If You Aren’t Already Selling Jewellery in China, Now Is the Time | BoF Professional, China Decoded

SHANGHAI, China — Cartier got a lot of attention — and more than a little flak — for its Qixi campaign over the last week. The ad sees a variety of couples, including two women as well as two men whose relationships are not overtly defined, enjoying one another’s company while wearing subtle pieces of jewellery.

The depiction of what many people believed to be same-sex couples in a Qixi campaign (the festival is a local variation of Valentine’s Day, so its messaging tends to skew romantic) was initially welcomed on Chinese social media, with Weibo users commenting on the refreshing change of imagery from a major jewellery brand.

Soon after, however, when images of the campaign went up on Cartier’s Tmall site, a caption described two men pictured riding bicycles together as being father and son (rather than a couple), to the widespread disbelief and disappointment of many online commentators.

Even for major international brands like Cartier, it’s tough to stand out from the crowd around heavily promoted gifting occasions such as Qixi, which this year falls on August 25. The noise around festivals and gifting has reached fever pitch in the year of the pandemic.

A consumer sentiment survey conducted in late April and early May by Platinum Guild International (PGI) and the Sinus Institute shows that gifting occasions in 2020 are particularly important for jewellery, as people want to show their appreciation for their loved ones in the wake of unprecedented health, social and political crises.

Even though the Cartier campaign seemed to confuse more people than it converted, the message it was trying to send (broadening the idea of gifting jewellery as exclusively a romantic act from a man to a woman) actually taps into broader trends in China’s jewellery market that will be vital for brands of all sizes to understand as they increasingly rely on China for growth.

There have been mixed messages emanating from the world’s largest fashion and luxury market about the recovery of consumption. Just last week, retail sales for July disappointed with a year-on-year modest decline of 1.1 percent. While sales of garments and footwear were down, jewellery was a bright spot, up by 7.5 percent over the same period a year earlier.

China was already the world’s largest jewellery market before coronavirus hit, accounting for 29.5 percent of all jewellery sales in the world last year, according to figures from Euromonitor, and as the first country to emerge on the other side of the pandemic (pending further unforeseen disaster) the country will continue to play an outsized role in any return to growth for the sector in the near future.

Jewellery was a bright spot, up by 7.5 percent over the same period a year earlier.

This is a sector that has changed dramatically over the past decade, with an influx of major international brands to the market a key driver. However, the changing nature of China’s jewellery market means that there should now be room for smaller brands to benefit too – if they play their cards right.

New Consumers Look for Meaning

“China is leading the recovery of platinum jewellery this year [and] among Chinese consumers, those between 20 and 40 years old have become major acquirers and influencers,” explained Zhenzhen Liu, director of global corporate marketing at PGI.

These consumers, particularly those in China’s first-tier cities, think about jewellery much differently from their parents’ generation, according to Daniel Zipser, a senior partner at McKinsey & Company who leads the firm’s consumer and retail practice in Greater China.

According to Zipser, jewellery has traditionally been a somewhat generic category in China, with consumers weighing (literally) the gold content of a piece as its single benefit as a long-term investment. This has begun to change in recent years, however, as brand stories and personal expression have become more important parts of the consumer journey here.

“I would call it a gradual change, but [since the pandemic hit] it’s an accelerated gradual change, and a generational change,” he said.

According to PGI’s Liu, the unique positioning of precious jewellery as a category which has both lasting monetary and symbolic value in the eyes of Chinese consumers, makes it a popular choice as a meaningful gift, with 80 percent of Chinese respondents saying they planned to spend more on precious jewellery both for themselves and to give as a gift this year than before the pandemic, a far higher percentage than respondents in the other surveyed markets, which included Japan, India and the US.

“The personal meaning is the most important reason why consumers want to buy jewellery as a gift and maintaining value is the most important thing for those who want to buy for themselves,” Liu said.

It’s not just love-themed gifting that is proving popular. Earlier this year, a collection from market leader Chow Tai Fook found great success with a Gen Z-focused “good luck” platinum bracelet, which became a popular gift to give to young people undertaking China’s gruelling entrance exam, the gaokao.

“We have seen a similar thing with designs that symbolise love, best wishes, or positive meaning, they have been selling well in recent months,” Liu said.

These reasons for buying jewellery represent a relatively recent shift in the Chinese consumer psyche that’s important for brands to understand, because it opens a lot of doors for those who can cater to the needs of a new breed of jewellery consumer driving growth here.

Seizing the Online Opportunity

In essence, jewellery has become more like other luxury categories, a means for young consumers to express themselves and align themselves with styles and brand stories they feel suit their own lives and lifestyles.

This has been a major plus for international brands, including Cartier, Bulgari and Tiffany & Co., which have been able to capitalise on the appetite for brand stories with their own Chinese focus, complete with high-level digital campaigns (especially around this time of year) and flashy flagship stores across the country.

Smaller players, both domestic and international, have also rushed into China over the past three years, looking to connect with an audience that arguably would not have been as receptive to niche, independent jewellery brands before.

“China’s young generation have a global mindset and they care about the story and the meaning. I think when they consume, it’s not just about what looks good on them but it also makes them feel good inside,” said Ziwei Longhong, the founder of her own jewellery brand, Soft Mountains, which launched in 2017.

According to Ziwei, whose pieces are handcrafted by ethnic minority craftspeople, competition for attention has certainly increased over the past few years, but her brand has been able to continue to grow (Soft Mountains was picked up by Net-a-Porter in 2019 and Lane Crawford this year, creating a boost for the brand).

“You need to know your competitors and learn from your competitors and know your target customers [and how to] differentiate in such a crowded market. [But] I think when you are doing something from your heart, people can feel that,” she said.

Zipser agrees that although the jewellery space in China has become more competitive, China is a huge market with room for a number of new players, given they have a positioning and storytelling that resonates with at least one segment of consumers here.

There are no real white spaces or untapped opportunities left… but that wouldn’t stop me from entering [now] if I was a foreign jewellery brand.

“In China, given its scale and its importance to the luxury industry, there are no real white spaces or untapped opportunities left. Being in the market as it’s accelerating is a good thing. Yes, it’s competitive and you have to think about differentiation, but that wouldn’t stop me from entering [now] if I was a foreign jewellery brand,” he said.

Though China’s jewellery market has traditionally been dominated by giant retailers, some with thousands of points of sale around the country (a difficult model for any new player to compete with) this has been upended by the pandemic, which has further accelerated a shift to online.

According to data from BigOne Lab, jewellery sales on key platforms such as Tmall and JD increased by 71 percent in retail value in the first quarter of this year, versus the same period a year ago. In China, this coincided with the worst of the country’s coronavirus-induced lockdowns and retail closures.

It’s now the norm, even at the top end of the pricing pyramid, for jewellery brands to have an e-commerce presence in China, with Cartier joining Tmall in January and Chaumet opening a WeChat boutique with its entire collection for sale through the app. Smaller jewellery brands would be wise to do the same.

Don’t Forget About the Boys

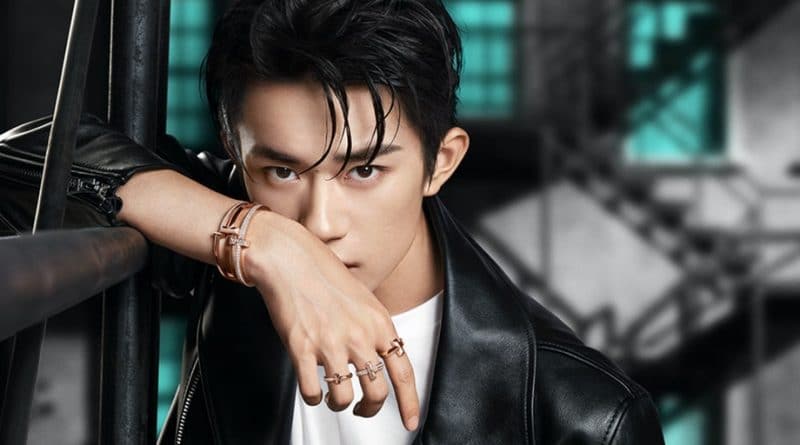

One consumer group underserved by jewellery brands in China remains young men, who have shown an increasing interest in accessorising with statement and fashion jewellery in recent years.

Though many international brands utilise male xiaoxianrou (little fresh meat) celebrities as ambassadors in the Chinese market (Kris Wu started this trend by fronting for Bulgari, with others, such as Lu Han for Cartier and Jackson Yee AKA Yi Yangqianxi at Tiffany following suit), the focus is more on using these heartthrobs to sell to women than to men.

The focus is more on using these heartthrobs to sell to women than to men.

“You have a young male consumer group that are very open to expressing themselves. Even five or 10 years ago, men were part of the purchasing process but less of the personal consumption. Recently we’ve seen that growing quite nicely, in beauty [and] fashion and I would be surprised if that doesn’t also apply to jewellery,” Zipser explained.

Young men in China have become accustomed to seeing other (usually famous) young men wearing jewellery and young women are more and more open to the idea of buying for their male partners on occasions like Qixi.

Though Qixi campaigns that ignore this reality feel a little old-fashioned, moving ahead with more cutting-edge messaging in China can be difficult too. In recent years, censors have blurred men’s earrings when they appear on television and much hand-wringing appears in state media over the “feminisation” of young men and what it means for society.

Daniel Zipser’s advice is to try and keep things simple, pointing out that there is an established route to market in China proving successful for other jewellery brands, so it makes sense to follow that.

“If you take a brand that is popular in their home market and you bring it here to Shanghai with a strong digital play combined with flagship store, it’s an attractive proposition,” he said. “It’s something brands are doing and will continue to do more of to take advantage of this opportunity.”

时尚与美容

FASHION & BEAUTY

A style from Li Ning’s Spring/Summer 2021 collection | Source: Courtesy

Li Ning‘s First Half Fiscal Year Net Profit Drops 14 Percent

As a sportswear giant with a focus on Chinese retail, Li Ning is somewhat insulated from global turmoil and its losses for the first half of the year were modest compared with international competitors. Li Ning’s 2020 interim financial report showed that revenue for the first half of the year was 6.181 billion yuan ($893 million), down 1.2 percent year-on-year; gross profit fell 1.6 percent and net profit was down 14 percent year-on-year to 683 million yuan ($98.7 million). During the period, the company said it continued to focus on the optimisation and upgrading of products, channels, retail operations, and supply chain, and promoted the core strategy of “single brand, multiple categories, and multiple channels.” (BoF China)

Are C-Beauty Brands Over-Spending on Idols?

Brands like Proya seem to be adding hot new celebrities to their ambassador line-up from week to week and are forking out a lot for the association, but the return on investment remains to be seen. Their annual contract with superstar Cai Xukun (who has 32 million followers on Weibo) is estimated to cost 8 million yuan ($1.16 million); female idol Xu Jiaqi, another face of Proya, reportedly has an annual value of 2 million yuan ($290,000) and the brand is working with an additional half-dozen idols at a similar price point. With an average product price point of 50 to 300 yuan ($7.25 to $43.40) Proya has to sell an awful lot to justify the cost of its scatter-gun idol strategy. (China Marketing Insights)

科技与创新

TECH & INNOVATION

JD.com | Source: Shutterstock

Is Alibaba Next in Line for US Ban?

Donald Trump has signalled that he is considering taking action against more Chinese companies, including Alibaba, one day after he ordered ByteDance to divest TikTok’s operations in the US within 90 days. Tencent’s WeChat is also in the firing line and analysts are now wondering whether search engine Baidu is also in the frame. Asked whether he was contemplating punitive action against more Chinese companies, such as the e-commerce giant Alibaba, Trump replied: “We’re looking at other things, yes we are.” As well as the ByteDance order, the US president on Friday ended a waiver that had allowed some US companies to continue selling goods to Huawei, the Chinese telecoms equipment firm, decimating its future prospects. (Financial Times)

JD.com’s Stock Surges after Profit, Revenue Beat Expectations

Shares for China’s e-commerce giant JD.com surged Monday after it reported second-quarter earnings that beat estimates. The company posted net income from operations of $700 million, more than double the $332 million reported a year ago. Revenue grew 30 percent to $28.5 billion, also beating analysts’ expectation of $27.4 billion. The company ended the quarter with 417.4 million annual active customers, up 30 percent from a year earlier. Mobile daily active users grew 40 percent. (Caixin Global)

消费与零售

CONSUMER & RETAIL

Taikoo Hui Guangzhou | Source: Courtesy

Swire Properties’ China Malls Report Sluggish First Half Performance

In an indication of how patchy a return to brick-and-mortar shopping has been, even city to city in China, the retail properties of Swire Properties on the Mainland showed mixed results. Sales at Beijing’s Taikoo Li Sanlitun plummeted by 38.1 percent, while sales at Chengdu’s Sino-Ocean Taikoo Li plummeted by 15 percent; growth was found only at Guangzhou’s Taikoo Hui where sales increased 3.4 percent and Shanghai’s Taikoo Hui, where sales increased slightly by 1.6 percent. In the first half of the year, Swire Properties’ rental income from investment properties in mainland China fell 8 percent year-on-year, mainly due to the depreciation of the yuan and the provision of rental support to tenants. (BoF China)

China Retail Sales Fall Unexpectedly in July

Fuelling concerns for the world economy, retail sales in China dropped in July by 1.1 percent compared with the same month a year ago, missing predictions for a small increase in consumer spending. The decline in retail sales was broad-based, with clothing, cosmetics, home appliances and furniture all worsening from June. Spending on catering fell by 11 percent from a year ago, reflecting the impact of physical-distancing measures. Analysts said heavy rain and flooding in parts of China probably contributed to the decline in consumer spending, indicating that the underlying strength of the economic recovery could still be intact. (The Guardian)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

An image from one of the early editions of ShanghaiPride | Source: Courtesy

ShanghaiPride Suddenly Shuts Down Citing “Safety” Concerns

After running for 12 consecutive years, ShanghaiPride, an annual festival that celebrates China’s LGBTQIA+ movement, announced abruptly last week that it would cancel all upcoming activities. In an email to its members, ShanghaiPride did not specify why it was shutting down, saying that it had to “protect the safety of all involved.” The lack of explanation for ShanghaiPride’s shutdown is emblematic of a bigger problem: In mainland China, the red line for LGBTQIA-related topics is blurry. Officials regularly remove LGBTQIA+ content from the public sphere without making clear the rules governing their censorship. On the 10th anniversary edition of ShanghaiPride last year, it attracted over 8,000 participants and 100 volunteers. The event’s shutdown is a huge blow to China’s LGBTQIA+ activists. (SupChina)

Almost 40 Percent of US Companies in Hong Kong are Considering Leaving

Nearly four in 10 members of the American Chamber of Commerce (AmCham) are considering relocating from Hong Kong due to the national security law, an indication of rising corporate fears over the sweeping new legislation, though most are still planning to stay, according to a recent poll. About 39 percent of the 154 firms surveyed by AmCham Hong Kong said they had plans to move capital, assets or operations out of the city after more details were revealed about the new law, an uptick from 35.5 per cent of businesses polled in July. (South China Morning Post)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent [email protected].

:quality(70):focal(820x393:830x403)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/WHPI7NREABGGJNQ2RGC57NZHVY.jpg)