For Luxury Brands, the Latest Battle Is for Local Customers | BoF Professional, This Week in Fashion

The success of Gucci’s reboot under Alessandro Michele and Marco Bizzarri is unmatched in the recent history of the luxury industry. This week, the Italian megabrand reported an 8.9 percent drop in third-quarter sales year on year — beating the predictions of analysts, who forecast a 10 percent decline — on the back of unexpected buoyancy in the wider luxury market.

But Gucci trailed peers at rival LVMH, where Louis Vuitton and Dior powered a 12 percent jump in fashion and leather goods sales at the group in the same period, as well as smaller Kering stablemates like Saint Laurent, which grew 3.9 percent.

Gucci is getting close to its goal of generating €10 billion in sales per year but sustaining the meteoric growth of recent cycles was always going to be impossible, and momentum had already begun to slow in 2019. Then came the pandemic, forcing store closures and damaging demand across the sector, sending Gucci sales down 33.8 percent in the second quarter.

But Gucci’s relative underperformance in Q3 highlights a specific area where the brand is vulnerable vis-à-vis competitors: the label is more dependent on tourism to drive sales and underpenetrated with local customers, who have become critical as Covid-19 continues to blunt international travel with Europe and the US still unable to get the coronavirus under control.

On Thursday, Kering Chief Financial Officer Jean-Marc Duplaix said Gucci had performed well in China and the United States (up 44 percent in North America), but had suffered in Europe, where, in the third quarter of last year, 70 percent of the brand’s sales came from tourists.

“Gucci has perhaps suffered more than others from the lack of tourist flows,” he said. “It’s clear we have some work to do in comparison to peers to re-engage the local customer.”

Saint Laurent, which returned to growth over the summer, has likely benefited from its emphasis on local customers. More recently, its Paris boutiques have taken to sending local clients bouquets of white roses. Meanwhile, Louis Vuitton chief executive Michael Burke said the brand has encouraged its 12,000 sales associates to think of themselves as single-person stores, equipping them with “clienteling” tools to better connect with local customers.

“Instead of saying, ‘I’m x number of stores down,’ we have 12,000 stores now,” Burke told BoF back in April when much of Europe was under lockdown. “In the beginning, it was just about… staying in touch, reaching out, making sure everybody is fine, nobody needs anything and, of course, progressively, [clients] got back into purchasing.”

But Gucci’s weakness with local customers is ultimately only a problem because grounded tourists are not repatriating the purchases they previously made abroad in high enough numbers. This signals something deeper may be at play with Gucci’s price-to-desirability ratio, with implications for sales to would-be travellers and local clients alike.

Getting consumers to stick with Gucci five years after its maximalist reboot “requires continuing newness and reinvention,” said Bernstein analyst Luca Solca. “This is probably where Gucci falls short — more so apparently in the eyes of Western domestic consumers.”

In the age of Covid-19, with most international travel on pause — there may be 1.1 billion fewer international travellers this year — engaging local customers is even more critical for the luxury sector, but such strategies can only do so much without the right creative content.

Disclosure: LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholder’s documentation guaranteeing BoF’s complete editorial independence.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

A Hermès Birkin bag | Source: Getty Images

Hermès sees luxury demand recover from pandemic slump. The French luxury label’s revenue rose 6.9 percent to €1.8 billion ($2.1 billion) in the third quarter, beating estimates by €100 million. Pent-up consumer demand, released as lockdowns eased in many markets, has helped the house in recent months. Going forward, Hermès plans to expand its presence on digital channels, though iconic products like Birkin bags will remain available in store only.

Kering beats estimates. The luxury group’s organic revenue fell only 1.2 percent in the third quarter, compared with analysts’ projection for a 9.1 percent drop. Kering’s overall revenue was €3.72 billion ($4.4 billion). It was boosted by a strong showing at many of the company’s smaller brands, including a 21 percent jump in sales at Bottega Veneta. Meanwhile, star brand Gucci saw sales slide 9 percent.

Moncler sees “encouraging” signs after better-than-expected third quarter. In the months between July and September, revenue dropped 15 percent year-on-year at current exchange rates to €361.8 million ($428 million). That’s an improvement on earlier in the year. The luxury label saw a 50 percent drop in sales in its second quarter and an 18 percent drop in the first quarter.

Report: Ferragamo family explores selling minority stake of business. The company’s chairman Ferruccio Ferragamo approached investors in September with an offer to sell a roughly 20 percent stake in the holding vehicle that controls the Milan-listed business, sources told Reuters. A spokeswoman for the company denied that the Ferragamo family planned to sell the stake.

Bulgari to focus on local customers as Covid-19 wipes out tourism. The LVMH-owned jeweller is especially focusing on China, where domestic consumers are seeking local retail therapy as the pandemic continues to curb international travel. Bulgari is seeing single-digit domestic sales growth in the West and double-digit growth in Asian countries.

Report: Adidas prepares sale of the Reebok brand. The company will decide in the coming months whether to proceed with a sale process, a person familiar with the matter told Bloomberg. Reebok has been hit harder by the pandemic than Adidas. Its revenue dropped 42 percent in the second quarter, compared to the German sportswear company’s 33 percent decline in sales.

J.C. Penney rushes to finalise sale to lenders and landlords. The retailer must first finalise a complicated lease agreement with less than a week to close the deal. J.C. Penney has drafted a purchase agreement and filed it to mall owners Simon Property Group Inc., Brookfield Property Partners and its lenders. They have until Monday to make a decision.

Kohl’s promises wary investors margin boost. The retailer plans to increase activewear sales to at least 30 percent of its business, up from about 20 percent in 2019. Kohl’s said its operating margin hit 7 to 8 percent over the last eight quarters thanks to improved supply chain and inventory management and more automation.

US retailers secure stores as worries about election unrest mount. Security experts warn that the US presidential election could spark renewed civil unrest. Stores in major cities like Chicago remain boarded up following on from Black Lives Matter protests during the spring and summer.

UK shopper numbers fall again as Covid-19 restrictions tighten. Shopper numbers were down 2.8 percent on high streets and 3.5 percent in shopping centres. The number has fallen since Prime Minister Boris Johnson imposed a tiered system of restrictions on parts of England.

THE BUSINESS OF BEAUTY

L’Oréal cosmetics | Source: L’Oréal

L’Oréal sales rebound after lockdowns ease. Overall sales came in at €7 billion ($8.27 billion), for the July to September period, rising 1.6 percent from a year earlier. This was a significant jump from the previous quarter, which saw a 19 percent year-on-year drop. L’Oréal reported the biggest improvement in its skincare division, which includes labels like Vichy, La Roche Posay and CeraVe.

Unilever could tidy portfolio with disposals in beauty and personal care. The consumer goods group is looking to divest a number of smaller brands. The announcement comes after Unilever reported stronger-than-expected sales growth in the third quarter.

PEOPLE

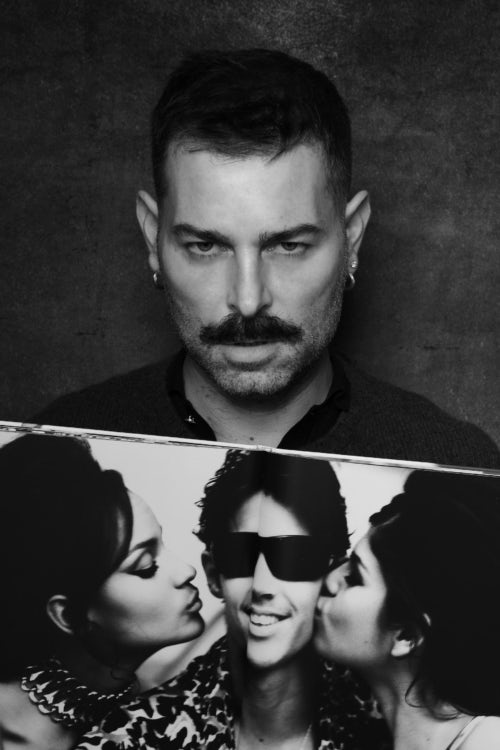

Fausto Puglisi has been appointed creative lead at Roberto Cavalli | Source: Courtesy

Fausto Puglisi joins Roberto Cavalli in senior creative role. Puglisi has been appointed creative consultant of the Italian brand, effective immediately. In his new role, he will oversee everything design-related and will lead the in-house design team, which until last year was led by Paul Surridge. Puglisi will present his debut collection in January 2021.

Malika Savell to lead Prada Group’s diversity initiatives in North America. Savell has been named chief diversity, equity and inclusion officer of Prada North America. In her new role, Savell will develop policies and programmes to ensure diverse representation across the company. Savell was previously the director of cultural diversity partnerships and engagement at LVMH.

Daniela Falcão to leave as managing director of Edições Globo Condé Nast. Falcão is stepping down from her role as managing director of Edições Globo Condé Nast just months after Buzzfeed published an article alleging she bullied employees. Edições Globo Condé Nast said Falcão is leaving to “to fulfil an old desire to dedicate herself to consulting and for personal projects.” She will continue in her role overseeing the Brazilian editions of Condé Nast magazines including Vogue, Glamour and GQ until the end of the year.

Kevin Tekinel and Charles Levai named creative directors of Uomo Vogue. Tekinel and Levai are taking over as creative directors of Uomo Vogue. Working under editor-in-chief Emanuele Farneti, their first redesigned issue for Vogue Italia‘s quarterly menswear imprint will be released in January. Tekinel and Levai have worked together on campaigns for Versace perfume, Miu Miu and Coperni since launching their agency Maybe earlier this year.

MEDIA AND TECHNOLOGY

Man Repeller to shut down. The company, which rebranded as Repeller earlier this year, faced criticism over the summer for its content and internal culture. The news it will close was shared with employees over a Zoom call on Monday.

ThredUp files confidentially for IPO. The size and price range of the offering have not yet been determined, the company said. ThredUp’s proposed IPO comes amid record high investor demand for new stocks. So far this year companies have raised roughly $114 billion in US IPOs, a huge jump from $62.5 billion for all of 2019.

Amazon extends work-from-home option until June. The development comes weeks after the e-commerce giant said more than 19,000 of its US frontline workers contracted Covid-19 this year. The new guidelines apply globally and are an extension of earlier instructions, which allowed Amazon employees to work from home only until January.

Compiled by Daphne Milner.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.