Can China Help Save Brands Again Next Year? | China Decoded, BoF Professional

It’s likely that fashion sales in China will return to pre-crisis levels within a year of Covid-19 causing widespread shutdowns in the country in early 2020.

This prediction, from The Business of Fashion and McKinsey & Company’s State of Fashion 2021 Report, seems extraordinary in some ways, especially considering the long road many other markets appear to face before reaching fashion sales comparable to those of 2019.

The speed of the predicted recovery — by Q4 2020 in an earlier scenario and by Q1 2021 in a later scenario, outlined in the report released this week — has even surprised some fashion industry insiders in China.

In other ways, though, it’s not surprising at all. The country’s consumption rebound has been well documented, with retail sales returning to positive territory in August and global brands, from beauty companies like Estée Lauder, to sportswear players Nike and Lululemon and luxury conglomerates, including LVMH and Kering, showing strong growth in the market, buoyed by consumers forced to spend money at home instead of shopping trips abroad.

It is more important than ever for brands to make themselves visible, attractive and available to Chinese consumers in the mainland .

With widespread international travel unlikely to resume for much of next year, it is more important than ever for brands to make themselves visible, attractive and available to Chinese consumers in the mainland .

“I have clients doing three times the business in China they did last year,” said Amrita Banta, managing director of Agility Research and Strategy. “Next year, China will be even more at the centre [of global business] than before. It’s really going to be China that everybody is looking towards.”

This means sharpening China-centred digital strategies and, for most brands that haven’t already done so, partnering with one of the country’s major e-commerce platforms. It will also require brands to rethink their physical store networks by considering increased investment in their China properties even as they make closures elsewhere in the world.

More Stores in More Cities

Though it’s never wise to place all of one’s eggs in a single basket, there have been some pretty compelling arguments in favour of the Asia-Pacific basket, and particularly its China portion, over the last half of this year.

A long line of customers outside the Gucci store in Chengdu’s International Finance Square. Getty Images.

According to analysis in The State of Fashion Report of 311 fashion companies that disclose regional sales figures, brands generating more than 30 percent of annual sales in the Asia Pacific (APAC) region — including Mainland China, Japan, South Korea and Taiwan — achieved higher market valuations during the pandemic than their counterparts. On average, APAC-focused companies boasted a market cap that was 18 percent higher than their competitors.

Brands including Montblanc, Hublot and MSGM are targeting Asia for new store openings, reflecting the region’s economic growth potential and its status as a safer haven at a time of contraction elsewhere.

Store numbers for top luxury brands in China rose 4 percent in the first half of 2020, while those for cosmetics brands jumped 8 percent, according to a report by property consultancy Savills. Here, where the offline market is expected to grow by up to 5 percent in 2021, compared to 2019 levels, many brands will need to expand their physical footprint to meet surging domestic demand.

Amrita Banta says there has certainly been a renewed focus on expanding Chinese retail networks amongst her clients, some of whom are looking at Tier 3 and even Tier 4 cities as future steps in an expanded China strategy.

“Brands realise there is a whole universe out there that does have the money; [lower tier Chinese consumers] are trading up. There is going to be less international travel and it costs much less to travel within China and we find a lot of that travel budget has moved into luxury goods,” she said.

Banta’s team are looking at cities such as Luoyang, a third-tier city in Henan Province with a population of 6.5 million that was once an ancient dynastic capital, as potential new markets for expansion.

Hainan Island, too, will be on the radar of many brands, with government policies giving the island special on-shore duty free status from July 1, 2020, a move that led to duty free sales on the island growing by 218.2 percent to 10.85 billion yuan ($1.6 billion) from that date to October 19, according to official figures from the Hainan Provincial Bureau of International Economic Development (Hainan IEDB). This in turn helped China Duty Free Group become the world’s number one duty-free retailer by turnover this year, according to analysis by The Moodie Davitt Report.

Brands realise there is a whole universe out there that does have the money; lower tier Chinese consumers are trading up.

Market research firm Kantar Worldpanel’s China general manager, Jason Yu, says that while Hainan Island will remain a force over the next 12 months because of the trapped Chinese consumer spend, he would expect travel opening to nearby international duty free strongholds, including Japan and Korea, which could begin to offer greater competition over that period.

“[Hainan Island] won’t replace people’s desire for international travel,” he said. “It’s not just about shopping, it’s also experiencing a different culture and lifestyle with the added benefit of shopping for international products with lower prices. In year one, to satisfy the immediate demand, people [went to Hainan] a lot, but in year two [of the pandemic period] people will have to think about the value equation.”

Though safety concerns are likely to curtail long-haul travel for some time, there is evidence of a pent up desire for international travel that is likely to benefit Asian destinations that have done a good job of controlling their own Covid-19 outbreaks.

A livestreamed program on July 1 hosted by China’s largest online travel agency, Trip.com, and the Seoul-based Korea Tourism Organisation that was selling South Korean tours and hotel packages attracted more than 2 million viewers and sold out of the hotel vouchers on offer, Korea’s Yonhap News Agency reported.

“Many travel lovers have been waiting for a long time to go overseas,” Wendy Min, director of international affairs at Trip.com Group, told The China Daily. “The industry may see ‘revenge travel’ after the pandemic, when there is a vaccine and when international flights are resumed.”

Sophisticated Digital Opportunities

Boxes at an e-commerce warehouse facility. Shutterstock

The impressive growth in beauty sales online in China this year has been largely driven by discounts, as major international brands battled for wallet share among Chinese consumers, offering lower prices through channels such as livestreaming in order to consolidate their customer base.

“This is really changing the market dynamics and is seeing all the big brands getting stronger,” Yu said.

“They have the opportunity to manage those users in a more effective way than in the department store age. Now there are so many different ways to engage those customers digitally. They are paying a price to acquire those users but the longer-term value can be quite substantial for these big brands,” he added.

For luxury brands, 2020 marked a turning point in the embrace of e-commerce and Chinese e-commerce platforms in particular. According to figures from Alibaba more than 200 global luxury brands — including Balenciaga, Prada and IWC — participated in Singles Day activities on its platforms alone.

JD.com, meanwhile, said the transaction value of goods from more than 130 luxury brands surged by 100 percent year-on-year in the first 30 minutes of sales.

Even with impressive growth this year, there is still plenty of room for luxury e-commerce to grow in China in 2021.

“E-commerce is huge in Asia, but when you look at luxury, it’s still very nascent. That’s something that not everybody understands,” said Grégory Boutté, Kering’s Chief Client and Digital Officer. “We’ve opened flagship stores for some of our brands on [Tmall’s] Luxury Pavilion and we’re also opening WeChat stores. This is an extremely fast-moving market where we see new platforms and new usage happening all the time.”

While the lack of international travel removes a major gateway for new brand discovery, the desire to discover new brands remains.

All this is not to say that the rebound in consumption for major brands doesn’t also mean opportunities for smaller niche and international players in China. Again, while the lack of international travel removes a major gateway for new brand discovery, the desire to discover new brands remains.

According to Mike Hu, Alibaba Group vice president and general manager of Tmall Luxury, Fashion and FMCG, attracting niche international brands to Tmall is one of the e-commerce giant’s main priorities for 2021.

“We hope to add more…labels that may be well-known in their home markets and have a long history but remain unknown to Chinese consumers. We’re trying to find ways to accelerate their journey and find success here,” Hu said.

The biggest challenge for global fashion and beauty brands looking to China over the next 12 months will be finding equilibrium: to balance investments in both online and offline channels, while building relationships and experiences for consumers across online and offline.

At a time in which global budgets are stretched, and operating costs in China, particularly in the online space, are rising, striking this balance will be difficult, but the stronger the ties that bind brands to Chinese consumers are now, the better placed brands will be to win new and returning business at home, as well as overseas, when that becomes a possibility again.

时尚与美容

FASHION & BEAUTY

Looks from Ms Min’s new menswear collection. Ms Min.

Ms Min Hosts Exhibition in Shanghai, Launches Menswear

One of China’s most respected home-grown designer fashion brands, Ms Min, is wrapping up its 10th anniversary year with an exhibition in Shanghai this week, in conjunction with acclaimed architecture and design firm Neri&Hu. Though their creative disciplines differ, similarities between Ms Min and Neri&Hu abound, with both creative businesses run by married couples (Liu Min and Ian Hylton at Ms Min and Lyndon Neri and Rossana Hu at Neri&Hu) and both companies known for incorporating traditional Chinese elements into their designs, while simultaneously re-imagining those traditions in new and modern ways. The brand is also unveiling its first menswear collection at the event. Dubbed Xiansheng (or Mister, in Chinese) the collection is designed by Hylton, a former Ports 1961 menswear designer and set to officially launch December 15. (Press release)

JD.com and Perfect Diary Battle for $1 Billion J-Beauty Deal

As The Business of Fashion predicted back in July, the second half of the year has seen M&A hotting up in China’s beauty sector, with numerous deals being done, many of them involving the recently-listed Yatsen Holdings, parent company of C-Beauty giant, Perfect Diary. And so it is with news this week that the company, as well as e-commerce behemoth JD.com, are among those interested in paying an estimated $1 billion for the rights to sell Japanese skincare brand Fancl in Asia (ex-Japan). The brand, which was established in 1980 and is known for its preservative and additive free skincare, reported sales in fiscal year 2019 of 122.4 billion yen ($1.17 billion), of which overseas market sales accounted for only 8 percent. The company has said in the past it hopes to increase this percentage to 25 percent by 2030. (Jiemian)

科技与创新

TECH & INNOVATION

Beauty blogger Austin Li Jiaqi applies lipstick while livestreaming on the e-commerce platform Taobao. Getty Images.

Li Jiaqi’s Company Fined for False Advertising

A company in Shanghai that is 49 percent owned by celebrity livestreamer Li Jiaqi, has been fined 10,000 yuan ($1,524) for false advertising. Market regulators received a tip-off that a Ficcecode branded shampoo bought online from Shanghai Zhuangjia E-Commerce Co Ltd did not have an anti-alopecia function as claimed, Shanghai’s market regulating body said. The company failed to provide relevant proof to support the claim, violating China’s advertising laws, the administration added. China’s stringent advertising laws have long been a concern for those with interests in the livestreaming industry, with the fast-talking, hard-selling style of livestreaming e-commerce popularised in China by the likes of Li Jiaqi and Viya making it easy for exaggerated claims to slip into broadcasts, causing them to fall foul of authorities. (Shine)

US-Listed Chinese KOL Incubator Looks to Go Private

Ruhnn Holding, a Chinese company that operates e-commerce stores in the names of its roster of online influencers, may say goodbye to the Nasdaq little more than a year after its listing there, as the US government moves to crack down on Chinese companies on American stock exchanges. Hangzhou-based Ruhnn’s board has received an offer to take the company private from three founders, Feng Min, Sun Lei and Shen Chao, according to a company statement. The trio proposed to purchase the American depositary shares (ADSs) they do not already own for $3.40 each, representing a discount of more than 70 percent on Ruhnn’s offer price of $12.50 in April last year. In the third quarter, Ruhnn saw its net revenue drop by 9 percent year-on-year to 248.5 million yuan ($36.6 million), which the company blamed on sluggish product sales, which slumped 38 percent year-on-year during the period, according to its latest earnings report. (Caixin Global)

消费与零售

CONSUMER & RETAIL

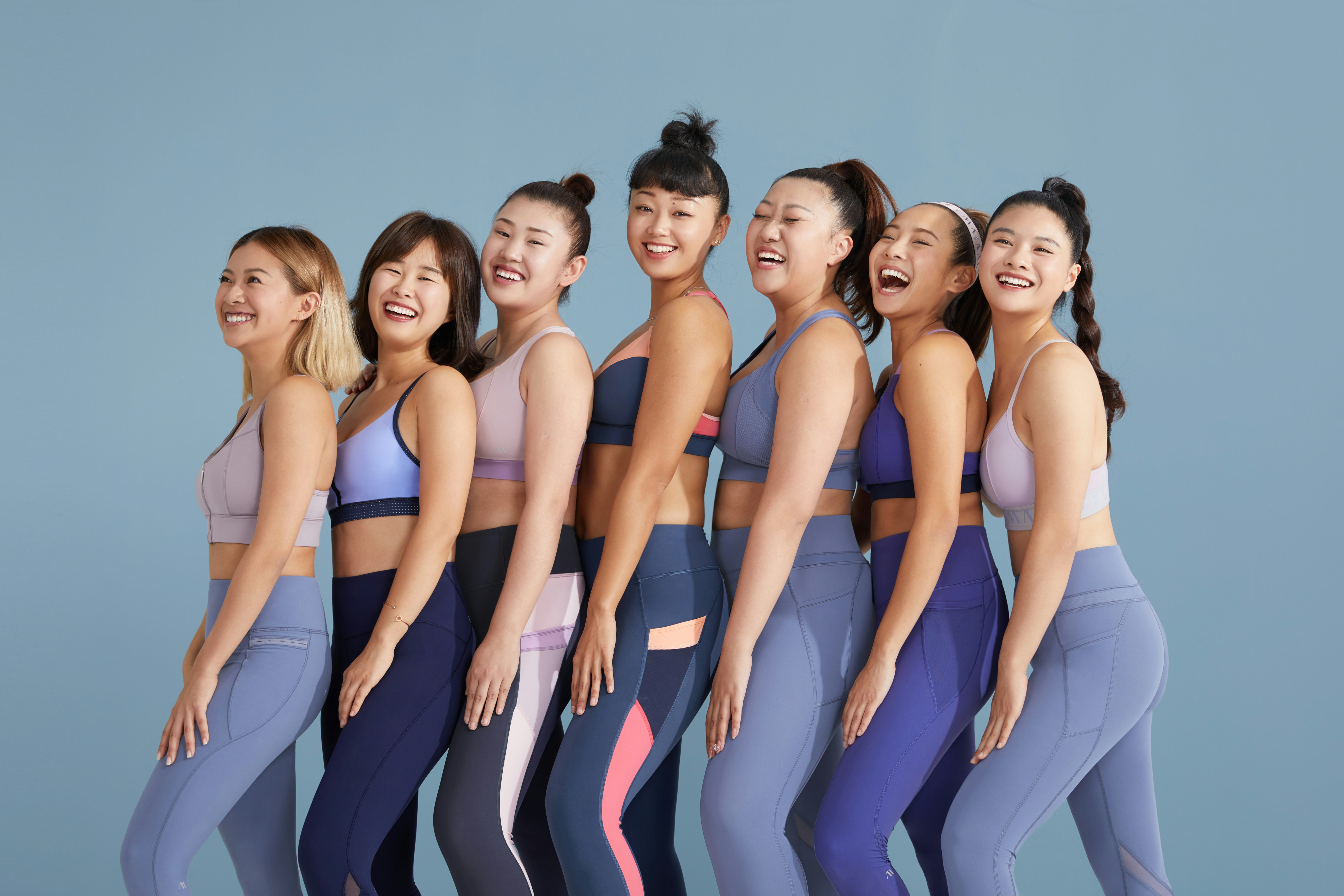

A Maia Active campaign image. Maia Active.

Maia Active to Open 20 New Stores Next Year

Domestic designer sportswear brand Maia Active has been riding several concurrent trends in China’s post-pandemic consumer market, in particular an increased focus among young women, in particular, on health and wellness, as well as a greater acceptance of Chinese brands among younger consumers. Now, the brand has completed its B round of financing, amounting to nearly 100 million yuan ($15.24 million). Maia Active plans to use the capital injection to more aggressively expand its physical retail footprint around China, with plans to add 20 more stores next year to its current roster of five offline stores in Beijing, Shanghai and Guangzhou. (Ladymax)

China to Overtake the US as the World’s Largest Consumer Market ‘Very Soon’

Lian Weiliang, deputy chairman of China’s nation’s top economic planning agency, told the China Reform Forum over the weekend that China would “very soon” overtake the US as the world’s largest consumer market. Lian cited the fact that China’s retail sales surpassed 40 trillion yuan (around $6 trillion) for the first time in 2019, an increase of over 42 percent from 2015. According to the US Census Bureau, the country’s retail sales totalled $6.2 trillion in 2019. The news comes after China surpassed the US as the world’s largest fashion market in 2019. Moreover, new a Bain report predicts that China will become the world’s biggest luxury market by 2025. (South China Morning Post)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

Workers in a factory in Hotan county, Xinjiang, China. Shutterstock.

US Businesses Press to Water Down Xinjiang Forced Labour Bill

Nike and Coca-Cola are among the major companies lobbying Congress to weaken a bill that would ban imported goods made with forced labour in China’s Xinjiang region, The New York Times reports. The bill would prohibit broad categories of goods sourced from Xinjiang in an effort to crack down on human rights abuses and has bipartisan support. Lobbyists have fought to water down some of its provisions, however, arguing that while they strongly condemn forced labour and in Xinjiang, the act’s ambitious requirements could wreak havoc on supply chains that are deeply embedded in China. Greg Rossiter, the director of global communications at Nike, said the company “did not lobby against” the Uyghur Forced Labour Prevention Act but instead had “constructive discussions” with congressional staff aides aimed at eliminating forced labour and protecting human rights. (The New York Times)

China’s Factories Expand at Fastest Pace in Years

China’s factory activity expanded at the fastest pace in more than three years in November, while growth in the services sector also hit a multi-year high, as the country’s economic recovery from the coronavirus pandemic stepped up. Upbeat data released on Monday shows manufacturing now at pre-pandemic levels. China’s official manufacturing Purchasing Manager’s Index (PMI) rose to 52.1 in November from 51.4 in October, data from the National Bureau of Statistics showed. It was the highest PMI reading since September 2017. The Caixin/Markit Manufacturing PMI (which focuses on small and medium-sized firms) rose to 54.9 from October’s 53.6, the highest reading in a decade. Analysts expect China’s economy to grow about 2 percent in 2020, the weakest since 1976 but still far stronger than other major economies. (Reuters)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent [email protected].