Where Does Nike Go From Here?

Nike, now entering the second year of its worst slump in many years, appears to finally be addressing some of its missteps.

Earlier this week, the brand rehired Tom Peddie, a 30-year veteran of the company who retired in 2020, as its vice president of marketplace, a move designed to support the continued recalibration of its distribution strategy. It was one of the clearest signs yet that the brand was rapidly unwinding a strategy that saw it cut relationships with major retailers in a bid to focus on direct-to-consumer channels.

Solving distribution may be the easiest of Nike’s problems to solve. As executives have begun to acknowledge, the only way out of this is to release more products people want to buy, whether it’s on the SNKRS app, in their stores or at a third party retailer.

Nike has already warned that it expects sales to drop 10 percent in the current quarter, and by mid-single-digit percentages in the year ending May 2025, after rising just 1 percent in its most recent fiscal year. If that forecast bears out, it will be the company’s worst performance in 25 years. Nike’s stock is down over 30 percent this year, closing Thursday at its lowest price since March 2020.

Internally, rounds of layoffs affecting its Beaverton, Oregon base and its European headquarters in Amsterdam as part of its $2 billion restructuring plan has seen the continued removal of long-tenured, senior employees and hammered already low internal morale.

Meanwhile, a host of challenger brands new and old are chipping away at Nike’s market share in myriad categories, from athletic footwear to activewear to lifestyle sneakers. Its closest rival Adidas is set to report its highest profit margin in three years when it reports earnings for the first half of 2024 on July 31.

Chief executive John Donahoe has repeatedly said Nike’s fortunes will reverse when investment in innovation and a refreshed product pipeline kick in. But little has materialised so far by way of new or exciting franchises.

Consider the launch of the Nike Dn sneaker. Hailed by the brand as the next big silhouette when it launched in March, the chunky lifestyle shoe never really caught on with sneakerheads, despite a major marketing push, store takeovers and consumer activations in multiple cities.

A lack of compelling new products also raises doubts about how much of an Olympics boost the company is likely to receive. The games are frequently cited by Nike executives as a valuable launchpad for driving brand heat — but its not certain how valuable the tournament will be without compelling products to centre marketing around.

Meanwhile, the brand’s decision to introduce a new footwear products below $100 — revealed by Matthew Friend on the brand’s fourth quarter earnings call in June — appeared to analysts to be counterintuitive, especially when brands like Hoka and On are thriving at a price point of $150 and up.

“It’s not that the customer isn’t wanting to pay more than $100 for sneakers,” said Jessica Ramirez, senior research analyst at Jane Hali & Associates. “Nike have always had pricing power and you don’t want them to dilute the brand by being associated with cheaper sneakers than their competitors.”

A more positive spin on the tepid-seeming turnaround is that Nike has the luxury of being able to take its time to guarantee the right outcome. The company is in no danger of losing its lead in the sportswear market; with $51.4 billion in sales in its last fiscal year, double Adidas’ annual revenue.

Nike coaxing Peddie out of retirement this week followed the hire of veteran American designer Tim Hamilton, formerly of The North Face, as vice president of men’s apparel, who joined the Swoosh in March. It now has respected names in charge of fixing its two biggest shortcomings, distribution and product.

And Nike is also taking the painful but necessary step of pulling back on the distribution of key retro franchises like the Air Force One and Dunks. Those silhouettes carried its lifestyle sneaker business over the past four years, but at the expense of newness, as Friend told analysts this month.

In their place, Nike is mining other models from its archive. The Vomero 5, a retro running sneaker, has picked up demand in recent months after and is one of the newer franchises which Nike is expected to ramp up supply of moving forward, Ramirez said. In the coming months, Nike will also flood the market with lifestyle models like the Killshot and the Field General, which more closely resemble Adidas’ successful Gazelle and Samba franchises, rather than the chunky basketball silhouettes like Dunks and Jordans. The brand also confirmed to sneakerheads delight the return of the Total 90 silhouette, a football boot turned casual sneaker which reached cult status among Nike lovers in the 2000s.

On the performance side, the newly launched Pegasus 41 running sneaker is expected to be pushed by the brand in the coming year. New products, and not just updates on retro models are also a priority.

“We expect the business contribution from new products to more than double from the start of fiscal 2024 to where we end the year in fiscal 2025,” Friend told analysts in June.

Experts believe that a successful course correction is likely. But it’s going to be a long-term process, and whether Donahoe is kept in his job to see it through is increasingly a source of speculation.

“I do think management has to change,” Ramirez said. “But if they continue to do what they’ve been doing the past three months, then there’s a path for them to get things fixed.”

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Burberry is preparing to cut hundreds of jobs. UK-based employees were told they were facing redundancy or must reapply for their roles, according to a report from The Telegraph. Employees fear as many as 400 jobs could be at risk.

Cucinelli stock slide hints at tough results season. Shares in the Italian cashmere house fell as much as 2.3 percent on Friday, even though its earnings met expectations. Markets’ downbeat reaction is an ominous sign for Europe’s luxury goods companies.

Barneys plots a bigger comeback thanks to Neiman-Saks deal. The company is looking to launch new Barneys products and branch out beyond the perfume and beauty lines into home goods, sportswear, intimates and outerwear. The items are to be sold at Saks Fifth Avenue and Neiman Marcus stores.

Adidas set to benefit as Nike struggles. Analysts expect the German sportswear brand to report a profit margin of 51.4 percent for the second quarter — its highest in three years — in part driven by the success of Adidas’ low-rise multi-coloured Samba and Gazelle sneakers.

Fast Retailing lifts forecast again as weak yen powers sales from tourists. The company lifted its full-year operating profit, citing strong performance since the second half. Fast Retailing is plotting an aggressive growth path overseas, taking advantage of a post-pandemic shift among many consumers for value over luxury.

Aritzia sales beat estimates on new styles. The Vancouver-based company reported revenue of C$498.6 million ($365.7 million) for its fiscal first quarter, which ended June 2, surpassing the average analyst estimate. Sales grew 7.8 percent from a year earlier.

Britain’s retailers report a sharp drop in spending in colder June. Data from Barclays showed that domestic retail spending fell by 2.6 percent, driven by a near 8 percent plunge in clothing sales.

US retailers try to move back-to-school shopping to July. In an effort to compete with Amazon’s Prime Day, Walmart, Target and Shein hope to entice parents to start back-to-school shopping earlier than usual. Back-to-school spending last year totalled an estimated record of $41.5 billion.

Pamela Love buys back her brand. The jewellery designer sees opportunities in her ear piercing and engagement assortments, seeking new investors to fund this next stage of growth.

Musée des Arts Décoratifs to host a ‘grand ball’ fundraiser in 2025. The event aims to revive the tradition of Paris’ great balls and mark the centenary of the International Exhibition of Modern Decorative and Industrial Arts. Unlike the Met Gala in New York, tickets will be sold to individuals or families, and not brands.

THE BUSINESS OF BEAUTY

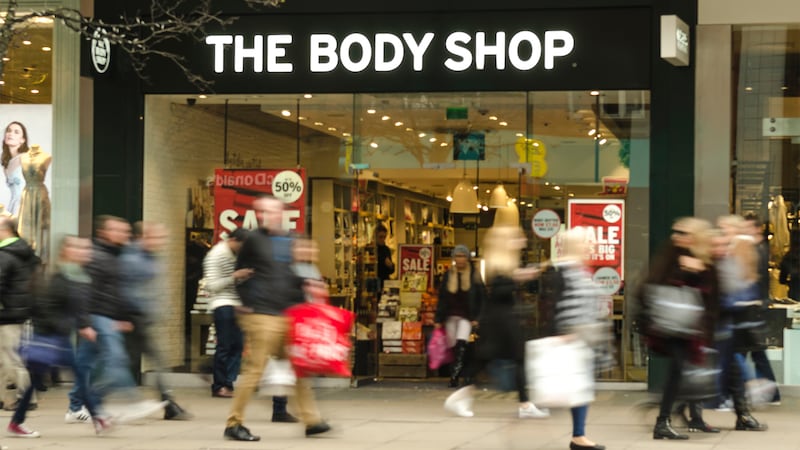

UK Tycoon Jatania poised to buy The Body Shop out of administration. Aurea Holding, an investment firm that Jatania runs with former UBS Group AG banker Paul Raphael, is in exclusive talks to acquire the brand after beating rival bidders in an auction process. The new owners plan to retain all of The Body Shop’s UK stores.

Dyson to cut about 1,000 UK jobs as new CEO reviews strategy. The company cited rapid growth and redundancies as reasons for the cuts. It informed workers plans to maintain its research and development hub in the country.

Puig will join Spain’s blue-chip index. Two months after the cosmetics company completed the country’s biggest initial public offering in nearly a decade, it will join its blue-chip equities on July 22. Puig’s share price has risen more than 3 percent since its market debut. It will replace Melia Hotels in the IBEX 35 index.

Naked Sundays to launch in Ulta Beauty. The Australian sun care brand will debut on the retailer’s website on July 14 and in 800 Ulta Beauty stores in March 2025. The move follows successful expansions into Target stores and Canada’s Shoppers Drug Mart stores this year.

David Beckham to launch a wellness brand. Beckham is now an investor in publicly listed biotech firm Prenetics, and will serve as a co-founder of a new wellness brand, IM8, under its umbrella. Beckham will also be an ambassador for the brand.

PEOPLE

Estée Lauder CFO Tracey Travis set to retire. Travis, who has been in the position for 12 years, will remain in her role for the next year, with her retirement effective June 30, 2025. Her successor has already been selected — ELC declined to share who it is at this moment.

Mulberry names Andrea Baldo as CEO. Baldo, who previously served as Ganni’s chief executive, will succeed Thierry Andretta. Andretta will depart the British handbag label, effective immediately, and Baldo will take over on Sept. 1.

Rabanne announces Troye Sivan as ambassador. The Australian pop singer will be the brand’s first makeup ambassador and will front its Fresh Touch Foundation campaign.

MEDIA AND TECHNOLOGY

‘The Devil Wears Prada’ sequel set amid the decline of magazines. Disney is working on a sequel to the hit 2006 comedy, with key cast members expected to return and a storyline that reportedly follows Miranda Priestly as she navigates the shrinking of print advertising revenues.

Immersive Vogue exhibition to examine runways past and present. The exhibition, held in London’s Lightroom, will lift the curtain on one of the industry’s most symbolic experiences. A list of houses and designers signed up to be involved include Gucci, Prada and Dior.

Compiled by Yola Mzizi.