How to Recession-Proof Your Business | Intelligence, BoF Professional

NEW YORK, United States — The women’s workwear label Aday has a plan to survive the recession: increase the profit margins on every blouse, jacket and pair of slacks it sells.

It’s an all-hands-on-deck effort, involving not just the design and planning teams but customer service and tech too.

“We call it cash-efficient growth,” said Co-Chief Executive Nina Faulhaber. “Whereas before we were growing like crazy, now we’re focused on [producing] fewer styles and making sure they sell through fast.”

Aday is one of thousands of brands, big and small, scrambling to prepare for what could be years of weak demand. Earlier this week, the National Bureau of Economic Research said the US officially entered a recession in February, even before the pandemic sent unemployment spiking to levels not seen since the Great Depression.

Cash is king in any crisis.

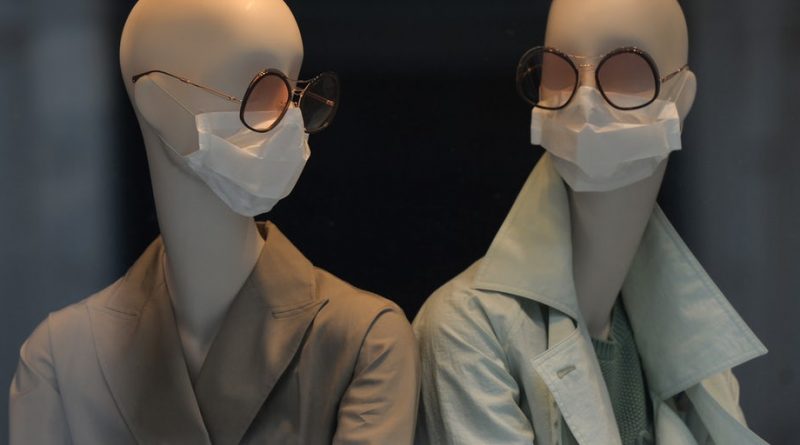

Many companies hope to offset sluggish sales by boosting margins via a leaner business model. That means holding down inventories and pushing high-margin products (Masks, for instance, are not only relevant today but also cheap to produce and can be marked up considerably). At brands ranging from Gap to Marc Jacobs, it’s also meant layoffs at headquarters and other steps to cut administrative expenses. Customer data, always essential, becomes even more crucial as marketing budgets are slashed.

Every dollar earned has to go much further than it did in January.

“Cash is king in any crisis,” said Eric Fisch, national sector head of retail and apparel at HSBC’s corporate banking division.

Rethink Merchandising

Many brands are starting their recession planning by focusing on their core products, and jettisoning the rest. Dozens of luxury labels, from Dries Van Noten to Rodarte, are planning to create fewer collections and cut down on promotions.

Selling fewer items will make it easier to manage inventory. Stockpiles of yet-to-be-sold merchandise are a big drag on fashion brands’ finances, and that’s doubly true after several months of poor sales during the lockdown. Cutting back on a collection also reduces sampling costs.

Aday is eliminating half of its new styles and hopes to reduce the different types of items it sells by 30 percent this year. Mikoh, a swimwear brand, is cutting “filler pieces” that don’t perform well online or with wholesale partners.

Aday campaign | Source: Courtesy

“We’re being very conscious about not creating giant collections,” said Oleema Miller, Mikoh’s co-founder and creative director.

Before starting its cull, Aday surveyed customers about their preferred styles and how long they expected to work from home. The brand found that the biggest block of its shoppers (42 percent) plan on working from home in 2021, for instance. This means that comfortable pants will sell better than a work blouse.

Some product categories naturally have higher margins — such as jewellery and small accessories like hats, scarves and socks.

Design and planning teams are also looking at manufacturing costs. Which fabrics will achieve the highest product margins? Are there more cost-effective alternatives to current factories?

Brands can also experiment with increasing prices on best-selling products. In May, Chanel raised prices on some of its most popular handbags.

Reduce Returns

Returns are a growing expense at many brands, particularly as more shopping takes place online during the pandemic. Good customer service can reduce how many items get sent back.

Aday offers a customer chat service on its website and a fit guide that includes measurements such as sleeve length and hem circumference, depending on the product category. Under the goal of improving profits, the label is reaching out to every customer after they make a purchase and even asking them to share their Instagrams to make personalised recommendations.

The label has also enacted a policy of making sure that shoppers interact with the same customer service agent in all of their communications to establish a more personal relationship.

When selling online, disclosing more information reduces returns. Shipbob, an e-commerce fulfilment service, found that 62 percent of returns were traced back to a product not matching its online description.

Cut Operating Costs

Countless brands have renegotiated rent and laid off employees during the pandemic. Many will need to take that approach to every aspect of their business to weather a prolonged downturn. Virtually any variable cost, such as hiring new employees, marketing and travel, can be eliminated, HSBC’s Fisch said.

“[Companies] have looked at every single line item in their budget and decided whether or not to cut it — that’s what it takes,” he said.

Even retailers that aren’t in financial trouble, such as Nordstrom, are planning on shutting down some of their less profitable stores. Mall staples such as Gap and Urban Outfitters announced outright that they wouldn’t be paying rent. And in as early as March, 65 percent of chief marketing officers surveyed by Gartner said they would be slashing their department budgets. A number of start-ups are closing offices or moving into smaller spaces as employees show they can work from home without sacrificing productivity.

Aday may close its San Francisco store as online sales have performed while it was closed during the pandemic. It’s also reevaluating its warehouses and other contracts as they come to an end, such as its website platform.

Consolidate Responsibilities

Staffing is often the biggest expense at small and mid-sized companies. Salary cuts can help avoid layoffs, but eliminating certain positions may be unavoidable if sales don’t pick up.

“If you have to make these sorts of decisions, wait until after the storm,” said Caroline Pill, vice president of global executive search at Kirk Palmer Associates. “Look at where there may be layers of responsibility … No one at the company should do just one thing.”

Companies should also look for ways to get more out of their employees.

“Now is the time to take a chance on the people that you hired … some people have secret passions that they don’t put on their CVs,” Pill said.

Instead of hiring from outside the company for new responsibilities, “look to your junior people who evolve into larger roles,” she added.

Ultimately, the more efficient the business model, the more profitable. Eliminating certain redundancies could entail long-term investments in data infrastructure, according to Jeremy Bergstein, chief executive of The Science Project, a creative agency that focuses on direct-to-consumer retail.

One example is upgrading inventory allocation systems so that all available products across stores as well as warehouses for online sales are integrated. This would allow stores to be turned into distribution centres as well, so that when a customer wants to purchase something online and it’s not available in the e-commerce stock but is available in a store, that sale would not be lost.

Such overhaul may be counterintuitive during times of conservative spending, but brands and retailers should at least look into making these changes down the road, according to Bergstein.

“Brands and retailers should be using all of this downtime to rip off these old bandaids,” he said. “You’re looking at operational savings in three or four years, but when it happens, you will have a better bottom line.”

Related Articles:

How to Prepare Your Business for a Post-Pandemic World