Digital wholesale marketplaces are competing for dwindling business as brands move to DTC – Glossy

Since March, a consistent theme among fashion brands has been moving away from reliance on wholesale partners, in favor of a setup that favors direct sales. Retailers canceled orders and stores were closed, making wholesale less appealing. But with stores set to open back up and retailers beginning to place more orders, the trade show market has seen platforms competing for what’s left of the wholesale business.

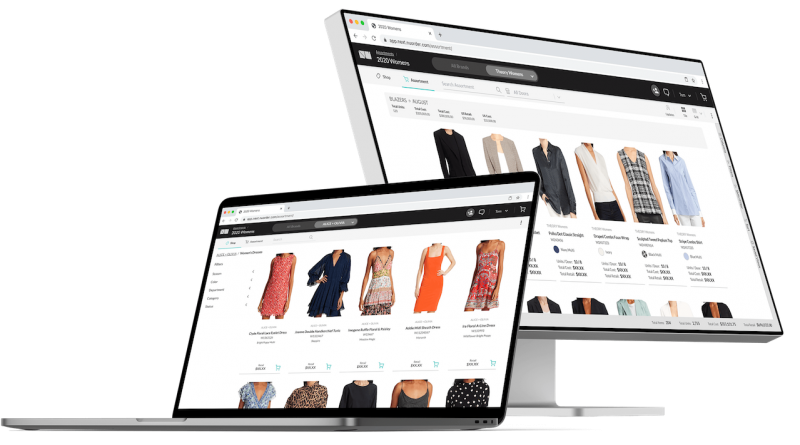

Physical trade shows like Coterie have dominated the fashion landscape for years, but now digital platforms are rising to prominence. Both NuOrder and Joor have transactions that surpass $1 billion per month and have hundreds of thousands of retail partners. Both have seen an increasing amount of interest from retailers, as well as from IRL trade shows wanting to bring their platforms online. But at the same time, brands like Burberry and Ralph Lauren are all shifting toward direct sales.

The platforms are working to get more brands, especially newer ones, using their tools, facilitate wholesale relationships and assist in revitalizing wholesale at large, said Heath Wells, co-founder of online wholesale marketplace NuOrder.

NuOrder is partnering with the CFDA for a digital event called Runway360, set to coincide with NYFW in September It will function as a sort of virtual trade show: Each participating brand will get a customizable online page that supports AR and VR activations, livestreaming and social media integrations, as well as a free year of NuOrder. It will not be limited just to brands that are showing at NYFW; it’s free for any brand that is chosen by the CFDA for the program.

Faire, another online wholesale marketplace, is hosting its first online trade show at the end of August called the Faire Summer Market. It will allow brands to set up their own stores and on pages that support livestreaming.

Wholesale marketplaces — looking to win over brands and retailers, and uphold the wholesale model — have had to do more than just update their shows and marketplaces technologically. They’re also making big changes on the financial side, lowering prices and offering more favorable rates to both brands and retailers.

For example, NuOrder normally only lets brands sign up for 12-month periods on the marketplace. Starting with the CFDA show in September, the company is offering stints for as short as eight weeks for less than $2,000. It’s also lowed annual rates to $10,000 for new brands. According to trade show company Exhibit Solutions, the average cost of a 20-foot by 20-foot booth at a typical in-person trade show could be up to $60,000.

“We’ve been lucky to afford the ability to work with brands on payment terms,” said Wells. “We realize we’re operating on a new paradigm, and we’re going to have to be realistic and approach this differently.”

Faire has also shaken up its prices, but from the retailer side, as opposed to the brand side. For the first time in the company’s history, many of the brands showing at its Summer Market will be offering discounts to retailers of up to 20%, which Faire will match up to 10%. According to Faire CFO Lauren Cooks Levitan, the promotions can be offered since the brands don’t pay anything to join the platform beyond a 15-25% commission, as opposed to the thousands of dollars they might spend just to be listed on a different wholesale marketplace.

Faire mostly specializes in smaller brands, a category that wholesale retailers like Galeries Lafayette have said are where it will put most of its emphasis moving forward, as bigger brands go direct. Promotions will help smaller independent brands get noticed by larger retailers looking to fill their shelves.

“Inventory is always the hardest thing for both the brands and the retailers,” said Lauren Cooks Levitan, CFO of Faire. “How much to make, how much to buy — it’s even more complicated in today’s environment. Retailers and brands could spend thousands of dollars on getting set up on a platform, but we’ve made ours free to join. There’s no cost to join our platform, but we get a commission [25% on a retailer’s first order, 15% on reorders].”

Cooks Levitan said that, based on Faire’s research, nearly 60% of the retailers it works with plan to wait until closer to the holiday season before they make their big holiday purchases, citing the continued uncertainty over inventory. Therefore, the platform that can offer those retailers the quickest turnaround and most up-to-date information are the ones that will likely see the most traction, she said.

Newer technology and a smoother process are nice, but for brands, all a virtual trade show or wholesale marketplace really needs to do is bring in new business. Cara Chen, vp of PatBo, said that in previous years, the company sold at IRL trade shows like Coterie NY, Cabana swim show in Miami and Splash swim show in Paris, but it has not yet done any virtual trade shows.

After a precipitous decline in wholesale business at the beginning of the pandemic, PatBO shifted heavily to DTC, but it has started to see interest from retail partners wanting to re-establish relationships. The brand is now considering returning to wholesale — but Chen said she would only pay to show at a virtual trade show if it could provably bring in “targeted stores at our price point.”

There’s some indication that the effort wholesale marketplaces are putting in is working. Wells said that after a period of significantly lowered wholesale sales in April and May, NuOrder is back up to pre-Covid levels of more than $1 billion per month in sales transactions. NuOrder added 500 new brand partners between April and May. Saks Fifth Avenue joined the platform in June.

But wholesale is still in a rough spot, and it’s going to be hard to convince many brands that it’s valuable and reliable, without serious reservations. Ralph Lauren saw its wholesale business decline by 93% in the last quarter, and brands continue to make significant shifts towards DTC.

And for those sold on wholesale, yet pinching pennies in mid-pandemic, there are workarounds to the marketplace middleman.

“Nothing can replace human interaction, but we have come up with creative and thoughtful ways to bring our collection to life for buyers,” Chen said. “We created a private Instagram account designed exclusively for buyers where they can see, watch and experience the upcoming collection from start to finish, from design to campaign photoshoot. It’s very important to highlight our brand ethos with each buyer, and we’ve found ways to do so virtually. Before each appointment, we send the buyers a curated Brazilian Spotify playlist and our favorite Brazilian Caipirinha recipe.”