Fashion Briefing: As luxury sales slow, brands are ‘moving downstream’ to off-price channels

This week, a look at luxury brands’ new embrace of outlet distribution. Scroll down to use Glossy+ Comments, giving the Glossy+ community the opportunity to join discussions around industry topics.

With luxury’s slowed growth expected to continue through next year, more brands are turning to outlet channels to offload inventory and retain sales. At the same time, off-price retailers are competing for their business by promising unprecedented discretion.

“It’s been a good turn of events for us,” said Neel Grover, CEO of Shop Premium Outlets, which Simon Property Group launched in October 2019 as the e-commerce counterpart to its 70 outlet malls. “We definitely have more inventory now, compared to a year ago. And it’s a lot more sale product than [made-for-] outlet product.”

He added, “In the last couple of years, luxury hasn’t had to discount at all, but the consumer is becoming more price sensitive. Luxury brands are coming to us because they want to limit or eliminate the sale inventory on their own websites, and we won’t overexpose them.”

Shop Premium Outlets’ products include clothing by Oscar de la Renta and Brunello Cucinelli, and accessories by The Row, Alexander McQueen and Dior. Louis Vuitton and Gucci are featured via pre-owned styles. Multi-brand retailer Intermix, which is in troubled water — amid another change in ownership announced this week, it’s furloughed employees and is reportedly not paying brands for shipped orders — launched on SPO on November 21. A $1,300 Veronica Beard jacket is among Intermix products currently being sold.

Grover stressed that, as a company owned by Simon Property Groups, which relies heavily on brands’ real estate revenue, Shop Premium Outlets is focused on ensuring brands’ success and being “additive” to their goals. The Simon connection has upped the comfort level of brands selling on the platform, he said. But not all of the site’s hundreds of brands are Simon tenants, and not all of them have a consistent presence on the site.

“Over the last few years, trust in third-party platforms has gone down for brands, whereas for consumers it’s gone up,” Grover said. “The dominant marketplaces out there have made brands hesitant to go there, but we’re more an extension of the brand experience.”

With Shop Premium Outlets, brands select the products they want to sell, at what price and in what markets, plus they approve the featured brand assets. In addition, they’re able to provide specifications around whether or not they want to be included in the platform’s marketing, which focuses on its own customer base and brand building — it doesn’t compete with brands on search keywords, Grover said. Within the platform, brands can also launch custom promotions around the loyalty program points customers earn by shopping.

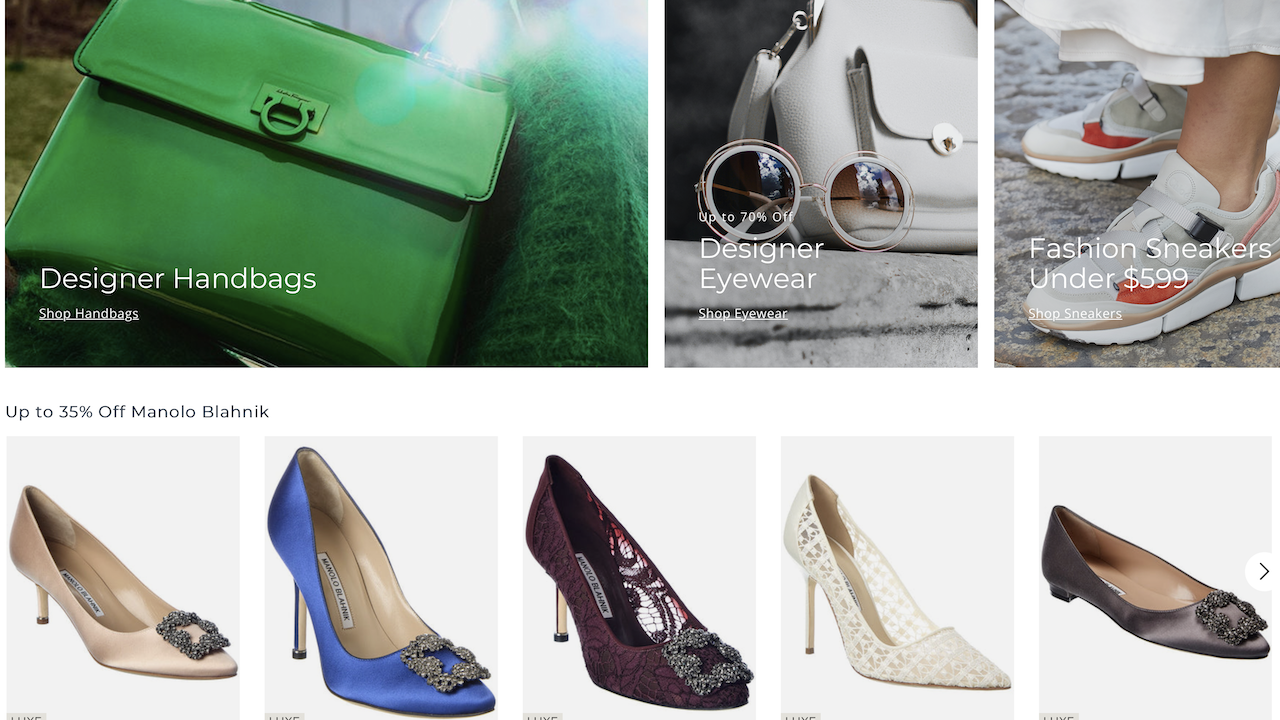

High-end brands categorized on the site as “Luxe” can set various parameters around how they want to be seen on the site. Some don’t permit their products to be shown to those not logged in as members, while others gate only the price or the opportunity to purchase. Usually, the higher end the brand is, the more restrictions it requires, Grover said.

In November 2021, online marketplace Otrium launched with a similar setup: Logged-in members are granted “access to hundreds of fashion outlet stores.” Currently featured are Badgley Mischka, Wolford and Belstaff, among others.

In weekly meetings with brands, Shop Premium Outlets brand managers share information on brands’ conversion rates, including how they stack up among competitors, plus offer recommendations to increase sales. Provided data can also be used by the brand to re-market to customers, driving them to channels focused on full-price products.

Grover said he and his team aim to provide easy discovery of premium brands’ outlet and sale products. At the same time, they’re promoting Simon’s physical retail locations throughout the country. For example, last year, it became the first marketplace to launch buy-online, pick-up at a brand’s store, offering both outlet and full-price locations.

If a brand has not digitized its outlet inventory, Shop Premium Outlets will often host a livestream at one of the brand’s physical stores to enable digital selling. Popular locations based on shopper engagement have included stores in New York’s Woodbury Common Premium Outlets, as well as Las Vegas- and Austin-based centers. Other livestreams have featured chats with brand designers.

Grover estimated in October that Shop Premium Outlets had hosted 30 livestream events for brands in the 12 months prior. The 30-minute livestreams typically feature a Shop Premium Outlets host, a well-versed brand spokesperson and 15-30 products that are part of a promotion running through the subsequent week. Currently, the livestreams are featured on shoppremiumoutlets.com, and Grover said the company has plans to amplify their reach through social platforms including TikTok.

Shop Premium Outlets doesn’t hold inventory, and brands handle their own shipping. Its operations instead center on merchandising, customer service, marketing — including through Simon Property Group’s physical locations — and technology. The company can onboard a new brand within a week, according to Grover.

Grover joined Shop Premium Outlets in early 2020, after serving as CEO at four other marketplaces, including Bluefly, Rakuten and Buy.com. With him, he brought CTO David Keel, formerly of Buy.com and Bluefly, and senior software engineer Scott Alvis, from Buy.com. The former is focused on advancing the company’s omnichannel capabilities.

Grover declined to share data around the number of full-price customers brands have earned through the outlet, but he described it as a “high, high, high, significant percentage.”

On its third-quarter earnings call, on November 1, Simon Property Group shared that its occupancy in its U.S. shopping centers was up 1.7% year-over-year, to 94.5%. Its base minimum rent per square foot was also up 1.7%, to $54.80. During the quarter, it opened its tenth outlet in Japan, Fukaya-Hanazono Premium Outlets, and started construction on Busan Premium Outlets in South Korea. It expects to open the Paris-Giverny Designer Outlet in Normandy, France in the first quarter of 2023.

Throughout the holiday shopping season, Grover said Shop Premium Outlets will maintain excitement by rolling out new partner brands and hosting livestream events.

Simon Property Group’s partnership with Tmall Global, Alibaba’s cross-border e-commerce platform, has proved the strategy’s potential since launching in late October. In November, Tmall hosted two livestreams from Shop Premium Outlets’ Woodbury Common Premium Outlets. Over 2 million viewers tuned in to the Black Friday livestream, and 1.3 million viewers tuned in to a November 4 livestream, timed with China’s 11.11 shopping holiday. The latter featured Michael Kors, Coach and Stuart Weitzman, among other brands. The Chinese are the No. 1 tourist market at Woodbury Common, according to David Mistretta, general manager at Simon Property Group.

“Chinese shoppers are well aware of the premium outlets in the U.S., as they are popular tourist destinations,” said Tony Shan, head of Tmall Global for the Americas. “Due to the current travel restrictions, they aren’t able to visit and shop them, which is why the partnership with SPO and Simon is exciting. … Chinese consumers are less price sensitive, but they do seek value and savings when they can.”

Grover expects SPO’s ambassador program will also work to the company’s advantage this season as influencers earning an affiliate commission create gift guides featuring products across brands. The company’s newly launched app, providing notifications around new prices and products, should drive sales, as well, he said.

“There are still luxury brands that want to continue moving upstream [with price points], but it’s also becoming increasingly typical for brands to have an off-price strategy,” Grover said. “The economy’s changing, and things are moving too fast to [nail] inventory quantities every time. Increasingly, brands want a comfortable way to move customers downstream.”

Inside our coverage

Revolve Group is getting into mobile gaming

Scanlan Theodore’s Melinda Robertson on preparing for an ‘inevitable’ recession

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/OJRFGVTNHFEBVLNEPM5F6YDXMU.png)