Is Hedi Slimane’s Celine Working? | BoF Professional, News & Analysis

Shooting yourself in the foot doesn’t usually kill you. Except in fashion, an industry where projects that get off to a rocky start are rarely given a chance to get back on track.

Under star designer Hedi Slimane, LVMH’s Celine is hoping to be an exception to that rule. After a debut show in September 2018 that seemed to alienate — even outrage — much of the audience the brand had built up under his predecessor Phoebe Philo, Slimane has followed up on that divisive start with a spate of collections that more deftly balanced his own taste for the young, thin and cool with market expectations for Celine to cater to a more mature base. Slimane’s pivot from “baby rockers” to a neo-bourgeois, Paris Left-Bank mood for Autumn/Winter 2019 proved influential, and the timely vision of youth fashion he presented for the coming spring could help win over a new generation of fans.

But even as Slimane seems to be finding his footing — and as LVMH continues to plaster fashion capitals with billboards featuring the black-and-white photographs he shoots himself for the brand — the pandemic has created a tough environment in which to stage a comeback. Financial analysts believe Celine, for which LVMH doesn’t break out sales or profit in its reports, has yet to make much progress on its target to become a brand with 2 to 3 billion euros in annual sales within five years of Slimane’s appointment.

Still, there are signs that the project may be turning a corner: Slimane’s Celine is gaining traction in the key Chinese market, he’s built a roster of influential celebrity spokespeople and while the pandemic has seen many clients flocking to the biggest blue-chip brands, his insistence on elevating “just clothes” into a luxury wardrobe could hit the mark following a multi-year fashion cycle dominated by over-the-top propositions from Gucci and Balenciaga.

In an industry that trades in first impressions, can Hedi Slimane still make his Celine a hit? Nearly three years after the star designer took over the brand, BoF breaks down what’s worked, what hasn’t, and where Celine might go from here.

Debut backlash

During a decade at Celine, Slimane’s predecessor Phoebe Philo built one of the most devoted followings in the business by designing for women who saw themselves as empowered, intellectual and discerning. Her products like Luggage totes, fur-lined Birkenstock sandals and swaddling turtleneck sweaters transformed Celine from a middling leather goods brand to a business with nearly €1 billion in annual sales — as well as the kind of place where Slimane, fresh off of star turns at Saint Laurent and Dior Homme, would actually work.

So Slimane’s Celine debut — in which the designer sent out an army of very thin, very young creatures in baby-doll dresses, ankle boots and cutesy fascinator hats — was not only brazenly similar to what he’d designed for Saint Laurent just a few seasons before, it felt like a betrayal to many of the clients who had been voting with their wallets for Philo’s more mature and sophisticated vision of how women should dress.

Fans of Phoebe Philo’s Celine were unreceptive to the abbreviated party frocks in Hedi Slimane’s debut collection. INDIGITAL.tv.

The strengths of the collection, and the precision of its execution, were apparently beside the point. Slimane’s strict curation of vintage references, expert styling, and the way his tailoring had evolved from truly skinny to a shape that was slim, but just slouchy enough to convey Parisian insouciance, were drowned out by the presence of such infantilising propositions.

English-speaking press were particularly unreceptive: on the same day as the controversial confirmation hearing for US Supreme Court justice Brett Kavanaugh, and with the #MeToo movement in full swing, Slimane and LVMH had picked the wrong moment to suggest women trade in their turtlenecks for abbreviated, sparkly mini-dresses or wrap themselves up like presents in giant bows.

“The female point of view appears to have fallen out of style,” Telegraph’s Lisa Armstrong wrote. “Here we go again,” Vanessa Friedman wrote for The New York Times, calling out the designer for not evolving his vision as he took over yet another brand, and calling the hats “haute flea market.” Writing for BoF, Tim Blanks purported to detect “a gust of toxic masculinity.”

Crowded field

Two years later, it’s safe to say the most vocal detractors of Slimane’s debut may have been overreacting — at least a tiny bit — when they attempted to align Slimane’s collection with the many indignities of living in a patriarchy.

But the issue of being out of step with the times was real, and went beyond the immediate political context. At Dior Homme and Saint Laurent, Slimane had made a name for himself by marketing youth style and culture through tight jeans, biker jackets and skinny ties. But with hip-hop having supplanted rock music as the dominant cultural force, relaxed, streetwear-inspired silhouettes had become the preferred mode of dress and were driving the success of brands like Off-White and Balenciaga.

As Celine branched into menswear for the first time ever, athletic-inspired “dad sneakers” and limited-edition skateboarding shoes were what had been driving sales in the category, not pointy leather boots.

Star designer Hedi Slimane worked at Dior Homme and Saint Laurent before taking the helm of Celine. Y.R.

Slimane also faced a crowded market for his signature aesthetic: as his reputation for possessing a Midas touch had grown during tenures at Dior Homme and Saint Laurent, copycats had sprung up at every price point, both for his skinny silhouettes and for his creative approach of tapping into nostalgia and the demand for authenticity by curating and reissuing vintage looks. From The Kooples to Suitsupply to Zara, Slimane’s revolution had made its way to every corner of the fashion market.

Meanwhile in the luxury space, Slimane’s successor at Saint Laurent, Anthony Vaccarello, was largely sticking to the slick, monochromatic template his predecessor had put in place, taking the fashion story forward a bit each season without alienating Slimane’s acolytes. He, too, has delved frequently into Yves Saint Laurent’s archives for inspiration, and has a knack for using those references to market a certain vision of youth. Up until the pandemic in early 2020, the brand, which is more widely known than Celine and has a more established history in categories beyond leather goods, had been growing at double-digit rates for 38 consecutive quarters, despite changing designers in 2016.

As many of Phoebe Philo’s clients quit Celine — in favour of Bottega Veneta, The Row and Hermès, some said — Slimane’s fans at Saint Laurent seemed happy to stay put. On menswear forums where “Slimaniacs” gather, Vaccarello’s propositions are still discussed as viable options more than two years after Hedi returned to the business at Celine.

Neo-bourgeois turnaround

The divisive start and crowded market have made for a rocky transition, with Celine’s retail sales under pressure through most of 2019, according to company sources, who spoke anonymously as the brand’s financials are not publicly reported.

Sales had returned to growth in late 2019 and were growing by double-digits until the pandemic struck early last year, one of the sources said, as clients’ fervour for protecting Philo’s legacy faded and as Slimane continued to build out his vision of Parisian wardrobe dressing, pivoting to more mature propositions inspired less by nightlife and more by a literary, Left-Bank mood with wool blazers, culottes, and shearling-lined boots.

Holed up in a Saint-Tropez villa, Slimane had landed on what felt like a more considered edit from the Yves Saint Laurent heyday he frequently references — proposing softer, less sexed-up pieces aimed at the mature client Celine is historically known for serving. After a debut that shook the market’s confidence in whether he was still a fashion leader, Slimane’s subsequent collections were as influential as ever: various takes on “neo-bourgeois” dressing and 1970s throwbacks started popping up on runways across Paris, London and Milan.

For fall 2019, Slimane pivoted to a 70s inspired, “neo-bourgeois” aesthetic that proved influential. INDIGITAL.tv.

The ethereal black-and-white photos he was shooting for the house also helped to build a visual universe in which his products, including ladylike, ultra-classic handbags, made more sense. The images, usually displayed within a thick white border, are not always easy to digest when viewed on a tiny smartphone screen (another timeliness problem), but they do communicate a message of simplicity and timeless luxury.

“He has a similar talent for styling and photography as Karl Lagerfeld did,” Babeth Djian, founder of the French fashion magazine Numéro said. “What he’s creating isn’t bourgeois, it’s a fantasy of the bourgeoisie — which is totally different.”

China inflection

While Slimane’s vision was not an instant success among the fashion influencer set — who continued to post Philo’s creations under the tribute hashtag “#oldceline” — it has steadily built up visibility through smart placements with A-list celebrities, including the South Korean pop singer Lisa from girl-group Blackpink (who is popular in China, as well, due to her role judging a hit singing competition) and model-heiress Kaia Gerber. While Celine continues to sell favourite bags from the Philo era, those stars have fuelled rising awareness of new options like satchels with the brand’s historic “Triomphe” logo (brought back by Slimane) and a monogrammed canvas line.

The flagship “16” handbag, first debuted by Lady Gaga during a visit to the Louvre, is also gaining interest as the brand rolls out a more supple, slightly less expensive version.

In China, online buzz for Celine by Phoebe Philo remained almost as elevated as for Slimane until April 2020, when posts on social media related to Celine by Hedi Slimane finally surged far ahead, according to Launchmetrics’ China subsidiary Parklu. His notoriety was rising just as China’s coronavirus lockdowns ended and luxury sales — fuelled by so-called “revenge spending” and the repatriation of shopping that typically occurred on shopping trips abroad — exploded in the key market.

Celine is benefitting in China from an increased presence on WeChat, where the brand’s mini-program integrates its social media content with opportunities to buy products instantly, noted Iris Chan, partner at the Digital Luxury Group.

Celine’s sales in Mainland China accelerated sharply following the lockdowns, and remained at high rates going into the fourth quarter, one source familiar with the matter said.

(Although rapid growth in Mainland China indicates traction, Chan says to take that signal with a grain of salt. “It can be easy for brands like this to see growth happening at exponential rates, because they didn’t have a lot to grow from. I don’t see it being a standout now in the overall market.” Due to the prevalence of shopping abroad, a brand’s domestic sales often need to double or triple to make up for lost tourist sales to Chinese consumers.)

After sales were hammered by the pandemic, Celine’s worldwide business saw a “good improvement” in the third quarter, according to LVMH’s results presentation.

Estimates vary widely for how the brand is doing today, with analysts saying sales could be down between 7 and 40 percent year-on-year for 2020.

So where is Celine headed? While the coronavirus crisis and resulting economic uncertainty has caused consumers to refocus on the most established and sought-after propositions like Chanel quilted flap bags and Louis Vuitton’s Neverfull totes, that same impulse to spend more carefully could see them gravitate to the ultra-classic, “just clothes” approach to luxury Slimane is pushing at Celine.

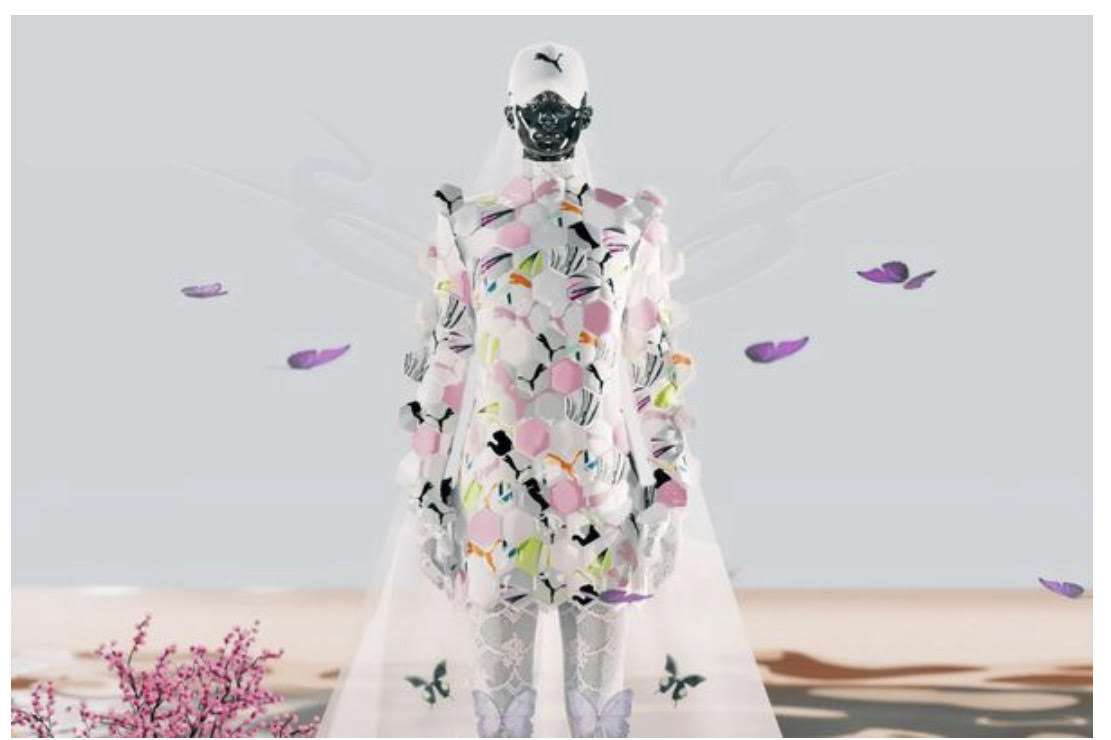

And Hedi has started to make in-roads at bridging his vision of timeless luxury with the tastes of the moment, particularly among younger shoppers: criticism that his vision of youth is stuck in another time has faded following his online fashion shows for Spring 2021, titled the “Dancing Kid” for men — a tribute to Tik-Tok-fuelled “e-boy” culture with oversized fits, colourful track jackets and mis-matched printed pants — and “A Portrait of a Generation,” his womenswear show that also took inspiration from the eclectic, high-low dressing habits of Generation Z. He introduced a range of sportier and more logo-heavy products, as well as showing off ways to mix Celine’s bourgeois staples like tailored blazers with more comfortable athleisure items could help broaden the brand’s audience (even if some critics found the logomania felt out of place at the brand).

Celine’s “Portrait of a Generation” (left) and “Dancing Kid” (video still, right) collections paid tribute to TikTok-fuelled Gen-Z fashion. Celine.

“I want those girls to be my friends,” Filippo Grazioli, a freelance womenswear designer who previously worked at Givenchy, Burberry and Hermès, said. “It’s simple garments, but who is buying complicated stuff now?”

“The brand is getting back on track as the collections evolve,” Mia Young, chief merchant at the Hong Kong-based department store chain Lane Crawford, said. “The mix of timeless luxury with more dressed-down pieces should help build on momentum with younger clients.”

Menswear in particular is starting to gain traction, Young said, and she expects it to accelerate with the arrival of more colourful pieces and relaxed silhouettes for spring.

‘Light at the end of the tunnel’

Even if Celine seems to be turning a corner, it almost surely remains far behind the targets set for it by its parent company, despite high levels of investment. (Slimane was paid at least 10 million dollars per year during his last role at Saint Laurent, according to a court settlement between the designer and the brand’s owner, Kering. Increased marketing spending on Celine, while undisclosed, has been manifest both on social media and in fashion capitals throughout the world.)

Executives at LVMH and Celine declined to comment for this story. But how Celine is performing, and what level of support it will continue to receive from its parent company, could be addressed at next week’s annual results presentation, where chairman Bernard Arnault will take questions from analysts and investors.

“There is likely some disappointment, but I think they see a light at the end of the tunnel,” said Erwan Rambourg, luxury analyst at HSBC. “The luxury of running 75 brands is that you can be patient with some. LVMH is inclined to expect that inflections are going to accelerate.”

“I would be surprised if Bernard Arnault pulled the plug.”

Related Articles:

Hedi Slimane’s First Celine Interview

At Celine, Hedi Slimane’s ‘Portrait of a Generation’

Disclosure: LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholder’s documentation guaranteeing BoF’s complete editorial independence.