The Met Gala’s September Gamble | This Week in Fashion, BoF Professional

Monday marked a major moment for the fashion industry with the return of the Met Gala, over two years after the last edition of the star-studded event, organised by Vogue editor Anna Wintour. By at least one measure, the Gala remains at the apex of fashion’s event calendar: it raised a record $16.75 million for The Costume Institute at the Metropolitan Museum of Art.

But to many observers, something felt off about the proceedings. Organisers took a big risk in moving the Met Gala off its perch on the first Monday in May, a slot so closely associated with the event that it was chosen as the title of a 2016 documentary.

There were reasons to gamble with tradition: the synergies between the Met Gala and New York Fashion Week are obvious, and the move spared the Costume Institute from further delay to much-needed funding. In an alternate reality, one could imagine the Gala serving as a spectacular finale to a week of shows, cementing the power of American fashion.

That’s not quite how things panned out, however. Perhaps it was the stubbornly high Covid-19 infection rate or the increasingly acrimonious fight over vaccinations. Much of the gossip before Monday focused on which stars had skipped the event or been left off the guestlist for refusing to get a shot. On the night itself, Nicki Minaj grabbed the spotlight from rival celebrities when she tweeted that she had declined to attend the event due to its vaccine mandate.

And as it turned out, the second Monday in September positioned the Gala at a noisy moment in the celebrity news cycle, coming less than 24 hours after Tom Ford closed New York Fashion Week and MTV’s Video Music Awards. For some celebrities, the Met event was the second or third time they had walked the red carpet this month.

The Met Gala’s challenges go beyond the date change, however.

The evening’s theme was American fashion, inspired by this year’s Costume Institute exhibit, “In America: A Lexicon of Fashion.” But the prevalence of labels like Balenciaga, Versace and Valentino on the carpet only served to underscore how decisively the luxury fashion industry’s centre of gravity has shifted toward Europe. It’s those deep-pocketed brands, rather than many of the American designers featured in the exhibit itself, that can afford to dress celebrities for the reported $275,000-per-table Met Gala (some 50 American designers attended, many as guests of companies and celebrities that purchased tables). Marc Jacobs, arguably the best-known American designer, was missing in action.

The event’s price tag has also attracted the attention of the public in a world that’s increasingly aware of income and wealth inequality, most of it negative. US congresswoman Alexandria Ocasio-Cortez set out to tackle this issue head-on, attending the event with a white Brother Vellies dress, which featured the words “Tax the Rich” in bright red lettering. Some derided this as a hypocritical stunt, though Brother Vellies designer Aurora James noted that Google searches for the phrase skyrocketed in the hours after the event.

The Gala has also struggled to stay fresh as its model of A-list stars parading up the carpet looks increasingly antiquated. The Met Gala is a perfect fit for stars like Rihanna or Jennifer Lopez who rose to fame via red carpet premieres and award shows. But the next generation of global celebrities are more likely to come from the more informal and often intentionally unpolished world of social media; it’s not entirely clear how the Gala helps TikTok’s Addison Rae or YouTube’s Emma Chamberlain, and vice versa.

The event has become less valuable, according to brand performance measurement company Launchmetrics, which measures the effectiveness of marketing and PR activities of a brand or event through its media impact value scale. The 2021 Met Gala’s media impact value was $543 million, a 12.9 percent decrease versus 2019. However, the Met Gala isn’t alone, as the majority of large-scale events have seen similar decreases since the start of the pandemic, said Alison Bringé, Launchmetrics’ CMO.

All of the above begs the question: Has the Met Gala lost its uniqueness and become just another event? Fortunately, the Costume Institute will have a chance to recalibrate in a few months: the next Met Gala, complete with the same theme, is scheduled for the first Monday in May.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Inditex reported an €850 million ($1 billion) second-quarter profit on Wednesday. Shutterstock.

Zara owner’s sales rebound to top pre-pandemic levels. Inditex reported a €850 million ($1 billion) second quarter profit on Wednesday. Sales during the period were in line with the €7.02 billion expected by analysts polled by Refinitiv.

H&M sales still lag pre-pandemic levels as restrictions bite. The Swedish group said on Wednesday sales grew 9 percent from a year earlier, though analysts polled by Refinitiv on average forecast net sales growth of 14 percent. Net sales were down 11 percent from the same quarter in 2019, before the pandemic.

Saint Laurent back on Paris schedule. After being the first major brand to leave organised fashion weeks after the onset of the pandemic, the Kering-owned label will reclaim a prime slot at Paris Fashion Week — closing out the first full day of runway shows on Sep. 28, according to an updated calendar released by FHCM.

Khaite, Fear of God and Theophilio among CFDA award nominees. The Council of Fashion Designers of America’s annual fundraiser and award ceremony will return on Nov. 10 in New York City, when new and established designers from Maisie Wilen to Demna Gvasalia will be up for awards for their work over the past year.

Primark sales miss expectations in the latest quarter on Covid hit. Owner Associated British Foods said Primark’s fourth quarter sales were lower than expected. It forecast fourth quarter sales would be down 17 percent versus 2019, but raised its full profit outlook for the fiscal year. The retailer also vowed to cut its environmental impact, pledging to use more recyclable materials, make clothing more durable (without raising prices) and improve wages.

Asos to tie executive pay to environmental goals. The online fashion retailer will join a growing list of fast-fashion companies to open up its supply chain for external scrutiny. Asos set out plans to achieve net-zero status across all its operations and make its own-brand products and packaging from more sustainable or recycled materials by 2030.

On Running surges in market debut. The company raised $746.4 million in its IPO after its shares priced above their target, before climbing an additional 46 percent to end the day at $35.

Gap selling $1.5 billion bond to buy back costly Covid-era debt. The deal will help the San Francisco-based company slash borrowing costs and focus on growth after Covid-19 hurt clothing sales. The new note offering is split into two parts, and marks a steep decrease in the cost of borrowing for Gap.

China’s shoemaking hub locks down following Covid-19 outbreak. The outbreak of the highly-contagious Delta variant in China’s Fujian province — which produces more than 1.3 billion pairs of shoes each year — is causing further disruption for global footwear brands already facing supply chain issues due to rising infections in Vietnam.

THE BUSINESS OF BEAUTY

Beauty products supplier Knowlton targets over $3 billion valuation in US IPO. Shutterstock.

Beauty products supplier Knowlton targets over $3 billion valuation in US IPO. The Quebec-based company, acquired by an investor group led by Cornell Capital in 2018, plans to sell roughly 57.14 million shares in its IPO, priced between $13 and $15 per share, in a bid to raise up to $857.14 million.

China’s People’s Daily slams medical beauty ads, urges regulation. The paper said it was “imperative and urgent” to regulate advertisements bombarding people with recommendations for cosmetic surgery, procedures and treatments as they had become excessive and made false claims about surgery’s ability to “change one’s destiny.”

China’s beauty sector investment spree continues. Chinese perfume label Scent Library, founded in 2015, has secured investment from Spanish beauty giant Puig, according to Chinese business media platform 36Kr. The Series B round is said to have raised $10 million, according to sources, though the companies involved declined to officially disclose the investment amount.

PEOPLE

LVMH’s Kenzo names Nigo as its new designer. Getty Images.

LVMH’s Kenzo names Nigo as its new designer. The Japanese entrepreneur and founder of streetwear label A Bathing Ape will be charged with reviving the brand, which also tapped a new chief executive, Sylvain Blanc, from French intimates brand Undiz.

Function of Beauty finds a new chief executive in Laura Mercier president. The brand, best known for its custom hair care formulas, has named Alexandra Papazian chief executive on the heels of receiving $150 million in funding from LVMH-backed private equity firm L Catterton last December. Prior to taking the reins at Shiseido-owned Laura Mercier, Papazian was a longtime L’Oréal executive. At Function of Beauty, she replaces co-founder Zahir Dossa who will move into the role of executive chairman.

Rimowa enlists Rihanna as the brand looks beyond suitcases. The multi-hyphenate mogul appears alongside Lebron James, Roger Federer and Patti Smith in a major campaign as the LVMH-owned luggage label continues its effort to become a ‘mobility’ brand and build a presence in new product categories.

Ben Cobb named editor of ES Magazine. The former editor-in-chief of Another Man and head of menswear coverage at LOVE will join The Evening Standard’s culture and lifestyle supplement in October.

MEDIA AND TECHNOLOGY

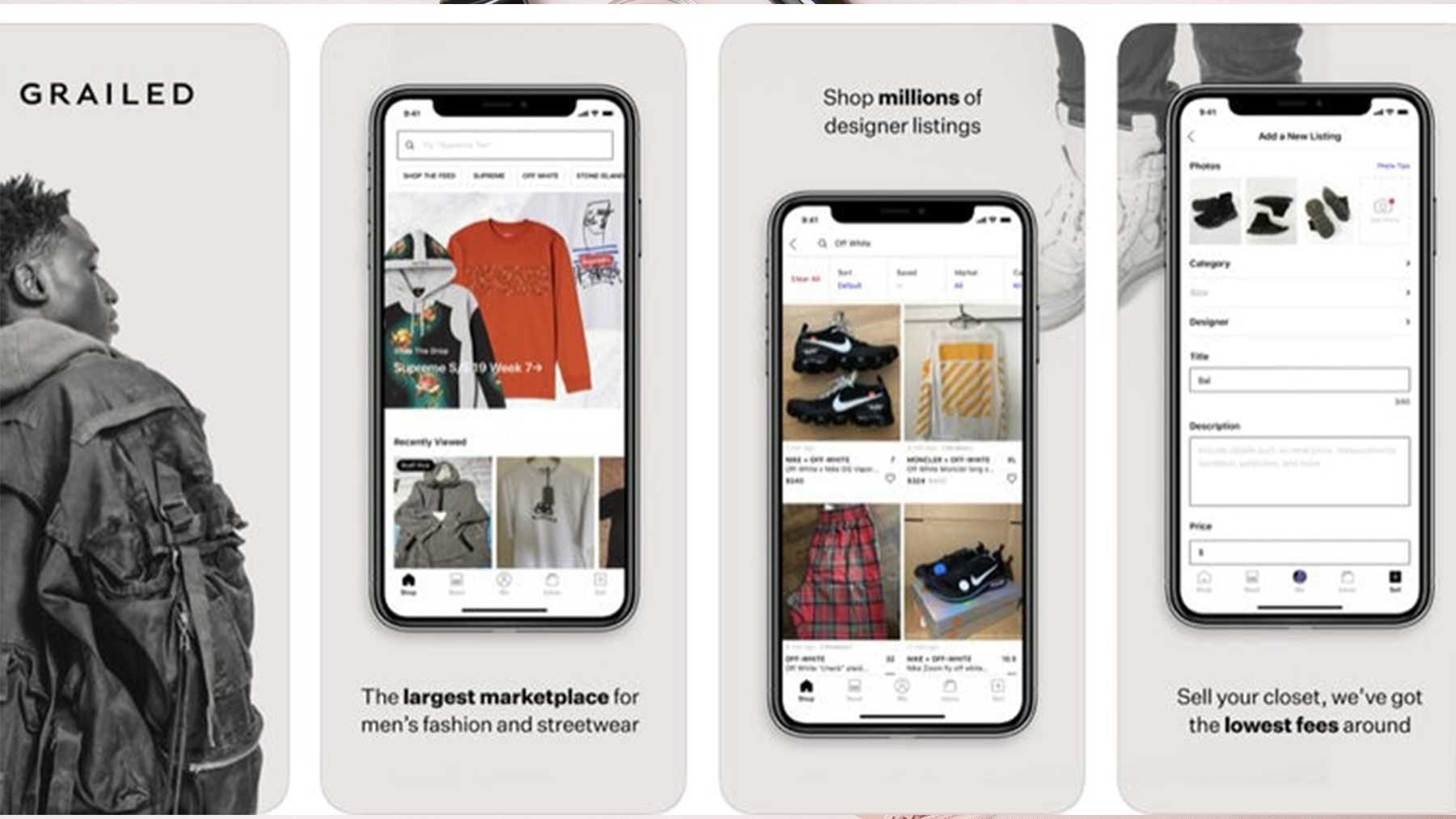

Founded in 2013, Grailed has become an online destination for menswear. Grailed.

Grailed raises $60 million in funding. Goat Group, the parent company of sneaker resale sites Goat and Flight Club, led the Series B funding round for the menswear resale marketplace. Other investors were Groupe Artémis, the Pinault family’s holding company and Gucci chief executive Marco Bizzarri.

Resale site Tradesy raises $67 million. The financing round — which will go toward category expansion (including a foray into menswear), and new technology — was led by prominent venture investor John Doerr, whose firm Kleiner Perkins has funded the likes of Rent the Runway and The Wing.

Poshmark launches in India. The social commerce platform enters a crowded e-commerce retail market, with major players including Walmart-owned Flipkart’s Myntra and Reliance’s Ajio, vying for the country’s 622 million internet users.

Compiled by Joan Kennedy.