What’s a Store For? | This Week in Fashion, BoF Professional

This week, retailers in the UK have been readying their stores for Monday’s reopening after a months-long lockdown. In the US, retail has already reopened across the country. But as governments in key Western markets ease Covid restrictions in response to falling infection rates, luring consumers back to physical stores may not be easy. While recent traffic to fashion retailers in the US is way up over last year, it’s still significantly behind 2019 levels.

According to psychologists, it takes an average of two months for people to form new habits. More than a year into the pandemic, it’s safe to say that the shift to e-commerce has resulted in new digital habits that shoppers are unlikely to unlearn just because stores reopen.

Also liable to linger are the traumas associated with crowds of people and touching things. And while continued virus containment measures, from mask-wearing to social distancing, help to mitigate these fears, they also detract from the full physical shopping experience.

At the same time, the work-from-home revolution means many people no longer commute to city centres where fashion retailers tend to be located in the first place and with international travel still largely grounded, tourist traffic will be sorely missed.

But underlying these factors is an even deeper question that the pandemic has made more urgent than ever: what is the purpose of a physical store in the digital age, anyway?

The original concept of the store as a mere storage and distribution hub was dead long before the internet. The best fashion retailers have always offered novel services and entertainment value alongside access to products. But the mainstreaming of e-commerce put new pressure on stores to deliver things people couldn’t get online, something the pandemic has only dialed up.

More than ever, physical retailers cannot simply depend on nicely curated and merchandised product selections. No longer a necessary stop on a Saturday afternoon, stores must instead learn to compete for precious leisure time with art galleries, restaurants, concerts and parks.

“It’s like a theme park,” said Selfridges buying director Sebastian Manes of the UK department store chain’s uncanny ability to pack its stores with people by selling the experience of shopping itself. Its flagship on London’s Oxford Street is reopening on Monday with an outdoor SoulCycle studio, a Pangaia pop-up and a new “experience concierge” offering everything from floristry classes to children’s parties in the toy department. “It’s about having fun,” added Manes.

On nearby Brook Street, Farfetch-owned Browns is making its own case for physical retail with a new Dimore Studio-designed, technology-infused store complete with art installations and a restaurant that extends onto an outdoor courtyard. Meanwhile, a few miles away in Belgravia, Anya Hindmarch is opening a five-store “village” that features an “Anya Cafe” and a hair salon serving cocktails with its blow-dries, the first in a series of pop-ups.

“Shopping is a pastime,” said Browns managing director Paul Brennan, who sees the store as a platform for “experience and connectivity that’s not available online” and is measuring success not in sales per square foot, once the holy grail of retail metrics, but in terms of customer engagement, tracking things like how much time visitors spend with in-store technology.

According to retail guru and BoF columnist Doug Stephens, brands must put the distribution of experiences, not products, at the very centre of their strategies. “Just displaying products nicely with a bolt-on café is not good enough,” he said. “The store is a stage and a studio. It’s about drama, theatre, animation. It’s about building and broadcasting experiences.”

This requires an approach to production and a cadence that’s more like television than traditional retail. It also has profound implications for the role stores ultimately play in the sales funnel. Retailers have traditionally used marketing to drive people to stores where they can buy things. But the rise of e-commerce, supercharged by the pandemic, is flipping the funnel, pushing transactions online while turning stores into stages for marketing experiences.

“Experiences are essentially an amalgamation of content,” added Stephens. “We must stop looking at retail as product distribution and start looking at retail as a media channel. The key metric is the store’s media value. What would 10 minutes of engagement be worth on Facebook? Now, remember that each minute spent in a store has exponentially higher value.”

For retailers, seizing the opportunity means fundamentally reimagining their operations, from the way they hire talent to the rhythm at which they work to the way they measure success.

“We will reach the promised land when retailers understand they are in the business of creating content,” said Stephens. “You are no longer in the retail business, you are in show business.”

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Asos 2021 Circular Collection campaign. Asos.

Asos’ first-half profit soars 275 percent. Driven by the popularity of e-commerce during the pandemic, the British online fashion retailer saw sales rise 25 percent and made an adjusted pretax profit of £112.9 million ($155.3 million) for the six months to Feb. 28. However, the company remains cautious on its short-term outlook given concerns about the economic prospects of its young customers.

Fast Retailing lifts full-year profit outlook as China shines. One of the most resilient retailers during the pandemic, the Uniqlo owner reported a 23 percent jump in half-yearly operating profit. Earnings at the company’s Chinese business are expected to continue to rise throughout the year, while operations in the US and Europe are projected to post losses.

Giorgio Armani may consider joint venture partner. The designer said his long-held belief that his namesake company should remain independent was no longer “so strictly necessary,” in an interview with US Vogue. But, Armani ruled out going the way of many other Italian luxury goods brands, including Gucci, Fendi and Bulgari, which have been bought by industry giants LVMH and Kering.

Allbirds takes steps toward IPO. The footwear start-up is hiring an employee to manage regulatory and other financial filings, a move that is typically a precursor to an initial public offering. If successful, Allbirds would be among the first of DTC brands in its class (including Warby Parker and Everlane) to go public, rather than sell to a larger rival or continue to tap venture capital firms for funding. The company has raised over $200 million and has a valuation of $1.7 billion.

Luxury sales on Tmall rise 159 percent in first quarter. An average of one new flagship stores per week opened on the online retailer’s Luxury Pavilion last year, as international luxury brands turned to Chinese e-commerce as a potential bright spot in a dismal 2020 that saw closures and economic headwinds in markets around the world. Recently, Saint Laurent and Van Cleef & Arpels opened stores on the platform.

Nike settles suit over Lil Nas X’s ‘Satan Shoes.’ As part of the agreement, MSCHF product studio, the organisation behind the shoes, will start a voluntary recall of the “Satan Shoes” (created in collaboration with Lil Nas X) and previously released Jesus Shoes — both of which were based on Nike sneakers. A notice of the settlement hasn’t yet been filed with the court.

Kim Kardashian’s Skims valued at $1.6 billion.The Series A round of $154 million was led by Joshua Kushner’s venture capital firm Thrive Capital, with additional investment from Imaginary Ventures and Alliance Consumer Growth. Founded in 2018, the inclusive shapewear brand has sold over 4 million units as the multi-billion dollar shapewear market heats up.

Nordstrom partners with Dover Street Market. For the next six weeks in select cities and online, Nordstrom’s Space boutique, which typically stocks a mix of emerging and established brands, will feature the seven labels supported by Dover Street Market Paris, Dover Street Market’s platform for emerging designers. It marks the first time the Comme des Garçons-owned concept store has partnered with another retailer to establish a shop-in-shop.

Saks Fifth Avenue moves to halt sales of fur products. The retailer will keep faux-fur on its shelves, along with products that include cattle hide, shearling, down and leather. Saks fur salons, which sell items like mink coats, fox puffers and rabbit jackets, will close by the end of this fiscal year, which concludes on Jan. 29. The move is part of a broader trend by US department stores to stop selling such goods.

THE BUSINESS OF BEAUTY

Rodin Olio Lusso cream and face oil. Rodin Olio Lusso.

Estée Lauder closes Rodin Olio Lusso. The brand, which helped ignite the face oil trend in upscale beauty, will cease online operations on April 19. The group did not give a reason for the closure of the brand, but the move follows its shuttering of another recent acquisition, Becca Cosmetics in February, as it prepares to recover from a difficult pandemic period.

Kim Kardashian prepares skin care entry. Kardashian filed applications to trademark the name Skkn by Kim in March. The trademark will also apply to hair care, nail products and other categories. In January, Coty took a 20 percent stake in her beauty business, KKW Beauty, after it announced plans to debut skin care in 2022.

J-Beauty giant Kao to remove ‘whitening’ from labels. Kao said it decided to drop the term as part of a broader commitment to diversity, adding that it was wrong to promote the message that one skin tone is superior to another, and will use the word “brightening” from now on. Kao’s move makes it the first J-Beauty giant to follow the lead of international cosmetic giants, Unilever, Johnson & Johnson and L’Oréal that have made similar changes to their labelling recently.

PEOPLE

Chiara Ferragni, founder of The Blonde Salad. Chiara Ferragni.

Chiara Ferragni joins Tod’s Board of directors. The Italian influencer and entrepreneur is expected to bring insight into a younger generation and the way they shop. Ferragni has leveraged her audience of 23 million Instagram followers to build a namesake apparel line. For Tod’s, boosting its digital capabilities is a key focus as the Italian footwear company seeks to bounce back from a deep pandemic slump.

Fashion’s go-to DJ Michel Gaubert apologises for offensive ‘Wuhan girls’ video. The DJ, who has created runway soundtracks for brands like Chanel and Valentino, posted a video of guests at a Parisian dinner party wearing paper masks meant to indicate typically Asian features with someone in the background saying “Wuhan girls, wahoo!” on his Instagram. Within minutes, Gaubert deleted the post, but it had already attracted attention. Diet Prada criticised up the video, while Susanna Lau called it “patently racist.”

J.Crew taps Madewell executives for marketing, digital and sustainability roles. The American retailer, which filed for bankruptcy in May 2020, appointed Jose Davila as chief people officer, Danielle Schmelkin as chief information officer, Derek Yarbrough as chief marketing officer and Liz Hershfield as senior vice president of sustainability. The latter three each spent years working directly for the Madewell brand, which has served as a bright spot in the company’s portfolio.

Aimé Leon Dore’s Teddy Santis named New Balance creative director. The designer will create collections for the sportswear brand’s Made in USA collection, a premium line that has at least 70 percent of its products produced domestically. Santis is already known for his collaborations with New Balance, which began in 2019.

MEDIA AND TECHNOLOGY

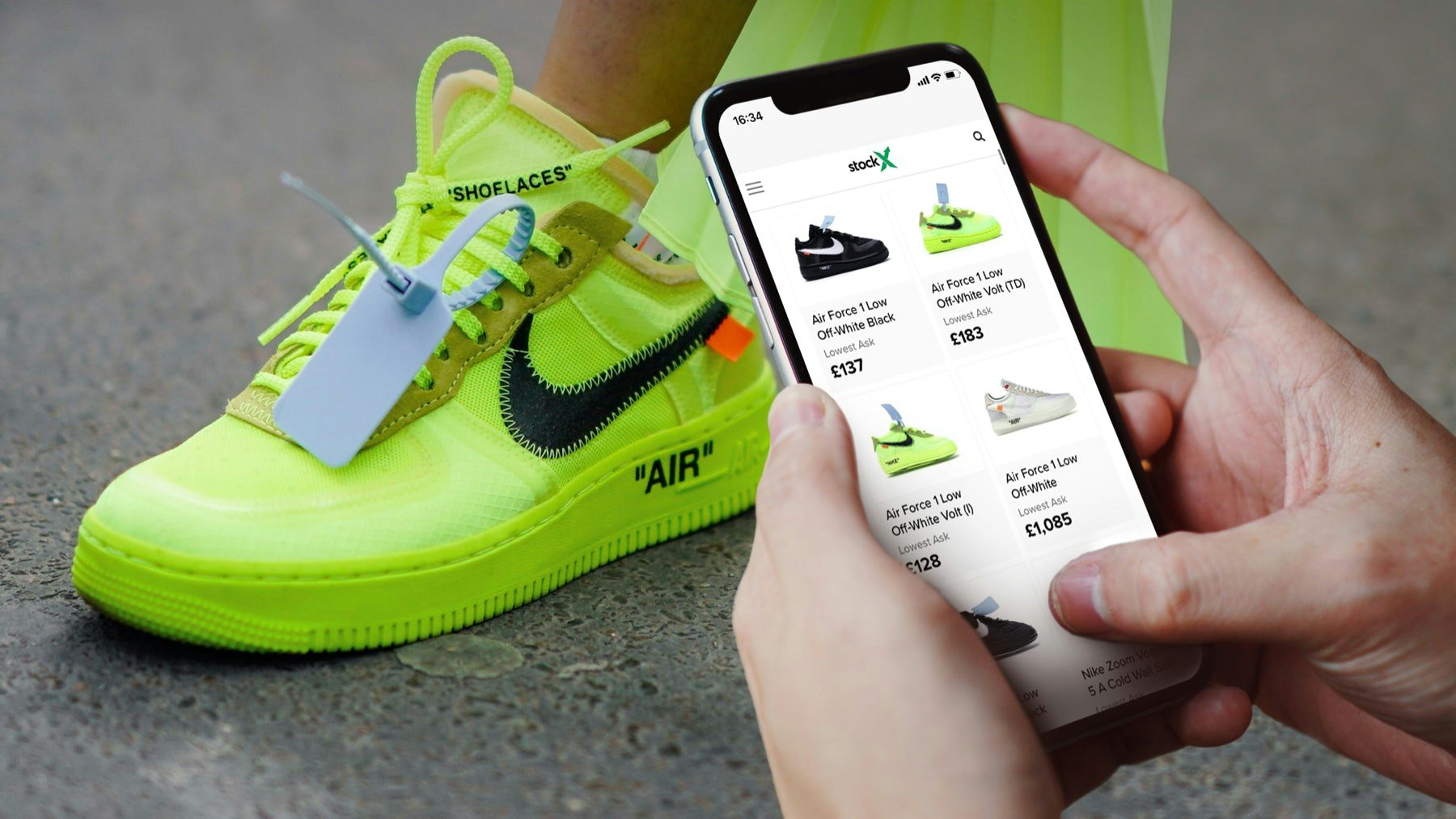

Nike Air Force 1 Low Off-White Volt. Getty Images.

StockX valued at $3.8 billion after latest funding round. The sneaker marketplace said on Thursday that it had raised $255 million in a late-stage financing round led by technology focused investment firm Altimeter Capital, with new investment from growth-equity firm Dragoneer and existing investors. The online retailer of sneakers, apparel, electronics, collectables and trading cards is expected to make preparations to go public as soon as later this year, Reuters reported, citing a person familiar with the matter.

Twitter held discussions for a $4 billion takeover of Clubhouse. Undisclosed sources told Bloomberg the companies discussed a potential valuation of roughly $4 billion for Clubhouse. Discussions are no longer ongoing, and it’s unclear why they stalled.

Flipkart is said to aim for IPO in the fourth quarter. The Indian e-commerce giant controlled by Walmart Inc. is leaning toward a traditional debut in the US, unnamed sources told Bloomberg, though IPO discussions are still in flux and subject to change.

Pinterest announces creator fund. The social media company known for its digital image boards is stepping up its efforts to woo influencers to the platform with financial support, joining similar programs at TikTok, Facebook and others. Pinterest’s fund is currently limited to creators from underrepresented communities in the US and comes with education and connection to the platform’s advertisers for additional paid opportunities.

Compiled by Joan Kennedy.