Credit Crackdown: Home Borrowers Fall Victim To The Law of Unintended Consequences

Housing

Banks are asking ever more robust questions of wannabe mortgage borrowers, after changes to the credit contracts law came into force this month | Content partnership

Jeremy Couchman and his partner bought their first home six years ago. It’s in the Wellington suburb of Northland, where average prices have more than doubled in the six years since the couple got their toe in the market. According to CoreLogic, Northland’s median property value has risen from $620,500 in 2015, to $1,370,350 now.

They bought the house the year they moved back from a stint in London, and Couchman took a job as an economist at Kiwibank.

“If I’m going to be honest, I would say over this period I’ve been very happy to be a homebuyer, because we’re seeing phenomenal house price growth,” he says.

“I think a lot of people would agree with that – it would have been hard to sit on the sidelines and watch. This is our first home.

“If I was still a first home buyer, it would have been quite hard to swallow. And I imagine it has been for those first home buyers.”

READ MORE:

* Credit law changes pose real problems for ‘borderline’ borrowers

* Govt announces extra protection against loan sharks

* Green light for debt-to-income limits on housing investors

* The pros and cons of debt-to-income restrictions for home loans

Couchman has real empathy for those trying to get that first toe in the housing market, watching the deposits they need to pay rise faster than their weekly earnings. And, he warns, there is a new and unexpected hurdle.

Changes to the Credit Contracts and Consumer Finance Act that came into effect this month were intended to protect cash-strapped borrowers from rapacious High St loan sharks. But some observers argue they are having an unintended consequence for those seeking to borrow to buy a home.

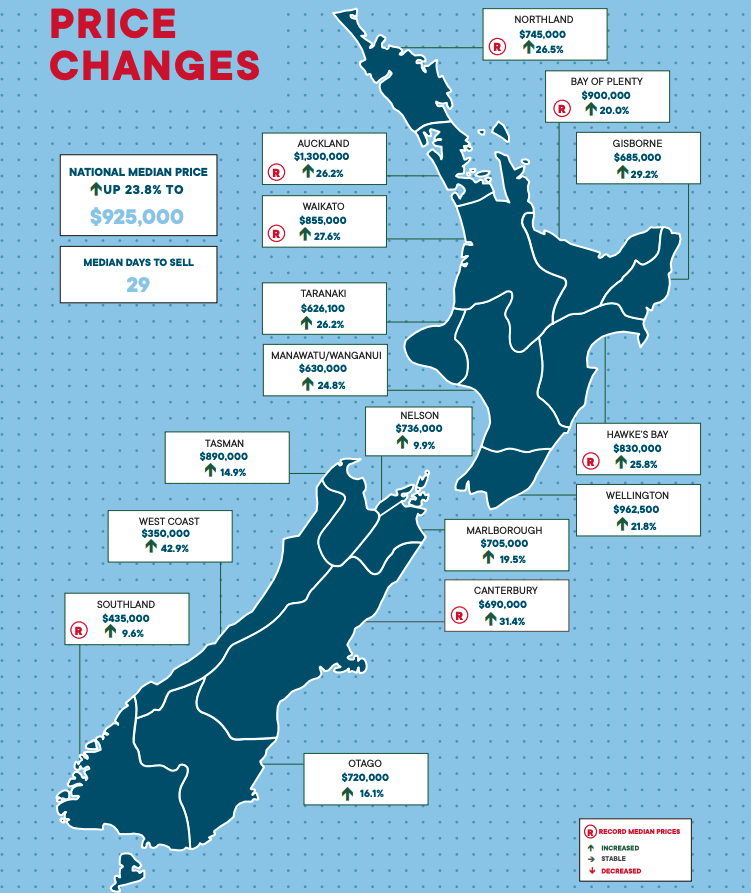

It comes as borrowing hits all-time record highs. The Real Estate Institute reported this week that across the whole country, median house prices hit a new record of $925,000, up 23.8 percent in a year. And the average Auckland house is now $1.3m.

Property buyers borrowed $7.7 billion in October, according to the Reserve Bank, and first home buyers made up $1.45b of that.

Many of those borrowers look exposed as rates rise: $617m was lent to first home buyers with less than 20 percent deposit. That could leave some vulnerable.

Mortgage managers are now looking very closely at potential borrowers’ spending, and may demand to see statements from all their bank accounts at credit cards, not just those at the bank that’s lending them the money.

Phoebe Davis, a partner at Wynn Williams, agrees that it will be tougher to get a mortgage – but she argues that may be a good thing. “My professional view is that mortgage lending is not the target of these legislative changes, rather it was more to combat the increase in payday lending and high interest finance offers.

“That said, it wasn’t an unexpected consequence and with interest rates set to rise it is likely to give some additional security regarding lending by banks.”

She adds: “It is too early to tell whether these changes will have any real negative impact on mortgage lending and in turn the housing market, and then whether there’ll need to be adjustments elsewhere to counter the unintended consequences for those looking to borrow, particularly first home buyers.”

Others believe the new controls, originally designed to protect vulnerable borrowers, might ultimately restrict the supply of credit to those who need it most.

“For the banking sector, they may be a bit more risk adverse around lending to people that are deemed a bit more high risk,” Couchman says. “And so they don’t lend. So that restricts credit further, in the near term.”

– Jeremy Couchman, Kiwibank

This week on Newsroom, Bell Gully lawyers Sophie East and Richard Massey warned the law changes created a real disincentive for lenders to extend credit to “borderline” applicants who cannot clearly demonstrate that they can comfortably afford a loan.

The changes introduced significant new penalties for lenders who breach responsible lending rules, with new, broadly-worded obligations that remain unclear in several important respects.

“Unless there is meaningful clarification on the details of the regulations, lenders will continue to take a conservative approach, at the expense of less affluent borrowers,” they wrote. “The unfortunate result is that these changes, which were intended to protect vulnerable borrowers from ‘loan sharks’, make it all the more likely that many borrowers will have to seek credit from alternative sources.”

Mortgage managers won’t just be looking at borrowers’ spending. Couchman says they will continue to scrutinise income, too, and they have always examined the job security of those on short-term contracts.

“For the banking sector, they may be a bit more risk adverse around lending to people that are deemed a bit more high risk,” Couchman says. “And so they don’t lend. So that restricts credit further, in the near term.

“Banks need to be confident applicants will be able to live within their means if taking on a mortgage means they will have to markedly reduce discretionary spending. Borrowers may have to demonstrate that they can before taking on a mortgage, rather than a bank just taking the applicant’s word for it.”

There is an impact on property investors, too, who are also having their financials scrutinised more closely. This will include occupancy rates (a key driver of income) and factoring in tax changes around interest payment deductibility (which effectively increases the costs of operating a rental property).

Couchman says there is already “some pre-application filtering going on” as applicants realise the new level of information needed for an application. “What we have seen is a significant fall in application numbers over the last few months. But several factors are likely behind this fall, not just CCCFA changes. These include tighter LVRs, rising mortgage rates, rising test interest rates, and changing market sentiment.”

Time will be the test of the extent to which the new law changes do serve not just as a protection for lenders against over-eager High St lenders, but also as a de facto debt serviceability restriction on property investors and home buyers.