Effective Analysis Types in Forex Trading

Forex trading is all about making the right choice at the right time. But you cannot do it by just guessing. Traders use different types of Forex analysis for profitable trading. You can also employ one of these types of Forex Analysis to earn profit.

Types of Forex Analysis:

There are three main types of Forex Analysis done by Forex traders. You can analyze the Forex trends by the charts or the economic situations of the related countries or even the past movements of your currency pair. These three types of Analysis are:

Fundamental Analysis:

Fundamental Forex analysis involves analyzing the economy of the country whose currency you want to trade. Thus the main economic factors such as the interest rate, employment ratio, productivity, and income are analyzed to grasp the stability of the economy to predict the price movements of the currency of that country. It is a thorough analysis. you have to also keep an eye on any news related to that country as well.

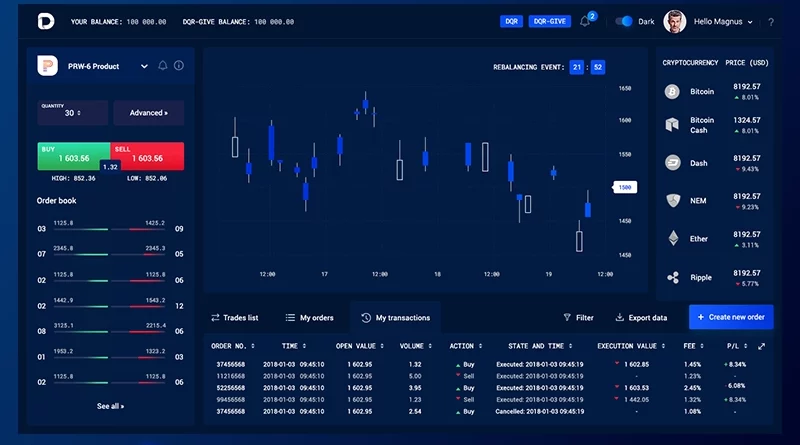

Technical Analysis:

Technical Analysis of the Forex Market involves analyzing the currency pair with technical tools such as charts. It also includes the analysis of the past value movements of the currency pair to judge future movements. It is done both manually and by using automated systems. The automated system is preferred as compared to a manual one because it saves time.

Weekend Analysis:

Weekend Analysis allows you to analyze the Forex market in a calm environment as the market is close so you don’t need to keep an eye on price fluctuations. Thus you can organize your thoughts and develop a relaxed mindset that is essential for setting up effective trading plans for the week ahead. It is just like preplanning for trade. Weekend analysis can motivate you to set a motto and a plan to follow.

Application and usage of Analysis:

There are four main uses of Forex market analysis. It is like a procedure of four steps.

Analyzing the Drivers:

The key to success in Forex trading lies in understanding the current state of the market and the reasons for its current state. If you understand the factors that cause changes in the market then you can determine the future price changes as well. Forex analysis helps you to understand, analyze and evaluate the drivers that cause market movements.

Indexes:

Forex analysis also helps to chart the main indexes for a long duration. It will help you to understand if the movement of the market is inverse or not.

Consensus:

A consensus can help you to do a profitable trade in case of a turning point.

Timing the trade:

Timing the trade is also helpful for traders. If the first trade fails, another opportunity will appear for support. Thus Forex analysis helps traders in their trade in various ways. It can also help you in choosing trading strategies as well.

Source by Ahsan Khan