How ‘Buy Now Pay Later’ Became Fashion’s Go-To During the Pandemic | Intelligence, BoF Professional

NEW YORK, United States — Early on in the pandemic, Rachel Gannon noticed customers on her off-price website, Cara Cara, were shopping differently.

Rather than pay for their purchases upfront, they were opting to pay in monthly instalments stretching out as far as three years. Gannon had begun to offer a “buy now, pay later” option in November, using Klarna, a Swedish payment services firm. But usage doubled during the pandemic. Those customers also tended to spend more.

“People spend more money when they don’t have to pay it all upfront,” she said.

The pandemic has been a boon for instalment-payment companies. Customers who select this option during checkout are effectively taking out a small loan to finance their purchase, which they pay back over periods ranging from a few weeks to several years.

Even before Covid-19, a growing number of retailers were introducing “buy now, pay later” plans, from fast fashion to luxury. But demand has exploded during the lockdowns when consumers turned to online shopping in record numbers. Brands see instalment plans as a way to keep consumers spending in a bad economy. They hope instalment plans will bring in new customers and increase average order values.

Asos, Drunk Elephant, La Mer and American Eagle are among the brands that signed up with Afterpay during the pandemic. Sephora, The North Face and Adidas joined Klarna. Signet Jewelers and Oscar de la Renta are among the new clients of Affirm, a smaller, San Francisco-based start-up that is eyeing an initial public offering, according to the Wall Street Journal. Sydney-based Afterpay, the biggest of these firms, saw revenue more than double to $3.8 billion in the quarter ending June 30, compared with a year earlier.

Being able to spread purchases out over several weeks without interest might be extra comforting.

“During the quarantine period in 2020 more people may be watching their weekly budgets,” said Lucia Perdomo-Ruehlemann, chief marketing officer at skincare brand Drunk Elephant, which added Afterpay after receiving numerous requests from customers. “Being able to spread purchases out over several weeks without interest might be extra comforting.”

Most of these lenders were founded after the 2009 recession, and have yet to be tested by a weak economy, which will likely trigger a higher rate of missed payments and add to criticism that instalment plans encourage consumers to spend beyond their means.

And though it’s the lenders, not the retailers, that take on the financial risk, consumers may blame brands anyway when interest and late fees start piling up. Customers typically pay no interest on short-term loans, though annual percentage rates can top 20 percent depending on the borrower.

“There is a real fear and concern when you are giving up some control of the customer experience to a system that you don’t fully manage,” said Jake Makler, head of partnerships at Quantum Metric, which provides data and analytics to fashion brands like Lululemon and Neiman Marcus.

A Meteoric Rise

Instalment plans are only the latest way retailers have extended credit to their customers. Layaway, where customers would put purchases aside until they paid for them in full, became popular in America retail during the Great Depression but faded with the emergence of credit cards. Retailers issued store credit cards starting in the 1980s, but their popularity waned after the 2009 recession when more customers began missing payments.

For fashion, these companies solve an age-old problem: their best customers, young people, also tend to have the least spending power. Young shoppers saw their earning power crimped by the last recession, and are more likely to be saddled with debt from student loans. Many see instalment plans as less intimidating than credit cards. Some 23 percent of Millennials don’t have credit cards, according to TD Bank.

“These shopping loans are very appealing to Millennials and Gen Z, especially right now,” said Kimberly Palmer, a personal finance expert at consumer finance site NerdWallet. “A lot of young people don’t have credit cards, either because they have bad credit … or because they are making a choice to avoid debt.”

A lot of young people don’t have credit cards, either because they have bad credit or because they are making a choice to avoid debt.

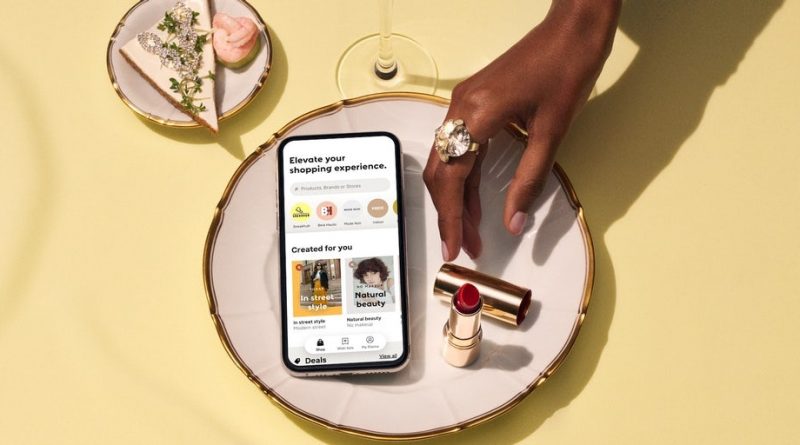

These lenders target younger shoppers with marketing heavy on Millennial pink and partnerships with brands like Revolve and Kylie Cosmetics. Next week, Klarna will team up with the women’s magazine Cosmopolitan to host a virtual “Hauliday” shopping event.

In just a few years, buy now, pay later has gone from a niche offering to e-commerce table stakes. Personal loans in the US have doubled since 2014, topping $161 billion last year, according to consumer credit reporting agency TransUnion. David Sykes, head of Klarna in the US, said he expects buy now, pay later to “achieve Paypal-like levels of ubiquity within the near term.”

“Klarna’s long term ambition is to sit at the intersection of retail, banking, and payments,” he said.

Why Retailers Sign On

Instalment plans aren’t cheap for retailers, which typically pay 4 to 6 percent of each transaction, compared with 1 to 3 percent for Visa or Mastercard.

Some retailers say the service attracts new customers and convinces them to spend more.

“Today, you have to give lots of flexibility to shoppers, and this is one of the expectations,” said Carl Cunow, co-founder of luxury swimwear brand Onia. Cunow has personally financed purchases with Affirm and offers Klarna for Onia. “Everyone is also kind of watching what everyone else is doing, so you need to keep up.”

Today, you have to give lots of flexibility to shoppers, and this is one of the expectations.

Installment-plan providers also promote the brands they work with through their own payment apps as well as advertising campaigns. That’s proven a big draw, particularly for smaller brands. These firms also pitch themselves as helping with customer retention; Affirm says 67 percent of its shopping loans are made to repeat customers.

“We think of them as a marketing partner … they are reaching out to audiences for us that we probably don’t reach, or can’t afford to reach,” said Dan Clifford, chief marketing officer of Mansur Gavriel, which has used Afterpay and now uses Klarna.

Nothing Is Free

Direct-to-consumer jewellery brand Mejuri started using Klarna in November, but the company hasn’t seen a meaningful uptick in return customers, said President and Chief Operating Officer Majed Masad.

As the buy now, pay later industry has grown, it has also drawn criticism for pushing younger shoppers into debt. In the UK, Stella Creasy, a member of parliament, has called on regulators to investigate whether these services deceptively market themselves as risk-free to young and uneducated shoppers.

“Most customers don’t realise that borrowing money is never free,” said Palmer of NerdWallet. “And of course, brands don’t want to be associated with people taking on debt and getting into financial hardships.”

Brands don’t want to be associated with people taking on debt and getting into financial hardships.

Greg Fisher, Affirm’s chief marketing officer, said the company is invested in “helping people build their financial wellness,” which is why he said the company doesn’t charge late fees. Molnar of Afterpay said the company targets a more financially fluent consumer — the average Afterpay user is in their mid-30s — and added that its user’s loss rate was about 1 percent, “which is significantly lower than using credit products.”

Klarna’s Sykes said the company takes “being a responsible lender extraordinarily seriously,” and that the $150 average order value through the service is a “manageable amount.” Last year, Klarna debuted a campaign, “Mindful Money,” to promote responsible spending. Afterpay and Klarna shut off users’ accounts if they are late on payments so that customers cannot make additional purchases.

The industry isn’t immune to the effects of the pandemic, though.

It’s entirely possible that many consumers will end up defaulting on the shopping loans they are taking out now.

“Given the current economic instability and financial fragility of many Americans, it’s likely that an increasing number of Americans will struggle to pay their bills,” NerdWallet’s Palmer said. “It’s entirely possible that many consumers will end up defaulting on the shopping loans they are taking out now, which does mean these companies are taking on more of a risk.”

Small brands in particular also need to weigh the benefits of offering instalment plans against the expense.

“You have to be mindful of the costs because they do add up when you are running a small business,” said Cara Cara’s Gannon. “Your margins can be diminished in a minute.”

But for some brands, the benefits outweigh the costs, as these services fill a need. Clifford of Mansur Gavriel said the fees can be equivalent, or even sometimes less than acquiring customers via social media. Young consumers also want to keep shopping but might not have access to credit.

“This is a generation who has shifted the way we pay,” said Nick Molnar, co-founder and the US chief executive of Afterpay. “They want to be empowered to spend their money.”

Related Articles:

Off-Price Retailers Are Now Selling Online. Will Shoppers Follow?