Why fashion brands are investing in B2B virtual experiences – Glossy

Virtual showrooms created for retail buyers and fashion press are trending, despite the widespread goal among brands of directly selling and marketing to consumers. With ad budgets down, among other pandemic-related obstacles, brands are actively seeking traditional press coverage and the support of multi-brand retailers that provide awareness. That comes at a price, but one they can better stomach.

Since late June, brands including Uniqlo and Mango have introduced virtual showrooms for press, and Canali and Diesel have launched similar tools aimed at buyers — that’s not to mention the brands that have launched digital showrooms on wholesale platforms including Joor and NuOrder. Contemporary brand Ganni designed one digital showroom to cater to both audiences. In a way, it’s fashion month all over again — with brands falling back on an old industry model in a play for brand awareness.

“Media plays a key role as a communication channel,” said Michael Zakerzewski, U.S. communications director at Uniqlo. The company, which typically goes all out for a press preview — building out individual rooms spotlighting collaborations, for example — launched a two-story virtual showroom on September 10. It features its core fall styles on one floor and collections with designers including Hana Tajima and J.W. Anderson on the other.

In terms of spend, Zakerzewski only shared that it was “an investment.” It was created in-house by the digital, creative, merchandising and product teams. And the intention was to offer convenience for editors, allowing them to view the styles and send through sample requests at their convenience. So far, editors have spent a “decent” amount of time on the site, which is modeled after a store and offers up product information through pop-up windows.

Uniqlo will continue to provide a virtual showroom as a supplement to IRL previews in the future, particularly because they work to also get collections in front of editors in markets without a press day, said Zakerzewski. Future iterations will feature additional features, based on editor feedback, like an option to view which store locations carry the styles.

According to Emily Smith, creative director of Lafayette 148, the brand’s in-person press previews had been more affordable than its new virtual presentations as they were held in an owned showroom and “the experience was the content.” She would spend one-on-one time with editors, who would also interact with featured models. The events also worked to secure “quite a bit of coverage” for the brand, she said.

Now it’s doing virtual previews, with videos and storytelling as the focus. The latest, on September 17, featured a fashion show sans spectators, callouts to the seasonal inspiration and a live discussion between Smith and attendees, which included international editors. After the event, the editors were sent a gift from the collection and a QR code to access digital assets.

“We’ve embraced every tool available to us, from traditional media to social media and its influence,” said Smith, who noted that the assets for the preview were repurposed for social media and will be a “a great tool for our sales team.” Going forward, Lafayette plans to host previews both virtually and in-person.

In terms of wooing retailers, which have proved pain points this year, brands are giving them discounts to earn their business — as contemporary brand L’Agence is doing, as shared by CEO Jeff Rudes during last week’s Glossy Fashion Summit. And they’re investing in providing their buyers a standout buying experience.

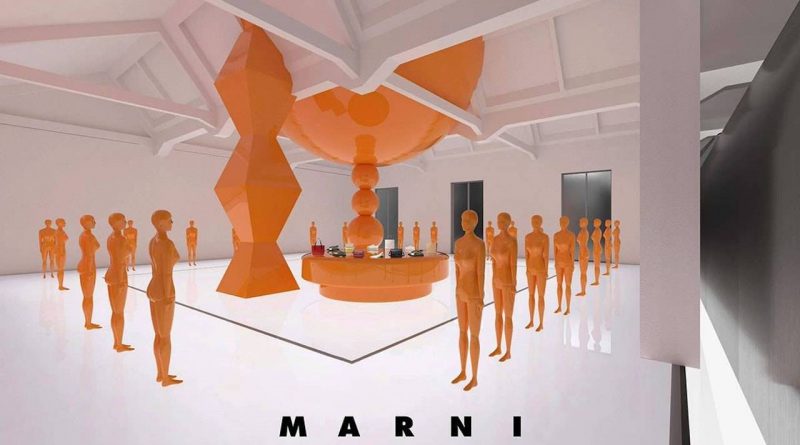

Neha Singh, founder and CEO of Obsess, which creates virtual shopping experiences for brands and retailers, said her business is up 300% year-over-year, and growing. Since March, she’s doubled the size of her team and expanded to verticals beyond fashion, including beauty and big box retailers. Prior to April, the company had exclusively created consumer-facing showrooms for brands, but now showrooms made for wholesale buyers are a significant part of the business. It’s launched 10 in the last three months, for companies including Diesel, Marni and Koche. It’s created just one intended for press, so far.

“We hadn’t even thought of this use case,” said Singh of the wholesale showroom concept. She noted that brands are comparatively more creative with these showrooms, going beyond the store-like visual and product details by incorporating features like runway videos, avatar concierges, voiceover explanations, a live-chat option connecting users to the brand, and video game-style details. “Their creative director gets involved, it’s a big project,” she said. As for engagement, she said buyers spend “a lot” of time in the showrooms, as it’s part of their job.

And it’s not a temporary fix for brands. Singh said all of Obsess’ clients have at least a 1-year contract, and many are in the process of planning their showroom for next season. Diesel, for one, considers the virtual showroom a sustainability play, requiring fewer samples to be created and eliminating the need for buyers to travel.

For her part, Louise du Toit, evp of Ganni North America, got to work on Ganni Space when it became apparent that seasonal markets may not happen. The password-enabled microsite is now serving as its press and buyer showroom for spring 2021. At the Glossy Fashion Summit, du Toit stressed the need to make it “really special” and to infuse personality. That came by way of plenty of photos and videos, as well as personal notes from the brand’s designer and a wishlist functionality allowing buyers to upload their style picks to Joor.

“A lot of work went into this,” said du Toit, of the site. “It wasn’t a cheap fix.” But it did work to grow the brand’s wholesale business year-over-year, during the pandemic, and du Toit plans to offer up a similar site every season moving forward.