‘Deficient’ $5.4b Bid For Infratil Still A Risk For NZX

Business

There’s a certain irony to the news listed infrastructure investment company Infratil might be sold to the Aussies, writes Nikki Mandow

Earlier this week, $190 billion superannuation giant AustralianSuper formally announced a $5.4 billion takeover offer for Infratil. This was, apparently, a new improved price following a previous, secret bid in October.

The Infratil board dismissed both, describing them as “unsolicited”, “deficient” and materially undervaluing the company’s renewable energy and digital infrastructure platforms.

“No further engagement is planned at this stage,” Infratil CEO Marko Bogoievski said.

Still, most things are available at the right price, particularly in the world of investment funds.

The next, bigger, offer could be accepted. Or the one after that.

A deal would see Infratil leave the New Zealand stock exchange and become a private company. And the obvious irony of that is it would do for Infratil what the company’s founder Lloyd Morrison fought to avoid happening to the NZX – sale to the Australians.

Morrison, who died of cancer in 2012 aged 54, argued a vibrant economy needed a vibrant stock exchange. (He also thought we needed a better flag.)

A significant hit for the NZX

Losing Infratil from the NZX wouldn’t be a disaster for the market, but it would be significant hit. The company makes up around 3 percent of the exchange – maybe a bit more after the big post-offer spike last week. And the stock has been a super-solid, long term performer for the New Zealand investing public.

Analysts believe there is future upside for the company too, particularly given Infratil owns some tempting assets in the sought-after sustainability space. Of particular interest to AustralianSuper are wind and solar power generator Tilt Renewables and the green-leaning CDC Data Centres.

Infratil also owns stakes in renewable energy-focused companies in Switzerland (Galileo Green Energy) and the US (Longroad Energy), as well as 51 percent of Trustpower, 49.9 percent of Vodafone and 66 percent of Wellington Airport.

It would be naive not to suspect an ulterior motive, in hindsight, when just a couple of days before the AustralianSuper bid went public, Infratil came out saying it had received “a number of enquiries” about Tilt and had engaged Goldman Sachs to do a strategic review, including looking at selling its $1 billion, 65.5 percent stake.

Look, the company seems to be saying, Tilt on its own is worth a billion and we have interested buyers. Pah to your $5.4 billion.

The Tilt Renewables share price has jumped in sympathy.

Fund managers Newsroom spoke to mostly seem to agree the bid undervalues Infratil, although ACC, the company’s biggest investor, urged it to open its books and consider the bid.

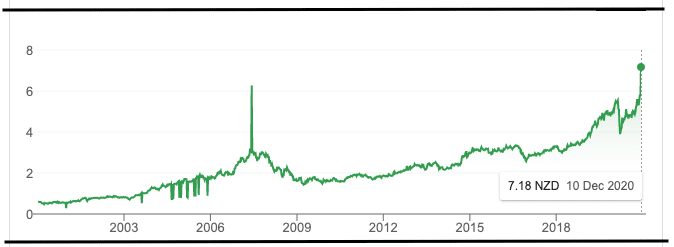

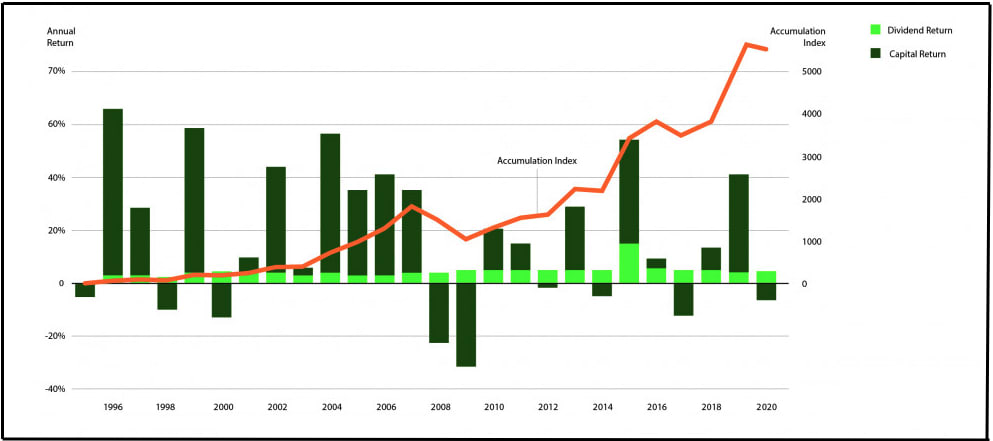

In the 26 years since Infratil listed, the company’s annual after-tax compound return on investment has been 18.2 percent. Or at least that was the figure as of the September 30 interim results date. At the current share price it’s about 19.2 percent, says Tim Brown, who leads Infratil’s capital markets and economic regulation team.

That’s pretty impressive, says Fisher Funds senior portfolio manager Sam Dickie.

If that sort of growth rate continues, AustralianSuper’s $7.43 a share bid, a 22.2 percent premium to Infratil’s closing price when the offer was announced, is only factoring in a couple of years of future performance, he says.

In fact the gap nearly closed after the stock rallied on news of the Aussie bid.

Dickie reckons this isn’t the end of the road.

“AustralianSuper is a credible bidder. I suspect this is their opening gambit and it could go higher from here.

“If I was guessing, the next step will be they will go away and figure out what price is required to make the Infratil board engage, and open up the books for due diligence.”

It’s not clear what that price would be, Dickie says, but the independent directors would need to consider a bid at some stage. “They would be remiss not to.”

A “phenomenal company”

I own a small number of Infratil shares. So do 18,358 other people, according to the company’s 2020 annual report.

Tim Brown says this is probably only half the total, with many retail shareholders having their shares in broker accounts.

“Far more have an interest via KiwiSaver accounts. At 77 percent local ownership, Infratil is one of the most NZ owned stocks in the NZX50.”

And they’ve done well over the years.

An Infratil graph shows someone who invested $100 on listing day, March 31 1994, and subsequently reinvested all dividends and distributions, would now own 1398 shares worth $5464. That’s like doubling your money between five and six times.

Dickie calls it “a phenomenal company”.

Infratil is one of Fisher Funds’ biggest holdings at 5 percent of total funds, and Fisher Funds is one of Infratil’s biggest shareholders.

NZX’s head of issuer relations Sarah Minhinnick says it would be a shame to see a top 10 NZX company leave the exchange, particularly since Infratil doesn’t just have shareholders, but also bondholders – 15,486 of them as of March this year.

Others, like the NZ Shareholders’ Association CEO Oliver Mander, agree with Minhinnick, although his predecessor, Bruce Sheppard has a more NZ Inc-centred take.

“I personally take the view that if a foreigner owns a power station, who cares, they can’t take it anywhere.

“I was sadder losing F&P Appliances, where they shut factories and migrated their business to China. Or Frucor, or Lion Breweries, or Xero.

“If A2 Milk went, that would be more cataclysmic – there’s a company creating jobs and IP in New Zealand that could be easily moved overseas.”

NZX teetering towards a recovery?

The Infratil drama hasn’t been the only thing going on at the NZX this week – the exchange hosting not one, but two new listings parties, complete with balloons, confetti and the ringing of bells.

This takes total new companies debuting on the exchange this year to seven, and there’s one more potentially arriving next week.

Not world-shattering, but a considerable improvement on the dire performance over the last few years when the NZX has tried a number of unsuccessful ploys to lure companies to list.

Between 2017 and 2019 only two or three companies joined the exchange each year. But a six-person issuer relations team headed by Minhinnick and focusing on new listings may be beginning to turn the exchange’s fortunes around.

Minhinnick says the team is doing a lot of cold calling, trying to persuade companies to consider the local market, or a dual listing with Australia.

She says she is optimistic about the pipeline.

“We are having the most conversations we’ve ever had. There’s been a mental shift about access to capital following the arrival of Covid and the need for companies to recapitalise.”

Aged care and retirement village company Radius Residential Care listed at 80 cents this week, though no shares changed hands, and Auckland Real Estate which specialises in, you’ve guessed it, Auckland real estate, added an NZX listing to its ASX one, though it didn’t trade either.

This brings the number of equity listings on the NZX to around 130, although this is still tiny compared to around 7000 in Australia, Bruce Sheppard says.

“If we were on the same scale as Australia we would have just under 1000.”

Xero removed itself from the NZX in early 2018 for a sole listing in Australia.

A difficult takeover bid

Oliver Mander at the NZ Shareholders’ Association says it won’t be an easy deal to pull off, particularly in terms of deciding the value of the assets.

AustralianSuper hasn’t included Trustpower in the deal, which complicates matters, as does the fact that Infratil is separately reviewing Tilt.

There’s also the question of what would happen to HRL Morrison & Co, Lloyd Morrison’s original investment company, if AustralianSuper took over.

Morrison & Co became the management company for Infratil’s portfolio of assets when the company listed in 1994, and the manager has done a good job, as evidenced by Infratil’s success. But shareholders have sometimes baulked at the size of the performance fees – $100 million in 2019, for example.

And AustralianSuper might feel it can manage the Infratil assets itself.

“There’s an air of disdain about Infratil’s rejection of AustralianSuper’s takeover bid that Australians haven’t felt from their Kiwi cousins since Trevor Chappell bowled that infamous underarm delivery in 1981.”

Meanwhile, there is one other curious aspect to the AustralianSuper Infratil bid – it is structured as a scheme of arrangement, not a takeover bid. This means that instead of making an offer to all existing shareholders and hoping to get the majority to accept, AustralianSuper made the bid to the Infratil board, leaving it up to them to control the process.

Schemes of arrangement are much more normal for friendly takeover bids, which makes one wonder if AustralianSuper blithely expected Infratil to jump at the chance.

Certainly the Australian press have acted surprised.

“There’s an air of disdain about Infratil’s rejection of AustralianSuper’s $NZ5.4 billion ($5.1 billion) takeover bid that Australians haven’t felt from their Kiwi cousins since Trevor Chappell bowled that infamous underarm delivery in 1981,” James Thomson wrote in the Australian Financial Review’s Chanticleer column.

“Apparently even the revised offer isn’t in the ballpark – much to the amazement/amusement of the AusSuper camp, which is stunned that its revised offer wasn’t even presented to Infratil shareholders and disappointed at the level of engagement it has received.”

Which maybe makes it all worthwhile.