What Is Chattel Mortgage?

Have you ever heard of the chattel mortgage? Do you know how it works? If the answer is no, then let’s know a few basics and how it works and how can you avail of it. A Chattel mortgage is a type of loan agreement under which any movable personal property of the borrower can be kept by the lender as security for the loan. Unlike conventional loan agreement under which the lender mark a lien on the property and takes possession of the property if the borrower defaults, the chattel mortgage work in such a way that benefits both the lender and the borrower.

Under the chattel mortgage, the lender neither marks a lien nor possesses the property but conditionally transfers the ownership of the property till the loan gets satisfied. This conditional transfer is nothing but a temporary ownership transfer between the lender and the borrower and the borrower’s rights on the property will be resumed back once the loan is paid. A chattel mortgage applies to all sorts of personal movable properties such as cars, homes, Business houses, and almost all the items on which you can take the traditional loan.

The only difference between a traditional and a chattel loan lies in the way the lender functions on his/her default borrower. It is considered to be the best mortgage option by many corporate houses as this would pave way for the free flow of working capital and funds their operational activities in time. Not only corporate houses but also individuals feel that it is beneficial over conventional mortgages as they do not lose their property in case of default.

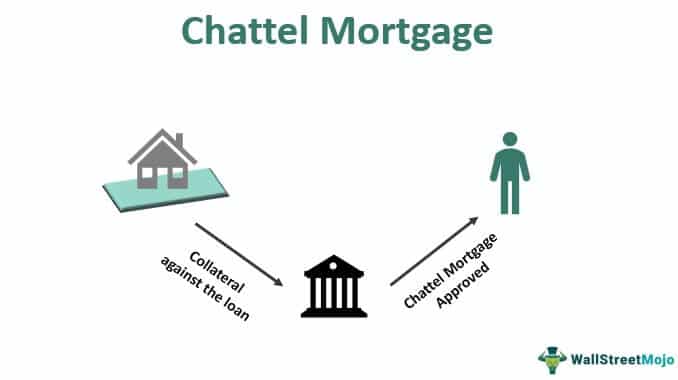

Now that we know what is a chattel mortgage, let’s look at how it works. Under the chattel mortgage, the lender funds the buyer’s movable property. i.e., the lender pays the cost of movable property that the borrower like to buy or own. Once the property is registered in the name of the borrower, the lender makes a mortgage on the property. This mortgage gives a right to the lender on the buyer’s property. If in case the buyer defaults on the repayment, the lender waits until the end of the loan agreement and postmaturity of the loan the lender transfers the property ownership to his name temporarily.

In case, the borrower fulfills the obligations as stated in the loan agreement, then the lender removes the mortgage on the property. Once the lender removes the mortgage, the borrower will get full rights to his property. The very working methodology has made it more popular among both businesses as well as individuals.