Can Fashion Keep Up Its Geopolitical Balancing Act? | This Week in Fashion, BoF Professional

This week, major fashion brands including H&M, Nike, Adidas, Burberry, Calvin Klein, Converse and Uniqlo came under attack over their stance against sourcing cotton from China’s Xinjiang region. Chinese netizens called for boycotts after a year-old statement from H&M saying the brand would no longer use cotton sourced from Xinjiang resurfaced on social media, igniting a firestorm that soon engulfed several other brands.

On Wednesday, H&M products were swiftly removed from China’s major e-commerce platforms, including Alibaba’s Tmall and JD.com and at least one H&M store was shuttered. Meanwhile, Nike products were stripped from China’s biggest sneaker resale site Dewu. And Chinese brand ambassadors have cut ties with several major fashion labels, including Adidas, Burberry, Calvin Klein, Converse, H&M, Lacoste, Nike, Puma, Tommy Hilfiger and Uniqlo.

At the heart of the storm are reports that over half a million Uighurs and other Turkic Muslim minorities are being coerced into picking cotton in Xinjiang, which produces 20 percent of the world’s supply. In the West, these reports have startled shoppers, angered politicians and stained major fashion businesses, which have been unable to guarantee their supply chains are clean amidst growing calls for accountability on what has become a major human rights issue.

But in China — where the government has flatly denied the use of forced labour, describing Xinjiang’s work camps as intended to uplift incomes and counter extremism — many are suspicious of Western motives and see the stance against Xinjiang cotton as not only biased but anti-Chinese, a view stoked by Chinese officials and echoed by influential celebrities who have severed relationships with “disrespectful” brands.

“Want to make money in China while spreading false rumours and boycotting Xinjiang cotton? Wishful thinking!” said the Communist Youth League, a Communist Party group, in a Weibo post. Meanwhile, state-controlled CCTV took aim at H&M, saying it was “a miscalculation to try to play a righteous hero” and that the company would “pay a heavy price for its wrong action.”

The campaign against the brands began just two days after the EU, the US, the UK and Canada imposed sanctions on Chinese officials for human rights violations in Xinjiang in a coordinated action that prompted retaliation from Beijing, which has blacklisted European and UK officials, ratcheting up tensions that were already running high after the US and China traded barbs in their first high-level meetings since the start of the Biden administration.

As geopolitical friction rises, the fallout over Xinjiang demands an increasingly difficult balancing act from fashion brands.

For years, brands have faced growing pressure from Western consumers and regulators to adopt more responsible business practices and clean up supply chains where labour abuses and environmental pollution are a problem. Young people, in particular, expect brands to take a stand on wider socio-political matters, too, embracing values that align with their own.

But these same brands depend heavily on consumers in China, the world’s largest fashion market and the only major economy to have contained Covid-19 and returned to steady growth. And many Chinese consumers hold radically different views to those of their Western counterparts on hot-button geopolitical issues in their immediate orbit where many Chinese feel under attack, from Xinjiang’s work camps to democracy in Hong Kong to the status of Taiwan.

In recent years, Chinese netizens have taken issue with brands they have seen as insulting, such as Dolce and Gabbana. But far more have been targeted over perceived transgressions with a geopolitical charge. Coach, Givenchy, Gucci, Fendi and Chanel have all been attacked for listing Hong Kong and Taiwan as separate countries on clothing and e-commerce sites rather than integral parts of China, as they are viewed by Beijing and most mainland Chinese.

Thus far, brands have managed a tricky tightrope walk, trying to balance concerns on both sides of the growing geopolitical divide. But as fashion brands are swept up in a “new cold war” between the US and China, and the reports from Xinjiang leave little room for manoeuvring, is this high wire act increasingly implausible?

For many brands, there is simply no going back on their commitments to get out of Xinjiang’s cotton fields, as Western governments move to turn what was already a moral hazard and a growing public relations problem into a legal obligation.

In January, the US said it would ban all products made from Xinjiang cotton unless brands are able to prove that their supply chains are free of forced labour. Canada and Britain have also introduced import restrictions on goods linked to Xinjiang. Meanwhile, the European Parliament aims to pass legislation holding brands liable for selling products made with forced labour, meaning Adidas could be tried in Germany under EU law for using Uighur cotton.

“We are at a turning point where all these brands will have to choose: either to prioritise their trade relations with China or to stop profiting from Uighur forced labour,” wrote European Parliament member Raphaël Glucksmann in an email to BoF. “The EU can have a decisive influence on the choice which these multinationals must make.”

Some have suggested that brands take a “dual track” strategy to Xinjiang cotton (much like many “cruelty-free” beauty players did when faced with China’s animal testing requirements) whereby brands sell products made with Xinjiang cotton only to Chinese market. But a two-tiered approach is unlikely to fly with Western governments or consumers.

To try and protect themselves from becoming future targets, brands can do their best to pull strings with Beijing, which has incredible power to shape the narrative in Chinese society. Some have made strategic hires in China to cultivate deeper relationships with the Chinese government. But as new laws take shape in the West, there may simply be no way for brands to avoid the wrath of China’s netizens, at least on the issue of Xinjiang.

Shares in targeted brands slid this week. And yet it remains to be seen whether the firestorm will actually result in lasting damage to reputations and sales. While Dolce and Gabbana has suffered significantly from Chinese boycotts, previous state-backed campaigns targeting brands like Apple and Volkswagen have failed to dent consumer demand.

As for the current firestorm, H&M has so far been hit the hardest. For the moment, its products remain scrubbed from China’s major e-commerce platforms and some shoppers have posted pictures of recently returned items on social media. According to news reports, shoppers are still streaming into the brand’s most popular retail outlets in Shanghai and Beijing. But the true test for H&M and others will come this weekend, next week and the weeks and months ahead.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Line in front of End Clothing store in London. End.

Carlyle takes majority stake in End. as streetwear deals heat up. The deal values the menswear retailer at $1 billion. Co-founders Christiaan Ashworth and John Parker will retain a significant minority stake and remain co-CEOs.

Burberry, H&M, Nike and others lose China ambassadors over Xinjiang. Nike brand ambassadors Wang Yibo and Tan Songyun have announced via statements on social media platform Weibo that they are ending their affiliation with the US sportswear giant over its decision to not use cotton sourced from the Xinjiang region.

Richemont shares rise after reports it rejected Kering’s approach. Miss Tweed wrote late on Sunday that Kering chief executive François-Henri Pinault directly made a cash-and-shares merger proposal to Johann Rupert, Richemont chairman and controlling shareholder.

Former Gap CEO Art Peck launches $200 million SPAC to buy fashion brands. Peck filed paperwork earlier this week with the Securities and Exchange Commission to raise money for a special purpose acquisition company (SPAC) called Good Commerce Acquisition Company. Peck plans to buy companies that sell apparel, accessories and home goods, among other products.

EssilorLuxottica gains EU okay for $8.5 billion Dutch buy. The Ray-Ban maker will acquire GrandVision for €7.2 billion ($8.5 billion) after pledging to sell more than 300 stores in three countries to address competition concerns.

Shinsegae, Naver to launch luxury e-commerce platform. Following last week’s deal in which Naver and Shinsegae bought around $221 million worth of each other’s shares, the South Korean retail group and tech giant’s shopping platform could streamline Shinsegae’s logistics and boost merchandise volume, while strengthening Naver’s advertising, e-commerce and fintech services.

China to host its first Hanfu expo. The once-niche market is booming as China’s younger generation becomes more enthusiastic about traditional culture. The event, to take place in Henan province’s Xiuwu county from May 7 to 9, will include fashion shows, economic forums and cultural events catering to both consumers and industry insiders interested in the traditional costume movement.

UAE retail recovery predicted by end of year. The Dubai Chamber of Commerce and Industry predicts retail sales in the United Arab Emirates will rebound and grow by 13 percent to reach $58 billion by the end of this year, boosted by the roll out of Covid-19 vaccinations and Expo 2020 Dubai.

South Korea’s retail sales growth hits two-year high. Online and offline revenue grew 10 percent last month from the same period in 2020, the sharpest increase since January 2019, a report released by the country’s Ministry of Trade, Industry and Energy revealed Thursday.

UK retail is failing on diversity measures, report shows. Fewer than 10 percent of chief executive officers in retail are women, while fewer than 6 percent of executive committees have Black or ethnic minority representation, according to the survey carried out by the British Retail Consortium, the executive search firm MBS Group and consultancy PwC.

THE BUSINESS OF BEAUTY

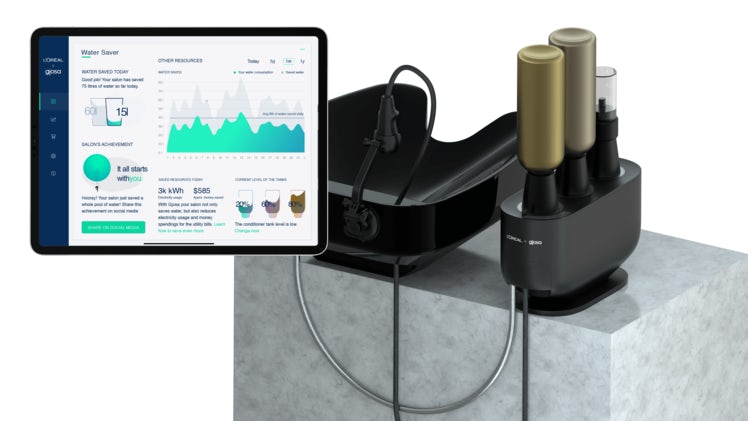

L’Oréal and Gjosa’s water-saving technology. L’Oréal.

L’Oréal takes a minority stake in environmental tech start-up Gjosa. The beauty giant is backing the five-year-old Swiss company, which develops technology aimed at saving water and energy, it announced in a statement. The companies have worked together since 2015 to optimise shampoo rinsing technologies. The investment was made through its corporate venture capital fund, Business Opportunities for L’Oréal Development (BOLD).

Indian beauty e-commerce platform Purplle raises $45 million. The e-commerce platform is looking to expand its presence in the world’s second largest online market, according to a TechCrunch report. The Series D round values the start-up — which has raised $95 million to date — at about $300 million.

PEOPLE

Alegra O’Hare, Global Chief Marketing Officer at Tommy Hilfiger. Tommy Hilfiger.

Alegra O’Hare appointed global chief marketing officer at Tommy Hilfiger. O’Hare will replace Michael Scheiner, who left the company in October, and will report to president and chief brand officer Avery Baker. Her new role, effective April 12, will encompass the development and implementation of global marketing strategies to engage with a range of generations of consumers.

Condé Nast names Jackie Marks chief financial officer. The executive succeeds Mike Goss, who was appointed at the end of 2019, in the position. She recently held leadership positions at asset management firm Mercer and media company Thomson Reuters, and will be Condé Nast’s first female CFO.

Osman Ahmed appointed fashion features director at i-D. The announcement of Ahmed’s promotion comes after two years at i-D spent as fashion features editor. In his new role, Ahmed will be responsible for overseeing i-D’s fashion coverage, writing and editing features across print and digital as well as special projects.

Cai Xukun is the new face of De Beers. Luxury jewellery house De Beers has officially named 22-year-old singer and actor Cai Xukun as its new brand ambassador, accompanying the announcement with the release of a commercial shot by Cai. The announcement of his ambassadorship on De Beers’ official Weibo account had more than two million likes and comments, making it the most engaged-with post De Beers has ever had on the platform.

MEDIA AND TECHNOLOGY

YouTube blogger reviewing products. Shutterstock.

YouTube begins trial of automatic product detection in videos. The platform will conduct a beta trial of the related products feature — which will make it easier for influencers to share products, and YouTube to get a cut of any sales — in the US.

Ted Baker became the first fashion brand with a ‘Club’ on Clubhouse. The British label is launching a branded-content series on the audio-only platform hosted by Abraxas Higgins, an active Clubhouse user with 370,000 followers on the app. Guests like artists Greta Bellamacina and Kojey Radical, both of whom appeared in Ted Baker’s most recent campaign, will participate in the discussions.

JD.com to invest $800 million in Dada Group. The investment, which will give the e-commerce firm a 51 percent stake of the grocery and delivery firm, comes at a time when JD.com is spinning off its logistics business, the in-house delivery network that gave it a competitive advantage over larger rival Alibaba Group.

Compiled by Joan Kennedy.