Sustainability Comes At a Cost. Fashion Isn’t Paying. | BoF Professional, News & Analysis

Key Insights

-

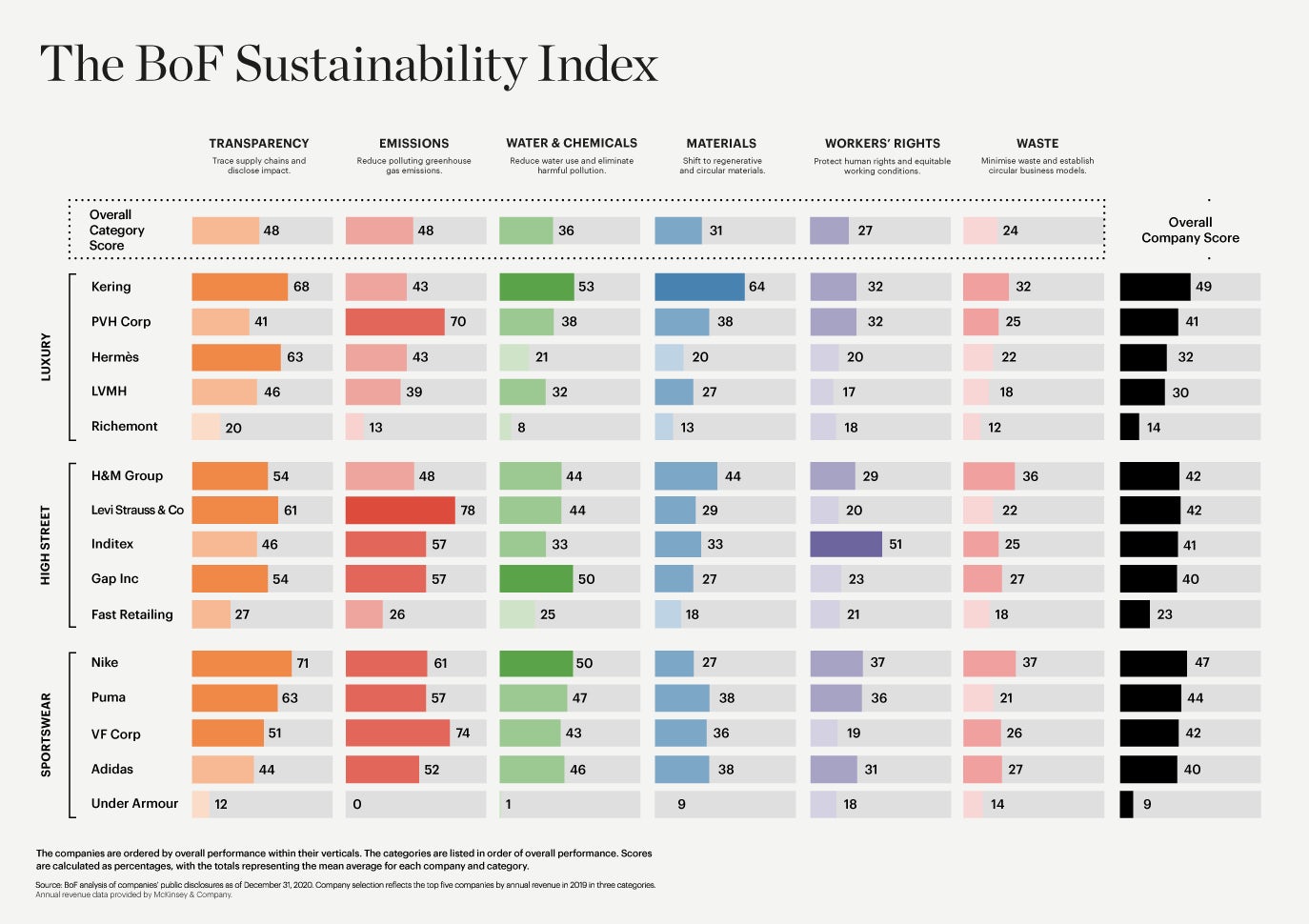

The BoF Sustainability Index tracks fashion’s progress towards ambitious sustainability targets for the coming decade. It examines public disclosures to rigorously benchmark performance and enable like-for-like comparisons at 15 of fashion’s largest companies.

-

The Index found that while fashion companies are speaking about sustainability more than ever before, actions are lagging public commitments. The average overall score of the companies assessed was just 36 out of a possible 100, with significant disparities between engagement and action.

-

Information about how companies are planning for the substantial investments required to meet sustainability goals emerged as a significant blind spot, with companies failing to match bold ambitions with details of how they plan to pay for them.

Last month Bangladesh-based denim manufacturer Mostafiz Uddin asked some of his customers for help securing a $3 million loan he said he needed to pay for upgrades that would allow him to operate more sustainably.

Even though Uddin had struggled to stay afloat as brands cancelled orders and put pressure on prices during the pandemic, the investment aligned with his long-term vision and was something the brands he worked with – big, global companies that had their own environmental commitments – said they wanted.

But when he asked them to provide letters indicating they were committed customers for his bank, a condition for any loan, only one – H&M Group – obliged, he said.

Uddin’s experience is being repeated over and over at every level of fashion’s supply chain. Many major brands have promised consumers they will eliminate toxic chemicals, switch to recycled polyester or reduce greenhouse gas emissions. They can’t hit those goals by installing energy-efficient windows at corporate headquarters in Paris or New York. They need factories, usually owned by third parties, to switch to green energy sources and install new equipment. It’s expensive work requiring long-term investment. And while brands may push for the upgrades, suppliers say they’re often on their own when it comes to paying for them.

The brands “are not contributing or helping in any way,” Uddin said. “When you want a little bit more money for [sustainably produced clothing] nobody wants to pay … all the financial risk falls on the suppliers.”

As a result, progress toward a cleaner fashion industry has come at a snail’s pace. For that to change, brands need to rethink their supplier relationships, experts say. Rather than pitting factories against each other each season to find the cheapest manufacturer, the industry needs to establish stable partnerships that enable long-term investments – even if it sometimes means clothes cost more to produce.

“This business is based on everything has to be cost neutral, which intrinsically it cannot be,” said Miguel Sanchez, a technology leader at denim trade show Kingpins Show and a board member at Transformers Foundation, an industry group representing the denim supply chain.

Who Pays the Bill

Scaling up innovations to make the fashion industry more sustainable will require between $20 billion and $30 billion every year for the next decade, according to a report by consultancy BCG and and sustainable fashion innovation hub Fashion for Good published last year. There is scant evidence companies are preparing to spend anything like this much, according to analysis drawn from The BoF Sustainability Index.

The BoF Sustainability Index

The report assessed 15 of fashion’s largest companies’ public disclosures on their sustainability policies and practices. Only a third provided information about investment or spending plans to support ambitious environmental targets.

The sums that were disclosed were a fraction of what experts estimate will be required.

LVMH said its capital expenditure related to environmental protection amounted to €10.7 million ($12.7 million) in 2019 and €10.4 million last year, though that doesn’t cover all of its investments in the space. Kering has committed €5 million to a fund focused on supporting regenerative agriculture projects. Adidas allocates an annual budget of between €1 million and €4.5 million to capital spending on energy efficiency measures and renewable energy generation. The company said it plans to expand these investments in the coming years to achieve its goal of climate neutrality in its own operations by 2025.

Most companies don’t provide details about their spending on sustainability at all, though some pointed to the competitive nature of such information to explain the lack of disclosure. PVH said it does “not disclose strategic financial planning details.”

Similarly, only a handful of companies indicated they provided suppliers with direct financial support or incentives to help them invest in reducing their environmental impact. The picture’s the same when it comes to labour rights. Just four of the companies analysed said they embedded the cost of wages in the prices they negotiate with suppliers. None are pricing for a living wage.

Many of the companies said they reward manufacturers that achieve high scores in environmental or social audits with more orders, but suppliers say in reality business largely goes where the price is most competitive.

For instance, when the price of organic cotton shot up in recent months, most brands were quick to switch to non-organic fibres or reduce the organic content in their material mix, said Alberto Candiani, president at Italian denim manufacturer Candiani Denim.

His family’s denim mill sits on a nature reserve just outside Milan, which means it has had to invest in more sustainable operations since the 1970s, long before most of the industry engaged with the topic. Those investments have amounted to more than €100 million, with much of the spending made over the last 20 years, Candiani estimates. Brands have never provided financial support, and he sees little indication that will change.

There are plenty of opportunities for brands to co-invest, “but they are simply not,” Candiani said.

Stepping Up

Still, there are signs the fashion industry is beginning to take spending on sustainability more seriously.

“There is definitely a gap right now between the ambitions of sustainability and the investments required to realise these goals,” Levi Strauss & Co. chief sustainability officer Jeffrey Hogue said in an emailed statement. The company’s working across several initiatives to unlock wider access to low-cost financing for suppliers’ investments in sustainability improvements, with a particular focus on water and energy use. “That also helps us deliver on our own goals and meet the demands we have for ourselves,” Hogue said.

Mounting interest in so-called environmental, social and governance financing within the wider investment community is helping to push dollars towards sustainability initiatives. In February, H&M Group raised €500 million in bonds that linked the company’s interest rate to performance on sustainability goals. Adidas raised a similar amount in September in a green bond earmarked for spending on more sustainable materials and energy, as well as funding underrepresented communities. Chanel and Burberry count among other fashion companies that have turned to green debt financing.

In 2019, Gap partnered with Indian textile manufacturer Arvind Limited in a roughly $4 million project to build a new water treatment facility at the manufacturer’s denim mill in Ahmedabad, India and establish an innovation centre focused on reducing the industry’s water use. Though the project represented a sizeable investment, it came together in a matter of months. Both companies considered the other a strategic partner and the investment would help them each achieve ambitious water targets.

More than that, “our idea was to make a blueprint,” said Arvind’s head of sustainability Abishek Bansal. Such partnerships offer the opportunity to “shift of the needle, not just moving it by 5 degrees, but completely turning the clock,” he said.

The inaugural BoF Sustainability Index benchmarks the performance of fashion’s largest companies against ambitious environmental and social goals that must be achieved in the next decade.

Download the full report ‘The Sustainability Gap’ here.

The BoF Professional Summit: Closing Fashion’s Sustainability Gap

On April 14 2021, BoF will convene leading sustainability experts and global thought leaders for a 3-hour live broadcast

of interactive conversations and panel discussions, in which we’ll unpack findings from The BoF Sustainability Index and

outline the steps that need to be taken over the coming decade to align the industry with global climate goals and social

imperatives. Space is limited.

As a BoF Professional member,

register now to reserve your spot.

If you are not a member, you can

take advantage of our 30-day trial

to experience all of the benefits of a

BoF Professional membership, including the Summit.

The BoF Sustainability Index is based on a binary assessment that examines companies’ public disclosures up until December 31, 2020. There are limitations to this approach and while the assessment was conducted in good faith, the results should be viewed as a proxy for sustainability performance and not an absolute measure. Where BoF was unable to identify public evidence to support a company’s performance relating to the assessment criteria, it does not necessarily mean the company is taking no action at all or that bad practices are present. Read the full methodology on pages 38-41 in the report here or see the FAQs.

Disclaimer: BoF accepts advertising arrangements from a range of partners, some of which may appear in The Sustainability Index. Such advertising arrangements and the Index are handled by separate parts of the business in order to ensure that BoF’s continued commitment to editorial integrity and independence is maintained, and any advertising arrangements between BoF and a partner shall have no impact on the methodology or outcome of the Index assessment. LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.

Related articles:

Brands Say They Want to Keep Workers Safe. Not All Are Willing to Pay for It.

Fashion Goes Green to Raise Capital

In Search of Business Case for Sustainability