Financial Regulation

The financial sector in Kenya has experienced significant growth in recent years and is generally considered strong. The sector is dominated by large commercial banks, which have expanded their reach across the country, providing financial services to both urban and rural areas. However, the financial sector in Kenya also faces challenges and weaknesses. Most of it is connected to regulations and fraud.

Down below we will describe the financial sector of Kenya in more detail, including regulations, business environment and prospects that are needed to consider before entering into the Kenyan market.

How is the Kenyan Financial Sector Regulated?

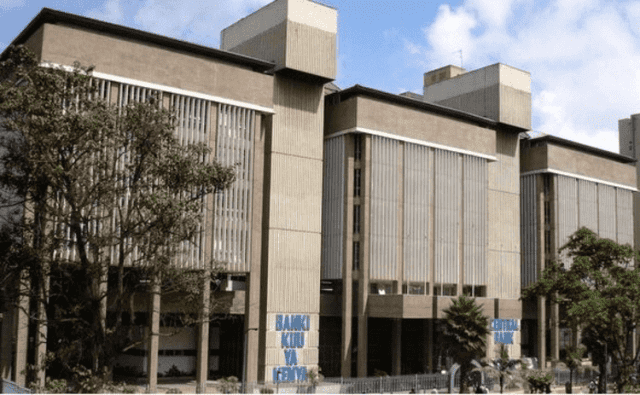

The financial sector in Kenya is regulated by several institutions, including the Central Bank of Kenya (CBK), the Capital Markets Authority (CMA), and the Insurance Regulatory Authority (IRA). These regulatory bodies are responsible for ensuring that financial companies comply with the laws and regulations that govern the industry, and for promoting stability and growth in the financial sector.

The CBK is the main regulator of banks, microfinance institutions, and other financial institutions that accept deposits from the public. The CBK has implemented several regulations, including capital adequacy requirements, liquidity requirements, and anti-money laundering laws, to ensure the stability and safety of the banking sector.

The CMA, on the other hand, regulates the capital markets, including the Nairobi Securities Exchange (NSE) and the bond market. The CMA has implemented regulations such as the Securities Act, the Capital Markets Act, and the Code of Conduct for market intermediaries. The CMA also regulates brokers, ensuring that they are licensed, meet the necessary requirements, and adhere to ethical standards. So for trading, always choose CMA regulated brokers in Kenya, as such brokers are safe.

The IRA is responsible for regulating the insurance industry, ensuring that insurance companies are licensed and that they comply with regulations related to solvency, capital adequacy, and risk management.

In terms of the effectiveness of the regulations, there have been some concerns about enforcement and compliance. Some financial companies have been found to be non-compliant with regulations, and there have been cases of fraud and corruption in the sector. However, the regulatory bodies have taken steps to improve enforcement, and have introduced measures such as increased penalties for non-compliance.

When it comes to the reputation of the Kenyan financial market, the regulations implemented by the regulatory bodies have helped to improve the market’s reputation in recent years. The market has become more transparent and accountable, and there is a greater focus on ethical conduct and compliance. As a result, the market has become more attractive to investors, and there has been increased interest from foreign investors in recent years.

What Kenya Need to Solve for Better Financial Regulations

Regulations are an important part of the financial sector in Kenya. They aim to create and maintain safety, fairness and user-centered conditions in the financial sector. For that there are some central regulations, that play the biggest role and they are:

- Capital adequacy requirements: That is one of the basic requirements in Kenya as well as in the world which includes having a minimum level of capital for avoiding losses and troubles with customers.

- Liquidity requirements: Kenya has a limited, sufficient level of liquidity that should be acceptable for the society that uses banking services.

- Anti-money laundering laws: Kenya often faces problems with fraud or terrorism. This law is responsible for identifying such problems in the financial sector in advance.

- Licensing requirements: Financial companies are required to obtain a license from the regulatory bodies before they can operate in the sector.

- Code of Conduct: Market intermediaries, such as brokers, are required to adhere to ethical standards and conduct themselves in a fair and transparent manner.

While these regulations have helped to improve the stability and transparency of Kenya’s financial sector, there are still some challenges and weaknesses. One of the main problems is the high level of non-performing loans, which can lead to instability in the banking sector. There are also concerns about fraud and corruption, which can damage the reputation of the financial sector and deter investment.

So as problems are many, Kenya needs to take some action. For example, the regulatory bodies could increase the enforcement of regulations, implement more stringent measures to prevent fraud and corruption, and provide more support to consumers and investors. Financial companies could also take steps to improve risk management and transparency and work to build more trust with their clients.

These problems can damage brokers and traders by reducing confidence in the financial sector and making it more difficult to do business. Brokers and traders may also be affected by regulatory changes, such as increased licensing requirements or stricter enforcement of regulations. However, by working together with regulatory bodies and financial companies to address these issues, brokers and traders can help to improve the stability and transparency of Kenya’s financial sector and ensure that it remains an attractive place to do business.