Inside Glossy’s Future of Beauty & Wellness Forum – Glossy

It’s been a rollercoaster year for the beauty industry. With the onset of Covid-19, consumers were largely denied the interactions that are intrinsic to beauty, from testing products in stores to pampering at salons and spas. At the same time, they took to new daily routines of personal care and grooming. After being rocked by the pandemic and economic chaos, brands found themselves under pressure to meet the moment as protests against racism swept the country. Into the chasm imposed by lockdowns, brands and beauty professionals poured out their creativity, explored formerly uncharted digital landscapes and connected with consumers and communities like never before. The result is an industry transformed.

Glossy’s Deep Dive: Future of Beauty & Wellness Forum is a collection of videos and key takeaways from our event that will provide valuable tips and key insights across the scope of the industry to inform your brand’s next moves. Below you’ll find key takeaways, quotes and stats, as well as videos from our recent beauty and wellness event.

01

The new face of beauty

Brands may be holding out hope that, when the pandemic eases, consumers will welcome the return of some old rituals, like putting on lipstick for an IRL party. But the events of the last six months have catapulted the industry toward new priorities and aspirations. Amid the year’s many reckonings, brands are re-examining their purpose and rethinking their product lines. Coupled with the ongoing evolution of longer-term trends in technology and sustainability, that’s a mix that is forging an exciting future.

Clean beauty is taking off in a big way, from makeup to marketing, and consumers are no longer required to make a choice between quality or sustainability. Brands are moving beyond “experiential” after weighing whether their experiences are sufficiently welcoming and representative of society’s diversity. Whether it comes to inclusivity around race, gender, disability or affordability, almost every brand can find room for improvement. Exciting things are also happening in hair care, where black-owned businesses are in the spotlight, at last, and part of a more general push for diversity in hair and beauty.

There’s increasing overlap between the beauty industry and other fields. Wellness and beauty increasingly go hand-in-hand, and that’s going to continue. “2021 is definitely going to be an even bigger moment for really solidifying wellness’ space within the beauty industry,” said Trinity Mouzon Wofford, co-founder and CEO of Golde. Mouzon Wofford said her brand’s vision “is really to take wellness, specifically wellness that’s powered by superfoods, and make it more accessible and approachable to the everyday consumer.” That’s partly a reference to price, but also in terms of messaging. “How can we just get our message and our products out to as many people as possible?” Mouzon Wofford said.

“2021 IS DEFINITELY GOING TO BE AN EVEN BIGGER MOMENT FOR REALLY SOLIDIFYING WELLNESS’ SPACE WITHIN THE BEAUTY INDUSTRY.”

TRINITY MOUZON WOFFORD, CO-FOUNDER AND CEO OF GOLDE.

Gen-Z consumers are cheering on the brands that aspire to have bold, ambitious visions and communicate with transparency and authenticity. Brands know that discerning, keen-eyed and vocal Gen-Z consumers are examining their every pronouncement on social media, and they know the stakes are high.

“They can see right through it, if it doesn’t feel authentic,” said Monica Arnaudo, chief merchandising officer at Ulta Beauty. “It’s a bit of a balancing act. It can’t just be that I see that this is a trend, and now I’m going to check the box. It’s got to be part of the heart and soul of the company.”

And brands, recognizing the power that consumers hold, are opening up the conversation and deploying digital and virtual technology to build resilient and creative communities, everywhere from TikTok to gaming platforms.

As “real-life” events and in-person retail become feasible once again, consumers will venture back out into the world. But the brands are not backtracking. The disparate new digital presences brands have carved out and built in 2020 are here for the long haul, and we can expect to see the online and offline worlds integrate and overlap in unprecedented ways as life returns to “normal.”

Here’s what you need to know.

Retail doesn’t just have to be experiential to be exciting. It should be inclusive, accessible and diverse.

“Experiential retail” has been the big, aspirational buzz phrase for brands and retailers over the past few years, but 2020 has been a moment to stop and ask what else consumers need from retail. Amid the literal pause forced by Covid-19, and the conversations around racism and social justice prompted by George Floyd’s death, brands are being more introspective about what retail should aspire to be.

Experiential is fine, but consumers are telling brands that the experience is nothing if it is not inclusive, accessible and diverse. That means implementing store designs that are welcoming spaces that positively speak to a variety of needs and experiences. It’s not about sending contrived “messages” — it’s about imbuing the brand with values that resonate with consumers because they are authentic.

Arnaudo said these traits are “incredibly important” to the Gen-Z consumer. “They really want to enter into stores where they feel they’ve got an inclusive and welcoming experience, and they have the ability to really play and discover and express themselves how they want and when they want.”

Retailers are investing in ensuring they stock brands that reflect diversity in multiple ways. Arnaudo said Ulta Beauty has been conscientious about offering brands at a range of price points, as well as clean, vegan and cruelty-free brands, and building its portfolio of black-owned brands.

“We know that this is important to our Gen-Z guests, who are extremely diverse and embrace diversity and inclusion much more than any other generation,” Arnaudo said.

- Consumers are rallying behind brands with a mission. In a year when brands have repeatedly been greatly criticized for leaning excessively on vague platitudes and cliches in their advertising and public statements, brands that have a clear purpose have stood out from the pack and engaged the passions of the switched-on Gen-Z consumer.

Sephora recently launched Selena Gomez’ Rare Beauty line of makeup, which encourages an inclusive approach to beauty, celebrating “rocking a full face of bold makeup or barely any makeup at all.” One percent of each sale is donated to Gomez’ Rare Impact Fund, which aims to raise $100 million over the next decade to support mental health causes. Tatcha has made expanding education opportunities for girls a compelling part of its vision. “There is a demand for diversity, to really authentically represent all the customers in their needs and in content, and in management and leadership, and in everything,” said Priya Ventakesh, Sephora svp of merchandising, skin care and hair.

“THERE IS A DEMAND FOR DIVERSITY, TO REALLY AUTHENTICALLY REPRESENT ALL THE CUSTOMERS IN THEIR NEEDS AND IN CONTENT, AND IN MANAGEMENT AND LEADERSHIP, AND IN EVERYTHING.

PRIYA VENKTAKESH, SEPHORA SVP OF MERCHANDISING, SKIN CARE AND HAIR.

- Inclusivity extends to flexibility and accessibility when it comes to payments and price points. Brands are enticing first-time customers and younger consumers with entry-level product options and flexible payment plans. Brands that silo themselves due to price are missing out on customers who could be potential fans and powerful advocates.

Arnaudo said that Ulta Beauty’s portfolio intentionally hits a number of price tiers, answering Gen Z’s desire for accessibility. “We’ve got brands at entry-level price points like E.l.f. and CeraVe, to more of the mid-tier price brands like Morphe and The Ordinary, and then to prestige brands like Tula and Tarte,” she said.

BOTTOM LINE

Brands are examining their assumptions and getting curious about both who their customers are and what consumers they are currently failing to engage. This is just the starting point on the road to rethinking and rebuilding the beauty industry toward a more diverse, inclusive future.

Ventakesh said Sephora is now allowing customers to spread payments across four equal installments. “That’s been really well received by our customers,” she said.

- Gender inclusivity is being addressed more thoughtfully than ever. Brands are ditching traditional branding that screams “masculine” or “feminine,” moving toward a more gender-neutral paradigm. In addition, they’re dropping linguistic designations, as they rebrand products and rethink packaging design.

“We intentionally set out to design a line that is very gender-neutral,” said Matthew Biggins, president and CEO of men’s grooming line Cremo. Cremo’s fragrances range from coconut mango and lavender to bourbon. And the brand has also reworked some of its products to be less prescriptive about who should be using them. Biggins acknowledges there’s work to do, but said the brand is moving in the right direction. “In our advertising and our packaging, we really don’t try to look at what the traditional masculine cues, designs or images are,” he said. “It really is about inclusivity.”

02

Digital and direct conversations are here to stay. This connectivity will be the long game until stores rebound.

With analysts forecasting that the economic aftershocks of Covid-19 will extend well into 2021, if not longer, the immediate future will be sluggish for brick-and-mortar. That means the industry can expect e-commerce and social media to continue to be the main drivers of conversations — and conversions — in the beauty space. And that tilt toward digital, though originally catalyzed by the pandemic, might become enshrined as consumers become addicted to the convenience and immediacy of digital commerce.

Brands that have built a solid hub on platforms like Instagram are extending their reach to experiment with other platforms. Mouzon Wofford of Golde said the brand is thinking about, “Where is our consumer, and also where does our message and where do our products fit best?” Golde shares recipes on Pinterest, engages with Gen Z on TikTok and is also exploring YouTube.

Different conversations are happening on different platforms, and of course, the demographics of each platform are different. “It’s definitely a balance of making sure that we’re doing as much as we can really well, and not jumping onto every single platform and not nailing it,” said Mouzon Wofford.

The pandemic has also forced brands to think about how to cultivate digital communities and offer compelling online-only services. Innovation in this space will be something to watch over the coming year as brands keep building out new digital offerings to serve their online communities.

- Skin care and beauty concierge services add a highly valuable personalized dimension to the consumer experience. Brands that think of themselves as providing a service, rather than simply a product, are able to offer consumers the helping hand many shoppers feel they need when navigating the complexities of beauty.

Soko Glam’s “Your Skin Concierge” program has evolved from an email service to a more responsive text messaging operation. “You get that person in your pocket in a very convenient way to talk to all the time about your skin,” said Soko Glam co-founder Charlotte Cho. “It doesn’t have to be about buying a product as a result of that; this is your companion and your friend that’s going to help you through your skin-care journey.”

- In-store shopping isn’t going away. Even younger consumers still crave the in-person retail experience, so brands are focusing on the interplay between physical and digital commerce. “Nine out of 10 female Gen Zers still prefer to shop in-store,” said Arnaudo of Ulta Beauty. “It’s still important for them to have that connectivity, the togetherness — they love to be with their friends and engage in beauty.” Brands are evolving their e-commerce offerings as a supplement to brick-and-mortar rather than a substitute.

One application of this logic sees brands digitizing traditional features of the physical store, such as try-on and consultations with sales associates. During the pandemic, Ulta Beauty removed testers from its stores, but customers were able to test products using the brand’s Glam Lab app feature. Usage of the Glam Lab has increased by nine-times the pre-Covid rate. Ulta Beauty has also recently launched one-on-one appointments with a “beauty advisor,” as well as a skin-care service that uses AI and AR technology to scan the consumer’s skin and give product recommendations.

- Digital events and activities that began as improvisations during lockdowns are here for the long-term. Although brands want to see virtual events and in-person retail return, many have reaped the benefits of virtual and digital activities. They realize there’s no need for their audiences to be limited by geography, and online events allow brands to keep the conversation going with diverse communities near and far.

Trinity Mouzon Wofford said that although in-person events are really important to Golde, they were only available to a limited community of consumers in major cities like New York and L.A. “We weren’t hitting folks all across the rest of the country,” she said. “You have these virtual events and you have people from all over. It really levels the playing field in an exciting way.” Whatever the next year brings, many brands will be making digital events a part of their long-term strategy.

BOTTOM LINE

Brands have discovered that digital conversations, communities and events can be hugely powerful drivers of energy and sales. Even if retail rebounds over the next 12-18 months, brands will be investing more in digital strategy and services that integrate the online and offline experience more seamlessly.

Across all industries, Gen Zs are fast becoming the focus of attention for marketers. For beauty brands, the sense of urgency is palpable, because consumers are engaging with their products earlier in life than ever. These savvy, opinionated young consumers have money to spend, but they’re extremely discerning about who they spend it with. Brands are exploring the spaces that Gen Z calls home and experimenting with different ways of engaging with — and learning from — the consumers that will define the next decade.

03

Customers are engaging with beauty at a younger age than ever before, providing new reasons for brands to connect with Gen Z or find creative ways to develop products.

With Covid-19, Ulta Beauty is finding that people of all ages are conscious of taking better care of their skin, including Gen Z. “They’re getting into skin care at a much earlier age,” said Arnaudo of Ulta Beauty. “They’re engaged in it at [ages] 11, 12, 13.”

Another characteristic of Gen Z is the speed, enthusiasm and responsiveness with which it picks up new products and trends. “With Gen Z, it’s a very fast cycle of response,” said Trinity Mouzon Wofford of Golde. “We’ll share a certain recipe or a certain product, and then the next week, suddenly, we’re getting tagged in all of this content from our community. That content is all about that product, because people are hoping to get shared into our Instagram Stories, and then people are purchasing it.”

- TikTok is where brands speak to Gen Z — and great content wins. The platform’s influencers are powerful gatekeepers with built-in audiences, which saves brands the work of having to first build their own audiences. Forming strategic partnerships with the right influencers allows brands to focus on creating great content in collaboration with the people who know their audiences best.

Venkatesh of Sephora said the TikTok format has been highly effective as a vehicle for the skin-care industry. That’s partly thanks to the ability of influencers like Hyram to deliver relatable and highly informative content, distilling complex concepts into easy-to-follow vignettes. “He’s been able to connect with Gen Z very fast, and he’s really real about skin care, which everyone appreciates,” Ventakesh said. “He just is able to translate skin care to his audience really fast.”

- Gen Z is skin-care savvy and relentlessly curious. The most successful brands are those that recognize that their relationships with consumers — and especially the younger generations — are by necessity an ongoing, two-way conversation. Brands should remember that their customer wants to be satisfied and they want brands to succeed, and that means listening when they tell the brand how it can do better.

BOTTOM LINE

Gen Z is the center of gravity for marketers, and brands are learning to speak their language. Brands shouldn’t try to force it, but instead, engage in a genuine conversation with the Gen Z consumer and take time to learn what they want. Brands that trust in this more organic approach and evolve with these young consumers will win the day.

“They are hungry for new information, and they’re not afraid to give honest feedback,” said Cho of Soko Glam. “There are many times where we launch something and we’re so proud of it, and then we hear some constructive criticism — and that’s great, because we’ll never get better unless we hear the real truth.” Cho said Soko Glam welcomes that dialogue as part of an iterative approach to product development. “Maybe we need it to launch and then constantly create tweaks,” she said.

- Gen Z loves TikTok, but brands are exploring a variety of new digital channels and virtual spaces. Gaming is one of the arenas most ripe for crossovers and collaborations. Tatcha, for example, made use of the world-building potential of Animal Crossing to create a virtual experience for loyal community members as a substitute for a planned trip to Kyoto that was thwarted by Covid-19.

“For us, it was never about, ‘We need to jump into gaming because it’s hot and it’s trendy,’” said Sarah Curtis Henry, CMO of Tatcha. Rather, the creation of “Tatchaland” was about leveraging gaming when the possibilities of the medium aligned with the right opportunity for the brand. “We could create our own island, Tatchaland, within Animal Crossing with details along the way that really reflect many parts of our brand heritage, from a tea house to [Tatcha founder] Vicky [Tsai] being the tour guide on the island.”

04

Makeup isn’t dead, but the brands that are doing well have pillars of clean beauty, inclusivity and values baked into their DNA.

The Covid-19 crisis has brought clean beauty and wellness to the forefront of many consumers’ minds. Clean products have been a work in progress for years for many brands, but consumer demand is spiking, driven by a renewed focus on health, an energized, values-driven younger generation and rising climate anxiety.

There’s simply no getting away from the fact that Gen Z expects beauty products to be clean and sustainable as a standard. Ninety percent of Gen Zers intend to buy a clean beauty product within the next 12 months. Gen Z “really celebrates and supports brands that stand for something,” said Arnaudo of Ulta Beauty.

Sarah Curtis Henry, CMO at Tatcha, said, “[Customers] expect brands to fully engage in this cause and use their power and economic sway to make a difference. Just like consumers expect brands to be community-driven and make social impact, sustainability is part of that.”

Fortunately, brands have never been in a better position to answer the demand. More products than ever meet a “clean” standard, and that no longer implies a tradeoff in terms of quality. Brands aren’t stopping there, either; brands that implement sustainability in their products tend to strive for sustainability in other aspects of their business.

- Clean makeup is the next big thing. The color formulas that brands are releasing today are a world away from the older iterations of “clean” makeup. The days of unreliable pigments and runny foundations are over, and today’s consumers can enjoy great products that are also good for the environment.

“You don’t have to compromise on the textures and the advocacy,” said Venkatesh of Sephora. “By choosing to be clean and natural, you can get the best of both worlds. I do believe makeup is there, as well, and it will keep getting better, because of the consumer engagement and demand. These brands are able to deliver really high-quality formulas, and the customer doesn’t have to compromise.”

- Clean also increasingly impacts packaging. Beauty brands are leading other industries by rethinking the way they package their products. In part, this is a response to clear demand from consumers, but it also reflects a ripple effect as sustainable thinking becomes internalized: When brands focus attention on creating clean products, that tends to have a knock-on effect on packaging.

Ventakesh said there’s a high correlation between sustainable approaches to products and packaging. “When a brand is conscious of what’s in their formula, they are also conscious of what the packaging is doing,” she said.

BOTTOM LINE

Brands that succeed with today’s uncompromising young consumers are threading the needle to create products that are functionally excellent yet sustainable. That commitment to sustainability has to be tangible in everything the brand does, as beauty becomes intertwined with a broader set of consumer values and aspirations.

- Be transparent about clean initiatives. Sustainability is a challenge, but it’s a learning opportunity for everyone. It pays for brands to be open, share timelines and speak frankly about all aspects of sustainability and bring customers on that journey with them.

Sarah Curtis Henry of Tatcha said the brand is on-course to deliver on its commitment to be 100% recyclable, reusable, refillable or compostable by 2023, and perhaps sooner. “We’re really diving in, and we also want to learn from the industry. It’s evolving, there’s no one definition of sustainability, and what we know this year will change again next year. But we’re here for it, and we’re going to continue to evolve as we learn more.”

05

The next big category to watch? Hair care.

Hair is booming right now. This is perhaps unsurprising, after several months during which consumers were forced to take responsibility for their own hair care like never before. But throughout 2020, stylists have taken to digital platforms to educate and inform consumers, and that has also paid off for beauty retailers.

Hair has also been a part of the broader conversation on diversity and inclusion. Retailers and beauty brands are acknowledging that they have fallen short on serving a diverse range of consumers and hair types, and many are committing to expanding their portfolios to include a more representative line of products and services.

Curtis Henry of Tatcha places hair care under the self-care umbrella that became such a pervasive part of the response to Covid-19. And she believes the importance of hair, along with categories like home and personal care, will continue to resonate. “These are all trends — if you want to call them trends — that consumers are still very much engaged with and that we expect to see continue going into next year. It will breed lots of new brands,” she said.

- Stylists have taken their skills online. Stylists adapted to salon closures by creating content for social and e-commerce platforms to help customers maintain their hair at home. That’s creating opportunities for closer collaboration between stylists, brands and retailers, as consumers act on product recommendations they receive from stylist-created content. Beauty brands see the potential for this to grow even into the post-pandemic landscape.

“It’s definitely working and resonating, and it’s really exciting to see all this engagement in hair care,” said Venkatesh of Sephora. Venkatesh said Sephora had seen a “big bump” in sales of products by salon brands like Olaplex and Kérastase, as customers have been learning how these products work and why they are important. “A lot of stylists have adapted really well to social and e-commerce platforms, and they are able to relay that message,” Ventakesh said.

BOTTOM LINE

The silver lining to a difficult, draining year for the beauty industry is a hair-care sector that is committing to a more diverse, inclusive future. Stylists have pivoted in a way that creates exciting collaborative possibilities with brands, and hair care is top of consumers’ minds like never before.

- Brands are giving Black hair the respect it is due, and the products to match that. Offering a more diverse range of hair-care products tailored to Black consumers and their hair care needs is a top action step for many brands. One of the best ways of doing that is by supporting and creating space for Black-owned hair-care businesses.

In June, Sephora was the first company to sign Aurora James’ 15 Percent Pledge, committing to ensuring that black-owned brands account for 15 percent of shelf space in stores. “Hair is a big part of the conversation there, because it’s the most tangible thing,” Ventakesh said. She said hair care will play an important role in bringing that pledge to life. Bread Beauty, which came out of Sephora’s Accelerate program earlier this year, is just one example.

- Bringing the barber home. Just as stylists are helping customers translate salon hair care to the home, expect to see brands looking at replicating the experience of barber shop services like a hot shave.

Cremo’s Biggins said the brand has tried to bring one under-appreciated aspect of barbershops to the fore in its work with barbers. “A lot of men actually use barbers as sort of a psychiatrist,” he said. “It’s like a safe place where you can go and let your guard down.”

06

Overheard

“Our community is king. We haven’t failed when we’ve really listened to them.”

Charlotte Cho, Co-founder of Soko Glam and Then I Met You Premium Skin Care

Today’s consumers — but especially Gen Z — want to play an active role in guiding product development, and brands are learning to leverage the customer feedback loop to their advantage. Letting go of the old ways of doing things — prescriptive, top-down, brand-led product design — means the brand has to let go of ego and control, embrace criticism and allow its community to guide the conversation. It can be painful, but the end product can be powerful. “Never underestimate the power of having that type of deep relationship with your community, plus make sure you stand for quality and make sure you don’t rush things,” Cho said.

“They expect brands to be human … they expect companies to take what’s been provided to them, in terms of commercial success and investment, from a consumer perspective, and actually return that to the community.”

Sarah Curtis Henry, CMO of Tatcha

Gen-Z consumers are more demanding than previous generations, in terms of what they expect from brands. They view themselves almost as partners of the brands they support, rather than simply customers. And these younger consumers view their support as a tradeoff. they want to know their money is supporting businesses that are aligned with their values. This year has seen lots of talk about diversity and inclusion, and many brands have made statements committing to “doing better.” Consumers will be holding the brands to those promises.

“You’re going into a category on the shelf that’s full of flowers and pastel colors, and all these traditionally feminine cues. You have to take a little courage and not be afraid to do something different.”

Matthew Biggins, President & CEO of Cremo

Beauty brands are reconceptualizing the way they present, package, label and market their products to reflect the gender fluidity of modern society. By moving away from the binary of “men’s” and “women’s” grooming, skin care and beauty products, brands can break away from gender tropes and limiting assumptions about which fragrances are “for” women and what type of imagery appeals to men. That leaves the brands free to focus on the product, crafting the branding to capture a more inclusive spectrum of consumers.

07

Glossy 101

What are nano-influencers?

Our conception of who can be an “influencer” is changing. Working with big-name influencers can be hugely effective, of course, but not everyone has the budget to pay for celebrity endorsements. There’s also a growing perception that, as professional influencers have become big business, they can no longer credibly trade on their “authenticity” as consumers and followers of brands. Instead, brands have identified a new category, the nano-influence: people with fewer than 1,000 followers who demonstrate deep engagement with the products they love, and whose endorsements and recommendations impact their friends’ purchasing decisions.

“We have found that, by and large, those are the girls who drive clicks,” said Mouzon Wofford of Golde. “They drive conversions — oftentimes, way, way more than someone who is considered a proper influencer. They’re much more engaged with your brand and they’re excited about the products. And we find that if we can educate them on our story and our mission, and why they should be excited about Golde, having them then tell that story and create their own content is so much more meaningful than us doing all of it on our end.”

What are the pillars of conscious beauty?

Business ethics and sustainable practices have never been more critical than they are today in the beauty industry, and that’s partly due to the rise of Gen Z. No generation has been as informed and opinionated as Gen Z, or as willing to hold brands accountable. According to one survey, 90% of Gen Zers intend to buy a clean beauty product within the next year, but what does “clean” mean?

Arnaudo of Ulta talked about the company’s five distinct “pillars” of conscious beauty, and says each of these is important to Gen Z in its own right. The five pillars are: using clean ingredients; cruelty-free practices, vegan, a focus on sustainability and the environment, and making a positive impact in the world.

“Every one of those is very important to the Gen-Z audience,” said Arnaudo. “For us it was really important that we did showcase a holistic approach.”

What is C-Beauty?

Japanese and Korean beauty are already established phenomena, but Chinese beauty, or C-Beauty, is starting to enjoy its moment, with a crop of brands rising from the world’s second-largest beauty market. Chinese Gen Zers and millennials are hungry for local brands to succeed on the global stage, but also rallying behind brands that speak to them from a Chinese perspective. Brands like Perfect Diary and Hedone have built huge followings inside China. Now the beauty world is anticipating a global breakthrough for C-Beauty.

“C-Beauty is on the rise in a big way, in terms of local brands,” said Curtis Henry of Tatcha. “In terms of where China’s going, that’s one for all of us to watch: locally cultivated brands and the role that they’ll play both locally and on the global stage.”

08

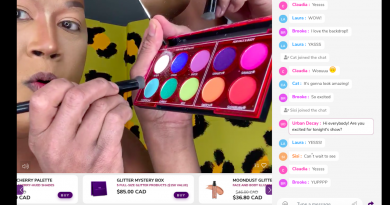

Event video: Beauty brand leaders discuss how to innovate in a fast-changing landscape

09

Event video: Beauty executives on understanding the wellness market and reaching Gen Z

:quality(70):focal(464x563:474x573)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/D3S6K4DZWBAYPB47ERBMIXG754.png)