The merge is done – what’s next?

GM. The merge is complete and it was a success! Many, many things have failed in Crypto this year.

The Merge didn’t.

Thank you to all the builders behind the scenes!

In Today’s Email, We’ll be Covering:

- ETH has Merged: It was successful. What’s next?

- Gains Network: A deep dive.

- DeFi Bites: S. Korea has issued an arrest warrant for Do Kwon, Starbucks partners with Polygon, and more.

Let’s Dive in!

📉 THE MARKETS

- Total Crypto Market Cap: $1.0T (-1.98%, 7 days)

- BTC Price: $19,776.61 (+2.4%, 7 days)

- ETH Price: $1,465.07 (-10.4%, 7 days)

- TVL in DeFi: $54.1B (-7.47%, 7 days)

- Fear & Greed: 20 (Extreme Fear)

ETH’s price is down after a successful merge.

1. A classic “buy the rumor, sell the news”

2. The macro environment’s still bad, especially after last week’s Consumer Price Index numbers (8.3% rise in CPI)

“The most important quality for an investor is temperament, not intellect.” – Warren Buffet

💡THE BIG STORY

What’s After the Merge?

|

|

The Merge is officially a success!

Ethereum has transitioned from a Proof of Work chain into a Proof of Stake chain. This lowers Ethereum’s energy usage by 99.9%!

All the ETH miners are moving onto other chains such as ETH Classic, EthereumPOW, Ravencoin, and more. Now that the Merge is over, what’s next?

The Next Upgrades

The next upgrade is called Shanghai.

There’s roughly $21B worth of Ethereum being staked now (Some of which have been locked for years). The most likely feature is the ability to start withdrawing locked Ethereum.

Will unlocking staked ETH crash its price?

Not really.

- Over 70% of locked ETH is underwater, according to Nansen. Psychologically, a lot of people will want to wait until it “breaks even” before they start selling.

- When the upgrade happens, there will be a limit on how much ETH can be withdrawn each day. It’s not like all 21m will be unlocked on the same day. Instead, there will be a “queue.”

The next major milestone will be addressing Ethereum’s issues with scaling and high gas fees.

They’ll do it through sharding (estimated 2023)

- Sharding is a multi-phase upgrade to improve Ethereum’s scalability and capacity.

- Sharding provides secure distribution of data storage requirements, enabling rollups to be even cheaper, and making nodes easier to operate.

- They enable layer 2 solutions to offer low transaction fees while leveraging the security of Ethereum.

- This upgrade has become more of a focus since Ethereum moved to proof-of-stake.

Some Things I’ll be Paying Attention to:

- How much sell pressure there will be once ETH’s unlocks begins

- The L2 race among Optimism, Arbitrum, Metis, Starkware and more for market share and adoption.

- How Layer 1s will adapt as ETH starts handling its scaling and gas issues

- How long will it take to implement sharding? ETH has experienced delays in its development in the past.

Even though the prices suck, it’s an exciting time to be a part of Crypto!

You were officially here B.M. (Before Merge)!

👨🔬 DEEP DIVE

GAINS Network – The Underdog of Perps

|

|

Written by Edgy with contributions from Ross Both and Kenji

I’ve been preaching about the real yield movement in the past few months.

It’s where protocols are paying out yields based on revenue fees rather than printing tokens.

There are 3 things that I’m looking for in a real yield protocol.

- A product that people want to use and pay for.

- The protocol shares the revenue with the token holders.

- The rewards are paid in sound money such as ETH or stable coins.

I want to share some of my research on a protocol that I believe to be undervalued:

Gains Network on Polygon.

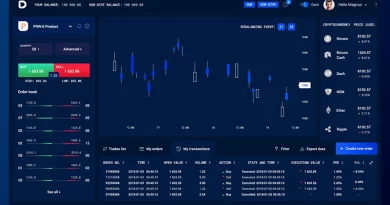

Part 1: I’ll talk about their flagship product gTrade – it’s a decentralized synthetic leverage trading platform.

Part 2: I’ll talk about DeFi opportunities for Gains Network.

(This isn’t encouragement to buy – I’m sharing my personal research with you. Think of this like me shining a spotlight on a project, and you should do further research if you’re interested.)

Notable Numbers

All time trade volume: $16.51B

# of unique gTrade users: 6,057

GNS Market Cap: $ 47,051,837

GNS Price: $1.57 (ATH was $4.78 in January)

What is gTrade?

gTrade is a decentralized, leveraged trading platform, and the flagship product of Gains Network.

Perpetual swaps have done well in the bear market with DYDX and GMX leading the charge.

What makes gTrade different from its competitors?

- You can trade Crypto, stocks, and forex. Everything’s synthetic aka “infinite” leverage. It offers users higher leverage than its competitors.

- It has the most pairings available by far.

- There’s a “practice mode” to stimulate live trading

- Custom Chainlink DON = no scamwicks. It’s great for leverage traders who complain about getting wicked out of their trades on other platforms

1. Synthetic Architecture

The biggest differentiator of gTrade vs its competitors (GMX and DYDX) is that gTrade is fully synthetic.

You’re never actually buying the asset you trade – instead, you’re betting on its price with $DAI.

When you trade on gTrade, you put down $DAI as collateral. That $DAI is locked for the duration of your trade. Let’s say you make an $ETH trade, which does a 10x. You get 10x your $DAI collateral back (minus fees).

2. Liquidity Efficiency (Low Slippage)

So how does the Synthetic Architecture work on the back end?

Since you’re “betting” on prices without having to own the tokens, there is no need for each token to have its own Liquidity Pool.

All of the gTrade pairs use $DAI Vault Liquidity. And it’s got ~$11m worth of $DAI in it, so it’s not going to be creating slippage anytime soon.

The $DAI Vault is the reason there are no “low liquidity pairs” on gTrade.

This is also the reason why gTrade can easily list different asset classes, like stocks, forex, and crypto.

3. No Scamwicks

I used to play FPS and Starcraft a lot. I’ve lost games because “lag” would happen at the worst times. I aim a headshot at someone, and then the screen freezes for 1 second. Then I’m staring at the death screen.

(I swear it was because of lag and not because I sucked!)

There’s lag in trading, and it’s called scamwicks.

During volatile trading periods (pick any recent crash), you see some very long wicks on the price charts of centralized exchanges that get a ton of people (unfairly) liquidated.

These are usually whales purposefully triggering liquidity cascades with big orders.

Even if these orders occur for a split second, scamwicks can still do damage.

gTrade has a unique way of sidestepping this issue.

gTrade uses a custom Chainlink DON (Decentralized Oracle Network) to get an aggregate for the token prices from several top exchanges. If a scamwicks occurs on a token on one of those exchanges, gTrade oracles ignore it and treat it like a defect.

In other words, the token prices on gTrade are always median prices – you can’t get scamwicked.

Usually, Chainlink oracles update price feeds every 30s. But that’s way too slow for scalping. So the gTrade team made their custom oracles that refresh every 1/100s instead.

Back to the gaming analogy – gTrade’s Chainlink DON is the equivalent of having a modem that never lags and always gives you a fair shot at winning.

Where the Yield Comes From

gTrade’s goal is to become a fully decentralized platform in the future. To achieve that, it has to incentivize different jobs in its ecosystem to users through its revenue fees.

Where does the revenue come from?

There’s a .08% closing fee on each trade.

That then gets distributed.:

- 40% GNS staking

- 40% DAI vault

- 20% GNS-DAI LPs.

Stats on Gains Network via Dune

For reference, $713k was distributed in August.

DeFi Staking Opportunities:

- Stake GNS to earn DAI. ~8% APY

- Stake DAI and get rewarded in DAI. ~12% APY (Solid stablecoin play)

- Provide liquidity in the GNS/DAI Pool and get rewarded in GNS. 37% APY.

Check the Gains dashboard as the % changes often. This is an estimate APY as of me writing this email.

Tailwinds and Catalysts:

- gTrade is only available now on Matic. It will be deployed to ETH Layer 2 Arbitrum within 1 to 2 months.

- For the longest time, Gains Network was run by a single Gigabrain, Sebastian. They’ve recently expanded their team to 9 people.

- They’ve just implemented a new referral program. Their marketing has always been one of their weak points. With a referral program, you can expect more people to be talking about GNS. (Like I am now)

- They’re implementing Lookbacks in their future v6.3 update. They’ll be the only platform with guaranteed all Limit Orders and all Stop Losses on all asset classes (stocks, crypto and forex).

- gTrade is currently the only decentralized platform that lists Forex. (The daily forex trading volume is at $6.6 trillion per day and presents a huge opportunity)

Risks to Be Aware of:

- The space is competitive. Competitors include DYDX, GMX, Kwenta, and more.

- Everything is based around DAI. Even though DAI is a decentralized coin, a large % of its collateral is USDC (which is centralized).

- The founder is anon. This doesn’t bother me as much since they have a long track record of shipping, but I know this can be a concern for some people.

So to wrap things up:

1. gTrade is a solid product. It has clear differentiators in this space, and plenty of tailwinds (Especially with the expansion to Arbitrum)

2. Solid Tokenomics. There aren’t any VC’s involved and GNS supply inflation is only 4.75% a year

3. Revenue Sharing. The fees come from the .08% closing fees on trades. And you can earn GNS or DAI stablecoin.

Full Transparency: Gains network just opened up their Ambassador program, and I’m a part of it. If you sign up, I earn a small commission at no extra cost to you. I’m writing about Gains because I like the protocol, and not because of the commission I may receive.

Trade Crypto, stocks, and forex with gTrade

🍿 DeFi Bites

- Do Kwon faces an arrest warrant. A South Korean court has issued a warrant against the founder of Terra. This happens after the $40 billion collapse of the Terra ecosystem.

- CME Group launches Ethereum options. The new contracts deliver one Ether (ETH-USD) futures, sized at 50 ETH per contract.

- Mysten labs raises $300M at $2B valuation. The company’s main project is the new L1 blockchain platform, Sui.

- MicroStrategy files to sell up to $500M worth of stocks. Many speculated that the money from this sale will be used to buy BTC.

- EthereumPoW announces its fork date, which will happen roughly 24h (September 15-16) after the Ethereum mainnet merge.

- Fidelity is considering offering BTC to retail investors on its brokerage platform with more than 30 million users. Fidelity has $4.5 trillion+ in AUM.

- Starbucks has partnered with Polygon to introduce NFT-based loyalty program. US members can earn and purchase digital collectible stamps in the form of NFTs.

- Dopex introduces the Bridgoor Bonding Program which allows user to purchase DPX with a 20% discount for a vesting period of one week.

- Frax launches Fraxlend, a lending marketplace that will enable the protocol to mint new FRAX through a lending process.

😂 MEME

— Pollo2x (@Pollo2x) September 15, 2022