How Beauty Brands Are Building Their Tech Muscle

KEY INSIGHTS

- Beauty companies are beefing up their technology offerings, not just in product development, but in the services and tools they offer consumers

- For a beauty brand to build a successful tech operation, however, the priority should not be implementing the most advanced technology, but the option that best fits what a brand’s particular consumers are looking for

- Brands also must consider if they want to build out their tech operations in-house or find an external partner, a decision that should be made based on long-term goals

The process for discovering the right serum for your skin type or foundation shade match today can appear to be something out of a science-fiction novel.

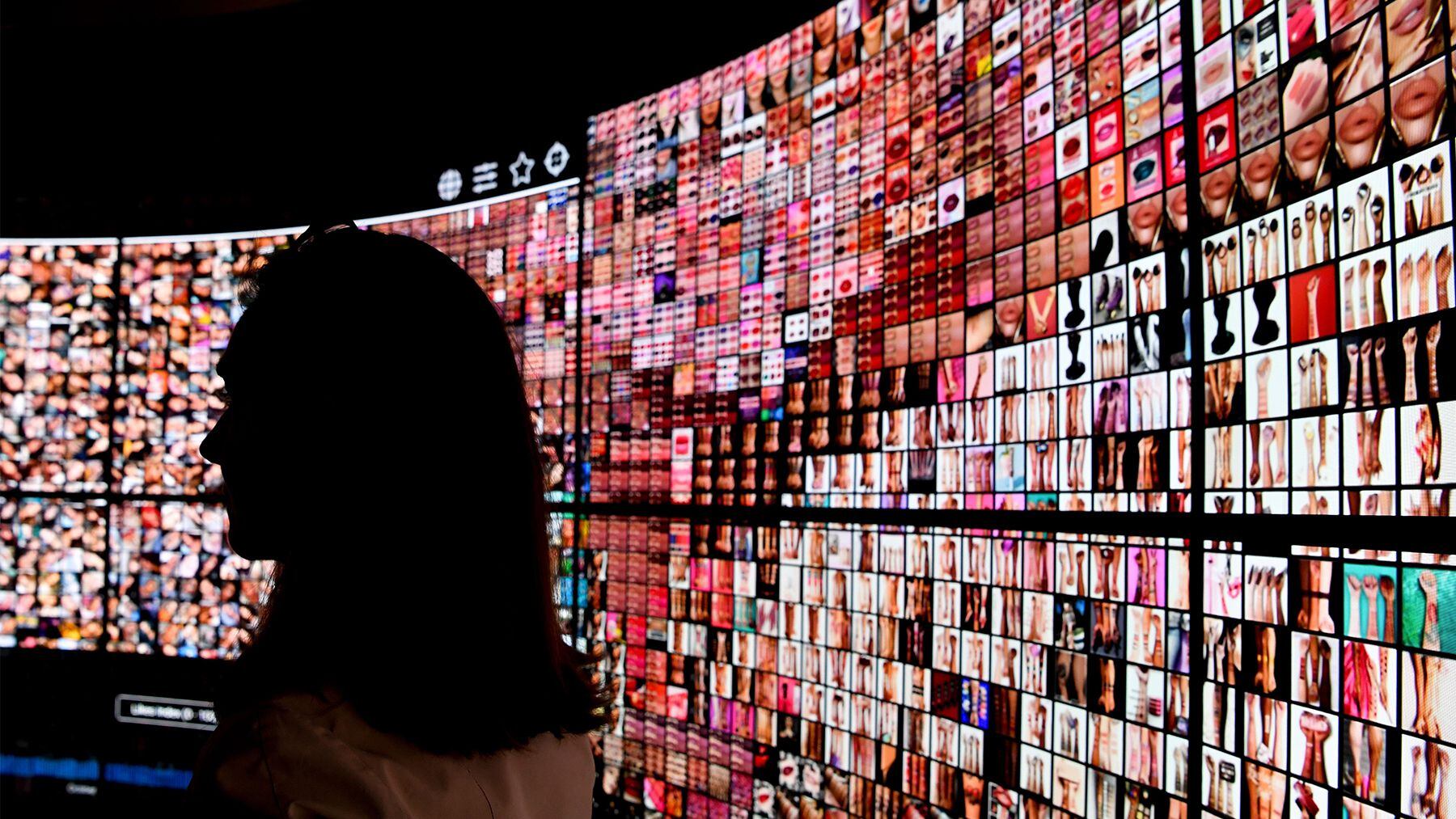

Increasingly, beauty brands are starting to look a lot more like tech companies, complete with their own tech incubators, artificial-intelligence capabilities and more. L’Oréal was one of the first to the trend when, in 2018, it acquired the augmented-reality technology company Modiface.

The momentum has only ramped up since. In the last year, cosmetics brand Il Makiage bought hyperspectral imaging computer-vision startup Voyage81 (after acquiring Israeli AI company Neowize in 2019); Ulta Beauty invested in AI retail tech company Adeptmind and launched a new virtual try-on partnership with Google; Estée Lauder rolled out AR try-on across its entire portfolio; and Clinique built on a beauty lab in the metaverse to promote a new serum. Just last week, L’Oréal announced a partnership with Alphabet-owned precision health company Verily that will see the two study skin issues and explore new product development.

Previously in beauty, technology advancements meant product development — as was the case for microbiome-focused skin care from Orveda, which was acquired by Coty in November 2021, or in Olaplex’s patented bond-repair capabilities. That definition has busted open to include how brands are using more cutting-edge technologies like augmented reality and artificial intelligence to create hyper-personalised experiences, products and devices for consumers.

“When we first went to the Consumer Electronics Show, there were no beauty companies there … now it’s flooded with so much,” said Guive Balooch, the head of L’Oréal’s technology incubator.

Beauty’s relationship with tech has shifted as brands stake their future on having the best gadgets, data and interfaces. The pandemic heightened the importance of digital channels and touch-free product trials, making technologies like virtual try-on table stakes. Now, to win over consumers, beauty brands must build out technological prowess in everything surrounding the product — not just the product itself.

“This is no longer just something that’s nice to have,” said Sampo Parkkinen, chief executive and co-founder of AR and AI wellness-technology brand Revieve. “Beauty tech has the power to transform how brands serve customers fundamentally.”

Finding the Right Fit

Technology, Balooch said, has the power to solve several challenges beauty consumers face, such as finding the right skin care regimen or shade of foundation, or being able to try on lipstick without having to buy a new tube.

“What Silicon Valley has done in the past 50 or 40 years is use technology to solve some of the big tensions in people’s lives … with beauty, the big challenge has been how do we solve the big problems that people and consumers face today?” said Balooch.

But even though certain digital capabilities, like virtual try-on, have practically become compulsory, said Parkkinen, beauty tech is not a one-size-fits-all solution. Figuring out what consumers want from a brand means a lot of experimentation and testing.

“What you should think about as a brand is: what do we stand for? What is the experience that we need to deliver to the customer?” he said. “What is the feeling I want the consumer to get when they interact with me?”

Ulta Beauty chief digital officer Prama Bhatt says Ulta first thinks about the experiences it wants to create and then determines what technology it needs to execute. Galooch, similarly, says tech solutions have to start with a problem and not exist only in the virtual space.

“You still need the makeup, you still need the actual product,” said Galooch.

Where brands often go wrong is when they replicate what’s working for a competitor without considering the particular needs of their own consumers, says Parkkinen. Depending on the target audience, sometimes it just matters that technology works, rather than if it’s the most advanced. A luxury brand, for example, might not want to use a fully automated AI-based experience.

Failure and constant pivoting should be an expectation, according to Bhatt. The retailer assesses new technology in terms of cultural fit and against a financial model of what it expects results should be, measuring indicators like incremental sales, frequency of visits and levels of engagement.

“If we believe in whatever that desired experience is, we are going to keep adapting and modifying,” said Bhatt. “There [are] other times we might just pause and say ‘No, we learned. Now it’s time to move on.’”

How Brands Build Capabilities

How a company goes about its technological transformation signals what it’s staking its future on, and differs by the deal.

“Some will develop [their technology] internally because they want to muscle their technology assets, and some brands will say, this is not our DNA,” said Accenture beauty lead Audrey Depraeter-Montacel.

With L’Oréal’s acquisition of Modiface, which provides AI capabilities to retailers like Sephora, the company was “saying ‘leveraging this technology is going to be strategically important for us, so we’re actually going to take this in-house,’” said Parkkinen.

Developing technology internally or acquiring a company to bring it in-house takes more time and money. But, brands that do so — rather than inking a partnership with an outside vendor — see holding that IP as important for their future. At L’Oréal, the primary consideration is whether it has expertise in a certain area and the immediate capabilities of inventing something independently said Galooch. If it doesn’t, it finds an outside partner — for its first augmented-reality app, it worked with Modiface and Image Metrics, a company known for its facial mapping in movies and video games, and for La Roche-Posay’s wearable UV sensor that tracks UVA and UVB ray exposure on a corresponding app, it partnered with John Rogers, a physical chemist and professor at Northwestern University, whose research and IP helped inform development.

Galooch points to the Verily tie-up as another example. “Without us, they wouldn’t have the information on skin, without them, we wouldn’t have the information to create this ecosystem because they’ve been doing it so well in [medicine],’’ he said.

For Bhatt, partnerships are not just about the technology, but also the founders and teams Ulta Beauty gets to add to its roster. The brand made two tech-focused acquisitions in 2018, AR and AI start-ups QM Scientific and GlamSt.

“Whether a strategic partnership, investment or full acquisition, they all say the same thing: the beauty market is changing fast,” said Depraeter-Montacel. “The traditional beauty market needs to follow this trend, and to move and to develop their assets.”

The Road Ahead

Despite the investment, Parkkinen said certain significant developments have not yet trickled down to consumers. That’s due to a few factors: mainstream hardware on mobile phones is not up to snuff, and there’s sometimes a gap in knowledge between brand executives and tech developers.

Success for some other types of more boundary-pushing tech can’t immediately be measured with just adoption rate. For example, L’Oréal’s UV sensor will help the brand unpack all the individualised factors that can contribute to melanoma and skin ageing. What matters is the fact that, with that information, the company will be able to make better products down the line, not today’s sales.

As technology becomes an increasingly important part of the industry, beauty executives will need to be more tech-literate. For a brand executive, a few years ago, it was enough to know customers and know products, says Parkkinen.

“Today, I also need to be an expert in technology,” he said. “I would need to be someone who spent several years in Silicon Valley to understand all this stuff.”

The potential of “this stuff” really has no limit. Innovation around product chemistry will continue — but L’Oréal’s Galooch sees a future where every product is surrounded by services, and formulas could even be designed specifically for the technology.

“The more science progresses the more we will be able to propose new products,” said Depraeter-Montacel. “I think there is a lot in front of us and the brands know that — that’s why they’re investing.”

:quality(70):focal(461x613:471x623)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/EAIQHNJXDJDPVOMNNNUJKXDG7A.jpg)