4 Catalysts in December

Sam Bankman-Fried has retained high-profile defense attorney Mark Cohen. The same lawyer who represented Ghislaine Maxwell in her sex trafficking trial.

He also claims he only has $100,000 in his bank. I wonder how he’s able to afford such an expensive lawyer 🤔.

This week we’re covering:

- December Catalysts: The events I’m paying attention to this month.

- Chart of the Week: GMX’s keeps printing money.

- News: Alameda’s investments leaked, Nexo’s leaving the States, and more.

Let’s Dive in!

📉 The Markets

“Trading doesn’t just reveal your character, it also builds it if you stay in the game long enough.” Yvan Byeajee

🚀 4 December Catalysts

A catalyst is an event that quickly causes change or action. Even though we’re in the bear market, there are plenty of interesting things happening.

Here are a few that I’m paying attention to.

#1 Gains Network – gTrading is Launching on Arbitrum

Gains Network is a hot contender in the battle of decentralized perps. They’ve only been on Polygon since launching. Now they’re set on expanding over to Ethereum Layer 2 Arbitrum soon.

This puts them right in the turf of a bigger competitor, GMX. Gains should do well on Arbitrum. They offer more trading pairs, forex, and leverage compared to GMX.

Another big development involves their gToken vaults that was announced a few hours ago.

gTraders! 🍏

Today’s a big day.

We just released a deep-dive article introducing gToken Vaults. 🔥

This is an innovative step forward for gTrade and we’re excited to soon bring gDAI Vaults to both Polygon and Arbitrum!

Read about it here:https://t.co/S3bQ7POMtE

— Gains Network 🍏 (@GainsNetwork_io) December 7, 2022

A few details:

• Stake dai and receive gDAI. You can use it as collateral or to gain additional yield.

• gDAI can serve as an over-collateralized stablecoin backed by gTrade liquidity.

I highly recommend reading the article a few times.

If you’re interested in trading on gTrade, considering supporting this newsletter by signing up under my referral link.

#2 Sushi’s Overhauling Its Tokenomics

Sushi is the #6 DEX in the world, and they’re looking to overhaul their tokenomics.

|

|

We saw several DEX’es improving their tokenomics structure including TraderJoe and SpiritSwap. They did this by adding in Ve style locking mechanisms, with farm boosting rewards.

Will Sushi follow suit, or introduce some new innovations?

Sushi’s also working on a proposal to increase their treasury by redirecting Kanpai fees. They only have 1.5 years of runway left in their treasury.

#3 Chainlink Implements Staking

Chainlink is a DeFi OG. They’re the connection between blockchains and real world data.

Let’s say there’s a decentralized sports betting platform. How will the protocol know the outcomes and scores of matches? That’s where oracles come in, and Chainlink dominates.

Chainlink rolled out the staking feature on Dec 6th. Only eligible community members can stake in this phase.

Staking will allow people to lock up their $link tokens to help increase the cryptoeconomic security of oracle services

Reward is roughly ~4.75% APR.

Official guide to staking Link

#4 Kujira Launches Bow

Kujira is a Layer 1 build on the Cosmos Ecosystem.

Kujira is creating a suite of products that emphasize real yield over token emissions.

Their main product is Fin. FIN is a decentralised, permissionless, orderbook-style DEX that allows users to trade assets easily. Think of it like a decentralized version of Kucoin.

Their newest product is BOW.

Bow is the automated market maker for Fin.

- Bow aims to deepen the liquidity of the pairs on Fin.

- An exchange needs volume to to become a success. Most places give out inflationary tokens to incentivize users.

- BOW uses an internal algorithm to automatically place a set of orders on a FIN pair. It’s similar to the one that Uniswap users.

- You can put different pools you want to provide liquidity to, which earns a % of fees. You can then stake that LP for additional rewards.

|

|

Official announcement from Kujira

Speaking of Narratives…

A list of wrong narratives I have seen recently.

— CZ 🔶 Binance (@cz_binance) December 6, 2022

🍿 DeFi Bites

Coinbase Wallet had to stop users from transferring NFTs. This was because Apple blocked their latest iOS release, claiming that the gas fees must be paid through their in-app purchase system.

This isn’t technically possible. It’s telling that the world’s second-largest tech company is making impossible demands.

Maple Finance is affected by the FTX contagion. Orthogonal Trading defaulted on a $10M USDC payment on Dec. 4. Maple has severed ties with them, citing that they’d misrepresented their financial position.

Alameda’s $5.3b investments leaked. Here’s a spreadsheet that SBF was using in early November in an attempt to raise capital. This blurs the lines between FTX and Alameda. Some of the investments on Alameda (such as Genesis) also appeared on FTX’s balance sheet.

Stripe released its embeddable and customizable crypto-to-fiat onramp for web3 companies. Now, developers can just embed the on-ramp into their platforms. No more dealing with complex KYC requirements.

MakerDAO votes to provide a 1% annual yield on DAI. Now, DAI holders can deposit DAI in a savings contract and earn more than the savings of some of the Wall Street banks. However, this is still lower than the Treasury yield, which is at 4.64%.

Uniswap DAO has put the “fee switch” to vote. This pilot program only applies to three pools on Uniswap V3. After the governance proposal was posted, $UNI prices saw a 7% surge on Dec 2.

Nexo Announces They’re Leaving the States. They blame it on the difficulty of doing business in the U.S. The the regulation is inconsistent and always changing. Fortunately, everyone can withdraw their assets.

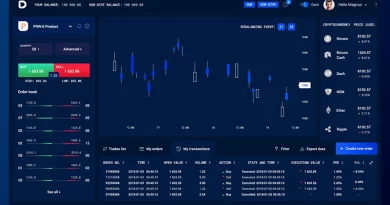

📈 GMX is a Monster

Gmx surpassed Uniswap’s daily fees for the first time ever.

Ever since FTX collapsed, more people are switching over to decentralized perp protocols. And GMX is welcoming them with open arms.

|

|

The Chart above shows the monthly fees generated since inception.

🐥 Crypto Twitter

What in the Ethereum application ecosystem excites mehttps://t.co/QxCa6EoWDl

— vitalik.eth (@VitalikButerin) December 5, 2022

First Longform Piece:

The Blockdollar

Answering:

– why doesn’t crypto have (many) productive assets on it?

– what does crypto do better than digitized fintech + web2?

– (implicitly, bonus) what is the “new meta” to take us out of this bear?https://t.co/ekQdAd6Gxg— T. M. Basile Genève 🌺 🦇🔊~timluc-miptev (@basileSportif) November 23, 2022

1/ The more I research @fraxfinance, the more impressed I am of their DeFi product stack.

Each vertical is embedded with innovation & meticulous strategic planning

I cover these in my full 36 page report on Frax published for FREE below ⬇️

— 0xwintersoldier.lens🌿 (@WinterSoldierxz) December 3, 2022

did a huge update to the FTX contagion chart last night.

i’ve begun capturing their investors as well as their creditors, and there are now nearly 50 impacted companies listed.https://t.co/uwK24EZFDn

— Molly White (@molly0xFFF) December 5, 2022

😂 Meme

After the last meme, a lot of you wanted a $SBF version.

Here ya go 😂 $SBF #Bitcoin 🌪💨$SPY $QQQ pic.twitter.com/MpZNpWL7Ab

— Rahul (@rhemrajani9) November 30, 2022