Nigeria’s food and beverage companies are swimming in cash

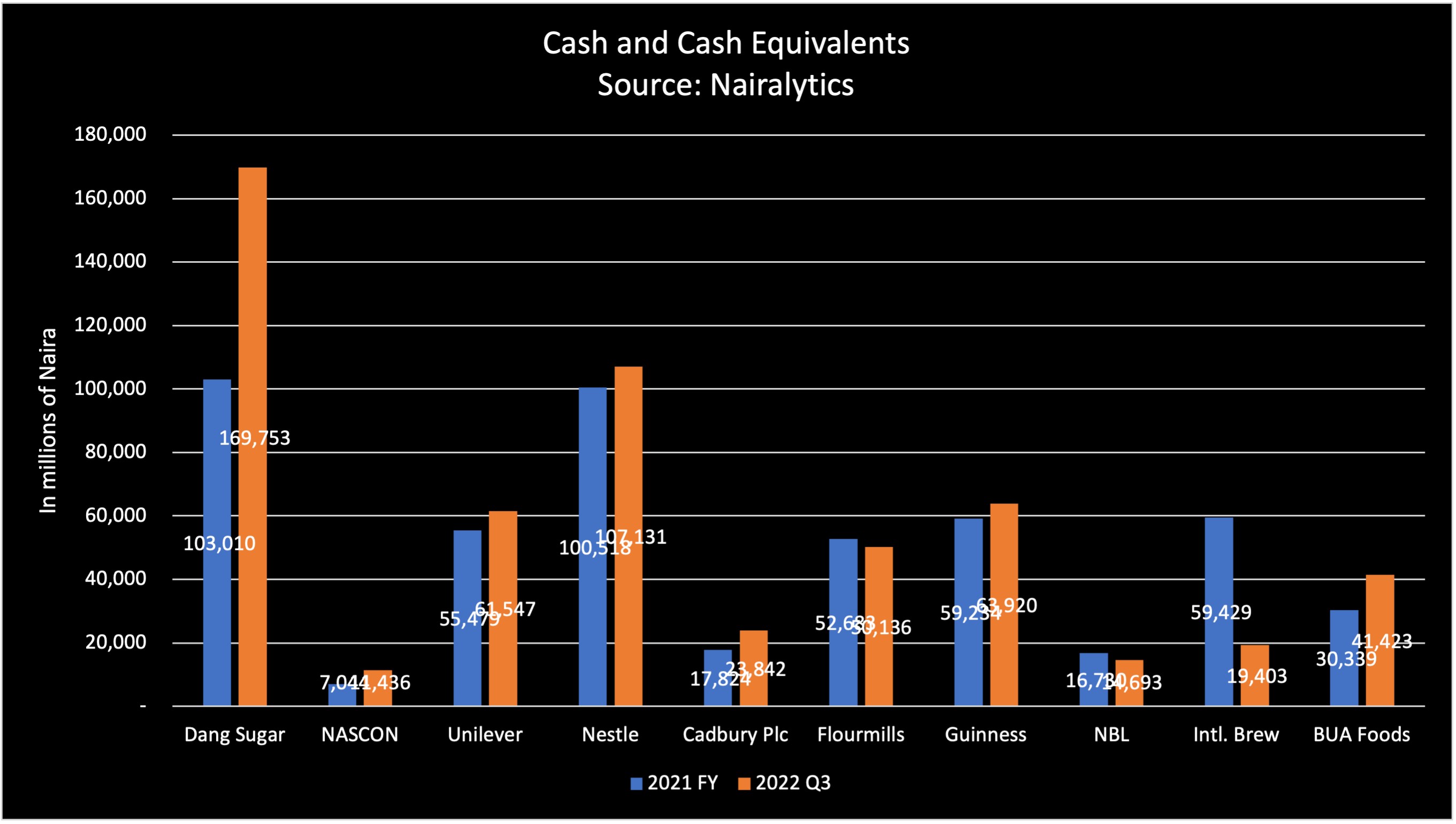

Nigerian companies operating in the highly competitive consumer goods sector boasted of a record cash pile of N563.2 billion, data from Nairametrics research confirms.

Nairametrics parsed through data from ten of the largest consumer goods companies on the Nigerian Exchange cutting across the brewery, food processing, and flour mills. They include Nestle, Cadbury, Unilever, and Dangote Cement. Others include Nigeria Breweries, Guinness, International Breweries, Flour Mills, BUA Foods, and NASCON.

Results from their cash flow statements in the first 9 months of this year compared to December 2021, show companies relied on a combination of debt, sales, and vendor management to shore up cash balances.

This is on the back of a highly inflationary environment which has negatively impacted consumer spending and the cost of operations for a lot of these firms. Yet, data from their financial statements reveal the companies managed to improve their liquidity.

Why is this a big deal: Cash is king and as such, understanding how much cash Nigerian companies have, especially consumer goods, helps project how viable they are.

- This is especially in a very challenging environment where exchange rates and galloping inflation seem to be eating up margins.

- For shareholders, the quantum of dividend payments planned for 2023 is dependent on how much cash companies have left on their balance sheets.

- The data also suggest the government might have no need to bail out any of these companies in the short to medium term as they are financially liquid.

FX Adjusted: Total cash balance for the first 9 months of the year was N563.2 billion compared to N502.2 billion at the end of 2021.

- However, when adjusted for the black-market exchange rate, the total cash balance is just $804.6 million compared to N889 million in December 2021

- This assumes an average exchange rate of N700/$1 currently compared to N565/$1.

- Important to add that included in some of the cash balances of the banks are foreign exchange balances which may have been converted using the official exchange rate.

- Nevertheless, the cash balances posted by these companies are impressive.

Challenging economy: The rising cost of goods and services has sent Nigeria’s inflation rate to a two-decade high of 20.7% forcing most consumers to prioritize consumption choices.

- The scarcity of dollars, critical for most of these companies to fund their raw material input has also meant they go creative at meeting their obligations.

- To manage high operating costs, some of the companies have relied on a combination of price increases and shrinkflation to boost sales.

- What this means is that consumers increasingly pay more for less particularly for consumptions goods and services they can’t do without.

- Some companies such as Unilever, and Nestle, have also relied on their related parties, often foreign shareholders for their forex needs often classifying the same as intercompany loans.

Cash-rich heavyweights: Topping the cash-rich companies on the consumer goods platform are the likes of Nestle, Dangote Sugar, Guinness, and Unilever.

- Dangote Sugar had the highest cash balance of N169.7 billion as of September 2022, compared to N103 billion the year before.

- Nestle is next with about N107.1 billion compared to N100 billion the year before.

- Unilever is next with N639 billion compared to N69.2 billion reported at the end of 2022

- In total, our records show total cash and cash equivalent ofN563.2 billion compared to N501.2 billion in December 2021.

Where is the cash coming from? Our findings indicate most of the cash in their balance sheet comes from a combination of debt and cash from operations.

- The increase of about N60 billion between December 2021 and September 2022, emanates from cash generated from operations as well as fresh loans obtained by some of the companies.

- Nestle for example took on an additional N12.4 billion in net cash flow from financing activities. Dangote Sugar also recorded N12.3 billion in fresh loans from intercompany financing.

- Nigeria Breweries and Flour Mills took on new financing amounting to N54.7 billion and N77 billion during the year.

How are they spending it: Most of the cash generated by these companies is often used to finance working capital, pay dividends, refinance loans, and invest in capital expenditure.

- Dangote Sugar, for example, spent some of the N88 billion it generated from operations on dividends (N12.1 billion) and investments (N13.1 billion), meaning it kept sizeable cash it generated on its balance sheet

- Nestle on the other hand generated just N5.5 billion in cash flow from operations but relied on net fresh loans from N12 billion to augment funding for Capex and dividend payments. It barely touched the N100 billion it closed the year 2021 with

What next with their cash: Nairametrics opines the hefty cash balance reported by these companies will help continue to fund capital expenditure in a very uncertain business environment.

- But while some of the companies have largely prioritized spending on Capex and dividend payments over the years, there will be pressure to pay most of their vendors.

- There is also the need to prepare for intense competition in a space that has witnessed an influx of foreign and cheaper goods and services.

- But we believe the most important usage of their cash will be hedging against exchange rate challenges and as such most of this cash is denominated in forex.