Inside Glossy’s executive focus group: Beauty brands on TikTok, travel retail and loyalty programs

Glossy recently hosted a focus group discussion with beauty industry executives on the state and future of beauty brand distribution. The conversation was lively and insightful leading to valuable observations that this report uncovers. A more detailed analysis of the industry with data insights is presented in Glossy’s 2022 Annual Report.

What follows are key themes and trends about how beauty brand merchandising efforts have changed in the past two years, and answers to questions such as: Where do experts see the intersection between e-commerce and in-store shopping headed? Which distribution channels may just be sleeper hits waiting for their moment?

Going viral on TikTok sparks record sales for new brands and legacy products

Marketers are eager to tap into elusive viral TikTok moments for their brands. The videos can result in record sales in mere hours, infusing life into brands that have been on the beauty scene for a while, or giving a boost to new entrants. Old-guard brand Abercrombie & Fitch, for example, garnered 128.5 million views on TikTok as of October 2021 thanks to its #abercrombie hashtag. But viral moments tend to occur when companies least expect them, making them hard to plan for and measure.

“It’s a little bit of a crazy phenomenon. But we will see items that we have sold for 10 or 15 years and they’ll go viral on TikTok and sales will just absolutely jump. … Our lip exfoliator that’s been around … got hot on TikTok, and our sales went through the roof. So you just never know what’s going to hit.” –Amy Elliott, vp and general manager of North American sales at E.l.f. Beauty

“With Fable & Mane, we’ve been viral a couple of times. The first virality was two or three months into the launch, which was unexpected; we didn’t even plan it. It was actually done so badly that we didn’t even have a tag [for the brand]. … But even without any link, we had six figures of sales in a couple of hours. And we sold out on Sephora. So that was a good lesson to learn. Sometimes lack of control and lack of data capturing can still lead to success.” –Akash Mehta, CEO, growth and digital marketing specialist for Fable & Mane

Industry leaders say influencers’ genuine appreciation for products is what connects with shoppers and instigates sales.

“A year and a half ago, Hyram [Yarbro] did an organic mention of our pore [strips]. It was a 15-second video, and we sold nine months worth of product within three days. … It’s about literally letting [influencers] speak their viewpoint and have their message, because that’s when it becomes the most authentic. And it was such a beautiful thing. It’s really shifted the way that we approach social channels and the way that we speak within our channels.” –JP McNary, chief commercial officer at Peace Out Skincare

Tried-and-true — and some new — platforms offer a more predictable impact

Despite striving for TikTok sales success, brands are not forgoing advertising on established social media platforms like Instagram, often finding they offer cost savings.

“You can get TikTokers that will charge $80,000 for one video. … But if you say, ‘[Give] me a story with a checkout code on your Instagram,’ it might be a lot cheaper and actually have a huge conversion for your brand. There are creative ways to not necessarily isolate the two entities but to think of them as one … If [influencers] really love the product and love the content, they might even post it again on TikTok because they have the piece of content already there. … We’ve actually ended up getting a lot more value from this kind of mindset.” –Akash Mehta, CEO, growth and digital marketing specialist for Fable & Mane

“It’s about finding a balance between the two [platforms]. … If [influencers] have 3 million followers on TikTok and maybe 20,000 on Instagram, I promise you those are very dedicated 20,000 followers that are on Instagram. So they listen, and it’s a very meaningful platform. We are pushing harder within TikTok, but we certainly are not walking away from Facebook and Instagram.” –JP McNary, chief commercial officer at Peace Out Skincare

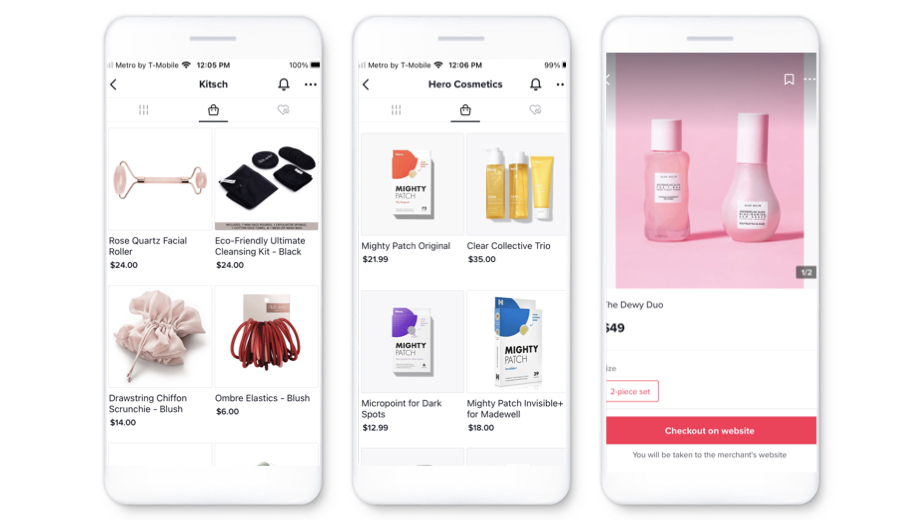

Other brands are investing in the relatively new Flip app, where shoppers and influencers alike can post beauty product reviews and demonstrations. And brands can use those videos on other platforms.

“It’s about building content. All of that content there, we can then use on other channels. They’ve changed their model already a little bit. … It’s not a free-for-all, in terms of paid anymore … but even just for content on our own channels, it’s so much more content. There are some influencers that we were already working with and [others] that we hadn’t been able to work with. For a smaller brand like ours, it opens up a new world, in terms of partners and reach.” –Amanda L. Kahn, svp of marketing and e-commerce at RéVive Skincare

Loyalty programs and direct outreach are keys to community

Not wanting to put all of their eggs in the influencer-marketing basket, some marketers turn to loyalty programs and direct consumer contact to create a sense of user community. The programs help brands to not only gain and retain loyal customers, but to also target ads and reach potential new shoppers through first-party data collection.

“As you think about TikTok or Flip, it’s all about creating these communities. One of the other places that we’ve tried to create a community is through our Beauty Squad [loyalty] program. That has been incredibly successful in attracting new customers to our website. … But it’s also an integral part of our first-party data, where we can talk directly to really engaged consumers. We can also personalize and tailor the message we’re sending to them, which can drive long-term engagement in the brand.” –Amy Elliott, vp and general manager of North American sales at E.l.f. Beauty

“Our brand was born out of the sheer necessity of this underserved group of Black and brown gentlemen not having access to clean, non-toxic products. Our founder, who started the brand in the kitchen of his home, looked at the space and said, ‘I don’t have a huge marketing budget, but I’ll give you a jar of goop, some hair balm and some beard balm. Try it out and see how it works, and then share that feedback online.’ So, influencer marketing has always been a part of our overall brand strategy.

“We’ve leaned into our first-party data … looking at our consumers and seeing how they can be a part of our influencing ecosystem. They may not be influencers by day, or rev-gen influencers who are doing it to actually drive orders, but they absolutely are part of our ambassadorial squad.

“We survey our consumers all the time, [asking,] ‘Where do you shop?’ and really looking at being strategic about where we are and how we provide him access. Whether it’s [via] social commerce, a mailer or a podcast, it’s really about meeting him where he is to ultimately plant those seeds and those little breadcrumbs to drive him back to Scotch Porter, on site or at retail in-store.” –Aleesha Worthington, vp of marketing for Scotch Porter

Marketers may find themselves boxed in by beauty boxes

One may think with the success of loyalty programs and personalized messaging, marketers would also gain patrons by offering product sampling through beauty boxes. But industry executives say that, while the boxes may be useful for new product introductions, they generally don’t offer a great return on investment.

“There are different box subscription models. … Some take free products from [your company], some pay a percentage of MSRP, and some … want you to pay to be in the box. … Where it is really compelling is when you get data [from a box activation] and you find information from the consumer. … If you can get a product into a box that is about giving them an introduction to the product, helping them fall in love with it, and then you can see recurring purchases outside of that box, then it makes a lot of sense. But as those boxes have grown in size, it becomes more of a marketing expense. Then you look for a much stricter return on that investment. It’s a great launchpad for awareness for a new brand. For an existing brand, you have to look at the economics of it.” –Tal Pink, vp of business development at Orly

“When I worked at Estée [Lauder] and Dior, I was fortunate enough to use SoPost and big-box subscriptions. … I saw good results. I didn’t see incredible results. It didn’t necessarily inspire me to invest heavily in it from day one. I found there were slightly cheaper sampling programs … But at the same time, doing lead gen ads myself and fulfilling it with my own distribution center was quite effective to see the value of sampling while still owning the data.” –Akash Mehta, CEO, growth and digital marketing specialist for Fable & Mane

Travel retail fails to take flight

Travel retail also isn’t taking off, especially for smaller brands. According to beauty executives, profit margins aren’t good, travel retail doesn’t cater to unique demographics, and brands with local stores in the same markets as airports are forced to compete with themselves for sales.

“If you’re [offering] travel retail in the U.K., London’s Heathrow [airport] is a competitive market to your London store. That taught me from day one, unless I’ve got a maximum opportunity within the market, I would really hold off on travel retail. Also, you won’t have the negotiation power as a single-unit brand. Big conglomerates negotiate the best shop floor and shelf as a group. You’ll see the Estée Lauder-clustered brands in one unit at the front of stores in the duty free [shops].” –Akash Mehta, CEO, growth and digital marketing specialist for Fable & Mane

“When you look at travel retail, the margins are very high. For a new brand or a small brand, that doesn’t work. [Travel retail] really hasn’t done a great job with niche [markets]. When you have a unique positioning … [like] clean formulations, sustainability or a unique demographic, it doesn’t appeal to that either. I’m not opposed to travel retail. … but it has a lot of work to do in order to be able to capture this unique niche market that [our brand is] in, and do a good job with it. And the margins are just out of control.” –Dawn Hilarczyk, head of global sales for Noble Panacea

“It’s also [important to have] brand awareness in the market you’re selling in or traveling to. It’s the innate understanding that this bottle of fragrance costs $69.50 in Macy’s, but [at the airport, it’s] two for $74.50 or one for $39.50. … When someone is quickly walking through T5, [they’re not thinking,] ‘That’s a great deal. I’ll buy one of those or a two-pack.’ That’s [unless] there’s a level you achieve in brand awareness, where the consumer knows they’re getting a good deal. When we talk about the store of the future and what that looks like, in terms of touch and feel and play, it almost seems like travel retail is designed [to benefit from] that. You’re a really captive audience when you’re stuck in the airport. So, there’s definitely opportunity there.” –Amanda L. Kahn, svp of marketing and e-commerce at RéVive Skincare

Online browsing and research drives in-store purchases post pandemic

When many brick-and-mortar stores temporarily shuttered during the pandemic, brands turned to e-commerce to support sales. But as consumers return to in-person shopping, industry experts are finding that shoppers continue to research and browse products online before, and even during, in-store visits.

“[In-store consumers] are utilizing product pages and e-commerce in a bigger way to validate or to educate their purchase beforehand. This was always happening, but we’ve seen a much higher conversion from people looking at the product page before purchasing, even while they’re in-store. It’s almost doubled [since] before the pandemic. So we are hyper-focused on growing both in-store and online. We’ve learned very quickly that those two are succinct at working together, and online is driving the in-store purchase in a much bigger way than it ever has before.” JP McNary, chief commercial officer at Peace Out Skincare

“Some of the best practices in brick-and-mortar and best practices online are interchangeable now. Brick-and-mortar offers ease of shopping, [with] buy-online, pick-up in-store. If you don’t have time to get it there, they can ship it that day. The brick-and-mortar role is also to really be innovative, from an experience standpoint, if they’re going to [remain open] long term. … [Consumers] want to have QR codes. They want to be able to read reviews online, and then decide if they want to shop or not in-store.”– Molly Haldy, svp of sales for Elizabeth Arden

Other brands have found that the online streaming events they began hosting during the pandemic have allowed them to tap into an ongoing dual-revenue stream.

“It now has become mainstream and part of our business. … From a retail events perspective, as we’re talking about our next launch and we’re negotiating with a retailer … there are twice as many types of events that we can hold. We aren’t limited to a calendar and travel and [concerns about], ‘What can we do in the U.K.? What can we do here? We can’t be in two places at once.’ … The model just shifted on its head, [in a way] that we would not have thought about before.” –Amanda L. Kahn, svp of marketing and e-commerce at RéVive Skincare

The store of the future combines brick-and-mortar and online experiences

As members of Glossy’s focus group noted, the “store of the future” is expected to rely on historically successful tactics like giving customers the option to see, touch and smell products in-store. However, with the rise of e-commerce, online offerings are becoming equally important. To give consumers a seamless future shopping experience, experts believe brick-and-mortar stores will need to combine in-person shopping with digital options like scanning QR codes to read online product reviews before making a purchase. Others expect stores to become so-called “entertainment hubs,” hosting events that bring influencers in-store to sample products. The future seems limited only by brands’ and retailers’ willingness to experiment.