The 10 Themes That Will Define the Fashion Agenda in 2021 | BoF Professional, News & Analysis

This article appeared first in The State of Fashion 2021, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

The past year will go down in history as one of the most challenging for the fashion industry on record, marked by declining sales, shifting customer behaviour and disrupted supply chains. On top of a humanitarian crisis affecting the lives of billions of people, Covid-19 is the catalyst for a deepening economic crisis. Like many other sectors, the fashion industry finds itself in the midst of unprecedented adversity, with revenues and margins under pressure. Yet the shifting landscape is also creating pockets of momentum and, despite the ongoing, widespread impact of the pandemic, some fashion companies are developing new ways to compete.

The pandemic has compounded the demand for all things digital, which in turn has enabled innovation, efficiency and new ways for businesses to scale up. The shift is permanent, and will continue to create opportunities to build slicker, smarter operating models and differentiated customer propositions that are more personalised to each customer. Equally, the crisis has emphasised the need to move to more sustainable and responsible ways of working in all areas of the value chain. As the number of fashion players responding to this need continues to grow, it will prove to be a long-term boon to companies, workers, customers and the planet.

Although more than half of business leaders in our BoF-McKinsey State of Fashion 2021 Survey also expressed concerns about things other than the Covid-19 health and economic crisis for the year ahead, the pandemic recovery timeline did weigh heavily on their minds. We should acknowledge that the mood of fashion business leaders may have evolved in the weeks that transpired since the survey, especially as the pandemic worsens again in the fourth quarter of 2020 — with government responses including more severe social distancing measures in Europe, the threat of new lockdowns across numerous regions and mass-testing in some Chinese provinces. Nevertheless, the collective sentiment of fashion executives gleaned from our survey does constitute a compelling yardstick against which to measure business leaders’ predictions and expectations for the year ahead.

Naturally, business leaders across the board hope for the effects of Covid-19 to dissipate and for the global economy to recover as quickly as possible. McKinsey Fashion Scenarios analysis for the industry over the next year anticipates that, in an Earlier Recovery scenario, the virus will be effectively controlled, thanks to a strong public health response (based on information available September 2020). In this scenario, government interventions will partially offset economic impact and global travel will pick up along with the possibility of larger social gatherings. The global growth outlook for fashion sales in this scenario determines that recovery would be achieved by the third quarter of 2022, with China leading the way with 5 to 10 percent sales growth in 2021 compared to 2019. Europe, on the other hand, would expect to continue to see lower sales in 2021 as international tourists stay at home, with sales down 2 to 7 percent compared to 2019. With footfall remaining low, pre-Covid levels of activity in Europe are unlikely to return before the third quarter of 2022. This scenario includes a similar trajectory for the US, with sales down 7 to 12 percent in 2021 compared to 2019, and recovery to pre-Covid sales only expected by the first quarter of 2023.

The primary driver of growth in the coming year will continue to be digital channels, reflecting the fact that people in many countries remain reluctant to gather in crowded environments. The Earlier Recovery scenario anticipates dynamic digital growth across geographies in 2021 compared to 2019, with more than 30 percent online growth in Europe and the US and over 20 percent growth in the already highly digitised Chinese market.

However, less favourable recovery scenarios must also be considered if there is a delay to a widely available vaccine. In this case, the virus would persist in some regions and new waves of lockdowns could take hold, accompanied by only partially effective government responses and ongoing travel restrictions, further embedding the consumer behaviour developed during the pandemic. If this more pessimistic Later Recovery scenario were to materialise, a deeper dip in sales in 2021 and slower global economic recovery would be anticipated. In this case, the US would see sales decline by 22 to 27 percent in 2021 compared to 2019, and pre-Covid performance in the country would not return until after 2025. Although significantly impacted, Europe would fare slightly better than the US overall in this scenario, with sales down 14 to 19 percent compared to 2019. However, the European luxury segment would suffer a considerable hit. If new lockdowns were to be implemented and travel restrictions persist, luxury sales in Europe could drop up to 40 percent and only recover to their pre-crisis level by the third quarter of 2023.

The primary driver of growth in the coming year will continue to be digital channels, reflecting the fact that people in many countries remain reluctant to gather in crowded environments.

There are, of course, a multitude of intermediate scenarios in between the two ends of the spectrum, each containing a combination of positive and negative effects set against the backdrop of an industry striving to recover its equilibrium. However, in all cases, we anticipate significant variation between geographies, with as much as a two- to four-year lag between fast- and slow-recovering markets.

On top of subdued sales, we expect industry players will see deep and long-lasting changes to both consumer demand and ways of working. Among potential short-term challenges, brands will need to manage a category shift towards casualwear and the continuing pressure on luxury, as well as shorter production cycles and cash constraints that lead to a slowdown in investments.

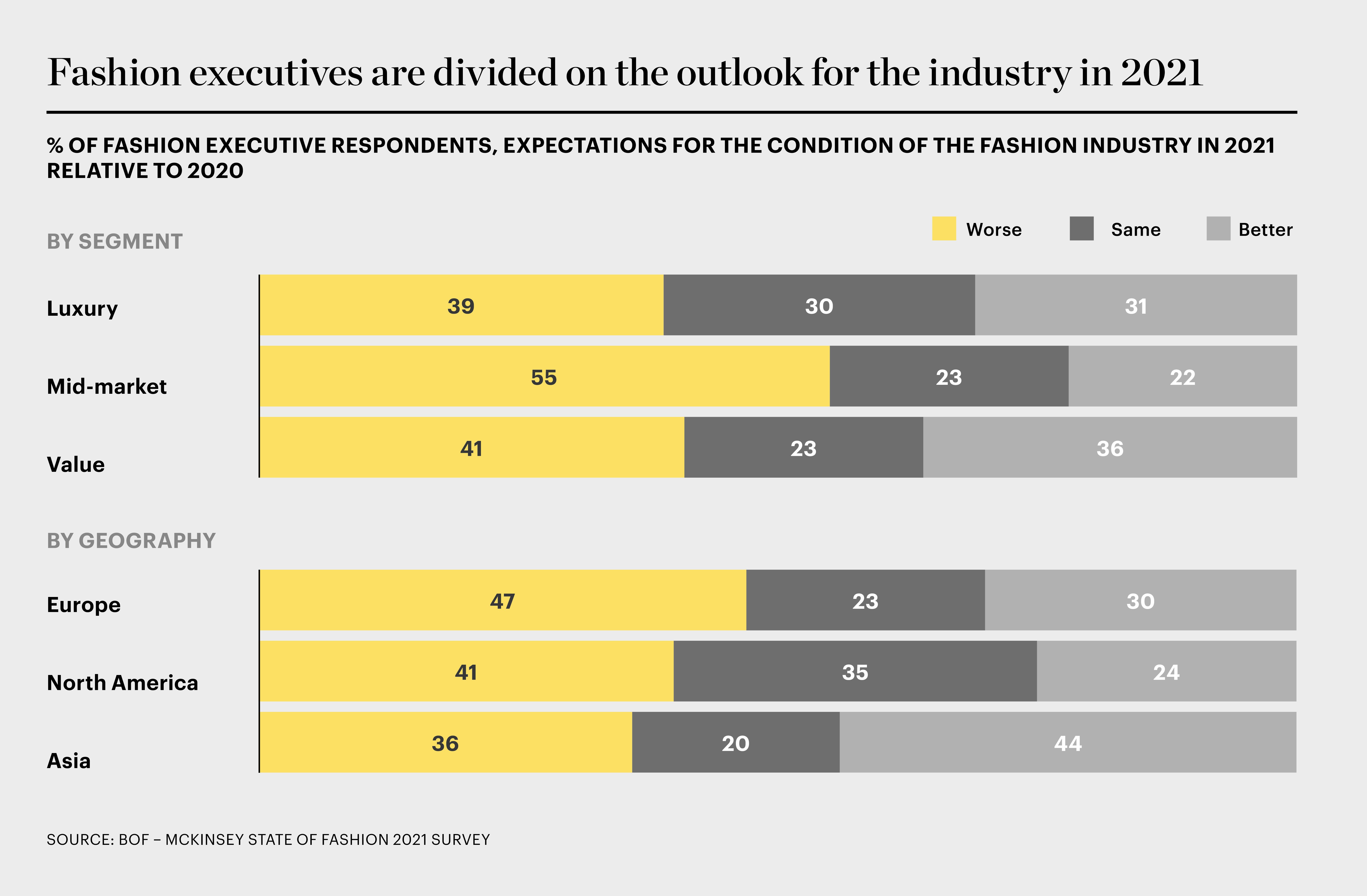

Set against this backdrop, the strategic outlook among business leaders is uneven, reflecting the diverse trends the industry faced even before the pandemic. Across all value segments, a larger proportion of executives in the BoF-McKinsey State of Fashion 2021 Survey are pessimistic rather than optimistic about the year ahead, but 32 percent of respondents still expect the industry to evolve positively next year. In line with pre-crisis attitudes, 31 percent of executives in the luxury segment and 36 percent in the value segment have a positive outlook for 2021, while only 22 percent of executives in the mid-market believe things will get better. In the luxury segment specifically, fashion executives express more confidence than McKinsey’s Earlier Recovery scenario, which forecasts a decline of global luxury sales by 12 to 17 percent in 2021 compared to 2019, and up to a 28 percent decline in Europe. The highest confidence is around the value segment, with 36 percent of executives projecting an improvement and another 23 percent predicting little change. This reflects the impact of the pandemic on consumers across different income brackets, as well as the more established appetite for cheaper fashion, now partially offset by rising demand for quality and durability.

In line with regional recovery rates so far, executives from Asia are the most confident about the upcoming year, with almost half sharing a positive outlook. The vision for 2021 is less optimistic in the west, with only around a third of European executives and a quarter of US executives expecting the state of the fashion industry next year to improve. The sentiment of European executives is the bleakest, with almost half saying conditions will get worse, compared to 41 percent of executives in the US.

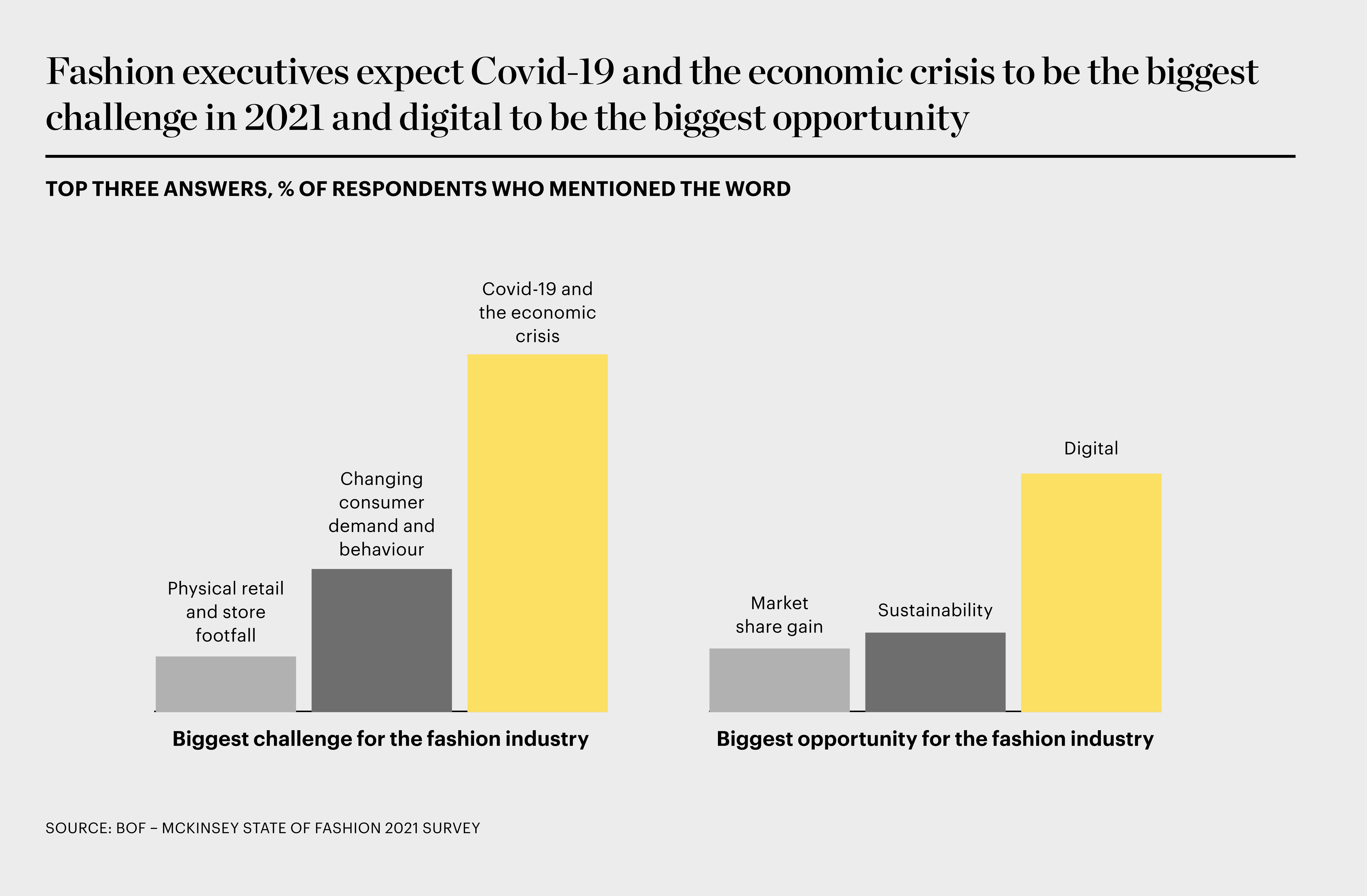

The extent to which these concerns are weighing on executives is shown in their choice of the top three words to describe the conditions we can expect for the fashion industry in 2021: “uncertain,” “challenging” and “disruptive.” Given the clouds that shroud the economic outlook this year, digital is seen by a third of executives as a silver lining that presents the biggest opportunity in 2021. Indeed, almost all businesses anticipate their online revenues to rise next year, with 26 percent of executives projecting a gain of 50 percent or more and nearly half of executives projecting growth of 30 percent or more. The digital opportunity in e-commerce as well as in the digitisation of business processes and operations is the most cited opportunity by far. Sustainability follows in second place, with 1 out of 10 executives citing it as an area of growth, underscoring the mindset shift towards sustainability that has begun to take place over the last few years. Optimism about digital and sustainability chimes with the widely held view that, despite the disruption of the pandemic, these trends will accelerate and, in turn, lead to a reset of the fashion industry.

Digital is seen by a third of executives as a silver lining that presents the biggest opportunity in 2021.

With the benefit of hindsight, we also asked survey respondents to reflect on the relevance of forward-looking sentiments gathered last year. Of the themes we highlighted in last year’s State of Fashion report, executives state that those impacting their business the most in 2020 were “Next Gen Social,” “Sustainability First” and, in third place, “On High Alert” of recession risk. These choices reveal how the Covid-19 crisis has accentuated trends that were forecasted in last year’s report and catalysed them in a way and at a pace no one could have predicted.

The 10 themes that will come to define 2021 suggest the beginning of a new chapter for the global fashion industry. 2020 has been a year of colossal change. What is clear is that the fashion industry, like many other sectors, will certainly exit this crisis in a very different form than that in which it entered. Depending on their sizes, geographies and the segments in which they operate, some players can anticipate a brighter outlook in the year ahead. Others will not.

In any event, there is no likely scenario which predicts a strong recovery in 2021. The upcoming year acts as a bridge between two different states of the industry. As such, the 10 themes for The State of Fashion 2021 each highlight a major disruption sparked by the pandemic. In order to cross the bridge into fashion’s new world, executives should pay heed, as each theme offers an urgent imperative for the year ahead.

The 10 fashion industry themes that will set the agenda in 2020:

1. Living with the Virus

The Covid-19 crisis has impacted the lives and livelihoods of millions of people, while disrupting international trade, travel, the economy and consumer behaviour. To continue to manage unprecedented levels of uncertainty in the year ahead, companies should rewire their operating models to enable flexibility and faster decision-making, and balance speed against discipline in the pursuit of innovation.

2. Diminished Demand

Following the deepest recession in decades, the global economy is expected to partially recover next year but economic growth will remain diminished relative to pre-pandemic levels. Since demand for fashion is also unlikely to bounce back due to restrained spending power amid unemployment and rising inequality, companies should seize new opportunities and double down on outperforming categories, channels and territories.

3. Digital Sprint

Digital adoption has soared during the pandemic, with many brands finally going online and enthusiasts embracing digital innovations like livestreaming, customer service video chat and social shopping. As online penetration accelerates and shoppers demand ever-more sophisticated digital interactions, fashion players must optimise the online experience and channel mix while finding persuasive ways to integrate the human touch.

4. Seeking Justice

With garment workers, sales assistants and other lower-paid workers operating at the sharp end of the crisis, consumers have become more aware of the plight of vulnerable employees in the fashion value chain. As momentum for change builds alongside campaigns to end exploitation, consumers will expect companies to offer more dignity, security and justice to workers throughout the global industry.

5. Travel Interrupted

The travel retail sector remains severely disrupted and destination shopping suffered throughout 2020. With international tourism expected to remain subdued next year and shoppers experiencing further interruptions to travel, companies will need to engage better with local consumers, make strategic investments in markets witnessing a stronger recovery and unlock new opportunities to keep customers shopping.

6. Less Is More

After demonstrating that more products and collections do not necessarily yield better financial results, Covid-19 highlighted the need for a shift in the profitability mindset. Companies need to reduce complexity and find ways to increase full-price sell-through to reduce inventory levels by taking a demand-focused approach to their assortment strategy, while boosting flexible in-season reactivity for both new products and replenishment.

7. Opportunistic Investment

Performance polarisation in the fashion industry accelerated during the pandemic as the gap widened between the best-performing companies and the rest. With some players already bankrupt and others kept afloat by government subsidies, we expect M&A activity to increase as companies manoeuvre to take market share, unlock new opportunities and expand capabilities.

8. Deeper Partnerships

By exposing the vulnerability of procurement partners, the weakness of contracts and the risks of a concentrated supplier footprint, the crisis accelerated many of the changes that companies were already making to rebalance their supply chain. To mitigate future ruptures, fashion players should move away from transactional relationships in favour of deeper partnerships that bring greater agility and accountability.

9. Retail ROI

Physical retail has been in a downward spiral for years and the number of permanent store closures will continue to rise in the post-pandemic period, compelling fashion players to rethink their retail footprints. Amplified by a potential power shift from landlords to retailers and the need to seamlessly embed digital, companies will need to make tough choices to improve ROI at store level.

10. Work Revolution

Prompted by fundamental changes in the way companies worked during the pandemic and the need to drive performance in the years to come, an enduring new model for work is likely to emerge. Companies should therefore refine their blends of remote and on-premises work, invest in reskilling talent and instil a greater sense of shared purpose and belonging for employees who continue to reconsider their own priorities.