Why Fashion Brands Were Silent After the US Capitol Storming | This Week in Fashion, BoF Professional

Soon after a costumed, right-wing mob, inflamed by online memes and outgoing US President Donald Trump, stormed the seat of the country’s democracy last Tuesday to stop the certification of the 2020 election results, many companies took swift action to protect their brands. Almost immediately, many paused their marketing activities for fear of appearing next to coverage or commentary on what President-elect Joe Biden gravely called “insurrection.”

The same day, CEOs from technology to finance issued statements on the matter. Apple chief executive Tim Cook lamented a “sad and shameful chapter in our nation’s history” and called for accountability. BlackRock chairman Larry Fink called the Capitol invasion “an assault on our nation, our democracy and the will of the American people.”

Even the Republican-leaning National Association of Manufacturers issued a strongly-worded statement denouncing the violence: “This is not law and order. This is chaos. It is mob rule.” And soon, companies from Amazon to Nike to Goldman Sachs had vowed to pause financial contributions to legislators who voted against certifying the election.

But few major brands rushed to make big consumer-facing statements.

Patagonia, no stranger to taking political positions, was one of the only fashion and apparel companies that issued a statement to its fans, condemning the “assault,” calling for the removal of Trump and noting the “double standard” in the security response to last summer’s Black Lives Matter protests and the storming of the Capitol.

In recent years, leading brands like Nike and Gucci have reversed years of corporate neutrality, taking a public stance on sensitive topics from racism to gun control. Most famously, Nike embraced polarising American football quarterback Colin Kaepernick, who began kneeling during the national anthem, which is played before sporting events across America, to protest the police brutality and wider social injustice suffered by Black people.

At the heart of the shift is the rising spending power of millennials, who expect the brands they love to embrace values that align with their own and take a stand on important socio-political issues as they lose faith in traditional institutions like government and the media. Millennial employees have similar expectations of the brands they work for at a time when attracting and retaining talent and fostering a strong company culture are more important than ever.

Never was this shift more visible than in the avalanche of support from major brands for Black Lives Matter when protests erupted after the police killing of George Floyd, another flashpoint in a deeply divided nation.

And yet, when a mob of white nationalists stormed the US Capitol last week, many of the same brands stayed silent, save for quiet statements pledging to withhold political donations. Why?

Some may have become more cautious after being burned when their statements supporting Black Lives Matter and other causes were seen as inauthentic, self-serving and, in some cases, at odds with their own internal cultures, attracting social media backlash.

In November, Gap was ridiculed when it posted (and then deleted) a tweet featuring a branded, half-red, half-blue hoodie — a reference to America’s political divide — with the caption: “The one thing we know, is that together, we can move forward.”

Others may have been wary of commenting on every new crisis at a volatile moment in history.

But for many, the underlying calculus was rooted in the distinction between politics and values. The killing of George Floyd was widely seen as above politics. It was not about being a Republican or a Democrat, or even an American. It was about fundamental human values that are global and universal in nature, transcending nations and their party politics in a way that the Capitol invasion — inextricably linked to Trumpism and the 2020 election — did not.

While universal values are not always universally shared, they are less fraught with the tension and complexity that can make party politics a minefield for brands. Critically, they can also be more easily activated in a way that is positive, constructive and aligns with a brand’s own framework of values. For example, Nike’s decision to support Kaepernick’s protest underscored its commitment to equality and aligned with its underlying belief in the universalism of sport.

Which brings us to the matter of aspiration. Fashion brands ultimately sell more than just clothes, shoes or bags. They sell a better you. As such, their worldview is fundamentally optimistic. Their brand storytelling is typically uplifting and empowering.

It’s far more natural and advantageous for them to stand for something positive — whether it’s racial equality or a cleaner planet — than stand against the ugliness of a reactionary mob.

Many brand managers will have watched the Capitol invasion unfold in real-time and, despite pressure from employees, quickly realised there was no positive brand story for them to tell.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

President-elect Joe Biden outlined plans for a $1.9 trillion stimulus package. Getty Images.

Biden proposes $1.9 trillion spending package. Ahead of his inauguration, the President-elect outlined a spending plan that includes a vaccination programme and $1,400 stimulus cheques for millions of Americans.

Luxury braces itself as Chinese authorities discourage travel ahead of New Year festivities. Chinese authorities have reported the country’s first Covid-19 death since May and reimposed small-scale lockdowns following a surge in local cases.

US Bans all Xinjiang cotton products. The move is the latest in a string where the US is increasing pressure on China over some companies’ alleged ill-treatment of workers. The US says the Chinese government has detained more than 1 million Uighurs and other ethnic and religious minorities, which the Foreign Ministry in Beijing denies.

MyTheresa aiming for $1.58 billion valuation. The luxury e-tailer is offering 15.6 million shares on the New York Stock Exchange. The company said it expects its share price to debut between $16 and $18 per share and aims to raise as much as $282 million, according to Reuters.

Poshmark IPO Opens Trading at $100. The resale marketplace debuted at more than double its expected price. The outperformance — which mirrors that of many other online retailers that boomed right out of the gate — speaks to investor interest in the resale sector.

Dr. Martens considers IPO. Owner Permira Holdings seeks to sell a stake in the iconic British bootmaker amid rallying stock markets. The company does not plan to raise any money in the IPO, according to a statement released on Monday.

Chanel to stage Cruise show in south of France this May. The Parisian house will present its Resort 2021/22 collection at the Carrières de Lumières, in the village of Les Baux-de-Provence, on May 4. It has yet to communicate plans regarding how many people will be invited to attend the show.

JD Sports is reportedly in talks with Authentic Brands Group to acquire Topshop. The UK-based sporting goods retailer is discussing a joint bid with the American licensing company for the high-street mainstay, Sky News reported Wednesday. As part of the deal, JD Sports would be ABG’s operating partner.

Fashion Nova factory faces Covid-19 outbreak. The Instagram-famous brand reported 203 cases in its Los Angeles distribution centre over the past two weeks, making it the third-largest ongoing outbreak in the county, according to The Daily Beast.

H&M taps Simone Rocha for latest designer collaboration. Available for purchase online and in stores beginning in March, the products will include menswear, children’s clothing and beauty — all new segments for Rocha.

London Fashion Week to proceed online. Following the reintroduction of lockdown measures across the UK earlier this month, the event will run from Friday, February 19 to Tuesday, February 23 with no live audiences.

Uniqlo parent company rides China resurgence to beat pre-pandemic profits. Fast Retailing announced that its overall group revenue for the quarter ending November 30, 2020 dropped 0.3 percent year-on-year, but operating profit rose to 113.1 billion yen ($1.09 billion), up 23 percent from a year earlier when the Covid-19 pandemic had not yet emerged.

Asos raises profit view after strong Christmas sales. Analysts have forecast a pre-tax profit of £115 million to £170 million versus £142.1 million in 2019 to 2020. Group retail sales rose 23 percent year-on-year over the four months to December 31.

Target holiday sales jump 17 percent as shoppers splurge online. The big-box retailer reported a bump in comparable sales for the holiday season. Its online sales more than doubled, thanks to faster deliveries and higher demand for home goods, electronics and beauty products.

Nordstrom’s holiday sales dropped about 22 percent. Net sales tumbled during the nine-week holiday period, which ended January 2, compared to last year. The company said its November and December sales were in line with expectations for the fourth quarter.

Marks & Spencer buys Jaeger. The British retailer said it was in the final stages of purchasing product and supporting marketing assets from the administrators of Jaeger Retail Limited and expected to fully complete the deal later this month. No figures were disclosed.

Lululemon trading update disappoints investors. The athleticwear company forecasts sales growth in the high teens for the period ending January 31, in line with earlier guidance, but some analysts were expecting a bigger boost.

Urban Outfitters drops after a tough holiday season. The retail group, which also includes Anthropologie and Free People, posted a 9 percent drop in comparable retail sales for the two months ending December 31. Trish Donnelly, chief executive of the Urban Outfitters chain, will depart at the end of the month.

Abercrombie & Fitch sees smaller-than-expected decline in fourth-quarter sales. The retailer said holiday-quarter net sales were expected to decline between 5 percent and 7 percent, as strong online demand was not enough to cushion the blow from temporary store closures and Covid-19 restrictions.

Primark owner warns of £1.5 billion sales hit if lockdowns last through March. However, the company has confidence in a strong reopening despite its lack of an online presence.

THE BUSINESS OF BEAUTY

The Hut Group-owned Ameliorate. Ameliorate.

Hut Group raises 2021 forecast as beauty lifts Q4 sales. The British retailer said it now expects 2021 revenue to be between 30 percent and 35 percent higher than last year, when sales hit about £1.6 billion.

Some major beauty influencers supported the Capitol riots. They’ve been mixing posts about the QAnon conspiracy theory with makeup tips for a while. Some of their fans and fellow influencers are fed up.

The genius of Pat McGrath. The newly minted dame spoke with Allure about the secret to her success.

Sephora wants its customers back. The beauty retail giant wants to make its stores are more welcoming and inclusive to entice back shoppers, nearly a year into the pandemic.

Flo will pay customers for data misuse. The fertility-tracking app settled charges that it shared sensitive health information with Facebook and Google.

Another Queer Eye star, another haircare product. Jonathan Van Ness’ upcoming line joins costar Karamo Brown’s grooming products in an increasingly crowded market for celebrity beauty.

Customisable makeup comes to Target. In what may be a first for the mass market, Billion Dollar Beauty’s custom palettes will be sold at the big-box retailer.

PEOPLE

Jim Gold has joined Moda Operandi as interim CEO. Getty Images.

Jim Gold named Moda Operandi interim chief executive as Ganesh Srivats exits. Srivats, who joined from Tesla in 2018, will be temporarily replaced by Gold, best known as the former president of Neiman Marcus. Co-founder Lauren Santo Domingo remains in her role as chief brand officer.

Valentino names new chief officer for client, digital acquisition. Enzo Quarenghi will join Valentino to head a new division combining its Retail Excellence and Global Markets units. He was previously Italy chief executive for payments giant Visa.

Louis Vuitton appoints David Ponzo commercial activities chief. He will succeed Anthony Ledru, who was appointed chief executive of Tiffany, as executive vice president of the luxury label’s commercial activities, making him responsible for Louis Vuitton’s network of 460 physical stores and e-commerce operations as well as store planning and client relations.

Balmain names Matthieu Petri chief commercial officer. Petri joins Balmain from Chaumet, where he served as retail director of Europe. Prior to this, he worked in strategy and project management at LVMH. In his new role, Petri will spearhead Balmain’s commercial strategy and optimise its wholesale and retail distribution network.

MEDIA AND TECH

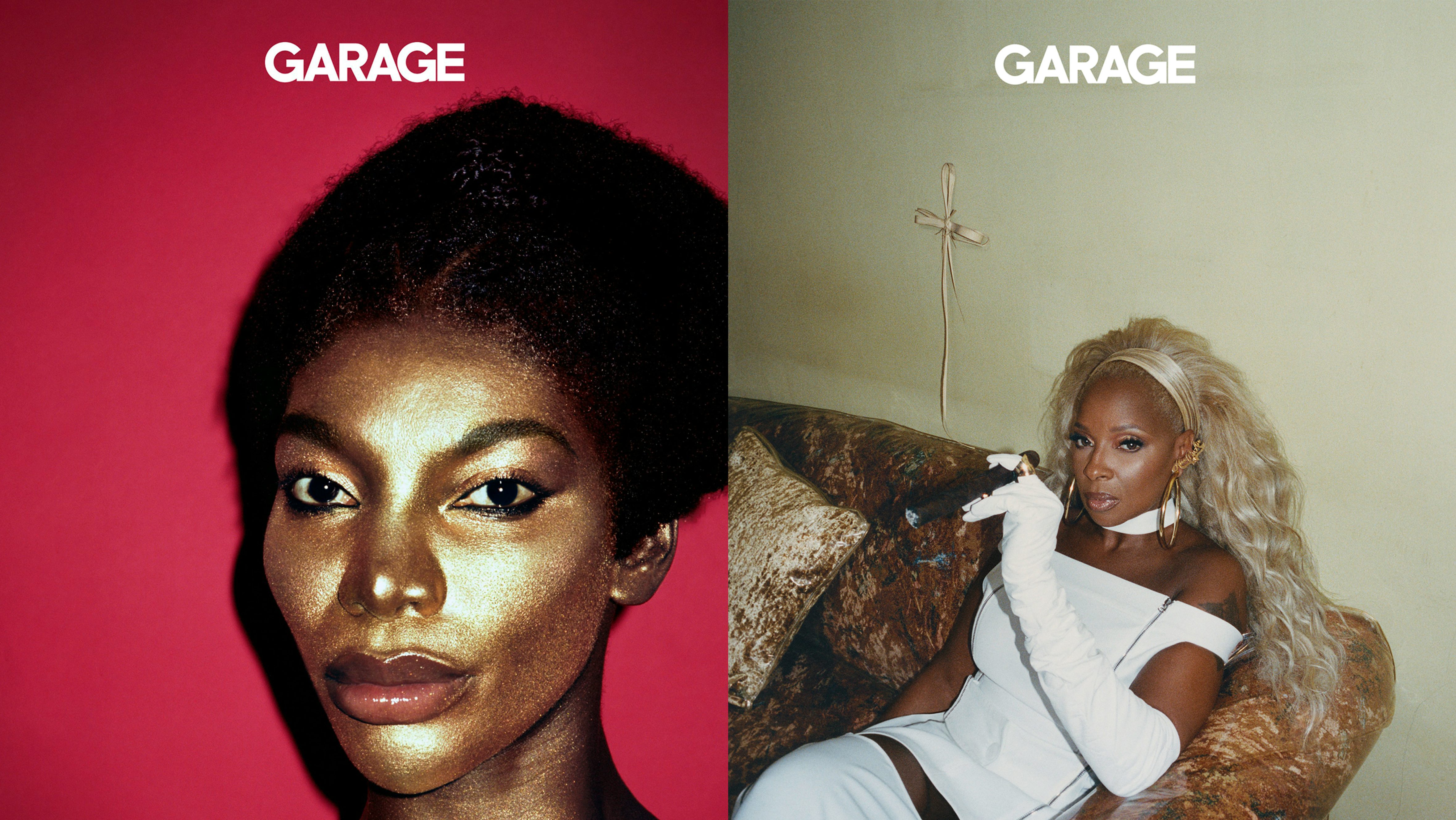

Garage Magazine Issue 19 featured Michaela Coel and Mary J. Blige. Garage Magazine.

Vice Media will cease publishing Garage magazine. The spring issue of the biannual publication will be its last at Vice, which acquired a majority stake in the art and fashion title from founder Dasha Zhukova five years ago. But the publication will not shut down.

Dazed magazine announces editorial shakeup. Isabella Burley, who has led the title since 2015, is exiting the British youth culture bible, with fast-rising stylist Ibrahim Kamara set to take her place as editor in chief. Lynette Nylander has been named executive editorial director, while current artistic director Jamie Reid and fashion director Emma Wyman are stepping down.

Report: Bustle Digital Group explores deal to go public. The company is aiming for a valuation of at least $600 million, including debt, and recently hired investment bank Farvahar Partners to identify an attractive deal with a special purpose acquisition company (SPAC).

Walmart creates fintech start-up in partnership with Ribbit Capital. The company has formed a partnership with an investor in stock-trading platform Robinhood, in a venture that will aim to give consumers ways to save, borrow and invest online or via phone without dealing with a traditional bank.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

:quality(70):focal(829x574:839x584)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/453L6LAGU5E5TI5V6CCTFLSU7I.jpg)