber base, likely hasn’t heard of Nanushka or Sandy Liang, much less have a burning desire to wear their clothes to the office. From their perspective, the thousands of dollars they might spend on renting fashion would be better put toward a large, permanent wardrobe from Zara or Poshmark. Rental requires more effort than shopping retail or resale; users must select their desired pieces and send back worn items every month.

And as rental has grown, Rent the Runway has faced new competition, such as luxury accessories rental start-up Vivrelle, Urban Outfitter’s Nuuly programme and one-time rental provider Hurr in the UK. There’s also Caastle, which powers rental for brands like Vince, Ann Taylor and Scotch & Soda.

These hurdles can be overcome. Rent the Runway could open storefronts in convenient locations and install drop-off kiosks in suburbs across America. Splashy marketing campaigns can raise awareness and help new customers overcome their hesitation about rental.

All that will cost money — of which Rent the Runway, having raised $357 million, now has plenty. But convincing millions of women to try out rental will require time and the patience of investors, a far less ample resource.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

LVMH-owned Fendi is collaborating with Kim Kardashian’s Skims. Fendi social media accounts.

Fendi to collaborate with Skims. The LVMH-owned brand, led by designer Kim Jones and chief executive Serge Brunschwig, is looking to build buzz through a collection with Kim Kardashian’s shapewear and intimates line. The announcement comes after images from a campaign for the collaboration leaked online earlier this month.

Moncler sales grew above analyst expectations in the third quarter. Boosted by strong sales in North America, China and South Korea, revenues at the Italian luxury down jacket maker rose by 55 percent in the third quarter, as sales increased by 27 percent at constant exchange rates year-over-year to €455 million ($531.62 million) — which is 10 percent above its last pre-pandemic third quarter in 2019.

Allbirds targets $2 billion valuation in New York IPO. The direct-to-consumer footwear brand and certified B Corp. announced on Monday that it will offer 19.2 million shares priced between $12 and $14 per share. Allbirds could raise up to $269 million in filing for its initial public offering, reports Footwear News.

Ikea buys former Topshop store in London’s Oxford Circus for £378 million. As part of a strategy aimed at adding more urban locations as opposed to giant out-of-town warehouses, the Oxford Street Ikea is set to open in 2023, and will be the biggest of such formats to date.

Partners Group buys stake in Swiss watchmaker Breitling. The investment firm will own a “significant” minority stake and will help majority owner CVC Capital Partners accelerate Breitling’s growth, the companies said in a statement on Tuesday. No financial terms were disclosed.

US holiday sales to rise as much as 10.5 percent, hit record levels. The National Retail Federation (NRF) forecast sales to increase between 8.5 percent and 10.5 percent to between $843.4 billion and $859 billion during November and December. A previous high of $777.3 billion was set last year.

Puma lifts forecast as demand for shoes offsets supply snags. The German sports company expects currency-adjusted sales to rise by 25 percent this year, up from a previous target of at least 20 percent, according to a statement Wednesday.

Eco-friendly washable shoe brand Rothy’s seeks fresh funding. It is in early discussions to raise funding that could value the label at more than $1 billion, people with knowledge of the matter told Bloomberg.

THE BUSINESS OF BEAUTY

India’s Nykaa IPO is heavily oversubscribed by anchor investors, according to sources. Shutterstock.

Report: India’s Nykaa IPO heavily oversubscribed by anchor investors. Indian cosmetics to fashion start-up Nykaa received bids for 40 times the number of shares it plans to sell to anchor investors in its initial public offering, a source with direct knowledge told Reuters, indicating strong interest. Investment firm Blackrock and asset manager Fidelity were among the top buyers.

PEOPLE

The Italian e-commerce retailer Luisa Via Roma named Alessandra Rossi chief executive officer. Luisa Via Roma.

Luisa Via Roma appoints chief executive. The Italian e-commerce retailer named Yoox Net A Porter Group veteran Alessandra Rossi chief executive officer. Rossi joins Luisa Via Roma as it’s set to target international expansion, look to augment its editorial offering and aim for a public listing following a €130 million (about $152 million) investment from Milan’s private equity fund Style Capital in September.

Olivia Singer joins i-D as global editorial director. The fashion editor — whose interests in the multicultural youth scene chime with the vision editor-in-chief Alastair McKimm has set at the Vice-owned style bible — will begin her new role on Nov. 1. She was most recently the fashion news director at British Vogue.

LVMH taps Dior’s Damien Bertrand to lead Loro Piana. The managing director at Christian Dior Couture will take over as chief executive of the Italian luxury brand, succeeding Fabio d’Angelantonio, a former Luxottica marketing executive who became Loro Piana’s chief executive in 2016, as the label looks to bounce back from the pandemic.

Dior promotes Olivier Bialobos. Dior Couture’s chief communication and image officer’s role will be expanded to include oversight of the label’s beauty segment as One Dior chief communications and image officer. He will report to Pietro Beccari, chief executive of Christian Dior Couture, and Laurent Kleitman, chief executive of Parfums Christian Dior.

GQ’s Adam Baidawi named head of editorial content in the UK. The men’s magazine’s deputy global editorial editor will now have a dual role, leading British GQ as well, Condé Nast announced Wednesday. The move is part of Condé Nast’s new consolidated global editorial strategy, and will see British GQ’s longtime EIC Dylan Jones leave after 22 years.

MEDIA AND TECHNOLOGY

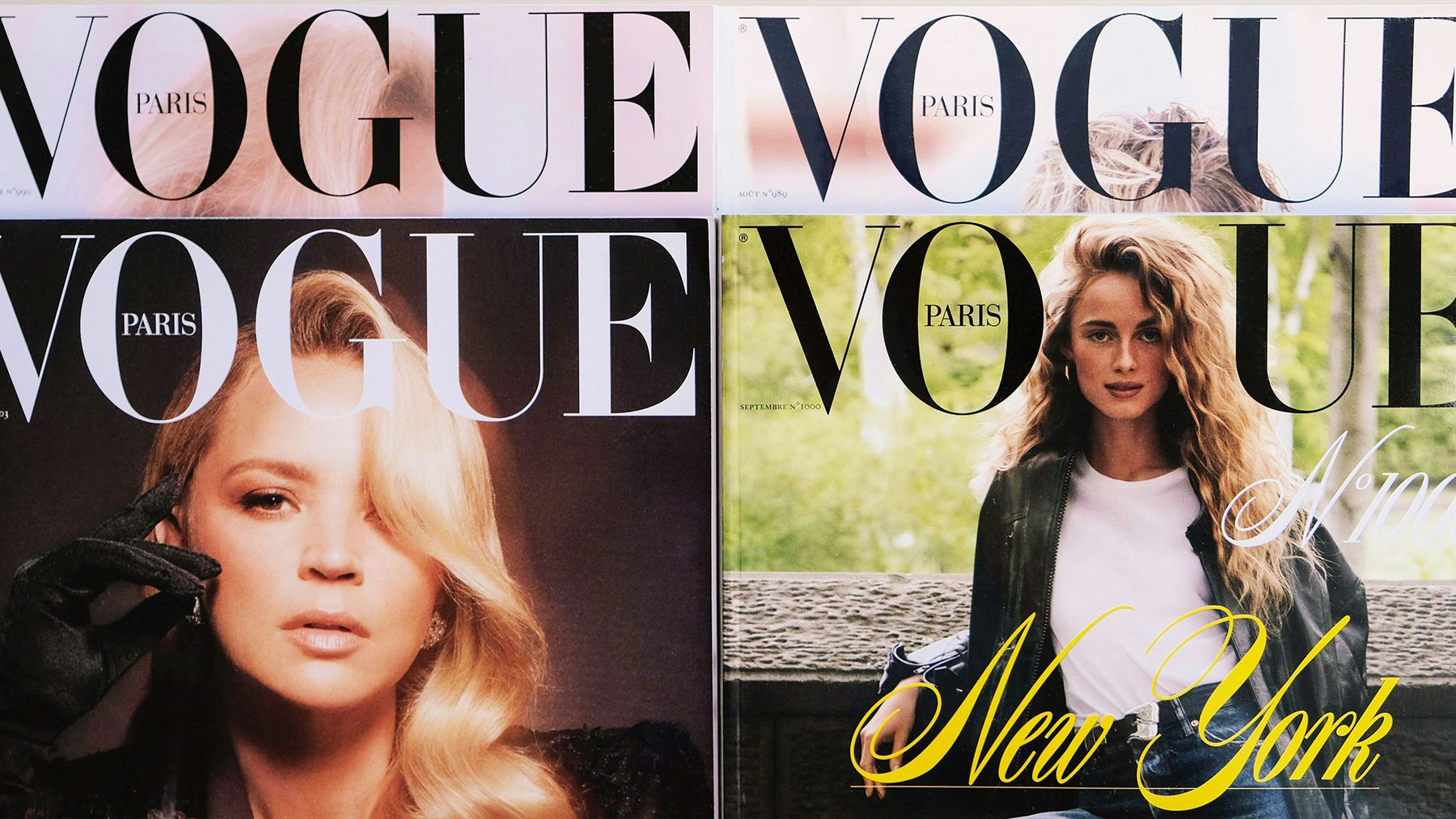

Condé Nast confirms Vogue Paris name change. Shutterstock.

Condé Nast confirms Vogue Paris name change. The influential French edition will now be known as Vogue France, wrote head of editorial content Eugénie Trochu in a message published on the publication’s website. The name change was first reported by Le Figaro last week, which detailed an ideological shift underway at the magazine as part of the publisher’s new global consolidation plan.

Shopify results miss estimates as pandemic boom ebbs. The Canadian e-commerce giant reported a smaller-than-expected rise of 46 percent in revenue for the quarter ended Sept. 30. Adjusted profit of 81 cents per share also missed analysts’ estimate of $1.18, according to Refinitiv data.

Compiled by Joan Kennedy.