MPs criticise banks over ‘measly’ savings rates, as mortgage rates keep rising – business live | Business

MPs criticise banks over ‘measly’ savings rates

Speaking of warning shots… the Treasury Committee has given UK banks another blast for not increasing savings rates faster.

MPs on the Treasury Committee have written to the bosses of Britain’s biggest banks, asking if they believe their savings rates provide ‘fair value’ to customers and whether customer inertia is being exploited.

The committee has also asked the FCA, which regulates the sector, if banks have changed their savings rates as a result of being challenged, how ‘fair value’ for customers will be assessed, and what enforcement action can be taken if firms do not comply with the consumer duty.

Harriett Baldwin MP, chair of the Treasury Committee, warns banks need to raise their “measly savings rates”.

Baldwin says:

“With interest rates on the rise and our constituents feeling squeezed by rising prices, it is only right that the UK’s biggest banks step up their measly easy access savings rates. The time for action is now.

“The biggest high street banks have a particularly important role to play in encouraging saving. Currently, they are failing on that social duty. We look forward to receiving answers to these important questions in due course.”

Key events

Weak competition led to higher petrol and diesel prices

Newsflash: Britain’s competition regulator has warned that motorists are paying higher prices for petrol and diesel, due to a decline in competion in the sector.

Following a review of the sector, the Competitions and Markets Authority has identified a series of problems in the retail market for motor fuel.

The CMA warns that supermarket chains Asda and Morrisons have taken a “a less aggressive approach to pricing” since 2019. They have traditionally acted as price leaders in the market, but have recently charged higher prices – and other supermarkets have not reacted by cutting their own prices.

According to the CMA:

Asda took a decision in 2022 to achieve higher margins by reducing prices in some of its PFSs more slowly than would previously have been the case as wholesale prices fell (ie “feathering” prices), with other retailers pricing by reference to them following a similar pricing path.

The CMA investigation found that consumers are paying generally higher prices than prior to 2019, for any given level of wholesale prices. During 2023, “competition has been significantly weaker on diesel than on petrol”, it warns.

In practice, the CMA says, average annual supermarket fuel margins had increased significantly from 2019 to 2022, representing a 6p per litre increase over this period.

The CMA is also concerned that there are “longstanding patterns of variable pricing” in different local regions, meaning consumers in some areas can pay “significantly more” for fuel than in others.

Thirdly, the CMA warns that competition at motorway services stations are weak, meaning that customers without access to fuel cards pay significantly more to buy fuel on the motorway than off it.

The regulator is recommending the creation of an open data fuel finder scheme, which would let customers check the price of fuel in their area (as already operates in Northern Ireland).

The CMA also wants the government to create “an ongoing road fuels price monitoring function for the UK market”, meaning an official eye on the market to keep retailers in line…

Last week, the boss of Morrisons admitted that supermarkets have increased profits at the petrol pumps as he was quizzed by MPs.

Senior officials from several major supermarkets told MPs they would support a transparent system of live fuel pricing, to help consumers get the best deal.

Chart: How average fixed-term mortgage rates have risen

According to the Treasury committee, the big four UK banks offer savings rates between 0.9% and 1.75% on their easy access savings rates, up from 0.5% and 0.65% in February.

The Bank of England interest rate is currently 5%.

Labour MP Dame Angela Eagle MP has added her voice tio the criticism of UK banks for not raising savings rates higher.

She says:

“In the middle of a cost of living crisis, the high street banks are squeezing higher profits from their loyal savings customers. This blatant profiteering has been shocking, and it’s clear to me this behaviour is miles away from the incoming requirement for firms to treat their customers fairly and with respect.”

In the financial markets, the oil price has jumped after Saudi Arabia announced it will extend its voluntary cut to production.

The Saudi Ministry of Energy said the voluntary cut of one million barrels per day, which began in July, will be extended to cover August as well.

This means the Kingdom’s production for the month of August 2023 will be approximately 9 million barrels per day, down from around 10m bpd in May.

Russia is also planning to cut crude export flows next month in an effort to keep the global market balanced

Deputy prime minister Alexander Novak revealed Moscow would cut half a million barrels per day off its output, saying:

“Russia will voluntarily reduce its oil supply in the month of August by 500,000 barrels per day by cutting its exports by that quantity to global markets.”

MOSCOW, July 3 (Reuters) – Russia will cut oil exports by 500,000 barrels per day in August, Deputy Prime Minister Alexander Novak said on Monday.

— Guy Faulconbridge (@GuyReuters) July 3, 2023

Brent crude, which had dipped in early trading, has now jumped by 1% to $76.20 per barrel, the highest in over a week.

A higher oil price threatens to keep inflation higher for longer….

UK mortgage rates hit highest since November

UK average fixed-term mortgage rates have continued to climb, adding to the pressure on borrowers.

Financial data provider Moneyfacts reports that the average 2-year fixed residential mortgage rate today has risen to 6.42%, up from 6.39% on Friday.

The average 5-year fixed residential mortgage rate has also risen today, to 5.97%, up from 5.96% on Friday.

Both rates are at their highest levels since last November, when mortgage rates had been pushed up by the market turmoil after the mini-budget.

Mortgage rates have been climbing over the last two months, as the financial markets have anticipated higher UK interest rates to fight inflation.

Borrowers whose fixed-rate deals finish this year will face a sharp increase in their repayment costs, with economists warning many face an exploding mortgage timebomb.

The number of mortgage products available has fallen today, Moneyfacts adds, as lenders continue to withdraw products (and often reprice them higher). There are currently 4,396 residential mortgage products on the market, down from 4,432 on Friday.

Moneyfacts also reports that banks lifted their savings rates (the issue worrying MPs on the Treasury committee), but they continue to lag behind borrowing rates.

It says:

-

The average 1-year fixed savings rate today is 4.82%. This is up from an average rate of 4.77% on the previous working day.

-

The average easy access savings rate today is 2.43%. This is up from an average rate of 2.40% on the previous working day.

-

The average 1-year fixed Cash ISA rate today is 4.47%. This is up from an average rate of 4.42% on the previous working day.

-

The average easy access ISA rate today is 2.55%. This is up from an average rate of 2.52% on the previous working day.

MPs criticise banks over ‘measly’ savings rates

Speaking of warning shots… the Treasury Committee has given UK banks another blast for not increasing savings rates faster.

MPs on the Treasury Committee have written to the bosses of Britain’s biggest banks, asking if they believe their savings rates provide ‘fair value’ to customers and whether customer inertia is being exploited.

The committee has also asked the FCA, which regulates the sector, if banks have changed their savings rates as a result of being challenged, how ‘fair value’ for customers will be assessed, and what enforcement action can be taken if firms do not comply with the consumer duty.

Harriett Baldwin MP, chair of the Treasury Committee, warns banks need to raise their “measly savings rates”.

Baldwin says:

“With interest rates on the rise and our constituents feeling squeezed by rising prices, it is only right that the UK’s biggest banks step up their measly easy access savings rates. The time for action is now.

“The biggest high street banks have a particularly important role to play in encouraging saving. Currently, they are failing on that social duty. We look forward to receiving answers to these important questions in due course.”

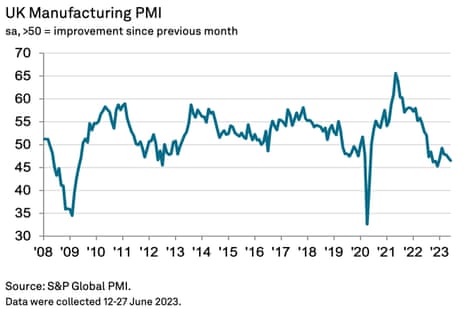

UK factory downturn accelerates

Britain’s manufacturing sector shrank at the fastest rate in six months in June, the latest survey of purchasing managers shows.

Data provider S&P Global reports that the UK manufacturing sector remain in contraction territory last month, with output, new orders and employment levels all falling.

Its Manufacturing PMI, which measures activity in the sector, dropped to a six-month low of 46.5 in June, down from 47.1 in May. The PMI has signalled contraction in each of the past 11 months.

The UK manufacturing sector “continued to report recessionary conditions in June”, explained Rob Dobson, director at S&P Global Market Intelligence.

Dobson says:

Producers are being hit by weak domestic and export market conditions with clients showing a greater reluctance to commit to spending due to market uncertainty, increased competition and elevated costs.

This is also impacting business optimism and stoking fears among some manufacturers that client spending may shift to lower cost rivals and markets.

FCA blasts home and car insurers for failing customers

Britain’s financial watchdog has just fired a warning shot at the insurance industry for failing customers.

The Financial Conduct Authority has announced that home and motor insurers must improve their treatment of vulnerable customers and how they handle customers claims.

Following a review of the sector, the FCA has uncovered examples of lengthy complaints handling times and people not given appropriate settlements.

The regulator discovered examples where motor insurance customers were offered a price lower than their car’s fair market value after it had been written off, which is against FCA rules.

Relevant firms have been told to put these wrongs right and where necessary provide redress to affected customers.

The review also found that some firms were unable to show they were monitoring customer outcomes well enough, and unable to identify vulnerable customers in need of additional support.

Sheldon Mills, Executive Director for Consumers and Competition at the FCA, said:

‘Timely and fair claims handling is especially vital during the cost of living squeeze.

‘While we have seen many firms treating their customers correctly, we found too many examples of customers not receiving the service they’re entitled to.

‘Where we found issues, we’ve told firms to put them right. We’ll be monitoring them to ensure they do.’

Eurozone factotry downturn deepens as output falls

The downturn in the eurozone’s manufacturing sector intensified during June, according to new data which underlines the risks of an economic ‘hard landing’.

Factory output in the euro area declined at the sharpest rate since October 2022 in June, according to the latest survey of purchasing managers from HCOB and S&P Global.

The eurozone manufacturing PMI found that demand for eurozone goods fell sharply at the end of the second quarter, with weak sales performances particularly evident in Austria, Germany and Italy.

Factory employment declined for the first time since January 2021 and business confidence dipped to a seven-month low.

But this slowdown could ease inflationary pressures, with output prices falling at the fastest rate in three years.

This all knocked the HCOB Eurozone manufacturing PMI to 43.4, down from May’s 44.8, which is a 37-month low. Any reading below 50 shows a contraction.

Energy prices might rise sharply this winter, IEA warns

Energy prices could spike this winter, the head of the International Energy Agency has said, if China’s economy rebounds this year.

Fatih Birol told the BBC that consumers could be hit by soaring bills again this winter, explaining:

“In a scenario where the Chinese economy is very strong, buys a lot of energy from the markets, and we have a harsh winter, we may see strong upward pressure under natural gas prices, which in turn will put an extra burden on consumers,”

Birol also warned that blackouts were less likely, but not unlikely, so governments should continue to push energy-savings measures, and renewable energy technology.

On Saturday, the UK’s price cap on gas and electricity was lowered, meaning slightly lower bills for around 27 million households. However, households won’t feel much relief as some government’s energy support measures also ended in June.

Last week, the boss of British Gas-owner Centrica predicted household energy bills will remain high for the foreseeable future…

European stock markets have begun July with small gains, with the FTSE 100 index up 17 points or 0.22% at 7547 points in London.

Last Friday, the US Nasdaq Composite index posted its best first half of the year since 1983, as investors flocked to technology companies.

Mark Haefele, chief investment officer at UBS Global Wealth Management, warns share prices are priced as if a soft landing is certain…

“For the positive overall narrative to hold together, an ‘immaculate disinflation’ is almost a prerequisite, and from an investment perspective, equity markets are not priced for a recession materializing.

With stocks already priced for the near perfection of a soft landing, we see better risk-reward in high-quality bonds over equities.”

Tesco has confirmed this morning that it has hired City veteran Gerry Murphy as its new chair to replace John Allan, who stepped down after allegations of inappropriate behaviour.

Murphy says Allan is leaving Tesco with its business, management and Board “in great shape and fit for the future.”

Murphy is stepping down as chair of Tate & Lyle to take on the Tesco job, but will continue to continue chairing fashion chain Burberry.

Victoria Scholar, head of investment at interactive investor, says:

Murphy will step down from Tate & Lyle after over six years in the job as he moves to the UK’s leading supermarket. He boasts a wealth of experience in UK consumer businesses and is a well-known voice in the British press on related matters. Tesco’s interim chair Bryon Grote said Murphy was the ‘unanimous choice.’

Last month Tesco’s CEO Ken Murphy said inflation remains ‘stubbornly high’ but it is past the peak while the supermarket reported an 8.2% jump in quarterly sales to £14.8 billion. Critics have argued that supermarkets and consumer goods giants have been ‘profiteering’ from food inflation as businesses pass on additional cost pressures to consumers in terms of higher prices. However, on Friday, Tesco cut prices for the second time in a number of weeks, lowering over 500 items in price in an attempt to attract customers amid the cost-of-living crisis and the increased price sensitivity among consumers. The goal is also for Tesco to preserve its dominant market share despite growing competition from the fiercely price competitive German discounters, Aldi and Lidl.

China’s June factory activity slows as conditions weaken

New data showing that China’s factory activity growth slowed in June has added to concerns over the global economy.

The latest PMI index of Chinese manufacturing, from Caixin, has slipped to 50.5 in June from 50.9 in May, close to the 50-point mark showing stagnation.

The report found that business confidence in China weakened in June, and that manufacturing employment fell for a fourth month in a row.

Wang Zhe, senior economist at Caixin Insight Group.

“A slew of recent economic data suggests that China’s recovery has yet to find a stable footing, as prominent issues including a lack of internal growth drivers, weak demand and dimming prospects remain,” said

“Problems reflected in June’s Caixin China manufacturing PMI, ranging from an increasingly dire job market to rising deflationary pressure and waning optimism, also point to the same conclusion.”

US Treasury secretary Janet Yellen to visit China to build ‘healthy’ ties

The deterioration of relations between Beijing and Washington could also hurt the world economy, with the two sides recently exchanging tit-for-tat sanctions.

But US Treasury secretary Janet Yellen is hoping to reestablish better relations with China, as she visits its capital this week.

Yellen’s trip is part of a push by President Joe Biden to deepen communications between the world’s two largest economies, stabilize the relationship and minimize the risks of mistakes when disagreements arise, White House officials say.

Yellen is expected to discuss with her counterparts the importance for both countries “to responsibly manage our relationship, communicate directly about areas of concern, and work together to address global challenges”, said the Treasury Department in a statement on Sunday.

Introduction: Hard landing fears for global economy

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Fears of a ‘hard landing’ in the global economy are swirling, as central banks hike interest rates to cool inflation.

Although UK growth has held up a little better than expected, the outlook for the world economy is worrying some investors.

Mark Dowding, BlueBay CIO, RBC BlueBay Asset Management. expects growth to “slow to a standstill in the second half of the year”, with the outlook in 2024 also looking downbeat.

Dowding explains:

“Interest rates have risen substantially in this cycle and some additional tightening may yet be ahead of us. In light of this, a mild recession remains likely, as a baseline assessment.

In the wake of this, it is understandable that markets will look to price lower rates in 2024, as long as inflation is seen as back under control at this point.”

Pimco, the bond trading giant is preparing for a “harder landing” than other investors, as monetary policy tightening slows economic growth.

Daniel Ivascyn, chief investment officer at Pimco, told the Financial Times:

“The more tightening that people feel motivated to do, the more uncertainty around these lags and the greater risk to more extreme economic outlooks.”

Central banks have now been raising interest rate for more than a year – but, monetary policy operates with a lag, it take a while to influence the real economy.

Ivascyn says:

“We would argue that the market may still be too confident in the quality of central bank decisions and their ability to engineer positive outcomes.

We think the market is a bit too optimistic about central banks’ ability to cut policy rates as quickly as the yield curves are implying.”

Also coming up today

The competition watchdog is expected to publish its report into the UK’s motor fuel market today, following complaints that customers are being ripped off when they buy petrol and diesel.

The chemicals tycoon Sir Jim Ratcliffe has blamed Rishi Sunak’s furlough system as a reason for the UK’s persistent inflation.

In a new book on his Ineos empire, Ratcliffe criticised the chancellor’s Covid-19 job protection scheme, arguing:

Everybody gets used to it, and nobody wanted to work. What do you think follows? It is the definition of inflation, because suddenly the currency doesn’t represent the same amount of value.

You have diluted it with all you have given away. Does he [Sunak] think it never has to be paid back? Does he think about inflation?”

Coming up on @TimesRadio Breakfast: Kate joins us for the day, as Aasmah is off. We have exclusive words with billionaire businessman Jim Ratcliffe, who accuses Sunak of ramping inflation with Covid measures. Plus, doctors’ pay, @rosiewright99 at Wimbledon, women and crime etc pic.twitter.com/PtwVsYmBQ0

— Stig Abell (@StigAbell) July 3, 2023

One problem with this argument, though, is that the US administration also created new money to stimulate the economy, including checks of up to $1,200 per individual. And America’s inflation rate, at 4%, is just half that of the UK (8.7%).

We also get a healthcheck on the world’s factories, through the latest Purchasing Managers Surveys from the manufacturing sector.

The agenda

-

9am BST: Eurozone manufacturing PMI for June

-

9.30am BST: UK manufacturing PMI for June

-

3pm BST: US manufacturing PMI for June