Sprinting for China’s Female Sportswear Crown – WWD

SHANGHAI — It was 2013 and every second Tuesday, Lisa Ou would visit the Nike flagship on Huaihai Road to browse through the racks. Ou, who had moved from New York to China two years prior, discovered that even in Shanghai — easily the most cosmopolitan city in the country — the options for workout gear were narrow and uninspiring.

As a women’s wear designer who graduated from Parsons in 2008 and was working for Badgley Mischka at the time, Ou had a discerning eye. Not a lot of what was on the market tempted her. So every 14 days, she would head to the Nike store because that’s when the brand delivered its new drops. The store staff knew to expect her.

“I really needed activewear,” said Ou, who remains a regular at Crossfit, HIIT and Pilates classes. “No city girl will wear Li-Ning. At the time, the options were Nike and Adidas; Lululemon wasn’t even here. You had some Taobao brands, but it was very limited.”

Ou visited the Nike flagship like clockwork for nearly three years, even checking out the brand’s stores in other cities when she traveled for work, too, because sometimes the assortment was different. Eventually, she became convinced that she should create what she’d long been seeking. In mid-2016, she launched Maia Active, a sportswear brand that combined style and function, designed specifically for the Asian woman.

While Ou was the natural right brain of the brand, its left brain came in the form of Mia Wang, an online whiz who had been through the e-commerce trenches at Xiaohongshu as employee number 24. It wasn’t too hard of a pitch for her to come on board and take on the chief executive officer role, Wang said. She’d been a merchant at Victoria’s Secret so her lingerie background meant she understood fit, and at Xiaohongshu, which served a user base that was 80 percent female, she’d seen the huge interest in activewear.

Today, the two women oversee an ath-leisure start-up that is one of China’s top brands in the category and clearing 150 million renminbi, or $22.8 million, in revenue. While that is still modest compared to the established global names, the brand is growing fast and on track to double what it made last year. Lululemon, which entered mainland China formally in 2016, keeps a watch on the label, as does Nike. When Nike ran focus groups in China before it launched its first yoga line last year, much of the feedback from their target audience came back: females in China like Maia Active.

The two founders at their Xujiahui, Shanghai, office.

Kyle Fong/WWD

The premise of Maia Active combines a number of accelerating trends in China, and investors including China Growth Capital, Sequoia Capital and China Media Capital have funneled 150 million renminbi into the young company. First, there is the play on health and ath-leisure overall. “The total market size for activewear in China was 250 billion renminbi last year and in five years, that number will double,” Wang said. “It’s hard to find any industry that will double in five years.”

It also focused on young females, a growing spending cohort, and the brand is digitally native, getting its start on Tmall. And while Maia Active did move early in the female sports apparel category, its traction wasn’t just in that western brands had not yet properly penetrated the Chinese market. Ou believed that a homegrown Chinese brand could know what the customer wanted better. Ou, 36, is from Taiwan, and Wang, 31, is from Inner Mongolia, so the two are largely selling to their own demographic.

Existing brands in a similar space were designed for cold and dry climates of North America or Europe, not the humid and hot environs much of China experiences. Even if the material was right, the fit was designed for Caucasians who were taller, with bigger busts, and larger hip-to-waist ratios. Chinese women liked the new proprietary fabrics Maia Active provided, its wide range of colors, and the cheerful, feminine aesthetic.

“The big brands are doing consumer research annually, but we are doing it every single day and every single minute. We design everything from the consumer needs,” Wang said, also sharing that Ou starts her day by looking at shopper reviews on their online store.

“I look first thing in the morning at comments,” Ou said. “I filter by most recent. To this day, even this morning. Everyday.”

“And then she’ll send a message to me. I really do get her message at 6:30 a.m., ‘This consumer is saying this!’” Wang said.

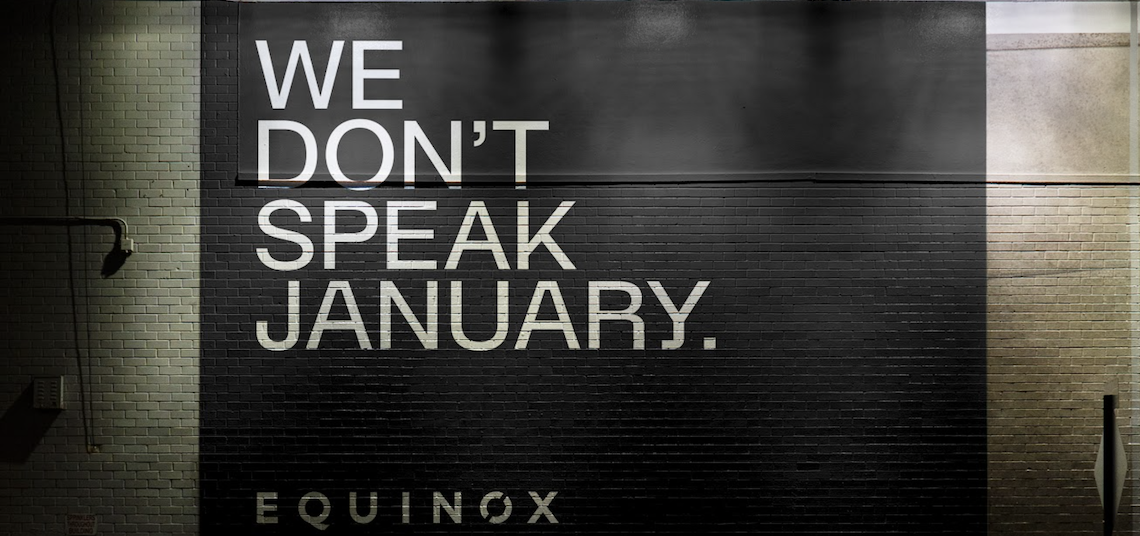

For a young company, Maia Active has a very well-defined outlook and brand universe, appealing to the modern generation of Chinese women who want to feel empowered and better themselves. Every season, Maia Active prints different mottos on the inside of the clothing so it’s only visible for the person who wears it, such as “It’s good to be me” or “I don’t sweat, I sparkle.” Another recent one asks the wearer to fill in the blanks “I am not pretty, I am…” as a way to get women to think about their worth other than superficial beauty.

Maia Active fields a lot of comparisons to Lululemon — it is an activewear brand with a strong focus on fabric and flattering fit — but the “Lululemon of China” is not a tag line the company embraces.

“I don’t think for us we ever look at ourselves as a China version of anyone,” Ou said. “I feel like every brand is different. It’s a big enough market to have multiple players. Our product, our designs are all different. If you look at the campaign image, you will never mistake it for Lululemon. We never really think that way honestly.”

Encouraging slogans, like the one on this mirror, can be found in its stores and on the inside lining of its clothing.

Kyle Fong/WWD

One of the main challenges for a brand starting out online in China like Maia Active is the question of how to gain customer traffic. The brand keeps 20 people dedicated to managing their Tmall presence, out of their workforce of 110 which sits in an office in Xujiahui, Shanghai. “We are a fashion company but we are very digital,” Ou shared. “We fuse data to make decisions and run e-commerce. We do our operations on a very detailed level, a lot of adjustments, and A/B tests.”

Overall, the company found that it boils down to a few key ingredients: strong visual identity, hero products and communicating its point of differentiation expertly to the consumer.

“The way people browse is very fast,” Ou said. “They stop on a page for three to five seconds, how do you create that visual memory? We had to first figure that out with our branding campaigns and visual identity. Then we focused on creating superstar products.”

For Maia Active, those were the Perfect-Fit and Cloud leggings, which are its top-two bestsellers.

“If you look at most of the clothing brands in the U.S., there are no hero products,” Ou said. “But if you look at cosmetics brands, there’s always a signature. You know SK-II has the Facial Treatment Essence. You know the product first before you know the brand. In the e-commerce environment, we needed one or two star products.”

The Perfect-Fit leggings focused on accentuating and slimming the waist, something that consumers put top of mind.

“We found that what people really care about is that they want to look good,” Ou said. “It slightly compresses and cinches the waist because people don’t want their tummy to look loose. It’s not just working out, it’s also a social thing. You’re going into a social environment, so looking good and feeling that extra support [around the waist] is important to them.”

Meanwhile, the Cloud material, which besides leggings is also used for tops and other garments, focuses slightly less on shaping but is super soft — like being enveloped in a cloud — and allows more for breathability.

Another gap Maia Active found is that many brands may include performance features in their product, but they fail to accentuate their value to the consumer.

“Other brands will say compression or quick-dry, but they don’t tell you what that will do for you. We break down every single detail and show our thought process so the consumer can understand all the thought we put into it.”

For the Perfect-Fit leggings that meant product copy that spelled out: “Magical slim-waist,” or “Goodbye little belly, hide away extra flesh; create an M-shaped peach bum.” It also provided side-by-side comparison photos of a standard legging versus their product to show the lifting and shaping qualities.

Their front-zipper sports bra was another hit and example of good communication. After workouts, women were loathe at the extra effort it took to get a sweaty and sticky bra off by taking it off over their heads.

“We made videos explaining you could take it off in one second by just undoing the front,” Ou said. “Some people look at the zipper and just think it’s a design thing.”

A Maia Active store.

Kyle Fong/WWD

Beginning last year, Maia Active began stretching into off-line retail. It now operates five stores in Shanghai, Beijing and Guangzhou. Next year, it’s going to pick up the pace, adding 20 more boutiques. It plans a brick-and-mortar network of more than 100 stores within the next three years.

Since off-line still proves crucial for people to make a decision on activewear, the physical stores have helped to increase the customer basket size dramatically, Wang said. So far, all of their stores have made back their cost after six to eight months, as opposed to 12 to 14 months for most other brands.

“Our best store [at Kerry Centre Shanghai] makes 20,000 renminbi per square meter,” Wang said. “The market average is about 2,000 renminbi so we are 10 times higher. Across all our five locations, on a productivity per square meter basis, we are still four times the average.”

The brand will break even this year and is on track for profitability in 2021, Wang said, adding that gross margin is increasing, too.

“Honestly, it’s important to reach profitability next year,” she said. “We hit our forecast and we are very happy with that. The reason we are breaking even and not profitable this year is because we are investing in our products, in our innovation lab. We are spending a lot in our payroll to get really good people join us to help us build up this business better. Our marketing cost is less than 15 percent, and our P&L term by term, it’s very healthy. We are building up the bottom line every year.”