UK bosses grow more optimistic as energy prices fall, and AI spending boom looms – business live | Business

Key events

Takeover action in the City

There’s a flurry of takeover excitement in the City this morning too.

Network International, which is the largest payment processing firm across Middle East and Africa, has received a takeover proposal from a consortium of CVC Capital and Francisco Partners.

This value the London-listed company at about £2.06bn, or 389p per share.

Shares in Network International have jumped 20% to 364p per share, having also jumped on Friday when CVC’s interest was reported.

Eslewhere, oilfield services and engineering firm Wood Group says it has decided to engage with Apollo Management, over an approach worth £1.66bn, or 240p per share.

Apollo is now required to announce a firm intention to make an offer for Wood by May 17th.

Victoria Scholar, head of investment at interactive investor, tells us:

“Having previously rejected four offers from Apollo, John Wood Group said it is willing to engage with the private equity firm again. A fifth proposal has been submitted to the Board at a final price of 240p per share in cash, valuing the engineering services company at £1.66 billion.

The deadline for a firm offer from Apollo has been extended from 19th April until 17th May. Speculation of a takeover has supported Wood’s shares this year, which are up over 49% to Friday’s close.

The recent recovery in sterling, which hit a 10-month high over $1.25 last week, could also be spurring some potential buyers to make their bids for UK firms now. If the pound keeps rising, it would make it more expensive for foreign firms to buy British companies.

Scholar explains:

This deal adds to the flurry of private equity M&A activity in recent days alongside Dechra Pharmaceuticals, Network International and property company Industrials REIT. There is a sense among international investors that the UK is ripe with takeover targets.

The recent rebound for the pound suggests opportunistic buyers need to make the most of sterling’s weakness before it appreciates further and is too late.”

CFO’s expect boom in AI spending

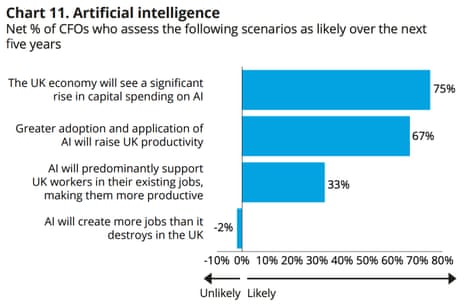

Deloitte also investigated CFO views on artificial intelligence – and found that bosses expect “significant growth in capital spending on AI”.

That, they believe, will help drive UK productivity.

However, CFO’s were almost equally divided between those who believe that AI will lead to an increase in the number of jobs and those who believe it will shrink the human workforce.

Stewart explains:

“The CFOs foresee artificial intelligence helping to drive UK productivity, an outcome that could provide a lasting boost to business growth.

They are divided, however, on how AI will affect the number of jobs in the economy, highlighting the need to ensure the gains from new technologies are widely shared.”

Campaigners, trade unions and MPs agree. They’re calling for stricter oversight of the use of artificial intelligence in the workplace, amid growing concerns about its effect on staff rights.

Introduction: US business confidence bounces after energy prices fall

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The health of the UK economy appears to be picking up, with finance bosses at top companies more optimistic about growth prospects.

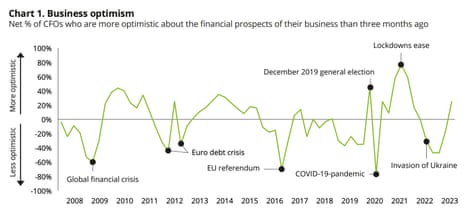

Deloitte’s quarterly poll of chief financial officers across UK boardrooms has found the sharpest rise in confidence since the rollout of COVID-19 vaccines at the end of 2020.

Having run markedly below average throughout last year business confidence has risen sharply, Deloitte says, and is now well above its long-term average.

Confidence has been lifted by the recent big fall in energy prices, as Britain also got through last winter without energy blackouts which had been feared.

Next-month natural gas prices are trading around 100p per therm today, having hit 640p per therm last August as Russia cut Europe’s gas supplies.

Brexit fears have been eased by the Windsor Framework, addressing some of the problems with UK-EU trading relations.

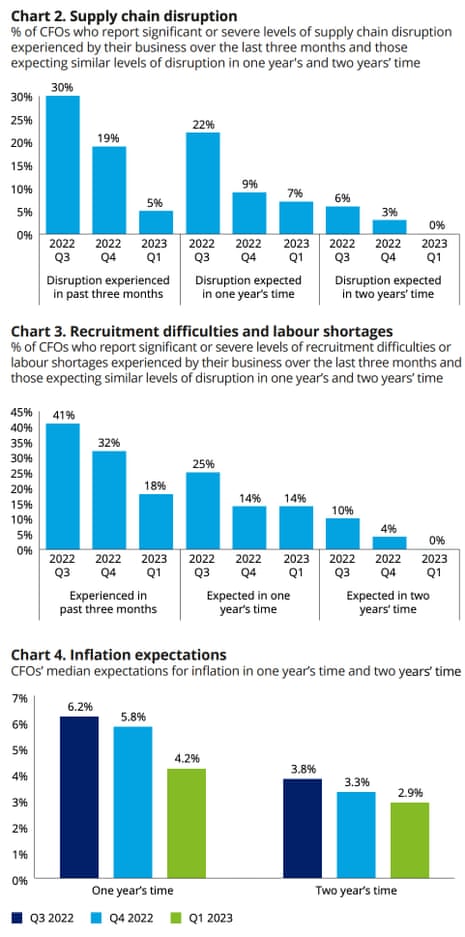

CFOs reported a marked easing of supply chain and recruitment problems, while firms are also expecting inflationary pressures to ease; expectations for inflation in one year’s time have declined from 5.8% to 4.2%.

Wednesday’s UK inflation data is expected to show a small fall in consumer price rises, to around 9.8% per year in March from 10.4% in the year to February.

But risk appetite is below normal levels, with CFOs heavily focussed on cost control and building up cash.

Ian Stewart, chief economist at Deloitte, says:

“The economic unpredictability that marked the beginning of 2023 has started to clear, with CFOs reporting the largest decline in perceptions of uncertainty to date. Business confidence has rebounded, helped by a decrease in energy prices, an easing of Brexit concerns and an improving inflation backdrop.

Crucially, finance leaders report little change in credit conditions, suggesting that March’s events in the global banking system have not affected the pricing and availability of credit for UK corporates.

Despite a brighter outlook, CFOs are alive to the continued risks facing the economy. Corporates remain in defensive mode and CFO risk appetite is subdued.”

Last Friday we learned that the UK economy has risen above its pre-pandemic levels, despite failing to grow in February.

The agenda

- 10am BST: China’s Foreign direct investment data

- 2pm BST: Bank of England deputy governor Sir John Cunliffe gives keynote speech at the Innovate Finance Global Summit

- 3pm BST: NAHB US housing market index

- 4pm BST: ECB president Christine Lagarde gives speech at the Council on Foreign Relations