Beauty Will Make a Quick Comeback, But the Market Will Have Changed | The Business of Beauty, News & Analysis

This article appeared first in The State of Fashion 2021, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

Pandemics do not alter history in as much as they accelerate it. This principle holds true for the changes witnessed across the global beauty industry, which saw nearly half a trillion dollars spent on beauty products in 2019. While beauty sales in the first half of 2020 declined by 10 to 30 percent, the sector — encompassing colour cosmetics, fragrance, haircare, personal care and skincare — is recovering. The reshaped market that will emerge out of the crisis, however, will reflect significant shifts across different regions, categories and channels.

These shifts are less a disruption of norms than a surfacing of trends already latent pre-crisis. With the exception of certain elements of beauty services and travel retail, many of these changes have played out on accelerated timelines, taking three to five months to materialise, rather than three to five years. Retailers and brands are rising to meet consumer demand and make the digital shifts needed in terms of product, commitments and purchasing experiences.

Recovery Speed and Character by Region

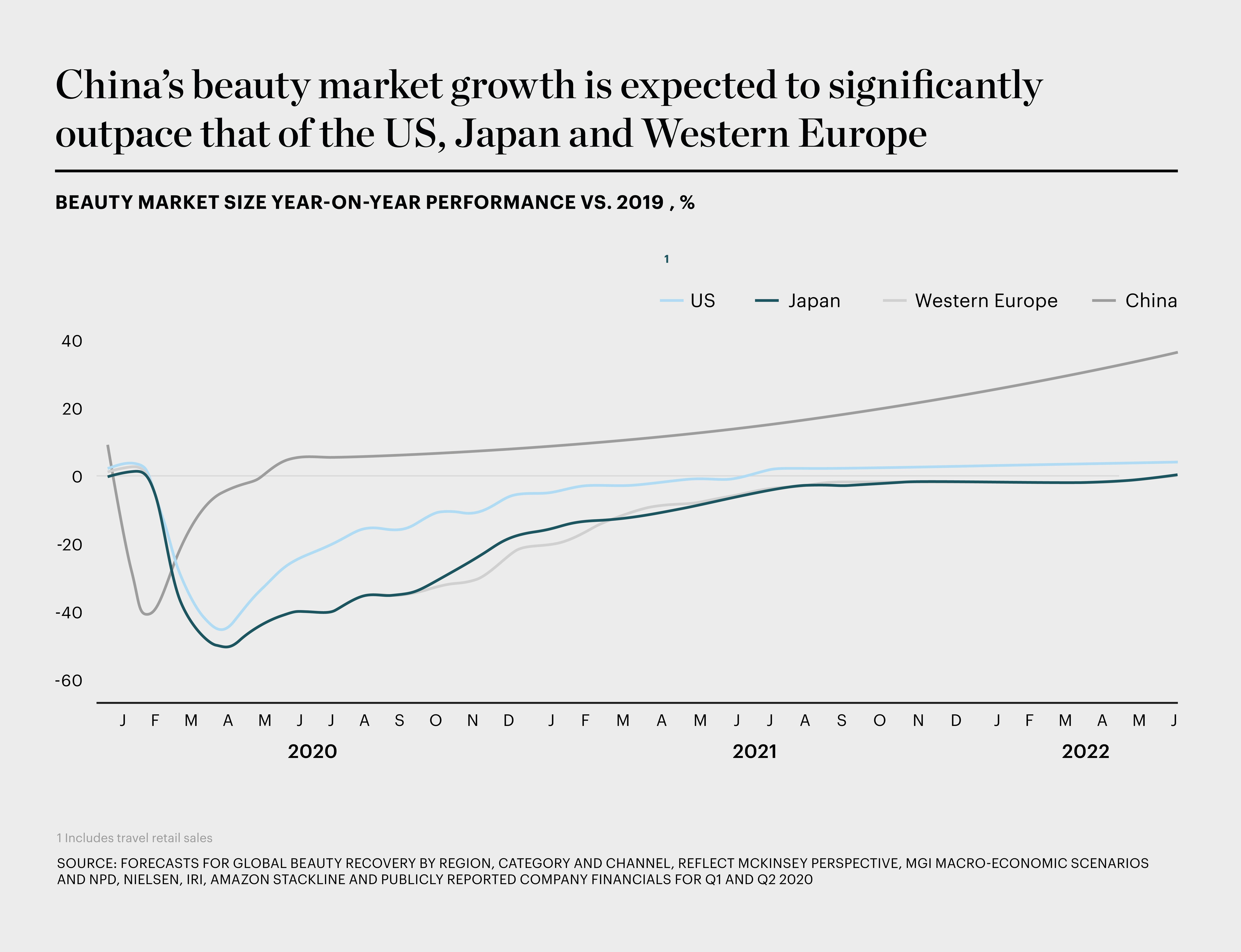

Inevitably, the recovery picture varies by region. Europe and Japan have been hit hard by their relatively low e-commerce penetration compared to other advanced economies and high exposure to the collapse of the $40 billion travel retail beauty market. In the context of continued negative consumer sentiment about economic recovery and new waves of local lockdowns and permanent department store closures, we do not expect beauty sales in Europe or Japan to return to 2019 levels until the first half of 2022 at the earliest.

China had already surpassed 2019 beauty sales by the first half of 2020, with an 8 to 10 percent average annual growth forecast between 2019 and 2021.

In contrast, China had already surpassed 2019 beauty sales by the first half of 2020, with an 8 to 10 percent average annual growth forecast between 2019 and 2021. This is partly due to the onshoring of some of the estimated $30 billion that Chinese consumers previously spent on beauty when travelling internationally. China’s beauty e-commerce market — which pre-crisis already comprised more than 40 percent of sales — has also continued to grow. Local “C-beauty” brands are leading the charge through innovative, agile and cost-effective digital go-to-market models.

Perfect Diary is emblematic of this, with its hyper-local influencer strategy and light-hearted “best friend”-style customer relationship management (CRM) focused on private traffic via WeChat and other direct channels to consumers — similar to how companies outside of China might use a blog or email. At the same time, international giants such as Estée Lauder Companies, L’Oréal Group and LVMH are also driving China’s beauty rebound. So far their investments in China are paying off, with L’Oréal Group reporting almost 60 percent growth of digital sales in China in the first half of 2020 compared to 2019.

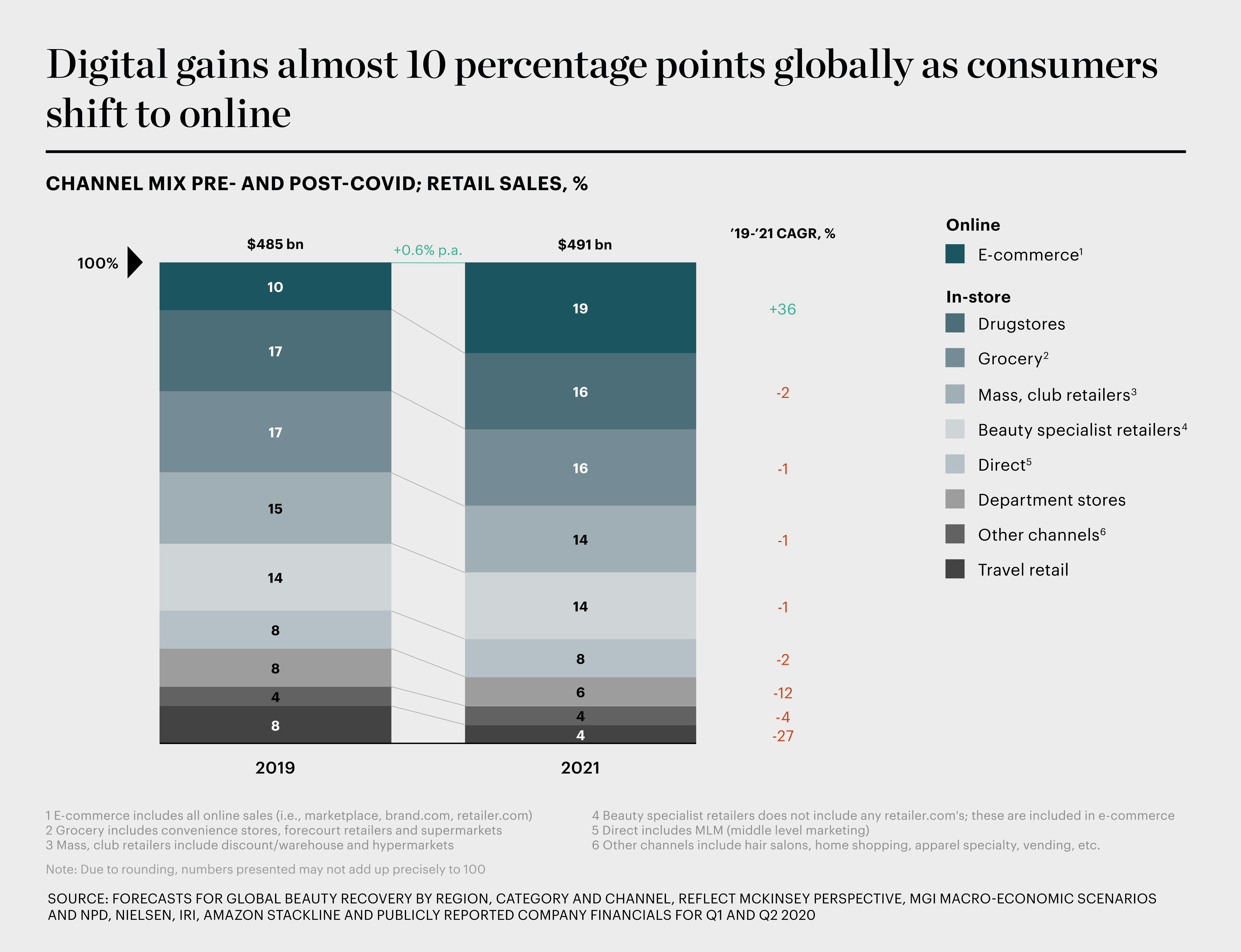

In the US, by comparison, we forecast a return to pre-crisis beauty sales by as early as the first half of 2021, with an average annual growth rate of 3 to 4 percent between 2019 and 2021 — if the pandemic is managed effectively in the interim. Like in China, digital will drive recovery. Pre-crisis, e-commerce accounted for 20 percent of the US beauty market; by 2021, McKinsey estimates that penetration could accelerate to 35 percent. This chimes with our consumer research, which found that one-third of US consumers plan to permanently make e-commerce their primary purchase channel for beauty. The ascendance of Amazon, which is on track to capture $10 billion, or over 10 percent, of US beauty sales in 2020 (up from $4 billion and under 5 percent in 2018) is a testament to this shift.

The shift to e-commerce for this sector is a global phenomenon: McKinsey predicts that the channel’s share of the beauty market will effectively double from just over 10 percent in 2019 to almost 20 percent by 2021. It is also a function of increased engagement in social media, both as a purchase and a discovery channel. Instagram has made significant in-roads into commerce, including plans to test shopping on its Reels video product. While social shopping is in its infancy in the US, 17 percent of US Millennials report they have either started to purchase directly through social media or are increasing their purchases via that channel. Many brands long-associated with Instagram, from Morphe to Charlotte Tilbury, have been quick to embrace Gen-Z-favourite TikTok, where users often showcase videos of themselves doing “challenges” in the form of a before and after video. Revlon’s #DoItBold challenge on TikTok, which invited fans to post content (not necessarily featuring Revlon products) that “tap[s] into your bold, bad self,” reached two billion views within three days of its October 16, 2020 launch.

Category Comeback and the Shift to Self-Care

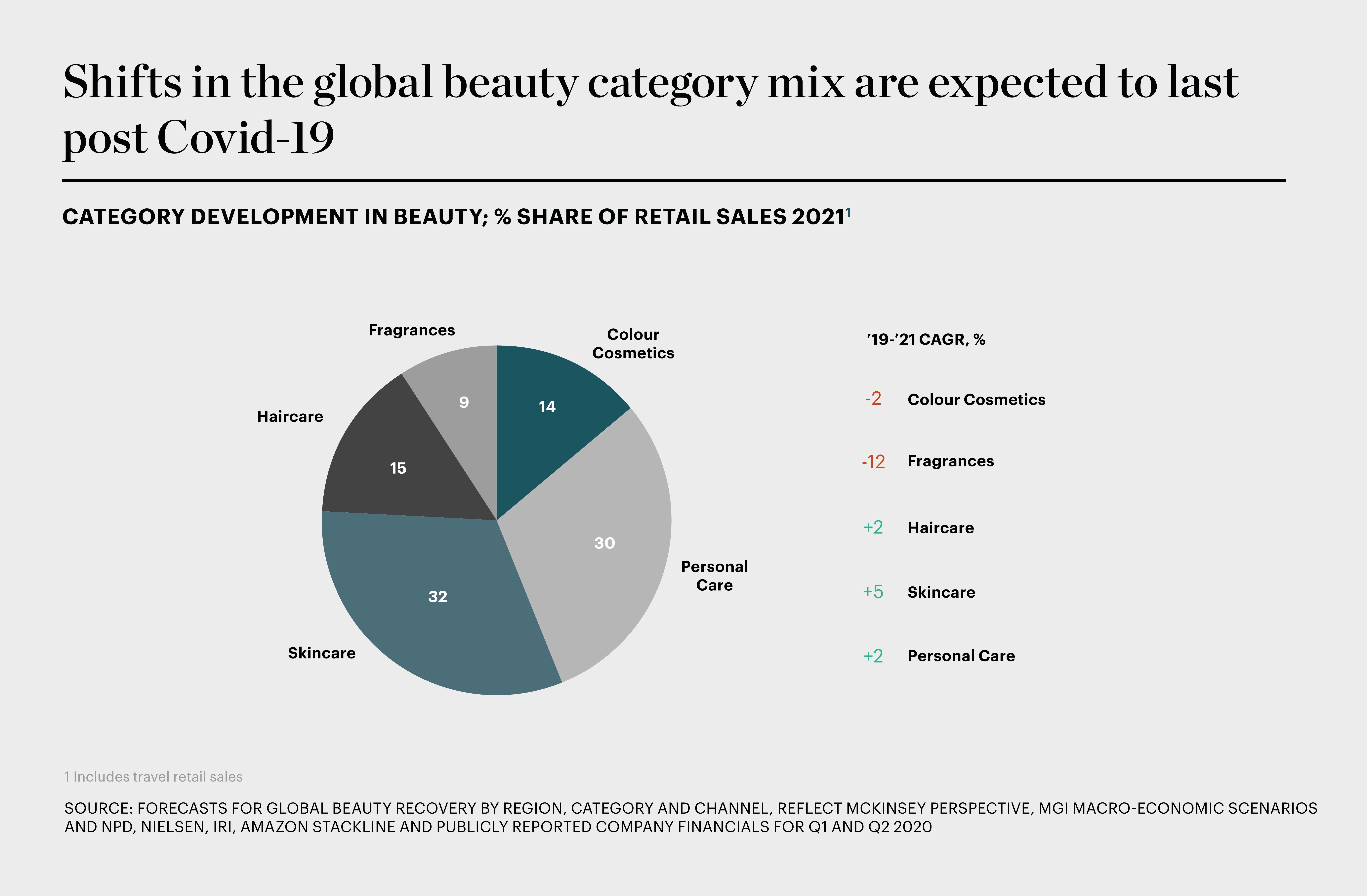

The overall return to pre-crisis levels in 2021 hides variations across and within categories. According to NPD, fragrance and colour cosmetics sales will likely continue to fall at an average annual rate of 12 percent and 2 percent respectively between 2019 and 2021. In contrast, haircare, skincare and personal care are predicted to grow in 2021.

Across the globe, eye makeup has emerged as a relative bright spot, with NPD reporting 6 percent growth of prestige eye makeup in the US in the second quarter of 2020 relative to 2019.

Going into the crisis, fragrance was already facing headwinds. Its biggest markets in Western Europe — UK, France and Germany, each worth approximately $3 billion in 2019 — had declined 8 percent, 6 percent and 3 percent respectively in 2019 versus 2018. Disruption in travel retail (which accounts for approximately 20 percent of the total global fragrance market), in addition to fewer out-of-home occasions, the inability to translate olfactory experiences online, and a spending shift to scented premium bath, body care and home fragrances, all pose challenges to recovery of the fragrance category.

Some niche, luxury fragrance brands have been relatively insulated by the strength of their home fragrance and bath and body business. However, these brands only represent a sliver of the fragrance market. Estée Lauder Companies reported in May 2020 that Jo Malone had doubled its home fragrance and bath and body business in China yet gains in Asia were not enough to offset an overall decline in the Estée Lauder group’s fragrance business. It follows that fragrance-focused players have been hit hard: Coty reported in August that quarterly net revenues in its prestige division dropped almost 75 percent. While Interparfums saw net revenues drop over 70 percent in its second quarter, the company expressed optimism that it would be able to close 2020 with revenues down only 38 percent relative to 2019.

Colour cosmetics had also experienced tempered sales going into 2020, after a growth streak between 2015 and 2018. Now, mask-wearing and the limitations of colour-matching online inhibit lipstick and face makeup sales. During the popular 618 shopping festival in June, China saw growth in the makeup category shift from lip products (the historic growth-driver of cosmetics in China) to eye makeup, which grew 159 percent. Across the globe, eye makeup has emerged as a relative bright spot, with NPD reporting 6 percent growth of prestige eye makeup in the US in the second quarter of 2020 relative to 2019. However, its growth cannot compensate for declines in the US prestige colour cosmetics category overall, which saw sales down by 52 percent in the second quarter.

But demand is not diminished entirely — it is just different — with growth coming from “self-care” products as consumers favour creams, masques, jade rollers and bath bombs. These categories are aligned with broader wellness trends and, crucially, lend themselves well to digital discovery and purchase. Across the globe, consumers indicate a growing preference for natural or so-called “clean” formulations, with 41 percent of German consumers and 30 percent of British consumers saying they prioritise this over a “stronger” formula.

Consumers are also turning to personal care and skincare products to address conditions specifically related to Covid-19, whether that is to address dry hands, breakouts from mask-wearing (“maskne”), or puffy eyes from hours squinting at a computer screen while working remotely. Doctors around the world have noted a spike in patients experiencing stress-induced hair loss. New York-based LM Medical practice, for instance, has seen the number of patients seeking solutions for hair loss go from one patient a day to five a day. They have also seen a 30 percent increase in procedures, which facial plastic surgeon Dr Lesley Rabach attributes to “people taking advantage of downtime — the whole recovery process is covered by a mask.”

DIY and the Return of Beauty Services

Throughout the pandemic, “do it yourself” products have also performed well. On Amazon, DIY categories of nail care and hair dye have seen growth of 300 percent and 200 percent respectively in the US relative to 2019 levels. To put this into context, this represents four to six times the growth rate of Amazon beauty overall. However, we anticipate that the majority of consumers will return to receiving beauty services in salons once they feel physically and financially secure enough to do so. In McKinsey’s June 2020 salon services survey, when asked why they were spending less, only 25 percent of consumers said it was due to being satisfied with the results of DIY beauty. For consumers who normally frequent salons, the percentage who were satisfied with DIY results dropped to just 15 percent.

When consumers do return to salons, they may be seeking different services and products more focused on embracing and enhancing their natural look.

When consumers do return to salons, they may be seeking different services and products more focused on embracing and enhancing their natural look. “Natural” does not, however, mean no products or services — this is a “you, but better” look. Over one-third of consumers report they plan to spend less on chemical treatments permanently altering the hair’s texture, such as keratin treatments, perms or relaxants; instead they report plans to purchase services and products that will better nourish their hair, such as bond building treatments. The natural look has its limits though: Consumers’ intent to continue covering their grey hair remains undimmed.

In terms of price points, we have seen a shift towards more affordable products in the US and Western Europe, but this appears to be driven by store closures in prestige beauty channels rather than a lasting trend. Mass-market nail polish, facial moisturiser, cleanser and haircare all saw growth driven by price, not volume. In China, we have continued to see strong growth from premium and luxury segments as well as deep-discount focused “shopping festivals” — such as as Singles’ Day and JD.com’s 618 sale — which drive disproportionate growth.

Conscious Consumption and a Call to Action

Today’s consumer is more ethically minded, demanding that brands and retailers build their businesses with a conscience. 2020 has seen a continued focus on sustainability, with beauty manufacturers facing pressure from both consumers and shareholders to take action. What constitutes “sustainable,” however, is not clear-cut, as there is no regulation defining what it means to be “natural”, “clean” or “sustainable.” Retailers from mass market to luxury are responding by creating their own standards, with “clean beauty-only” retailers flourishing, from US-based Credo Beauty to Oh My Cream in France. While claims around sustainability are increasingly table stakes in the beauty business, consumers are not necessarily willing to pay more for it. Two-thirds of consumers in Germany and the UK consider a brand’s actions on sustainability to be an important buying factor, but only one-third of Germans and 16 percent of Britons are trading up their purchases to more sustainable brands, versus 46 percent and 36 percent of Germans and Britons, respectively, trading up for quality.

The very public acts of racial injustice in the US and around the world in 2020 have also pushed the beauty industry to reflect on its role and responsibilities in shaping beliefs and behaviours. Consumers have called on global beauty giants to stop using promises of “whiteness” to sell products, citing the harmful stereotypes (if not ingredients) inherent in such claims. In the US, we are seeing companies join initiatives such as Aurora James’ 15 Percent Pledge (committing to dedicating at least 15 percent of their shelf space to Black-owned businesses) or Uoma Beauty founder Sharon Chuter’s #PullUpOrShutUp movement that challenged companies to go beyond words of support and be transparent about their actions. Beauty companies are recognising that being ethical and inclusive as organisations is both important and good for business — but that the industry has a long way left to go.

Digital Discovery and the Changing Role of the Store

Retailers around the world are rethinking their assortments to meet changing demand. Not surprisingly, many are planning to expand their 2021 assortment in skincare and natural products, according to a survey of 50 US beauty merchants across mass market and premium beauty retail. They also plan to focus on “hero” SKUs (a brand’s bestsellers). As Fabrizio Fredo, chief executive of Estée Lauder Companies, said in the company’s earnings call in May 2020, consumers are proving more inclined to “seek brands and products they trust” while in-store retail remains challenged.

In response to these and other shifts, retailers are adapting their store strategy and re-thinking the role of the store in an omnichannel environment. Sephora announced plans in early February to open 100 community-focused stores in 2020, but, in October, the company revised its plan, to instead open 40 stores in 2020 and 70 in 2021. Sephora Americas CEO Jean-André Rougeot described the stores as playing an increasingly critical role as part of the end-to-end supply chain, not its end point. The retailer has plans to test using stores as quasi-warehouses to facilitate same-day delivery of holiday orders. In other words, the need for stores remains strong but the reason to go to the store is changing.

Outlook for 2021 and Beyond

There is no question that 2020 has brought unprecedented challenges to consumers and companies around the world. Compared to other sectors such as fashion, beauty has been relatively insulated from the impact of Covid-19, as consumers continue to look to it as an affordable — and easily orderable — “pick me up” in a time of such duress. As beauty moves into a recovery phase, companies across the value chain — from manufacturers to retailers — will need to ensure they are flexible enough to adjust to category and regional opportunities, while maintaining or increasing their digital investments.

THIS WEEK IN BEAUTY

Kim Kardashian Kashes Out. The uber-influencer sold a 20 percent stake in her beauty line, KKW, to Coty for $200 million.

Halsey joins the celebrity beauty line trend. The singer says About-Face is a “multidimensional make-up brand for everyone, everywhere.”

India’s beauty unicorn plans IPO. Nykaa, a beauty marketplace that counts TPG and Indian tycoon Sunil Munjal’s family office as backers, is targeting a $3 billion valuation.

What is water wellness? Warm water with lemon is the latest craze among the Goop set.

Why Harry’s drew the FTC’s ire. The razor brand was too good at disrupting incumbent shaving brands to be acquired.

Billie’s acquisition is off too. The FTC showed its commitment to equality by throwing up hurdles to Procter & Gamble’s purchase of the female shaving start-up.

Centric Brands gets an LOL Surprise. The company acquired Taste Beauty, maker of the viral toys as well as well as food-shaped lip glosses as well as licensing deals.

Bath and Body Works continues to shine. The body care retailer reported strong holiday sales as parent L brands prepares to spin it off.

The authors would like to thank Danielle Bozarth, Sara Hudson, Aimee Kim, Clarisse Magnin, Jennifer Schmidt, Emma Spagnuolo, Marie Strawczynski and Yuanyuan Zhang for their contribution to this article.