Can ‘New Bottega’ Balance Hype, Heritage and Rapid Growth? | Intelligence, BoF Professional

PARIS, France — When rappers Kanye West, Stormzy and Skepta roll up to a fashion event, brands are typically hoping their presence will generate a social media frenzy. Not so at Bottega Veneta’s latest ready-to-wear presentation in October, where photographers only had a brief glimpse of the stars on their way into a closed-door “salon” at London’s Sadler’s Wells theatre. Posting about the event was strictly banned, at least until the brand shows its collection to the public later in November.

Not that there’s been any shortage of posts about Bottega Veneta’s clutches, intrecciato cross-body bags and boots in recent weeks: even with the brand opting out of this season’s Milan Fashion Week, the popularity of its looks among fashion editors, influencers and “It” girls drove social media publicity valued at $27.2 million on US-based accounts alone during the third quarter, consultancy Tribe Dynamics said.

Kanye West with daughter North West arrives at Bottega Veneta Salon 01 London collection

presentation at Sadler’s Wells | Source: Getty Images

Bottega Veneta is on a roll after the brand burst back into fashion’s spotlight last year thanks to designer Daniel Lee‘s “Pouch” handbags, square-toed pumps and belted trench-coats. After years of strictly limiting the marketing of its logo-free products, the brand is trying to strike a new balance between pleasing its base of “stealth wealth” shoppers — loyal clients who prefer the understated clout conveyed by items only recognisable to people in the know — and a push to expand brand awareness among younger clients who favour a sharper, social media-friendly image.

Parent company Kering’s bet that they can have it both ways is working so far: in the third quarter, sales were up 22 percent year on year, even as the coronavirus had most luxury brands reeling. Even absent a pandemic, the figures would have been highly impressive, both for the previously unknown designer, hired from Phoebe Philo‘s former studio at LVMH’s Céline, and for a staid brand whose growth had mostly stalled since it surpassed €1 billion in annual revenue in 2013.

Speaking the day after Kering released its latest financial results, Chief Executive Bartolomeo “Leo” Rongone, who moved to Bottega last year after serving as chief operating officer of the group’s Saint Laurent unit for seven years, attributed its newfound success to the clarity of Daniel’s vision and its popularity among influential clients who are “magnifying” the message online.

While accessories remain the core proposition, the brand has recontextualised its signature “intrecciato” (basket-woven) leather goods, situating those bags in a wardrobe complete with shoes, ready-to-wear and jewellery.

“With Daniel’s arrival, we moved from a single product to a silhouette, and an attitude,” Rongone said. “The financial results are a consequence of that vision.”

With Daniel’s arrival, we moved from a single product to a silhouette, and an attitude.

The brand returned to growth last year, with sales rising 2.2 percent to nearly €1.2 billion, excluding currency shifts. Operating profit declined amid increased investments in marketing as well creating a new design studio in Milan.

In some ways, Bottega Veneta’s revamp has run opposite the current of what’s supposed to make a brand work today. Luxury clients entering the market these days have been more attracted than ever to logo-driven propositions from the biggest brands, but Bottega Veneta was a rare exception, growing faster this past quarter than behemoths like Kering stable-mate Gucci or LVMH’s fashion division, which includes Louis Vuitton and Christian Dior. And, in a handbag market dominated by styles with long straps that free the hands for texting, Lee’s breakout item has been “the Pouch,” a clutch in pillowy cinched leather without a solitary strap from which to dangle it (the brand did add a golden chain to some models this year).

On the other hand, Bottega Veneta’s newfound success is a textbook turnaround for parent company Kering, which has honed a winning playbook for rebooting the luxury brands in its stables. Starting with Saint Laurent, then Gucci and Balenciaga, the Paris-based group’s designer-CEO duos like to hit the market loud and fast, and accelerate from there. The labels revamped their runway collections, brand images and commercial products in a rapid burst, before progressively rolling out a corresponding store concept to keep the momentum going.

The group has reshaped the role of designer from “person who designs ready-to-wear collections” to a sort of branding tsar, whose vision infuses everything from social media posts to store decor to commercial products (perhaps most important, as some runway chiefs take little ownership over the bread-and-butter merchandise their brands actually sell).

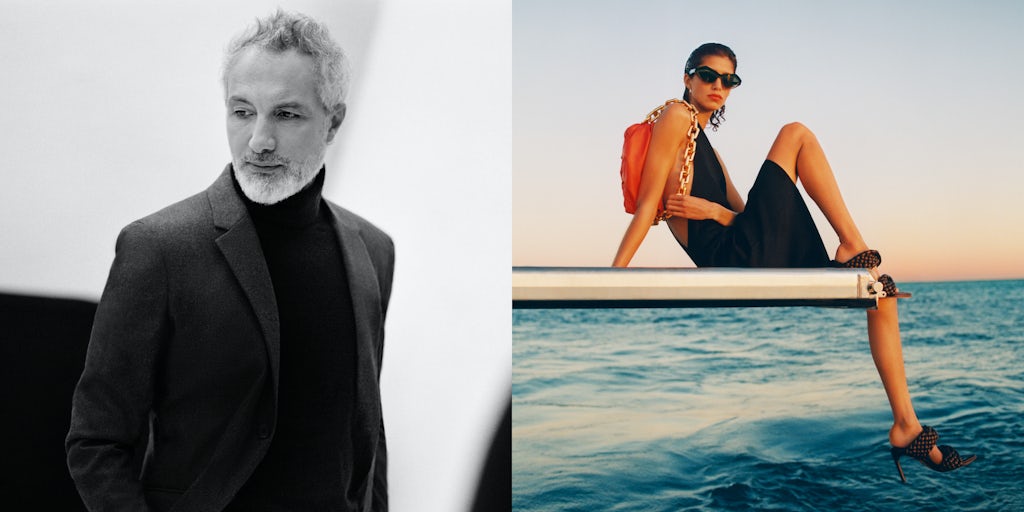

An image from Bottega Veneta’s Fall 2020 Campaign by photographer Tyrone Lebon

Despite working for big and established brands, Kering’s creative directors have managed to deliver head-to-toe concepts more in line with what you’d expect from one of fashion’s designer-founders. That every product Kering’s flagship brand Gucci sells, and every image the house publishes, should ultimately bear the stamp of creative director Alessandro Michele might not sound like a revolution, but it was.

At the old Bottega Veneta, a laser-focus on its suite of logo-free yet recognisable intrecciato bags had driven a roughly 30-fold increase in sales under designer Tomas Maier since Kering, then called PPR, acquired control of the brand along with Gucci in 2001. The brand’s emphasis on highly profitable leather goods and limited marketing expenses — discretion being the appeal — pushed its operating margin as high as 32 percent, close to that of much larger French rival Hermès.

But eventually the brand’s appeal with new clients waned, and after several years of stagnant sales and slipping margins designer Tomas Maier exited the company in 2018.

If Bottega Veneta wanted to win over the next generation of fashion tastemakers, it needed to credibly branch into other product categories and could no longer rely on top-priced, large intrecciato handbags and $400 wallets (Maier had designed ready-to-wear, but the collections were scarcely commercialised). It also needed to find a way to make its logo-free designs a part of the fashion conversation online — not an easy feat for strips of leather on a six-inch smartphone screen.

Since his runway debut in February 2019, Lee’s designs have been eye-catching enough to carry a show, but when taken product-by-product featured no shortage of eminently wearable, saleable items. His vision: sleek yet tactile, minimal but warm, with novelty products that nonetheless maintained a strong connection to the houses’ existing codes, gave Bottega the jumpstart it needed.

“His vision is not only bold, it’s immediate and pure,” Rongone said.

Lee celebrated the house code of intrecciato, but didn’t treat it as sacred: where Maier had privileged orderly, thin strips of leather, Lee magnified the pattern into chunky stripes, criss-crossed them like challah bread, or swapped out the leather for puffer-coat quilted nylon.

“He took the discretion and the intrecciato and injected an incredible amount of creativity to this base,” Rongone said.

He took the discretion and the intrecciato and injected an incredible amount of creativity to this base.

This season, the brand’s breakout item hasn’t been a bag but rather its “Tire” boot — a thick-soled Chelsea style that seems to land somewhere between a combat boot and wellington. The brand has also ramped up its selection of knitwear, belts and jewellery.

Bottega didn’t just diversify its offer — the brand also ramped up its visibility at break-neck speed. From the earliest days of the reboot, starting in summer 2019, scores of the industry’s most popular influencers and fashion editors raced to adopt the look dubbed #NewBottega online, enticed by photogenic products as well as the narrative that Lee had taken up the mantle for intelligent wardrobe dressing from Phoebe Philo.

Some of the fans were also enticed, no doubt, by a PR gifting programme that contrasted sharply with Bottega’s conservative past. (The brand declined to comment on whether the gifting was a large-scale initiative.)

Influencers with Bottega Veneta handbags | Source: @handinfire

Purchased full-price or not, the brand’s bags, shoes and chunky jewellery rapidly became wardrobe staples in the new influencer aesthetic, slipping in seamlessly with their belted blazers and trenches, cropped pants and plain T-shirts. That look has increasingly resonated among shoppers who want to look put-together, but not too dressed up, with a chicer, more discreet bent than Gucci’s colourful maximalism or the ironic fashion of Vetements.

Bottega’s newfound visibility is now driving sales to a younger generation who had previously been unaware of or uninterested by the brand. Clients below 40 years old now make up around 60 percent of sales, versus less than half last year, Kering said in a presentation last week.

Those younger consumers are the key to growth. Last year, sales to millennials and Gen-Z accounted for all of the luxury industry’s growth, according to Bain. And, as those consumers are often highly connected online, they can feed a virtuous cycle as interest in the brand trickles from top bloggers to a wider cast of influential consumers who are willing to post for free. On China’s Little Red Book social network, a favourite hub for the selfie-prone shoppers known as “Key Opinion Consumers,” a brand hashtag that translates as “BVlovecenter” was used 400,000 times.

Even during lockdowns, when stores were shut, sales associates kept getting orders from new clients who had tracked down their contact details through friends, Rongone said.

While he’s welcomed the flood of new consumers, Rongone says the brand is also focused on building loyalty. It rebranded the collections typically referred to as “Pre-Fall” and “Pre-Spring” as a series of “Wardrobes,” with the intention that clients should be able to build up a Bottega Veneta silhouette by adding new items each cycle. In the brand’s stores, bolder statement pieces are still balanced out by plenty of muted, if refreshed, options to cater to the tastes of long-standing clients.

“It’s very coherent,” Rongone said. “Daniel isn’t changing things just to change.”

It’s very coherent. Daniel isn’t changing things just to change.

With more frequent aesthetic revamps the norm, “we worry less now about alienating an established base,” Linda Fargo, senior vice president and womenswear director at Bergdorf Goodman, said. “Whether the excitement and sales momentum is sustainable is what we all hold our breath and hope for.”

So far, she isn’t worried. “After just seeing his Spring collection, we are further reassured that this reset isn’t ephemeral,” Fargo said.

Social media and search data also indicate that demand for the new look remains robust. In the US, the brand’s earned media value is up 166 percent this year, compared with an average 27 percent gain for the top-10 luxury fashion brands, according to Tribe Dynamics. Fashion aggregator Lyst said searches for Bottega bags in 3Q were up 89 percent, versus a 31 percent increase for handbags overall.

But just how far and how fast does Bottega Veneta plan to go? Kering has said it plans to keep growing Bottega mostly by updating rather than adding to its existing fleet of 264 stores. An opening in Miami’s Design District last autumn was the first store to be renovated to reflect Lee’s new concept, before coronavirus put such projects largely on hold.

The brand is set to resume the rollout soon, with a store in Omotesando, Tokyo reopening in January, targeting a “more joyous” atmosphere and playing up ties to the Venice region with signatures like palladiana terrazzo flooring.

Other initiatives include moving its e-commerce operations in-house early next year, which will facilitate ramping up omnichannel services and distance sales (leaning into the one-to-one distance service store associates had been doing during the coronavirus lockdowns).

Kering CEO François-Henri Pinault said he was counting on Rongone’s “passion and energy to realise the full potential of the new creative force at Bottega Veneta.”

Rongone said he was confident in keeping up the momentum, but neither he nor Kering would provide details of the scale or pace of growth they’re targeting at Bottega Veneta over the longer term.

One hint could be Rongone’s track record at Saint Laurent, however, where sales never exploded as at Gucci, but steadily climbed by double-digits under CEO Francesca Bellettini for as many as 38 consecutive quarters from 2010 to 2019. Another could be Bottega Veneta’s long-standing strategy of positioning itself as a sort of Italian Hermès — even if that comparison is one the current team no longer employs.

“Things have changed, but Hermès is probably still in the back of the mind of the management team,” Thomas Chauvet, analyst at Citi Bank said. That could imply a more moderate approach to scaling up than parent company Kering has taken at Gucci and Balenciaga. “I don’t think they’re expecting a Gucci-style renaissance,” Chauvet said. “It’s going to be a slower evolution.”

The pre-Lee stagnation also underscored the need for more aggressive marketing. “Brand awareness was not high enough” for the Bottega Veneta, which hasn’t been internationally famous for as long as some rivals, Chauvet said.

Asked whether the surging sales and popularity could undermine the brand’s long-standing reputation for discretion, Rongone said, “Our values remain the same whether Bottega Veneta is in the spotlight or not.”

“I don’t think there is a risk of brand trivialisation on the horizon — on the contrary,” Luca Solca, analyst at Bernstein, said. “Even taking into account the faster competitive tempo in the industry, this should propel Bottega Veneta for quite a few years more.”

Related Articles:

How Daniel Lee Reinvented Bottega Veneta

BoF Exclusive | Carlo Beretta on Operation ‘€2 Billion Bottega Veneta’