How Beauty Brands Can Take Advantage of TikTok Trends

When Futurewise — a new beauty brand from the founders of Starface and Plus — launches Wednesday, its TikTok-addicted customers will already be familiar with “slugging,” the skin care technique that inspired the brand’s initial slate of products.

The concept, where people cover their skin in a thick layer of petroleum-based product to lock in moisture and protect the skin barrier, went viral on the platform during the pandemic, and today, the hashtag has over half a billion views. Futurewise’s mist, cream and slug balm were created with the practice in mind.

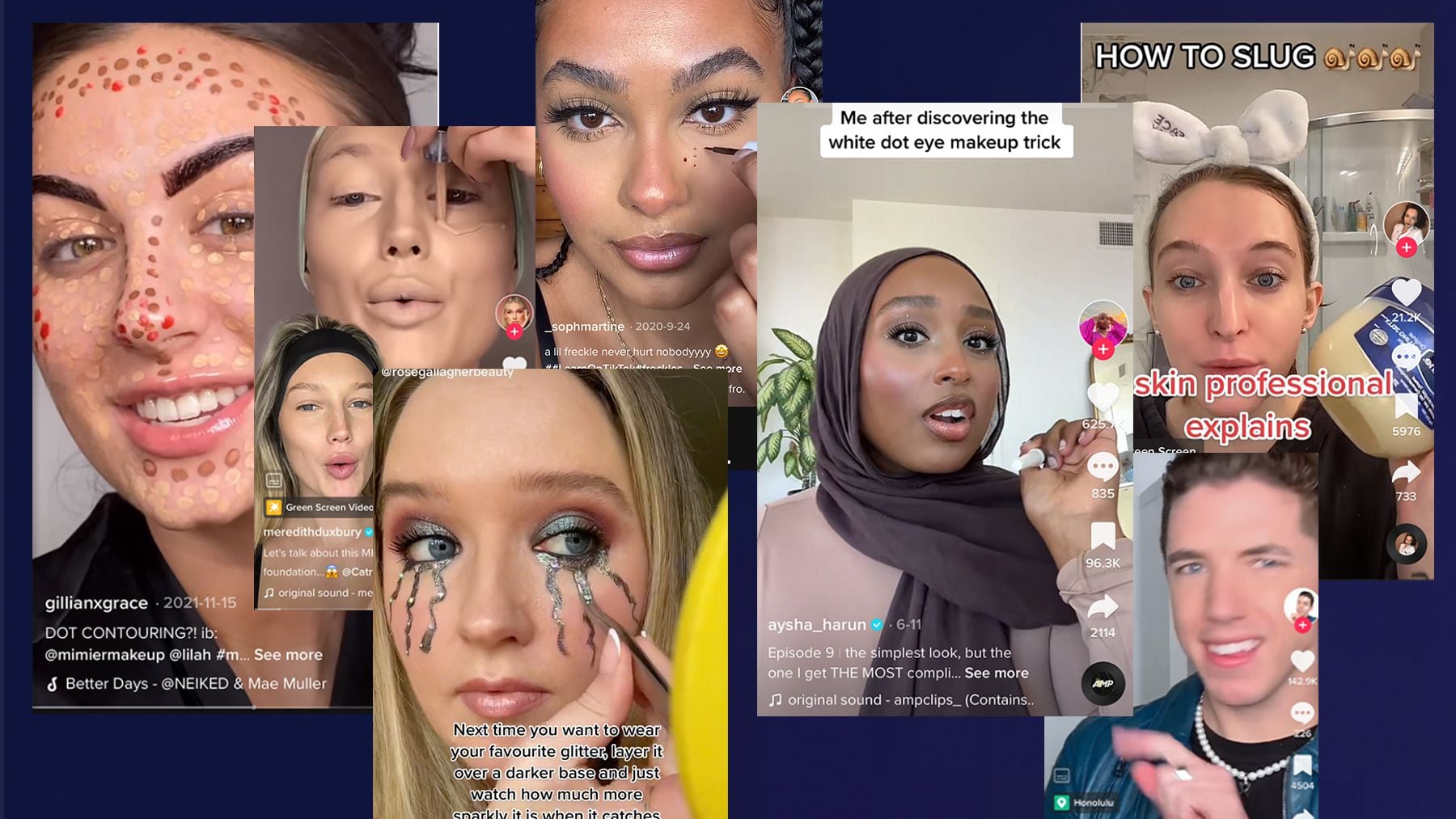

TikTok has sparked countless beauty trends, including over-the-top “Euphoria”-inspired makeup, faux freckles, face gems and more. It has sent drug store staple brands like CeraVe to the apex of the beauty conversation, and prompted a resurgence of products like Clinique’s black honey lipstick. TikTok even convinced people to use lube as a primer.

But reacting to the app’s constantly-shifting trend churn is a tough task for beauty brands. Creating new products that perfectly fit into a trend is often unrealistic. Even with the most agile supply chain, products take time to develop, and TikTok trends are often limited by geography and age group with life cycles as short as a few weeks. It’s hard to predict what might go viral, and determine what will stay cool.

“There’s nothing more cringey than a brand being late to a trend,” said Tyler Wentworth, director of strategy at marketing firm Movers+Shakers.

Still, ad hoc conversation on TikTok is a huge driver of beauty buzz, especially among younger consumers. Brands can build off of trends by understanding the wider tendencies they reveal, and tap into specific trends by using them to tell stories about existing products. They should also use TikTok to stay in touch with what consumers want and are talking about, and incorporate overarching themes into their assortments in a way that feels true to the brand’s ethos.

TikTok beauty trends tend to follow a similar pattern. They tend to pop up around advice that is easy to execute (like putting a few white dots around your eyes to draw attention) or that carry a “sick curiosity” or entertainment factor because they seem unlikely to work, said Rose Gallagher, a creator and makeup artist. Influencer Meredith Duxbury’s unconventional, super thick foundation application and even slugging are examples.

But in catering to trends, consumers don’t want to feel like they’re being blatantly sold to, and they aren’t interested in buying from brands that they feel are selling out.

“When you see brands or products that come out right away that have to do with a trend, you have to question, ‘was this a base formula that was already made that’s now being repurposed?’ Or ‘are there shortcuts being taken?’” said Whitney Bowe, dermatologist, TikTok creator and founder of her namesake skincare line.

Instead, Bowe says identifying real “moments,” rather than a fleeting trend, is important when looking to TikTok for inspiration.

“A lot of these trends will last for like two weeks, and then you have trends that turn into movements,” said Bowe. “Slugging had incredible lasting power on TikTok. It was a real educational moment for people when they started realising how important skin barrier is.”

At Futurewise, Slugging’s viral boom wasn’t the inspiration for the brand, said the brand’s co-founder Julie Schott, but rather, it was a good indication that it had hit on something. Instead, it was the practice’s history — slugging has deep roots in K-beauty and the Black beauty and Native American communities — that intrigued Futurewise’s founders.

“It did blow up on TikTok. I think that is a testament to just like this being an actual mainstay in how it can benefit people,” said Schott.

Because of the extended timelines involved in developing and manufacturing beauty products, timing a new brand to a TikTok trend is near impossible. However, founders can start planting the seeds of success on the app ahead of time.

Bowe, for example, started developing her skin cycling-centric brand in mid-2020. The term, which she is credited with coining online, refers to a routine with days designated to using exfoliation, retinoid, and recovery products rather than using them all at once. She first introduced the concept on TikTok in early 2021, and in June 2022, after she built credibility and an audience on the app, she launched the brand. Shortly after, around August, she said her routine went “mega-viral.” Today, the majority of her customers come from TikTok, where she has 1.1 million followers.

Even if a brand is able to time a product drop to a trend, to have real staying power, the product has to be strong. TikTok can help with this, too: Bowe said her audience on the app serves as a focus group for product development.

“On social media as I get more of the subjective feedback from people about the actual aesthetic experience,” she said. “I learn so much from my followers in terms of what they enjoy using and areas they feel there’s an unmet need.”

Even if brands can’t time new products to a TikTok trend, they can likely capitalise on them with products already in their assortment.

Milani Cosmetics, a mass beauty brand sold at retailers like Ulta Beauty and CVS, for example, has developed a reputation for its “dupes” — duplicates of more expensive products — on the app. That’s from both the work of Milani itself and organic conversation on TikTok. When the brand sent influencer Mikayla its liquid contour product, she called it a Charlotte Tilbury dupe. When Dior’s lip oil went viral, so too did Milani’s. Milani encourages the buzz with a “TikTok favourites” section on its website.

“People were like ‘Oh my God Milani’s at it again, they’ve duped the Dior lip oil,” said chief marketing officer Jeremy Lowenstein. “But we were well into development a long time ago on those products.”

Lowenstein doesn’t mind the sales afterglow — especially as Milani looks to capture new price sensitive consumers. The biggest focus for the brand is plugging its existing products into the conversation, whether that be by shifting copy, or pushing products that relate to trends. When it’s coming out with a new product, it looks at what hashtags are bubbling up and thinks about how to market it under that umbrella.

“We look at how we’re talking about products, what’s starting to trend, and then we map that against our own innovation calendar,” said Lowenstein.

Earlier this year Milani created a hashtag “Get Ready With Milani,” based on popular “get ready with me” videos. At the same time, “clean girl” aesthetic and “clean girl summer” were trending. It sent out a box curated around the “no-makeup makeup look” to creators and asked them to talk about it. It paid off: the #GRWMilani currently has 16 million views, and #milanicosmetics has over 230 million views, near double last year.

“We take trends and say, ‘here’s another way to think of the products,’” said Lowenstein.

Becoming popular on the app often comes down to getting product into the right hands — like Milani and Mikayla. But taking a less transactional approach usually resonates more with consumers.

“It’s the education that ends up leading a lot of the big trends,” said Gallagher. “The more [brands] look at educational content rather than sales-focused content, that’s where the magic is going to happen.”

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/ADWVG6H7UFCMFLYWFG3CM2LOTA.jpg)