If You Hate Speed Cameras, Then You’ll Like Verra Mobility Stock

If you’ve ever gotten a speed, red light, or school bus camera ticket in the mail, then you know how miserable they can be. At some point, you think to yourself that there’s got to be someone on the other side making a ton of money off these tickets. Well, there is a company making a ton of money and they have a near monopoly in doing so. Verra Mobility (NASDAQ: VRRM) is smart mobility technology solutions company with a presence in over 15 countries. In addition to safety cameras, they also provide automated toll and violations management and title and registration services to rental dealerships. The Company continued to generate positive cash flow during the COVID-19 pandemic as major car rental company Hertz Global (NYSE: HTZ) went into bankruptcy. The lockdowns spurred pent-up demand for commuters to the hit the roads hard and heavy when they were lifted. Despite rising fuel prices, the domestic travel recovery continues to drive profits for Verra as more travel means more tolls and more tickets. Verra also owns a 90% market share of the nationwide tolling, title, and registration solutions for rental car companies and traffic violations management for commercial fleets.

MarketBeat.com – MarketBeat

Misery is Loves Profits

Verra Mobility operates in three segments. The Commercial Services segment offers automated toll and violation management, in addition to title and registration solutions for rental companies and fleets. Government Solutions provides the automated safety solutions to the government and school districts with over 9,000 speed, red-light, city and school bus cameras. Parking Solutions provide software and hardware solutions to municipalities, universities, transportation hubs, and healthcare facilities.

Robust Top and Bottom Line Growth

Verra continues to provide robust earnings growth evidenced by its Q2 2022 release on Aug. 3, 2022. The Company reported earnings-per-share (EPS) profit of $0.15 beating consensus analyst estimates for a profit of $0.11 by $0.04. Net income was $29.6 million. Revenues rose 46% year-over-year (YoY) to $187.5 million beating consensus analyst estimates by $7.7 million. They generated $65.1 million from operations. Verra Mobility CEO David Roberts said, “This is an incredibly exciting time for the Company. Operationally, our businesses are generating very strong results fueled by favorable secular trends including robust travel demand that is driving improved performance in our Commercial Services business. Moreover, we had the opportunity to communicate our long-term growth strategy, financial outlook and capital allocation priorities at our inaugural investor day, which demonstrates the conviction we have in both the growth strategy and predictability of our business going forward.”

More Growth Ahead

Verra raised its full-year 2022 guidance for revenues to come in between $720 million to $740 million versus $717.5 million consensus analyst estimates. Full-year adjusted EBITDA is expected to come in between $325 million to $335 million, up from $325 million. The Company plans to expand into Europe and further integration of its Redflex acquisition. The implementation of the Federal Infrastructure bill will also help growth from the $2.7 billion allocation towards traffic safety and subsidies for school bus and traffic enforcement cameras.

Strategic Review Speculation

Activist shareholder Scopia Capital revealed a 5.3% interest of 8.3 million shares in Verra Mobility on its July 14, 2022, 13D filing. Scopia provided financial analysis in its letter to the Board of Directors. They indicated that despite the strong top and bottom line growth and market leader position of the Company, a valuation disconnect with stock price continues to exist. They place an intrinsic value of $25 per-share at 20X 2003 EPS of $1.25. Scopia has requested the board to consider a strategic review process to seek strategic alternatives including a possible sale of the Company, leveraged buyout or spin offs.

Here’s What the Charts Say

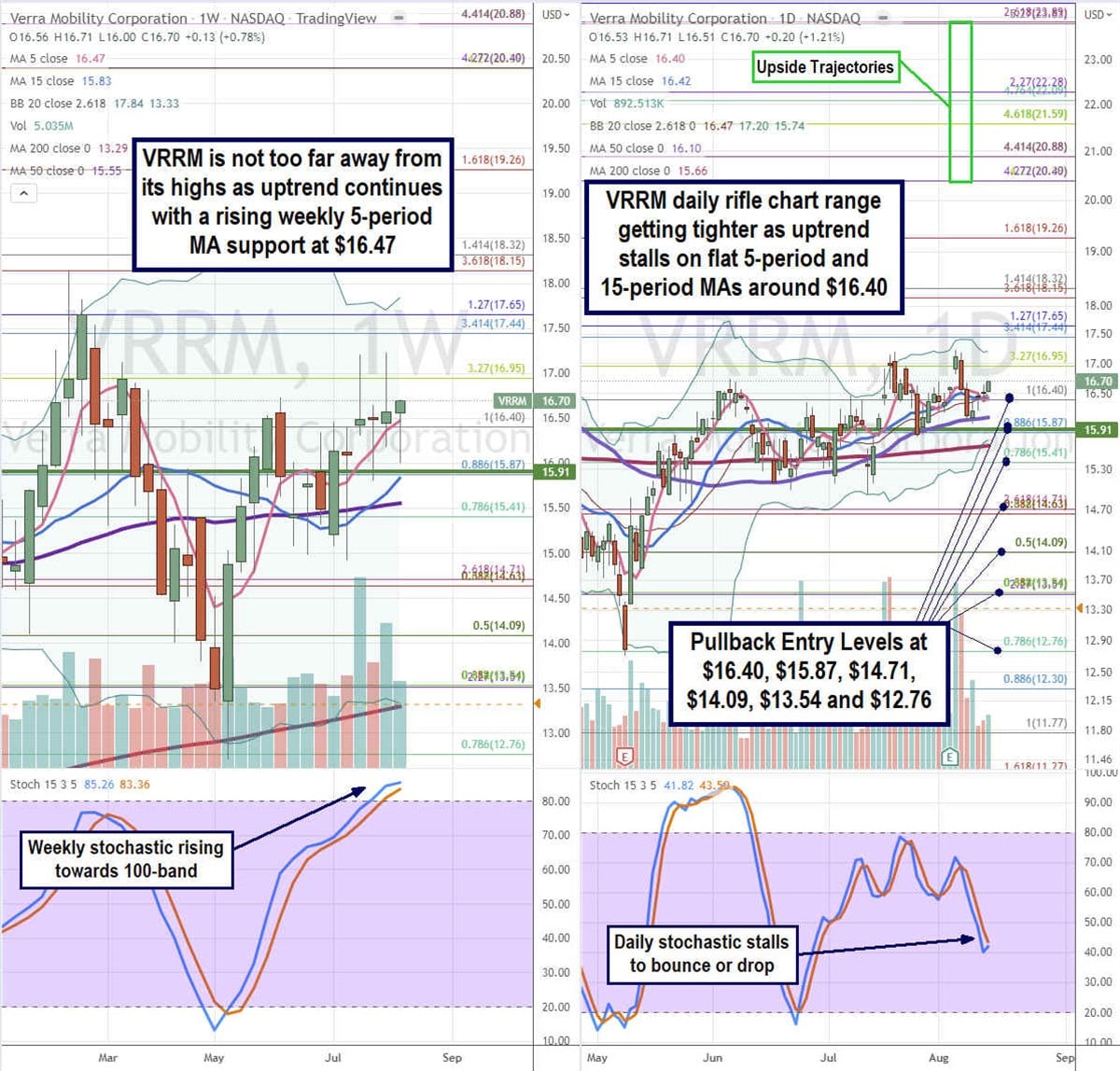

Using the rifle charts on the weekly and daily time frames provide a precise view of the price action playing field for VRRM stock. The weekly rifle chart hit its all-time high near the $18.15 Fibonacci (fib) level before falling to bottom near the $12.76 fib level. The weekly pup breakout formed with a rising 5-period moving average (MA) at $16.47 and 15-period MA support rising at $15.83. The weekly 50-period MA support is rising at $15.55. The weekly upper Bollinger Bands (BBs) sit at $17.84. The weekly lower BBs overlap with the weekly 200-period MA at $13.29. The weekly market structure low (MSL) buy triggered on a breakout through $15.91. The daily rifle chart has been slowing rising despite flat 5-period MA at $16.40 and 15-period MA at $16.45. The daily 50-period MA sits at $16.10 and 200-period MA sits at $15.66. The daily BBs are compressing as the range gets tighter ahead of a break. The daily upper BBs sit at $17.20 and lower BBs sit at $15.74. The daily stochastic fell to the 40-band and is stalling for a cross up or mini inverse pup down. Due to the compressed trading range, opportunistic pullback levels start relatively high at the $16.40 fib, $15.87 fib/weekly MSL trigger, $15.41 fib, $14.71 fib, $14.09 fib, $13.54 fib, and the $12.76 fib level. Upside targets range from the $20.40 fib up towards the $23.89 fib and further upside to the $40s.